The Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance is a legal document that outlines the terms and conditions for buying or selling common stock in a closely held corporation in the state of Illinois. This agreement also provides an option for funding the purchase through life insurance. This type of agreement is used when shareholders in a closely held corporation want to establish a pre-determined method for the sale of their shares in the event of certain triggering events such as death, disability, retirement, or termination of employment. The agreement ensures a smooth transition of ownership and provides a fair and equitable process for both the buying and selling shareholders. The agreement typically includes clauses that define the triggering events, the valuation method for determining the purchase price of the shares, the terms for the transfer of the shares, and the rights and obligations of the parties involved. It also includes details about the funding of the purchase, including the option to use life insurance to finance the buyout. There may be different types or variations of this agreement based on the specific needs and requirements of the shareholders or the corporation. Some common variations include: 1. Cross Purchase Agreement: In this type of agreement, each shareholder agrees to purchase the shares of the other shareholders in the event of a triggering event. This agreement is typically used when there are a few shareholders. 2. Redemption Agreement: In a redemption agreement, the corporation itself agrees to redeem the shares of the selling shareholder. This type of agreement is commonly used when there are many shareholders or when the corporation has sufficient funds to finance the buyout. 3. Hybrid Agreement: A hybrid agreement combines elements of both the cross purchase and redemption agreements. In this type of agreement, some shareholders may agree to purchase the shares of the selling shareholder, while the corporation agrees to redeem the shares of other shareholders. 4. Wait-and-See Agreement: A wait-and-see agreement allows the buying shareholders to decide whether to purchase the shares or allow the corporation to redeem them. The decision is typically based on factors such as the funding availability and tax implications at the time of the triggering event. The specific terms and provisions of the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance may vary depending on the parties involved and their specific circumstances. It is essential to consult with legal professionals to draft a customized agreement that meets the particular needs and objectives of the shareholders and the corporation.

Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

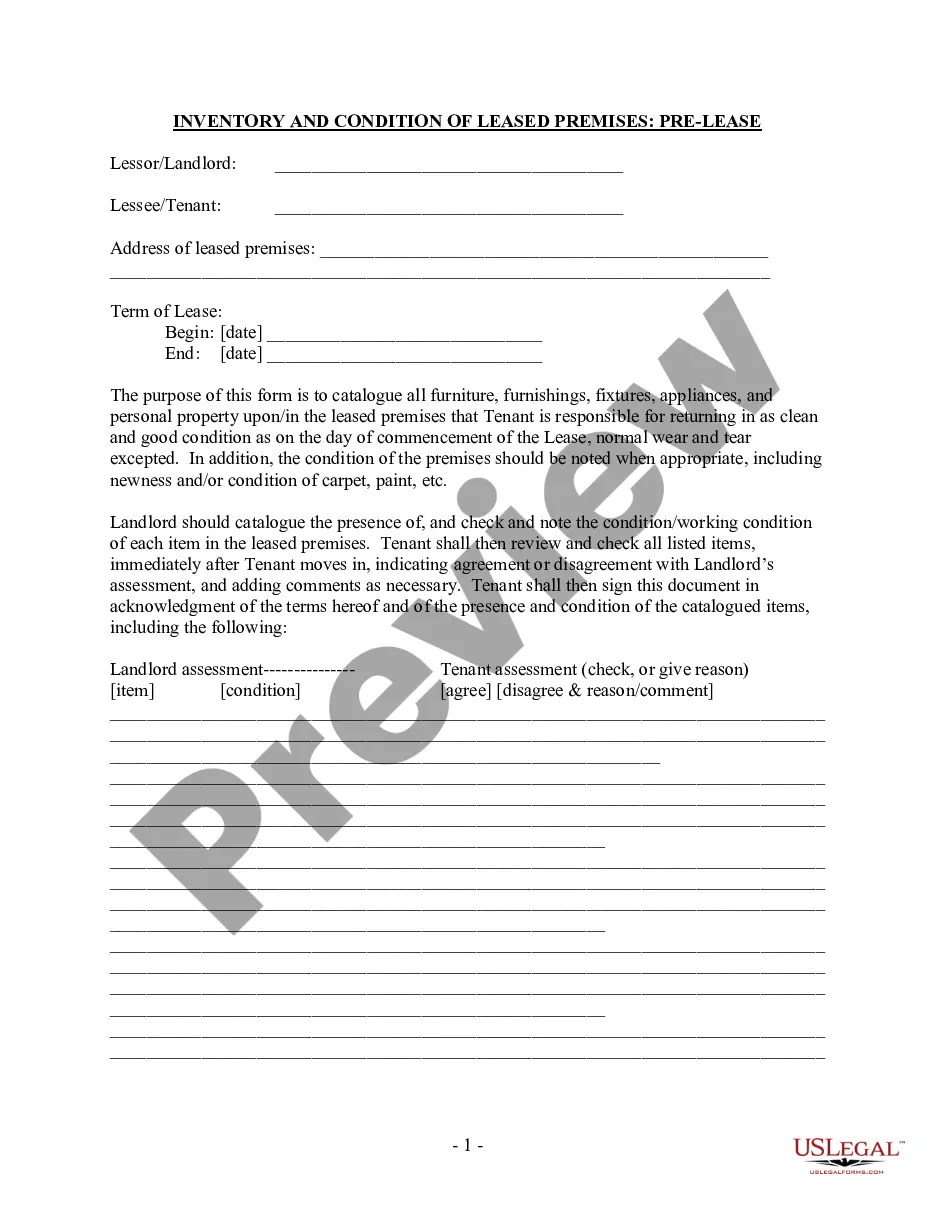

How to fill out Illinois Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

US Legal Forms - among the biggest libraries of lawful varieties in the USA - provides a wide array of lawful record themes you may obtain or print out. Making use of the web site, you can find 1000s of varieties for company and person purposes, sorted by categories, suggests, or search phrases.You will discover the most recent versions of varieties such as the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance within minutes.

If you currently have a subscription, log in and obtain Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance from the US Legal Forms local library. The Down load option can look on each and every kind you perspective. You get access to all formerly delivered electronically varieties in the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, listed below are basic directions to obtain started:

- Make sure you have chosen the best kind for your metropolis/area. Select the Review option to review the form`s information. Browse the kind outline to ensure that you have selected the correct kind.

- When the kind does not fit your needs, make use of the Research area at the top of the monitor to obtain the one which does.

- In case you are content with the form, affirm your selection by simply clicking the Get now option. Then, opt for the prices program you favor and offer your references to register for an account.

- Procedure the purchase. Use your charge card or PayPal account to accomplish the purchase.

- Select the structure and obtain the form in your system.

- Make adjustments. Fill up, modify and print out and indicator the delivered electronically Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

Every single design you put into your account does not have an expiry day and is the one you have forever. So, if you want to obtain or print out yet another duplicate, just check out the My Forms area and then click in the kind you will need.

Get access to the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance with US Legal Forms, the most considerable local library of lawful record themes. Use 1000s of professional and state-distinct themes that fulfill your business or person needs and needs.