Subject: Comprehensive Guide to Illinois Sample Letters to State Tax Commission for Decedent's Estate Keywords: Illinois, sample letter, State Tax Commission, decedent's estate, estate administration, tax filing, inheritances, tax requirements, estate tax, transfer tax, tax liabilities, tax exemptions, legal obligations. Introduction: When it comes to managing a decedent's estate in Illinois, it is crucial to navigate the state's tax obligations. This comprehensive guide provides you with a variety of sample letters to State Tax Commission concerning decedent's estate, ensuring compliance with tax regulations and simplifying the estate administration process. Below, you will find different types of Illinois sample letters to address various scenarios that may arise during estate tax filing and inheritance matters. 1. Sample Letter: Request for Estate Tax Information: To initiate communication with the State Tax Commission regarding a decedent's estate, this letter template allows you to request essential estate tax information. Highlight the estate details, including the deceased person's name, date of death, and any additional pertinent details. Clearly state your intent to comply with tax requirements and request specific information necessary for accurate tax filing, such as consent forms, tax return forms, or other relevant documents. 2. Sample Letter: Notification of Appointment as Personal Representative: If you have been appointed as the personal representative or executor of a decedent's estate, this letter template enables you to officially notify the State Tax Commission about your role. Provide important details about the estate, your contact information, and reference any relevant legal documents, such as a copy of the appointment letter or court order. This letter serves to establish your authority to act on behalf of the estate in tax matters. 3. Sample Letter: Request for Estate Tax Closing Letter: Once the estate tax return has been filed, it is common to request a Closing Letter from the State Tax Commission. This letter confirms the complete audit and acceptance of the estate's tax return, closing all estate tax matters. Use this template to formally request the issuance of a Closing Letter, providing necessary identifying information about the estate and acknowledging your responsibility for any corrected or supplemental filings if requested. 4. Sample Letter: Notification of Changes in Estate Tax Return: In the event that changes or corrections are required in an already filed estate tax return, use this letter template to communicate these modifications to the State Tax Commission. Clearly state the changes made, the reasons for corrections, and attach any supporting documentation. Prompt communication regarding changes helps maintain transparency and ensures the accurate assessment of the estate's tax liabilities. 5. Sample Letter: Request for Estate Tax Extension: If additional time is needed to complete the estate tax return, this letter allows you to formally request an extension. Specify the reasons impacting the timely completion and submission of the return, and propose a new date for filing to demonstrate your commitment to fulfilling legal obligations. Requesting an extension beforehand can help avoid penalties or interest charges for late filing. Conclusion: Managing a decedent's estate involves complying with Illinois tax requirements. By leveraging these various sample letters to communicate with the State Tax Commission, you can streamline estate tax filing, address specific scenarios, and ensure a smooth estate administration process. Customize these templates with the relevant information for your decedent's estate, making it easier to fulfill your legal obligations and navigate the complexities of estate taxation in Illinois.

Illinois Sample Letter to State Tax Commission concerning Decedent's Estate

Description

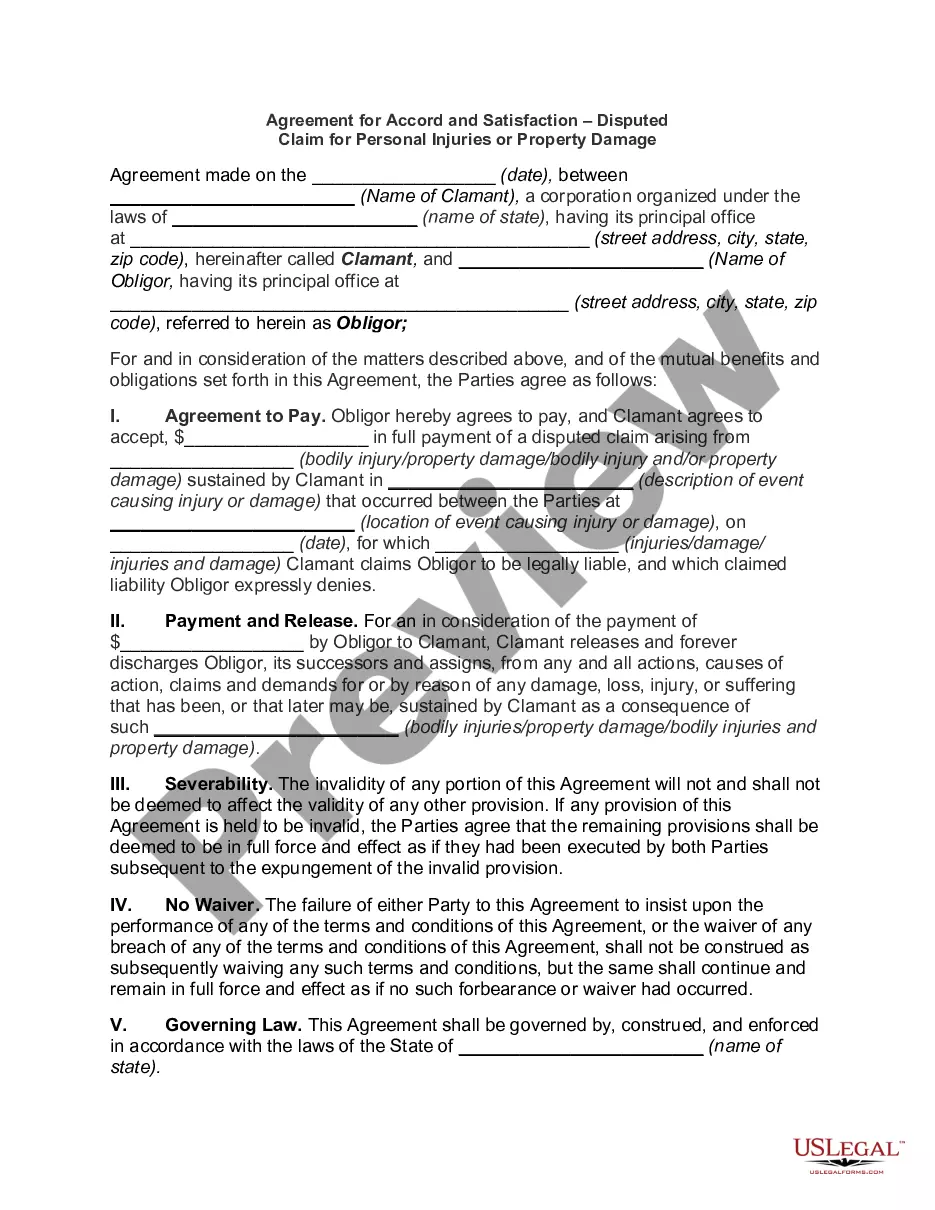

How to fill out Illinois Sample Letter To State Tax Commission Concerning Decedent's Estate?

Choosing the right authorized file web template can be a battle. Naturally, there are a lot of templates available online, but how will you obtain the authorized develop you will need? Utilize the US Legal Forms website. The services gives 1000s of templates, such as the Illinois Sample Letter to State Tax Commission concerning Decedent's Estate, which can be used for company and private requires. Every one of the varieties are examined by professionals and meet up with state and federal needs.

When you are already signed up, log in to your bank account and then click the Down load option to get the Illinois Sample Letter to State Tax Commission concerning Decedent's Estate. Make use of your bank account to look with the authorized varieties you might have bought earlier. Visit the My Forms tab of your own bank account and have yet another copy in the file you will need.

When you are a whole new customer of US Legal Forms, listed here are basic recommendations that you can adhere to:

- First, be sure you have selected the proper develop for the town/county. You are able to look over the shape making use of the Review option and study the shape explanation to make certain this is the best for you.

- In case the develop fails to meet up with your expectations, use the Seach industry to find the right develop.

- Once you are certain that the shape is suitable, click the Acquire now option to get the develop.

- Pick the costs program you desire and type in the needed information and facts. Design your bank account and purchase an order utilizing your PayPal bank account or credit card.

- Choose the document format and down load the authorized file web template to your product.

- Full, edit and print and indicator the obtained Illinois Sample Letter to State Tax Commission concerning Decedent's Estate.

US Legal Forms is the biggest local library of authorized varieties for which you will find a variety of file templates. Utilize the company to down load appropriately-made documents that adhere to state needs.