Illinois Financial Statement Form - Individual

Description

How to fill out Financial Statement Form - Individual?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Illinois Financial Statement Form - Individual in moments.

If you have an active monthly subscription, Log In to download the Illinois Financial Statement Form - Individual from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit and print the acquired Illinois Financial Statement Form - Individual. Every template you add to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Illinois Financial Statement Form - Individual with US Legal Forms, the most comprehensive collection of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you’ve selected the correct form for your location.

- Click the Preview button to examine the form’s content.

- Read the form’s description to verify that you’ve chosen the right one.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase Now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

To properly fill out a financial affidavit using the Illinois Financial Statement Form - Individual, gather all relevant financial documents and ensure all information, including income and expenses, is current. Clearly categorize your entries and double-check figures for accuracy. A well-prepared affidavit not only supports your position during legal proceedings but also helps foster transparency.

To fill out a financial statement effectively, begin by obtaining the Illinois Financial Statement Form - Individual. Ensure you provide complete and accurate information about your income, expenses, debts, and assets, as this will reflect your true financial picture. Take your time to review the document after filling it to ensure everything is correct before submission.

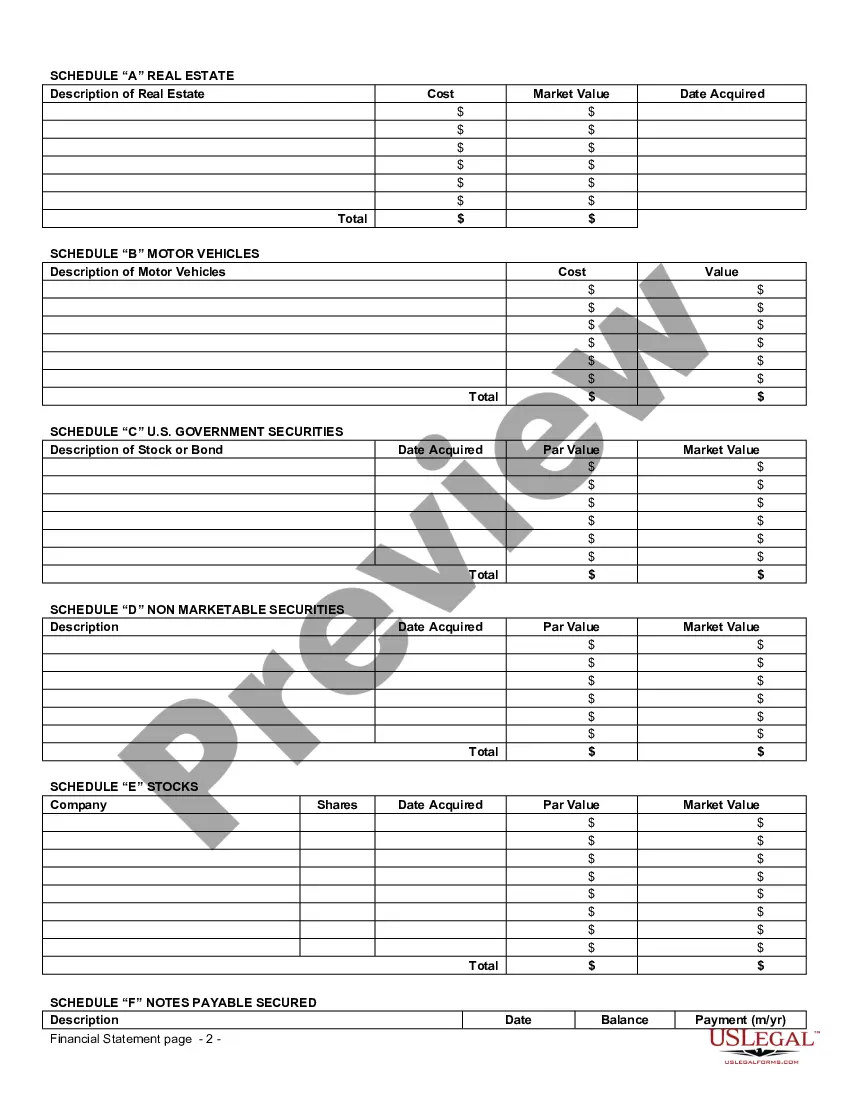

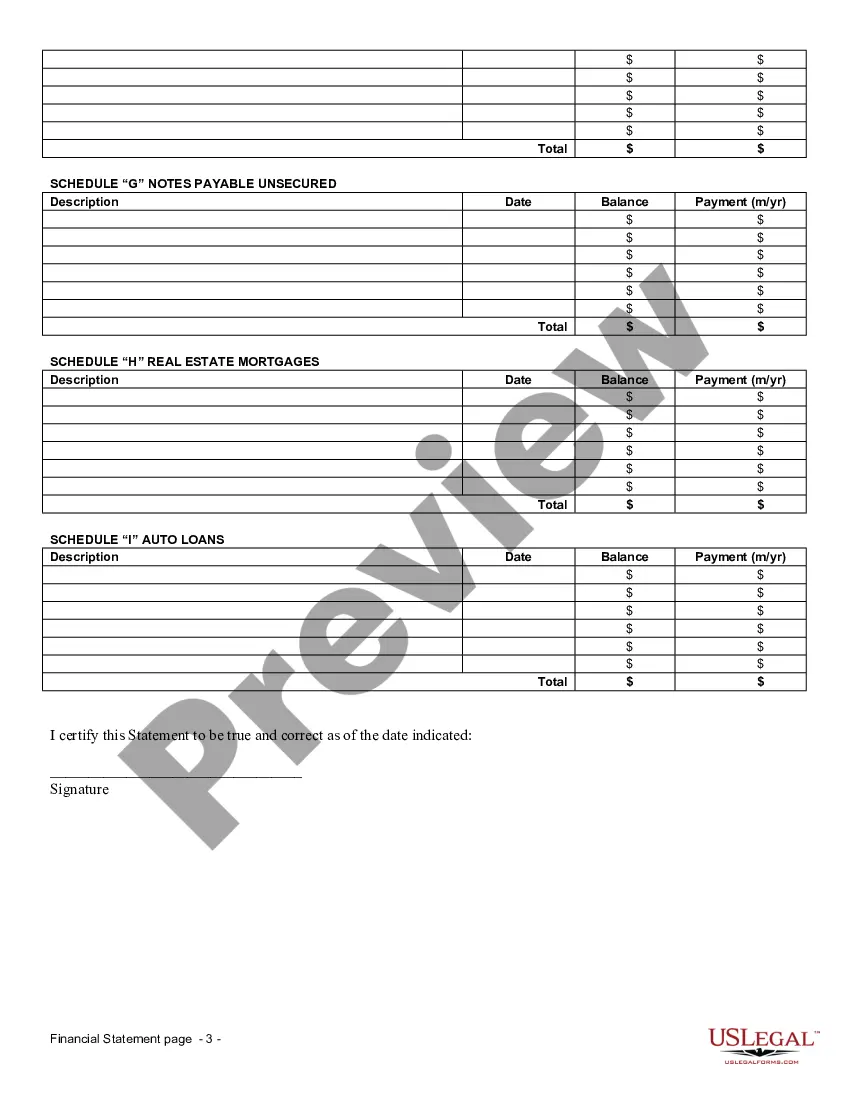

The format of the Illinois Financial Statement Form - Individual is structured to include specific sections for income, expenses, assets, and liabilities. You will find designated spaces to enter necessary figures and a summary section at the end. Following the designated order enhances clarity and ensures that all required information is captured efficiently.

An example of a financial statement is the Illinois Financial Statement Form - Individual, which typically includes sections for detailing income, expenses, assets, and liabilities. It acts as a comprehensive snapshot of your financial situation at a specific point in time. You can find a template of this form online, which can guide you in how to appropriately fill it out.

In Illinois, a financial affidavit is generally required in uncontested divorce cases, especially when there are financial disclosures involved. The Illinois Financial Statement Form - Individual serves as the affidavit necessary to outline your financial status. This information helps in determining equitable distribution of assets and liabilities.

Filling out a financial statement for divorce using the Illinois Financial Statement Form - Individual involves detailing your income, expenses, and assets comprehensively. Start with listing your income sources, followed by regular expenses such as housing, utilities, and child support, if applicable. Be precise and honest in your entries, as this document will be used during divorce proceedings to assess financial obligations.

To fill in an Illinois Financial Statement Form - Individual, start by gathering your financial information, including income, expenses, assets, and liabilities. Clearly list each category in the provided sections of the form. Ensure that all figures are accurate and up to date, as this document is crucial for financial assessments in legal proceedings.

To pick up Illinois tax forms, you can visit local government offices, such as the Illinois Department of Revenue or public libraries. These locations typically have physical copies of the forms, including the Illinois Financial Statement Form - Individual. Furthermore, if you prefer a digital solution, you can always access and print the forms from websites like USLegalForms, making it convenient to get the forms you need without leaving home.

You can easily download tax forms from the official Illinois Department of Revenue website. Their online resources include a comprehensive list of necessary forms, including the Illinois Financial Statement Form - Individual. Additionally, our platform at USLegalForms provides direct access to these forms, ensuring you can obtain the paperwork you need without hassle. This streamlines your filing process, making it more efficient.

The IL-1040 form is the Illinois Individual Income Tax Return form required by the Illinois Department of Revenue. It allows you to report your income, calculate your taxes, and determine your refund or balance due. This form is essential for individuals who need to include their income and deductions as part of their Illinois Financial Statement Form - Individual. Having the IL-1040 organized and correctly filled out can simplify your tax filing process.