Illinois Estate Claim is a legal process in which a person or entity can file a claim against an estate of a deceased person. These claims can be based on a variety of different reasons, including unpaid debt, breach of contract, personal injury, or wrongful death. There are three main types of Illinois Estate Claims: Creditor Claims, Heir Claims, and Beneficiary Claims. Creditor Claims are claims made by creditors of the deceased for money owed. Heir Claims are claims made by the heirs of the deceased for a share of the estate. Beneficiary Claims are claims made by beneficiaries of the deceased for a share of the estate. All Illinois Estate Claims must be filed with the probate court in the county where the deceased lived at the time of their death.

Illinois Estate Claim

Description

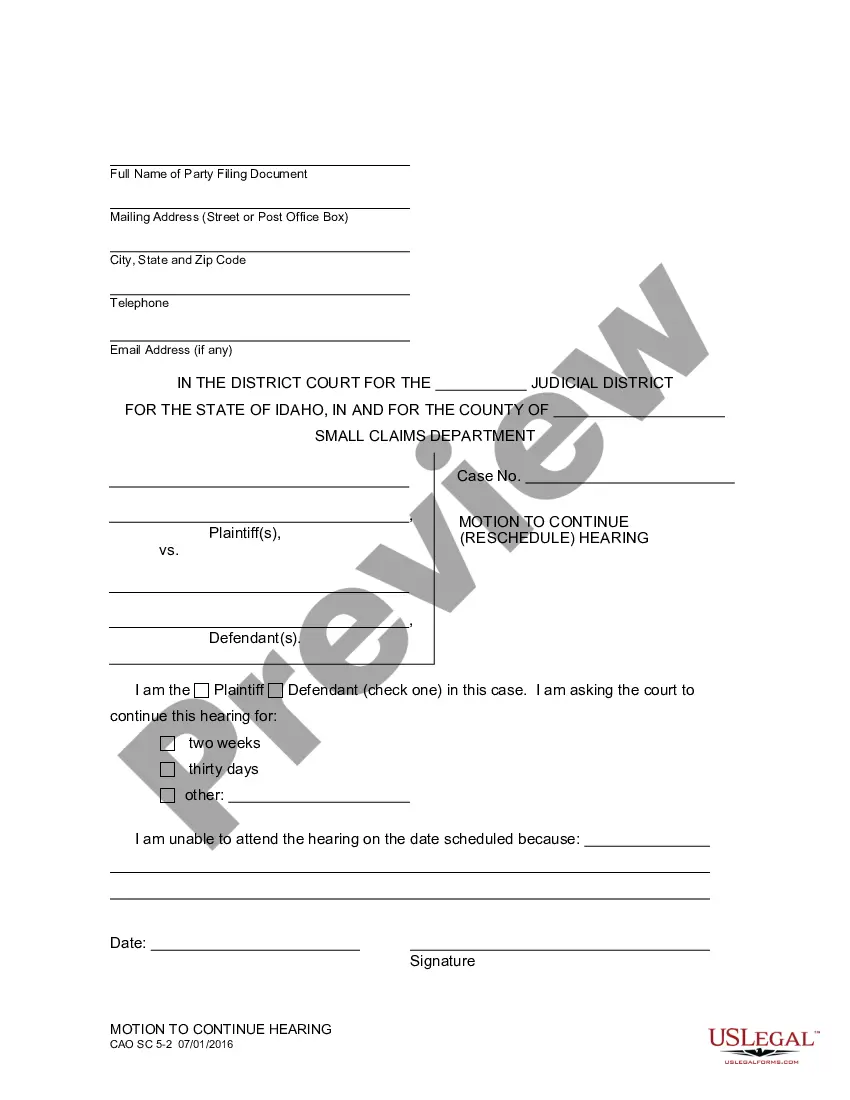

How to fill out Illinois Estate Claim?

Coping with official paperwork requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Illinois Estate Claim template from our library, you can be certain it meets federal and state laws.

Working with our service is easy and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Illinois Estate Claim within minutes:

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Illinois Estate Claim in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Illinois Estate Claim you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

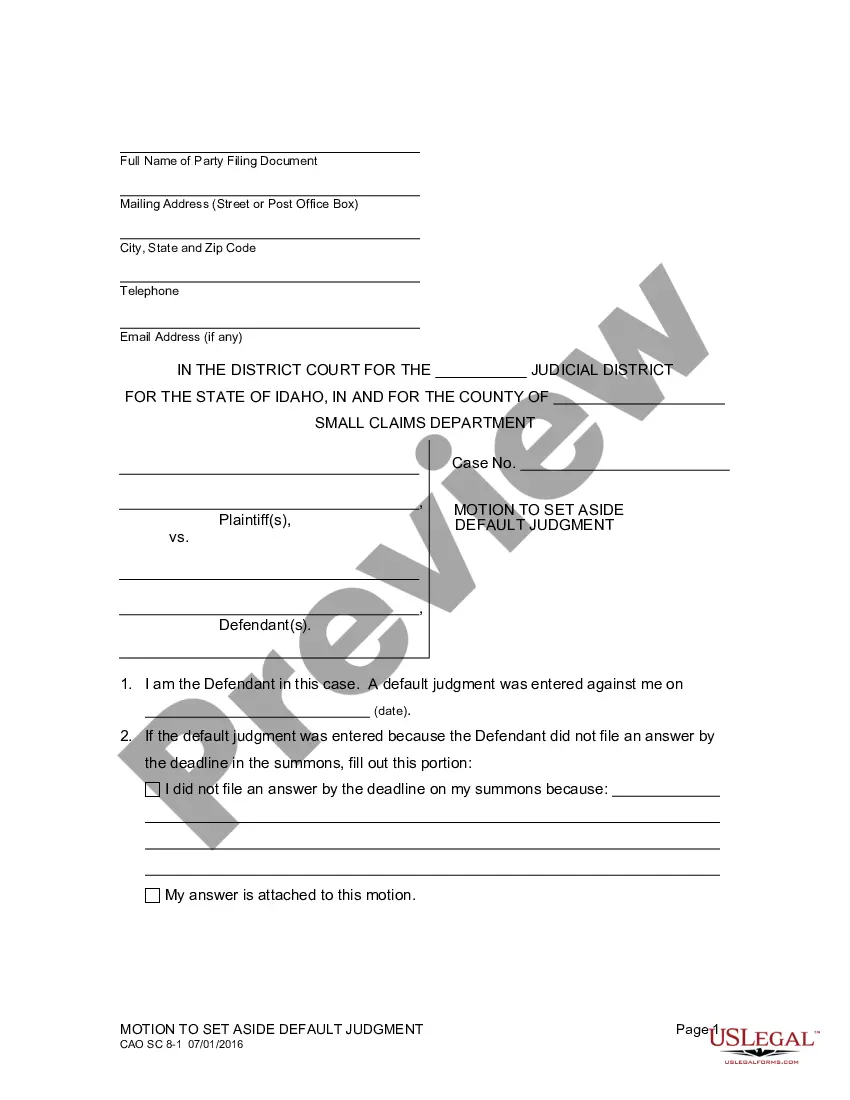

Every estate does not have to go through probate. Probate is the legal process to make sure that a deceased person's debts and taxes are paid. In Illinois, a lawyer is required for probate unless the estate is valued at or less than $100,000 and does not have real estate.

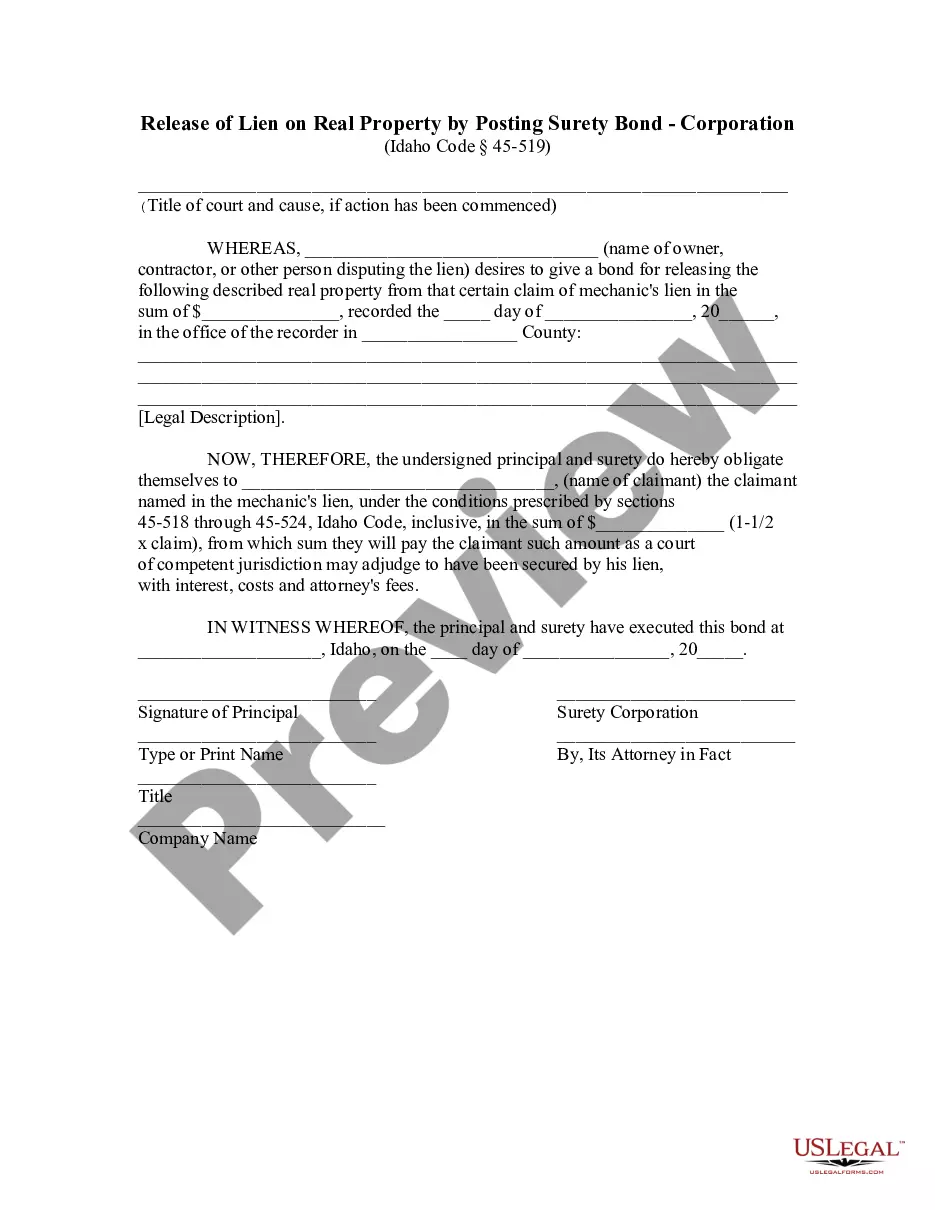

A claim against the probate estate can either be filed with the court or mailed to the representative of the estate. Once the representative receives notice of the claim, he or she can either allow the claim or send a notice to the claimant informing them that they are ?disallowing? the claim.

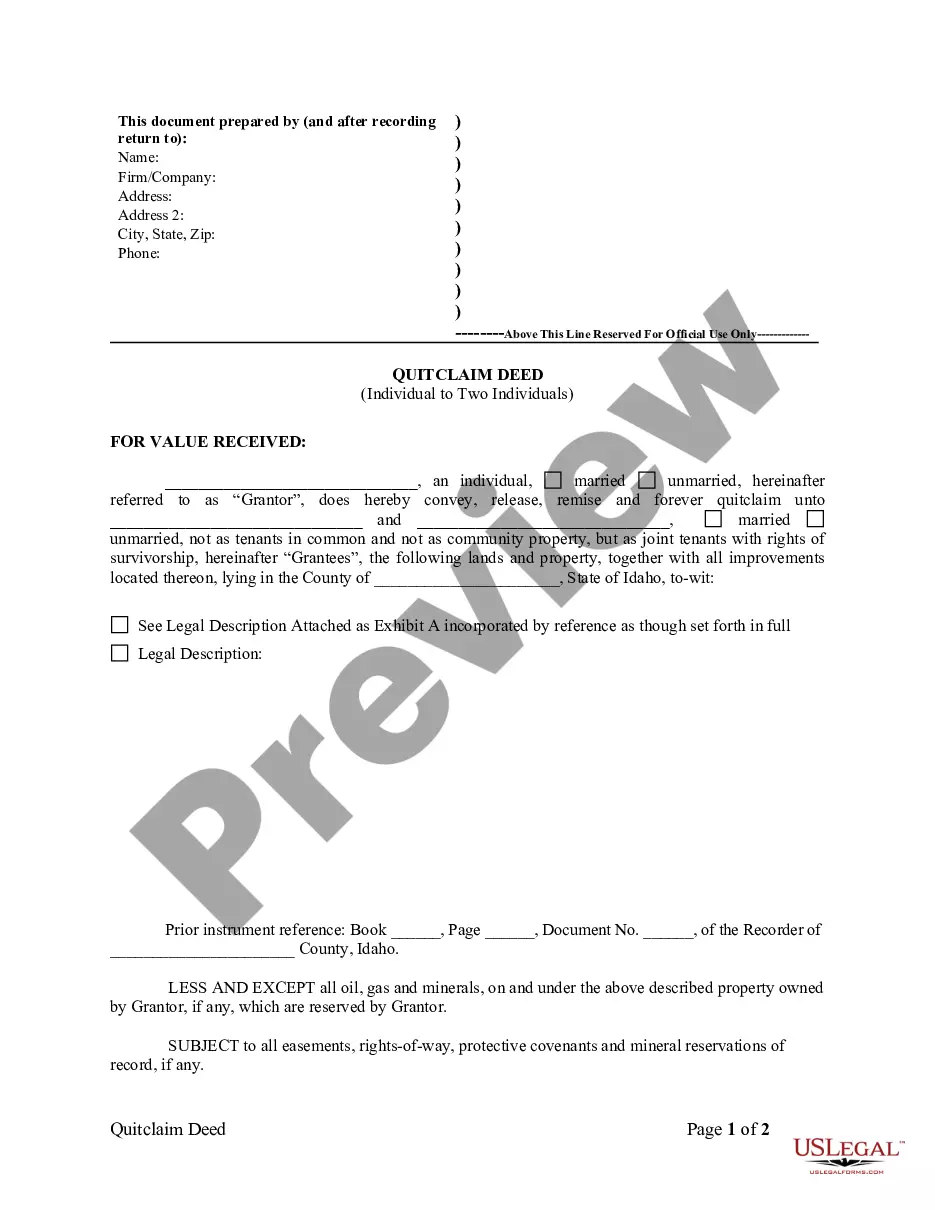

No probate will be necessary to transfer the property, although of course it will take some paperwork to show that title to the property is held solely by the surviving owner.

Things that aren't part of the deceased person's estate don't have to be handled in settling their estate. Probate is just one way to settle an estate when someone dies. And it's not always required. Illinois law allows a different and simplified procedure for handling small estates.

Probate is typically necessary in Illinois when the decedent owns any real estate or more than $100,000.00 of non-real-estate assets outside of a trust.

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

When is the Deadline to File a Probate Claim in Illinois? The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate.

Three Tips to Avoid Probate in Illinois Create a Living Trust. The simplest way to avoid probate is to create a living trust instead of a last will.Hold Property Jointly. Another effective way to keep your real estate assets out of probate is to hold your property jointly.Name Beneficiaries on Your Accounts.