The Illinois Bill of Sale — Quitclaim is a legal document used to transfer the ownership interest of a property from one party to another. It is commonly used in real estate transactions, where the seller (granter) relinquishes their rights and claims to the property in favor of the buyer (grantee). The Quitclaim Bill of Sale in Illinois is a binding agreement that provides legal protection to both parties involved in the sale. It outlines the terms and conditions of the transfer, including any warranties, if applicable. This document helps establish clear ownership rights and prevents future disputes or claims against the property. There are no different types of Illinois Bill of Sale — Quitclaim itself. However, there may be variations in the language and content used depending on the specific circumstances of the sale. Some key elements typically included in a Quitclaim Bill of Sale are: 1. Parties: The names and contact information of the granter (seller) and grantee (buyer) are mentioned at the beginning of the document. 2. Description of Property: A detailed description of the property being transferred is provided, including the legal description or address. 3. Consideration: The agreed-upon price or consideration for the sale is specified, along with the payment terms, such as cash, check, or installment payments. 4. Warranties: Unlike other types of real estate transactions, the Quitclaim Bill of Sale does not typically include warranties about the property's title or condition. It only guarantees that the granter surrenders their interest in the property. 5. Signatures and Notarization: Both the granter and grantee must sign the document in the presence of a notary public. This ensures the authenticity and legal validity of the transaction. It is crucial to consult an attorney or legal professional when drafting or executing an Illinois Bill of Sale — Quitclaim to ensure it complies with state laws and meets the specific requirements of the transaction.

Illinois Bill of Sale - Quitclaim

Description

How to fill out Illinois Bill Of Sale - Quitclaim?

Have you encountered a scenario where you require documents for personal or business use almost daily.

There are numerous authentic document templates available online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers a wide variety of form templates, including the Illinois Bill of Sale - Quitclaim, which can be tailored to meet state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes.

The service provides well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Illinois Bill of Sale - Quitclaim template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/county.

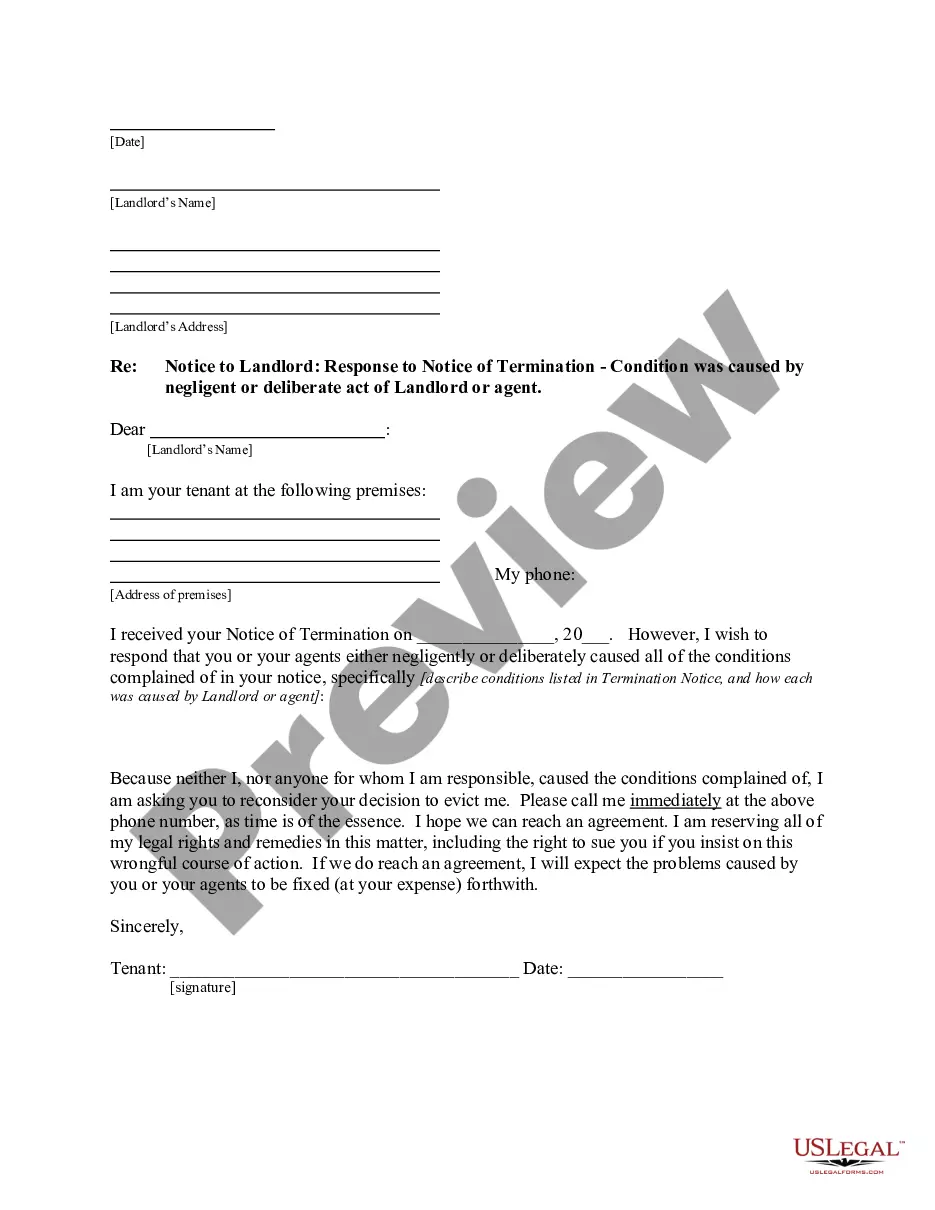

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Lookup field to find the one that matches your requirements and needs.

- Once you find the correct form, click on Acquire now.

- Choose the pricing plan you prefer, complete the necessary details to create your account, and pay for your order with your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can obtain another copy of Illinois Bill of Sale - Quitclaim anytime if necessary. Just click on the required form to download or print the document template.

Form popularity

FAQ

Filing a quitclaim deed in Illinois involves a few straightforward steps. Begin by preparing the necessary document, ensuring you include relevant property details. Next, sign the quitclaim deed in front of a notary and submit it to the county recorder's office. Leveraging a platform like USLegalForms can simplify this process, providing guidance and templates to ease the filing of your Illinois Bill of Sale - Quitclaim.

Filling out a quit claim deed in Illinois requires specific information to be accurate and complete. Start by entering the names and addresses of both the grantor and grantee, followed by a thorough legal description of the property. Don't forget to sign the document and have it notarized to make it official. By using resources found at uslegalforms, you can easily create an Illinois Bill of Sale - Quitclaim that ensures all necessary details are included.

You do not necessarily need a lawyer to file a quitclaim deed in Illinois, as many individuals successfully handle this themselves. However, legal advice can ensure the document is crafted and filed correctly, which might save time and prevent future disputes. Platforms like uslegalforms can provide you with guidance and templates for completing your Illinois Bill of Sale - Quitclaim, making the process accessible and straightforward.

An example of a quitclaim could be when one sibling transfers property ownership to another sibling without any payment. This deed serves to relinquish any claim that the transferring party has on the property. For instance, if a parent wishes to transfer their home to their children, an Illinois Bill of Sale - Quitclaim would facilitate this simple transfer process without complications.

Writing your own quit claim deed involves including specific elements to make the document legally binding. You should clearly identify the grantor and grantee, provide a description of the property, and state the consideration, which refers to what is exchanged. By following templates available through platforms like uslegalforms, you can confidently draft an Illinois Bill of Sale - Quitclaim that meets state requirements while saving on legal fees.

The most common use of a quit claim deed is to transfer ownership of property between family members or close acquaintances. Often, this deed facilitates the easy transfer of property without having to deal with complex legalities. For example, you might use it when gifting property to a relative or when putting a spouse's name on a deed. Utilizing an Illinois Bill of Sale - Quitclaim ensures a smooth transaction in these familial situations.

Yes, you can complete a quitclaim deed on your own in Illinois, provided you follow the necessary legal guidelines. Utilizing templates from platforms like USLegalForms can provide you the right format and instructions to ensure compliance. Make sure to have the document notarized after filling it out, as this adds to its legality. Doing it yourself can be a straightforward way to handle property transfers efficiently.

You can request a copy of a quitclaim deed from the county recorder's office where the property is located. Most counties also offer online access to their public records, which can simplify your search. If you used USLegalForms for the original deed, you might find a copy in your account documents. Always ensure you have the necessary details, like property address and the parties involved.

To get a quitclaim deed in Illinois, you can either draft one using a template or hire an attorney for assistance. If you choose to use a template, platforms like USLegalForms provide ready-made documents that comply with state regulations. Simply follow the instructions, fill in the necessary details, and ensure it is signed and notarized. This process will help you create a valid Illinois Bill of Sale - Quitclaim.

You can obtain a quitclaim deed in Illinois through various legal document providers or online platforms. Websites like USLegalForms offer access to templates tailored to Illinois laws. These templates simplify the process, allowing you to easily fill in your information. Additionally, you may find quitclaim deeds at your local county clerk's office.

Interesting Questions

More info

Ships Corporate amendment Services View Protect your brand Trademark registration Trademark track Trademark monitor Provisional patent Copyright View Help decide business services Attorneys with every step right guidance with attorney your side network attorneys have average client rating stars Legal help Attorneys with every step right guidance with attorney your side network attorneys have average client rating stars legal help Attorneys with every Rent a Lawyer's Service Search for a Lawyers In The State of California Search For A Lawyers On Yelp.