A Buy-Sell Agreement between shareholders and a corporation in Illinois is a legally binding contract that outlines the terms under which shares of a corporation may be bought or sold by the existing shareholders. It is designed to establish a clear set of rules and procedures regarding the ownership and transfer of shares, helping to protect the interests of all parties involved in the corporation. There are several types of Buy-Sell Agreements which can be used in Illinois, depending on the specific needs and circumstances of the corporation and its shareholders. Some common types include: 1. Cross-Purchase Agreement: This type of agreement allows the remaining shareholders to purchase the shares of a departing or deceased shareholder. Each remaining shareholder individually agrees to buy the shares in proportion to their existing ownership percentage. This ensures a smooth transition of ownership and prevents outsiders from gaining control of the corporation. 2. Redemption Agreement: In this type of agreement, the corporation itself, rather than individual shareholders, agrees to buy back the shares of a departing or deceased shareholder. The funds for the share purchase are usually provided by the corporation's life insurance policy on the shareholders' lives or through a sinking fund. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and redemption agreements. It provides flexibility by allowing the remaining shareholders and the corporation to choose the best method for purchasing the shares of a departing or deceased shareholder. The Illinois Buy-Sell Agreement typically includes various important provisions, such as: a. Purchase Price: The agreement stipulates the method for determining the price at which shares will be sold, which can include a formula based on the corporation's financial statements or through a valuation process. b. Restrictions on Transfer: The agreement may contain provisions that restrict the transfer of shares to outsiders. These restrictions help maintain the ownership within the existing shareholder group and prevent potential conflicts of interest. c. Triggering Events: The agreement specifies the events that will trigger the buy-sell provisions, such as death, disability, retirement, or resignation of a shareholder. This ensures the smooth transition of ownership in case of unforeseen circumstances. d. Funding Mechanism: The agreement outlines the funding mechanism to facilitate the purchase of shares, such as using personal funds, corporate funds, or obtaining life insurance policies on shareholders' lives. e. Dispute Resolution: In case of disagreements or disputes, the Buy-Sell Agreement usually includes procedures for resolving conflicts, such as mediation, arbitration, or other alternative dispute resolution methods. f. Terms and Conditions: The agreement includes various terms and conditions related to the sale and transfer of shares, including payment terms, timelines, and any additional rights or obligations of the parties involved. It is essential for shareholders and the corporation to consult with legal professionals experienced in corporate law in Illinois when drafting and executing a Buy-Sell Agreement. This ensures that the agreement complies with state laws and adequately protects the interests of all parties involved.

Illinois Buy Sell Agreement Between Shareholders and a Corporation

Description

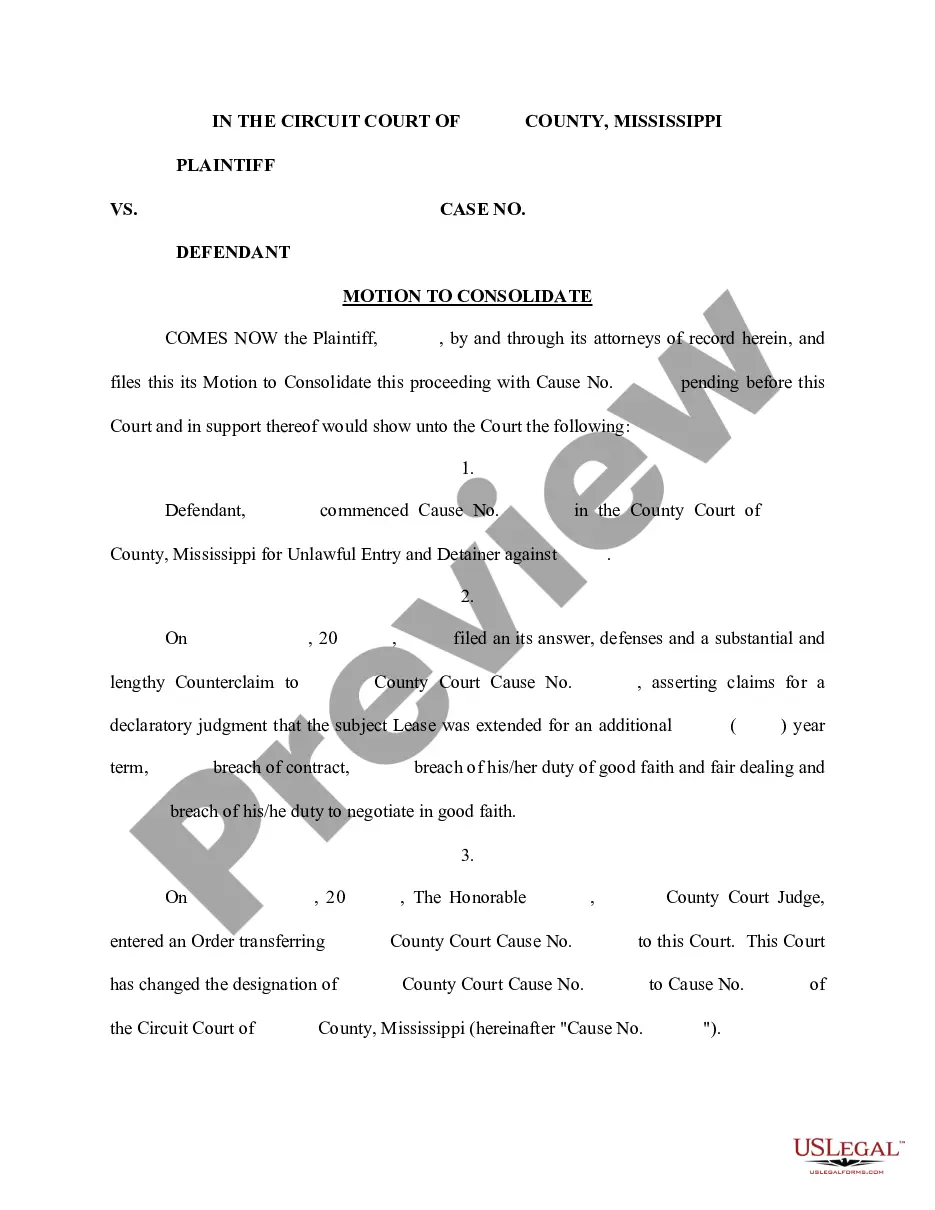

How to fill out Illinois Buy Sell Agreement Between Shareholders And A Corporation?

You might spend multiple hours online searching for the legal document template that complies with the state and federal requirements you will require.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can readily obtain or print the Illinois Buy Sell Agreement Between Shareholders and a Corporation through my services.

First, make certain you have chosen the correct document template for your state/town of preference. Review the form description to confirm you have selected the appropriate form. If available, utilize the Review option to examine the document template as well. If you wish to find another version of the form, use the Lookup field to find the template that fits your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and then select the Download option.

- Subsequently, you can complete, modify, print, or sign the Illinois Buy Sell Agreement Between Shareholders and a Corporation.

- Every legal document template you purchase is yours permanently.

- To retrieve an additional copy of the purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

Form popularity

FAQ

The agreement between shareholders and a company, often established through an Illinois Buy Sell Agreement Between Shareholders and a Corporation, governs the rights and responsibilities of shareholders regarding stock ownership. This crucial document ensures that all shareholders understand their obligations, including buyout terms and valuation methods. By clearly defining these aspects, the agreement fosters trust among shareholders and protects the company's long-term interests.

A shareholder buy-sell agreement is a legally binding contract that details how shares will be handled in various situations, such as death, disability, or retirement of a shareholder. This document, often referred to as the Illinois Buy Sell Agreement Between Shareholders and a Corporation, ensures that shares are bought back by the corporation or sold to remaining shareholders, thus maintaining the intended ownership structure. By having this agreement in place, shareholders can avoid disputes and ensure a smooth transition of ownership.

sell agreement can help simplify the transition of ownership by ensuring that shares are transferred directly to the designated parties without the need for probate. This Illinois Buy Sell Agreement Between Shareholders and a Corporation streamlines the process, allowing shareholders to avoid lengthy court proceedings. Consequently, the heirs or beneficiaries can receive their shares quickly and with less hassle, ultimately preserving the company’s operations without disruption.

Typically, a buy-sell agreement is created by the shareholders of the corporation in collaboration with a qualified attorney. This process ensures that the Illinois Buy Sell Agreement Between Shareholders and a Corporation accurately reflects the intentions and agreements among shareholders. Involving legal professionals helps in drafting a clear and enforceable agreement that can prevent future disputes.

To obtain a shareholders agreement, you can start by researching templates specifically designed for an Illinois Buy Sell Agreement Between Shareholders and a Corporation. Many online platforms, including US Legal Forms, provide customizable templates that suit your business needs. It is also advisable to consult with a legal expert to ensure compliance with relevant laws and protection for all parties involved.

While a buy-sell agreement provides structure, there are some disadvantages to consider. It can create financial obligations for shareholders if they need to buy out another's shares unexpectedly. Additionally, poorly drafted agreements may lead to conflicts if the terms are unclear. An effective Illinois Buy Sell Agreement Between Shareholders and a Corporation is crucial to minimizing these risks.

In a corporate buy-sell agreement, the corporation itself is a party to the transaction. This type often enables the corporation to buy back shares from a shareholder under specific conditions. The Illinois Buy Sell Agreement Between Shareholders and a Corporation addresses these scenarios, ensuring a smooth transfer of ownership while protecting the interests of remaining shareholders.

Writing up a buy-sell agreement involves several steps. Start by gathering input from all shareholders to ensure their needs are met. Then, draft the agreement by including essential details such as share valuation, payment terms, and conditions for triggering the agreement. Using a service like US Legal Forms can guide you through creating a personalized Illinois Buy Sell Agreement Between Shareholders and a Corporation.

sell agreement typically includes key components such as valuation methods for shares, triggering events for the buysell provisions, and payment terms. It may also outline the responsibilities of parties and any specific conditions for selling or transferring shares. Understanding these elements is crucial when creating an Illinois Buy Sell Agreement Between Shareholders and a Corporation.

Filling out a buy-sell agreement requires careful attention to detail. You start by identifying the parties involved, which include the corporation and its shareholders. Then, specify the terms of the agreement, including conditions for buying and selling shares. Using platforms like US Legal Forms can simplify this process, providing templates tailored to the Illinois Buy Sell Agreement Between Shareholders and a Corporation.

More info

(“The Advisor”). The Investment Advisors use your personally registered email address, phone number and/or fax number on this website to provide you the option to make donations to a 501(c)(3) non-profit organization (“501(c)(3)”) or to share personal information with a registered security firm. If you have previously donated to us at. Please visit this page for your password. In order to donate to such a 501(c)(3) organization or share your personal information, please make sure you check the appropriate box on the donation form and sign your name. Only registered 501(c)(3) organizations and registered security firms can be made direct donations. Any unauthorized attempts to make a donation to a non-c)(3) entity will be rejected. Please note we are not a federal 501(c)(3) organization and cannot receive federal grants. By clicking on the donate button(s), you agree to be bound by this notice and the Privacy Policy at.