The Illinois 2017 Class 6B SER (Sales and Use Tax Exemption Replacement) affidavit is a document that is used to replace the exemption certificate for sales and use tax in the state of Illinois. This document is used by businesses to claim that they are exempt from paying sales and use tax on their purchases. There are two types of Illinois 2017 Class 6B SER affidavits: the Manufacturer’s Affidavit and the Reseller’s Affidavit. The Manufacturer’s Affidavit is used by a manufacturer to claim that the items purchased are either for use in the production of tangible personal property, or for the sale or resale of tangible personal property. The Reseller’s Affidavit is used by a reseller to claim that the items purchased are for resale and not for use by the reseller. Both affidavits must be signed by an authorized representative of the business and must provide details of the items and the total amount of the purchase.

Illinois 2017 Class 6B SER affidavit

Description

How to fill out Illinois 2017 Class 6B SER Affidavit?

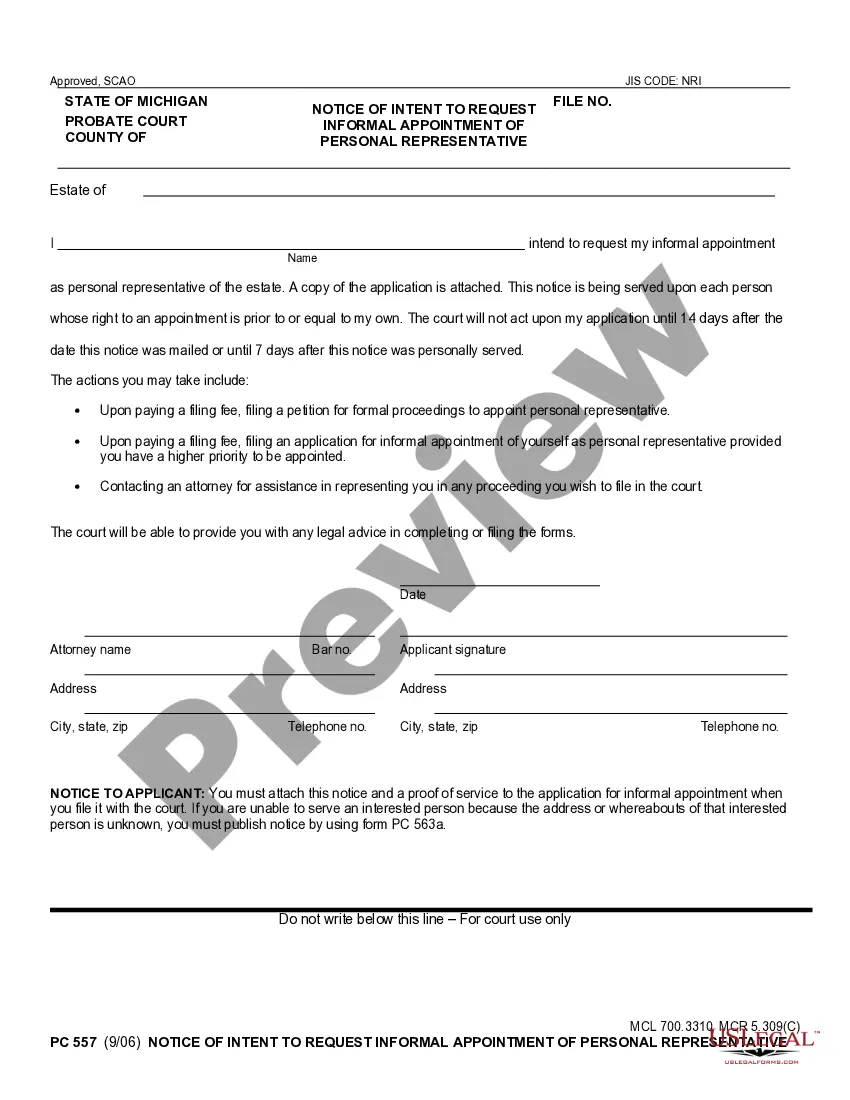

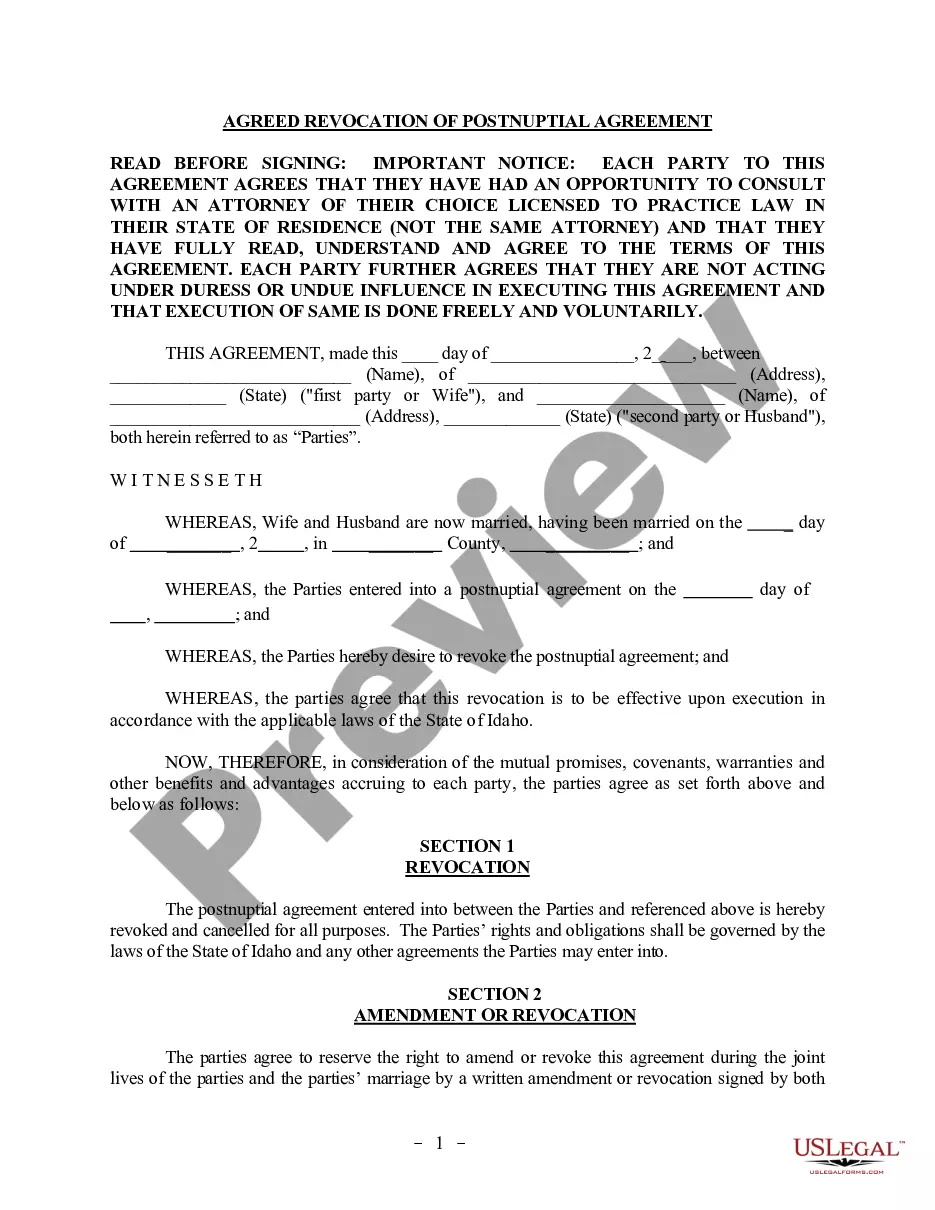

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are verified by our experts. So if you need to fill out Illinois 2017 Class 6B SER affidavit, our service is the perfect place to download it.

Obtaining your Illinois 2017 Class 6B SER affidavit from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the correct template. Afterwards, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it suits your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Illinois 2017 Class 6B SER affidavit and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Class 6b. Designed to encourage industrial development throughout Cook County by offering a real estate tax incentive for the development of new industrial facilities, the rehabilitation of existing industrial structures, and the industrial reutilization of abandoned buildings.

Class 8 Property Tax Incentive The Class 8 program offers reduced Cook County property tax rates on commercial and industrial projects in areas experiencing severe economic depression. Qualifying properties can receive a 12-year reduction in real estate assessments from the standard Cook County rate of 25 percent.

Cook County Class 9 Program offers a 50% reduction in assessments and taxes to developers who complete major rehab on multifamily buildings and keep rent below certain levels.

The Class 7c classification is designed to encourage commercial development throughout Cook County by offering a real estate incentive for the development of new commercial facilities, the rehabilitation of existing commercial structures, and the commercial reutilization of abandoned buildings.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

The Class 7b classification is designed to encourage commercial development throughout Cook County by offering a real estate incentive for the development of new commercial facilities, the rehabilitation of existing commercial structures, and the commercial reutilization of abandoned buildings on properties that have