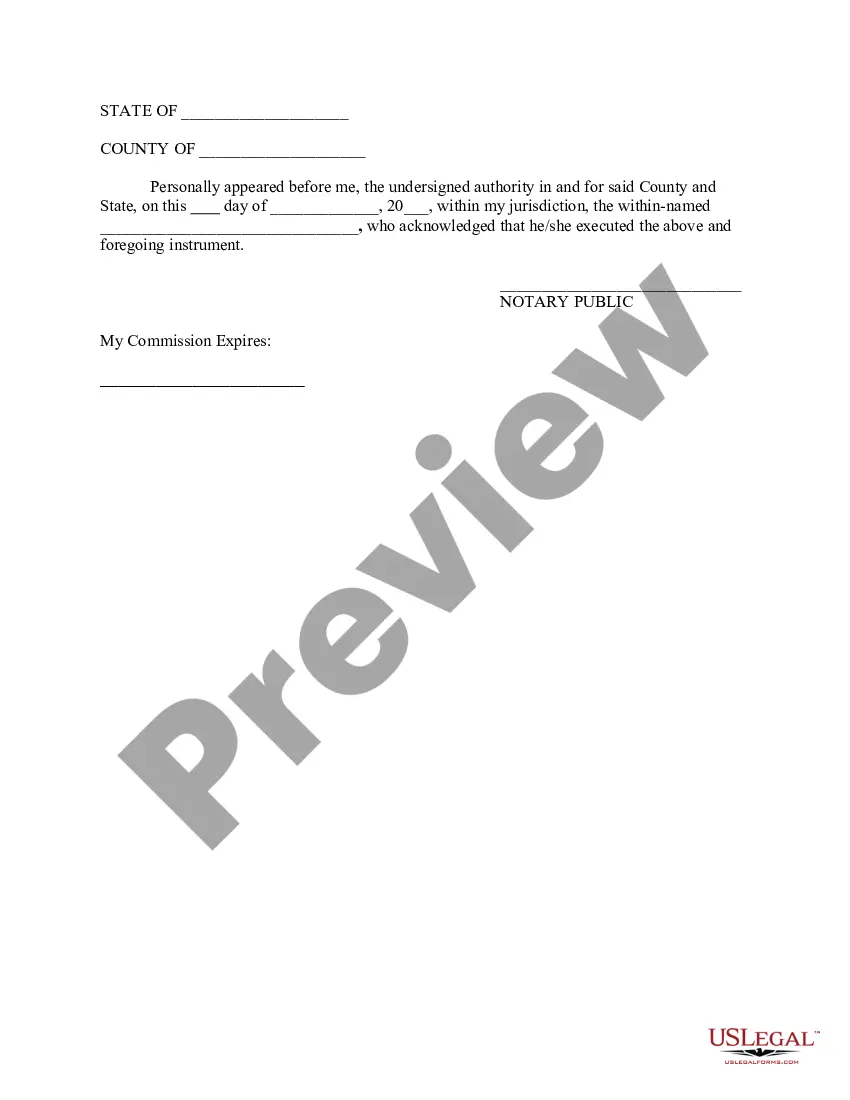

Illinois Certificate of Heir is a legal document used to transfer the title of a motor vehicle without the need for probate, especially when the vehicle has not been specifically mentioned in the deceased's will. This certificate allows the rightful heir to claim ownership and registration of the vehicle. The Illinois Certificate of Heir serves as a legal proof of inheritance and helps facilitate the transfer of the vehicle's title smoothly. It is crucial to utilize this certificate to ensure a seamless process and avoid any legal complications. Types of Illinois Certificate of Heir: 1. Illinois Small Estate Affidavit: This type of certificate is applicable when the deceased's estate does not exceed a certain value, set by state law. If the estate qualifies as "small," the Small Estate Affidavit can be used to transfer the vehicle's title without going through the probate process. 2. Illinois Affidavit for Ownership of Vehicle When Owner Dies Without a Will: In circumstances where the deceased did not leave a valid will behind, this affidavit can be used as evidence of warship to obtain the transfer of the vehicle's title. It enables the heir to establish their rightful claim and ownership. 3. Illinois Affidavit for Title Transfer of Watercraft or Outboard Motor (No Probate): In cases involving watercraft or outboard motors, this specific affidavit is utilized to transfer the ownership without going through probate. It is essential to use the correct form to ensure a proper and valid transfer of title. When applying for an Illinois Certificate of Heir, several key documents and information are typically required. These include: a) Death certificate of the deceased owner. b) Vehicle identification number (VIN) or watercraft details. c) Proof of relationship to the deceased, such as birth or marriage certificates. d) Affidavit or sworn statement from the heir(s) establishing their right to inheritance. e) Proof of payment of any outstanding debts or taxes associated with the vehicle. To obtain an Illinois Certificate of Heir, the following steps are typically involved: 1. Gather all the required documents and information. 2. Complete the applicable affidavit form accurately. 3. Sign the affidavit in the presence of a notary public or authorized representative. 4. Submit the completed affidavit, along with supporting documents, to the appropriate local office, such as the county clerk's office or the Illinois Secretary of State's office. 5. Pay any necessary fees associated with the transfer of title. 6. Await confirmation and receipt of the Certificate of Heir, which will enable the heir to obtain the transfer of the motor vehicle's title. Obtaining an Illinois Certificate of Heir to transfer the title of a motor vehicle without probate is an efficient and legally sound process. By following the correct steps and providing the required documentation, heirs can effortlessly claim rightful ownership of their inherited vehicle.

Illinois Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Illinois Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Finding the right authorized file format can be quite a battle. Obviously, there are a variety of web templates available online, but how will you find the authorized kind you need? Make use of the US Legal Forms site. The service offers thousands of web templates, for example the Illinois Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), which can be used for enterprise and personal demands. All the varieties are checked by experts and satisfy federal and state needs.

If you are previously listed, log in to your accounts and click on the Obtain key to find the Illinois Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Make use of accounts to appear through the authorized varieties you might have bought formerly. Check out the My Forms tab of the accounts and get another copy of your file you need.

If you are a brand new user of US Legal Forms, listed here are easy directions so that you can follow:

- Very first, make sure you have selected the appropriate kind for your town/region. It is possible to examine the shape while using Review key and read the shape explanation to make certain this is basically the best for you.

- If the kind does not satisfy your preferences, utilize the Seach area to discover the right kind.

- Once you are certain that the shape is proper, click on the Get now key to find the kind.

- Select the pricing strategy you desire and enter in the essential information. Design your accounts and purchase an order making use of your PayPal accounts or bank card.

- Pick the data file structure and down load the authorized file format to your gadget.

- Comprehensive, modify and print out and signal the obtained Illinois Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

US Legal Forms is definitely the greatest collection of authorized varieties for which you can see a variety of file web templates. Make use of the service to down load skillfully-created files that follow express needs.

Form popularity

FAQ

It costs $155 to transfer the title on a vehicle in Illinois. This fee does not include vehicle taxes or registration fees, which you will have to pay as well (except in tax exemption cases).

The Title Transfer Process When you purchase a vehicle in Illinois, all you need to do is bring relevant documents to our counter. These documents include the title, the bill of sale, your identification, and proof of residence, such as an electric bill in your name.

Small Estate Affidavit A Small Estate Affidavit describing the vehicle year, make and vehicle identification number. ... The decedent's title, which does not need to be assigned. A copy of the death certificate or abstract. A completed Application for Vehicle Transaction(s) (VSD 190).

Title transfer if gifting a car to a family member You need to sign the title and give it to your family member. The family member then needs to submit an Application for Vehicle Transaction(s) (VSD 190) within 20 days to get the title in their name and must file Form RUT-50 and pay any applicable taxes.

A copy of the death certificate or abstract. The decedent's title. A completed Application for Vehicle Transaction(s) (VSD 190). If the vehicle will not be operated, the buyer may obtain only a title by using an Application for Vehicle Transaction(s) (VSD 190).

A Transfer on Death (TOD) beneficiary is a simple way to transfer ownership of a vehicle after the titled owner has died. By naming a TOD beneficiary on your title application, you can avoid the need for the vehicle to go through probate upon your death.

Upon the death of a vehicle owner, transferring the vehicle title depends on whether the title was in the decedent's individual name or joint ownership. If the title was in the decedent's name only, the procedure de pends on whether the decedent's estate is being probated.

The vehicle must be solely owned and not a business. Only one name may be listed on the Certificate of Title as the beneficiary. A beneficiary cannot be added to the title when there is a lienholder; lessor or ownership is designated as ?joint tenancy.? The beneficiary does not have interest or control of the vehicle.