Illinois Historic Resident Freeze-2014 is a program in the state of Illinois that allows homeowners who have lived in their current home for at least 10 years to freeze their property taxes. This freeze applies to the assessed value of the property and not the current market value. This means that the amount of taxes the homeowner pays will be based on the assessed value from the year they applied for the freeze, even if the market value of the home increases. The freeze is only available to homeowners who meet certain eligibility criteria such as income limits. There are two types of Illinois Historic Resident Freeze-2014: the Senior Freeze and the General Homestead Exemption. The Senior Freeze is specifically available to seniors who are 65 years of age or older and meet the income criteria. The General Homestead Exemption is available to all Illinois homeowners who meet the income criteria.

Illinois Historic Resident Freeze-2014

Description

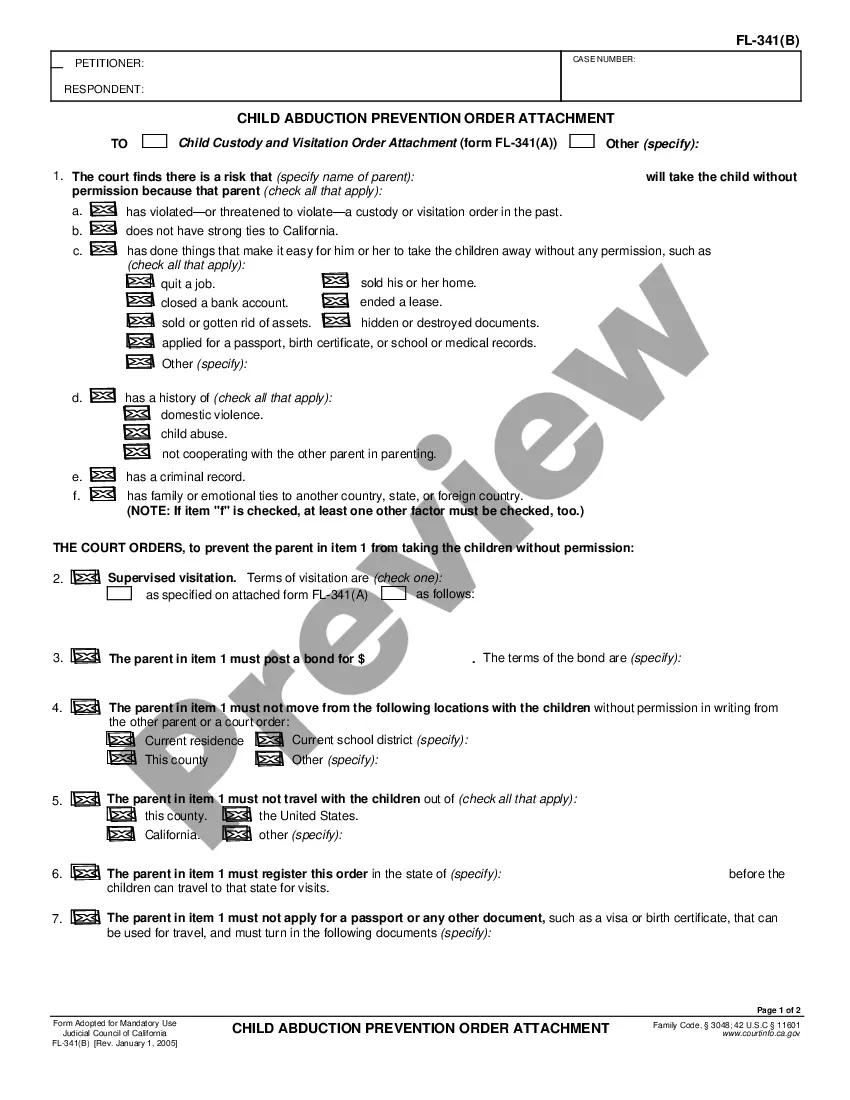

How to fill out Illinois Historic Resident Freeze-2014?

If you’re seeking a method to correctly finalize the Illinois Historic Resident Freeze-2014 without employing a legal expert, then you’re in the ideal location.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and business scenario.

Another fantastic aspect of US Legal Forms is that you will never misplace the documentation you bought - you can access any of your downloaded templates in the My documents section of your profile whenever needed.

- Ensure the document you see on the page aligns with your legal needs and state regulations by reviewing its text description or utilizing the Preview mode.

- Enter the document title into the Search tab at the top of the page and select your state from the dropdown menu to find an alternative template in case of discrepancies.

- Reiterate the content check and click Buy now when you are sure about the paperwork satisfying all requirements.

- Log in to your account and click Download. If you do not yet have one, register for the service and choose a subscription plan.

- Use your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you want to save your Illinois Historic Resident Freeze-2014 and download it by pressing the relevant button.

- Incorporate your template into an online editor to swiftly complete and sign it or print it out to prepare your physical copy manually.

Form popularity

FAQ

The winter of 2013-2014 in Chicago was marked by extreme cold and heavy snowfall, contributing to what many refer to as one of the harshest winters. Temperatures dropped dramatically, which amplified the importance of programs like the Illinois Historic Resident Freeze-2014. For residents, dealing with property taxes during such severe winters can be daunting, making the freeze program crucial for seniors.

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

Property Tax Freeze for Historic Residences What it does: Freezes property taxes over a 12-year period for rehabilitating an owner-occupied single-family home, condominium, cooperative unit, or a multi- family building of up to 6 units (where one of the units is owner-occupied).

The Senior Freeze Exemption (Senior Citizens Assessment Freeze Homestead Exemption) allows a qualified senior citizen to apply for a freeze of the equalized assessed value (EAV) of their property for the year preceding the year in which they first apply and qualify for this exemption.

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

The Illinois Historic Preservation Tax Credit offers a 25 percent credit for eligible expenditures on rehabilitation of properties eligible for the federal historic credit located in designated River Edge Redevelopment Zones approved by the state in portions of Aurora, East St. Louis, Elgin, Peoria, and Rockford.

The Illinois Revenue Act (35 ILCS 200/Art. 10 Div. 4) provides owner-occupants with an eight-year freeze on the assessed value of their historic residences. After the eight-year assessment freeze period, there is a four-year period during which the property's assessed value steps up to its current amount.