The Illinois PTaX-343-a Physician’s Statement for the Homestead Exemption for Persons with Disabilities is a form used by individuals to apply for a property tax exemption. This form must be filled out by a qualified physician and submitted to the county assessor’s office in order for the applicant to receive an exemption on their home. The form certifies that the applicant is a person with a disability and is eligible for the homestead exemption. It contains questions about the applicant’s disability, living situation, and income. There are three types of Illinois PTaX-343-a Physician’s Statement for the Homestead Exemption for Persons with Disabilities: the Standard Statement, the Blind Exemption Statement, and the Disabled Veteran Exemption Statement. The Standard Statement is used for individuals who are disabled and have an annual family income that does not exceed $35,000. The Blind Exemption Statement is used for individuals who are legally blind and have an annual family income that does not exceed $35,000. The Disabled Veteran Exemption Statement is used for individuals who are disabled veterans and have an annual family income that does not exceed $65,000.

Illinois PTaX-343-a Physician's Statement for the Homestead Exemption for Persons with Disabilities

Description

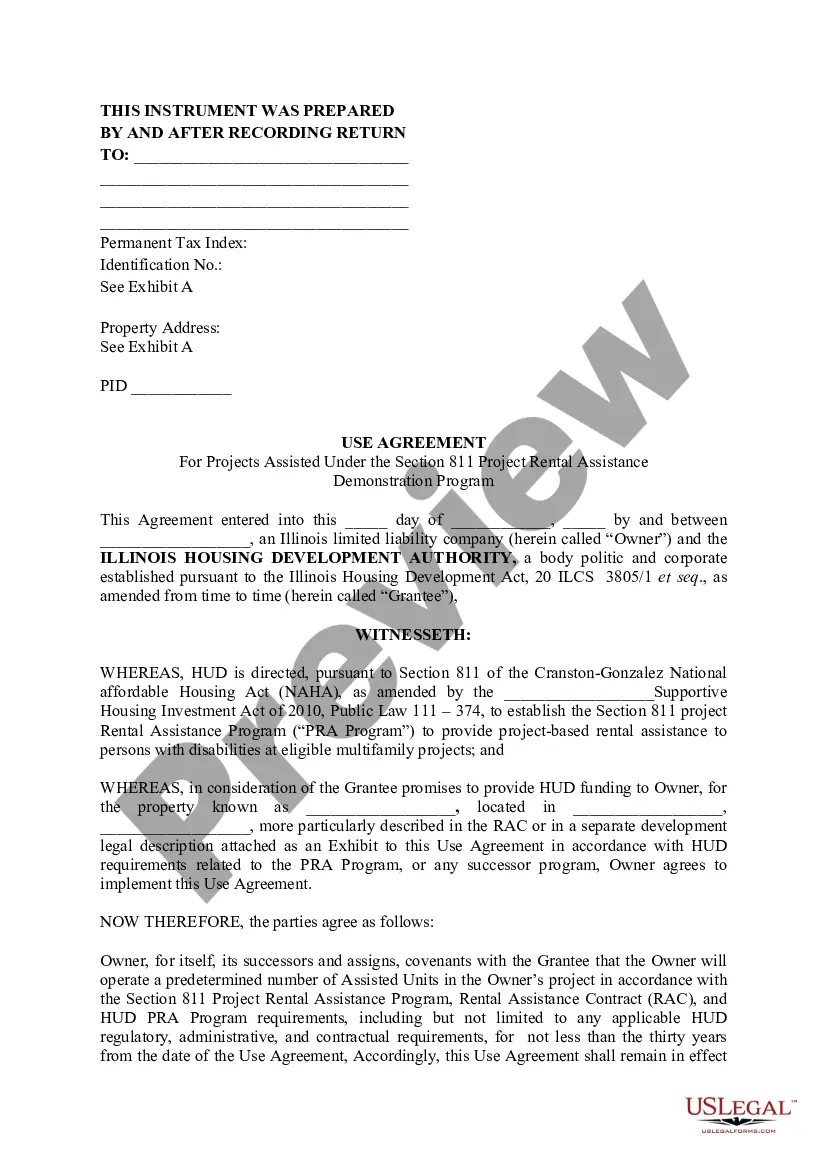

How to fill out Illinois PTaX-343-a Physician's Statement For The Homestead Exemption For Persons With Disabilities?

US Legal Forms is the most simple and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Illinois PTaX-343-a Physician's Statement for the Homestead Exemption for Persons with Disabilities.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Illinois PTaX-343-a Physician's Statement for the Homestead Exemption for Persons with Disabilities if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one corresponding to your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Illinois PTaX-343-a Physician's Statement for the Homestead Exemption for Persons with Disabilities and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding formal paperwork. Give it a try!