An Illinois Request for Installment Payment Hearing is a legal hearing that is available to individuals who owe a debt in the state of Illinois. This hearing is designed to allow individuals to make payment arrangements with their creditors in order to pay off their debt in installments. The hearing is held in front of a judge who will evaluate the individual’s financial situation to determine if they are able to make the payment arrangements. If the judge decides that the individual is able to make the payments, they will establish an installment payment plan. There are two types of Illinois Request for Installment Payment Hearing: a regular hearing and an expedited hearing. A regular hearing is a traditional hearing that is held in the courthouse and is open to the public. An expedited hearing is a hearing that is held within seven days of the individual filing the request. This type of hearing is typically held over the phone and is not open to the public.

Illinois Request for Installment Payment Hearing

Description

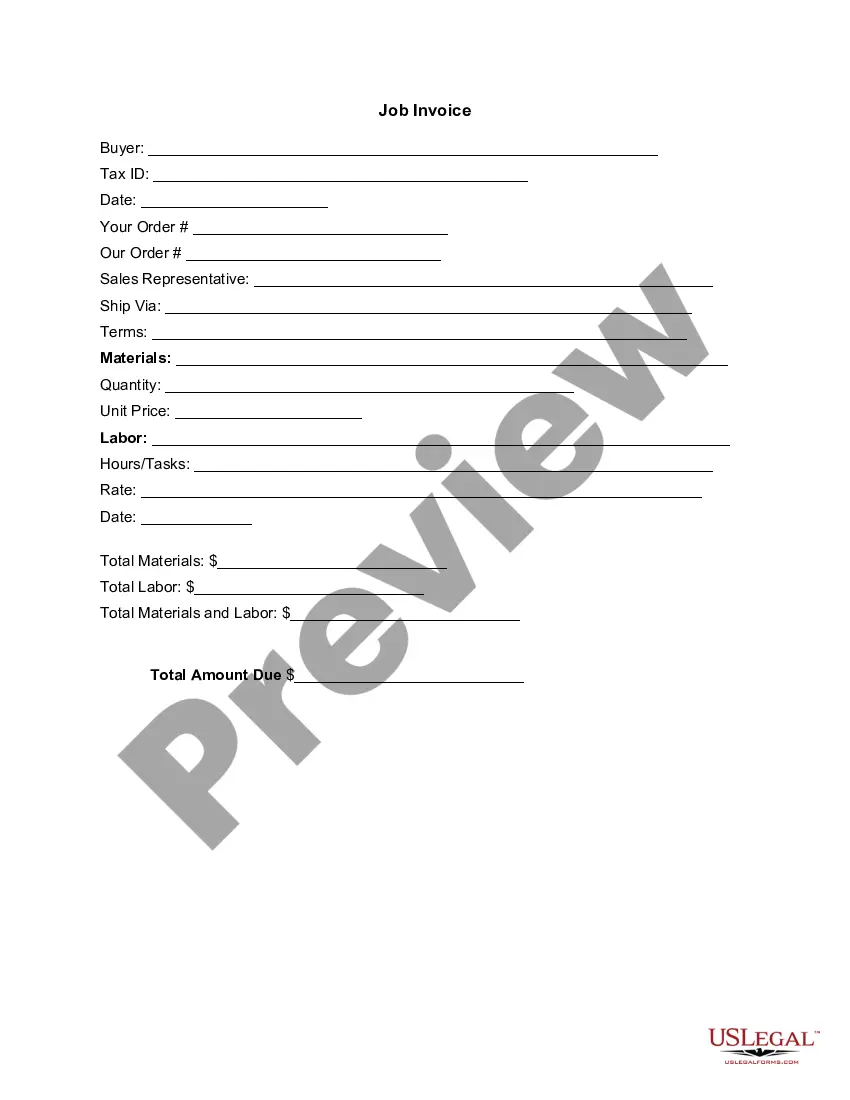

How to fill out Illinois Request For Installment Payment Hearing?

How much time and resources do you often spend on drafting official documentation? There’s a better way to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Illinois Request for Installment Payment Hearing.

To get and prepare a suitable Illinois Request for Installment Payment Hearing template, adhere to these simple steps:

- Examine the form content to ensure it complies with your state regulations. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Illinois Request for Installment Payment Hearing. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Illinois Request for Installment Payment Hearing on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

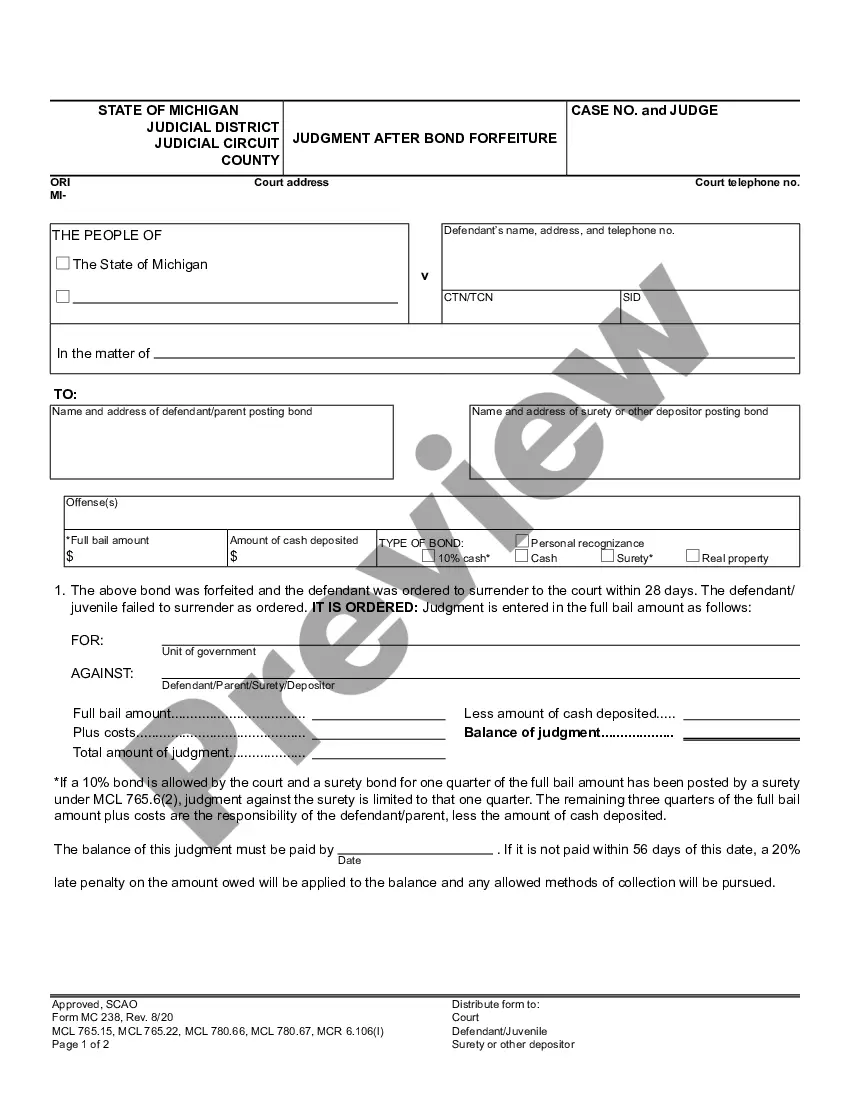

A motion for a stay may be made to the reviewing court, or to a judge thereof, but such a motion must show that application to the circuit court is not practical, or that the circuit court has denied an application or has failed to afford the relief that the applicant has requested, and must be accompanied by

What happens if a defendant does not pay a judgement? A creditor can enforce the judgement and use state laws to seize assets in the hands of the debtor or third parties to collect the amount owed.

If you do not pay, the creditor can start collecting the judgment right away as long as: The judgment has been entered. You can go to the court clerk's office and check the court's records to confirm that the judgment has been entered; and.

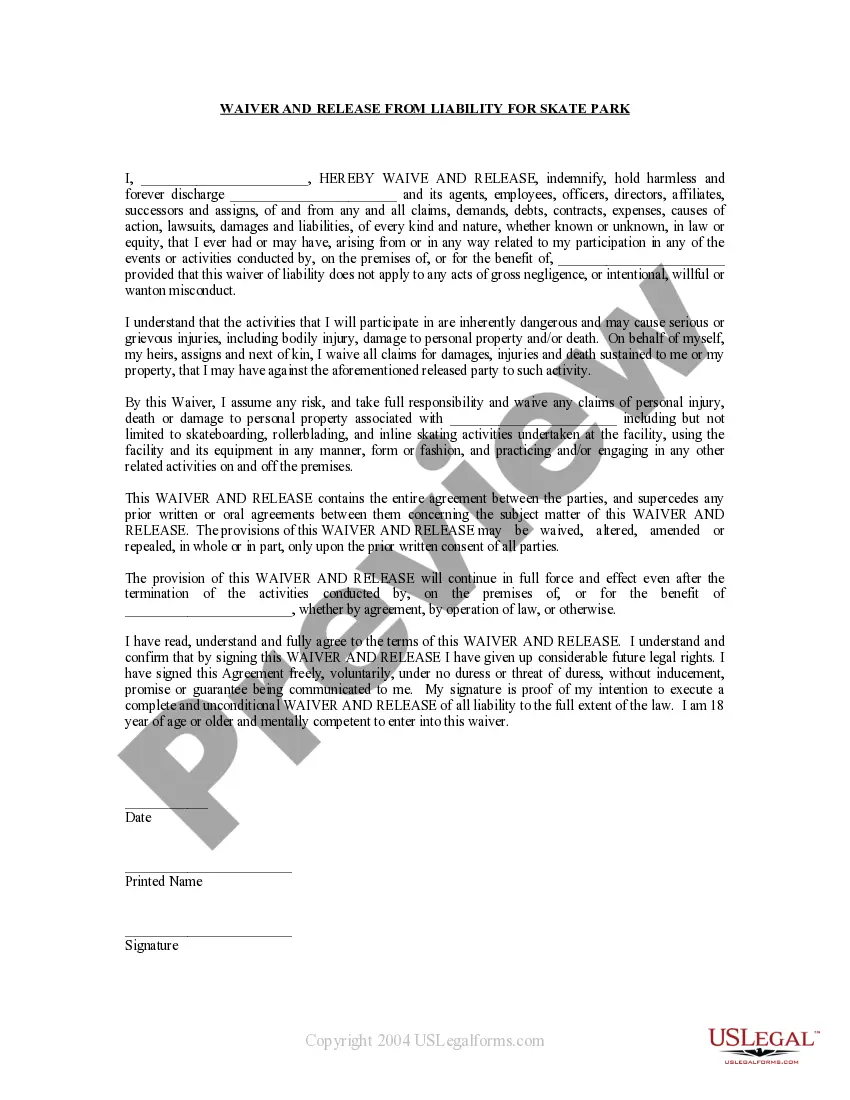

If you have tax delinquencies that you cannot pay in full because of a financial hardship, you can request a payment installment plan using MyTax Illinois. Simply log into your MyTax Illinois account and click the Set up a Payment Installment Plan with IDOR link. Use the Sign up Now!

A citation to discover assets is a legal proceeding in which a creditor attempts to collect on a debt from a debtor. The citation is served upon the debtor and requires the debtor to appear at a hearing where the creditor can inquire about the debtor's assets and income.

If you do not pay the judgment, the judgment creditor can garnish or "seize" your property. The judgment creditor can get an order that tells the Sheriff to take your personal property, like the money in your bank account or your car, to pay the judgment.

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

As used in this chapter: (a) "Installment judgment" means a money judgment under which a lien may be created on an interest in real property under Section 697.320.