The admission of a new partner results in the legal dissolution of the existing partnership and the beginning of a new one. From an economic standpoint, however, the admission of a new partner (or partners) may be of minor significance in the continuity of the business. For example, in large public accounting or law firms, partners are admitted annually without any change in operating policies. To recognize the economic effects, it is necessary only to open a capital account for each new partner. In the entries illustrated in this appendix, we assume that the accounting records of the predecessor firm will continue to be used by the new partnership. A new partner may be admitted either by (1) purchasing the interest of one or more existing partners or (2) investing assets in the partnership, as shown in Illustration 12A-1. The former affects only the capital accounts of the partners who are parties to the transaction. The latter increases both net assets and total capital of the partnership.

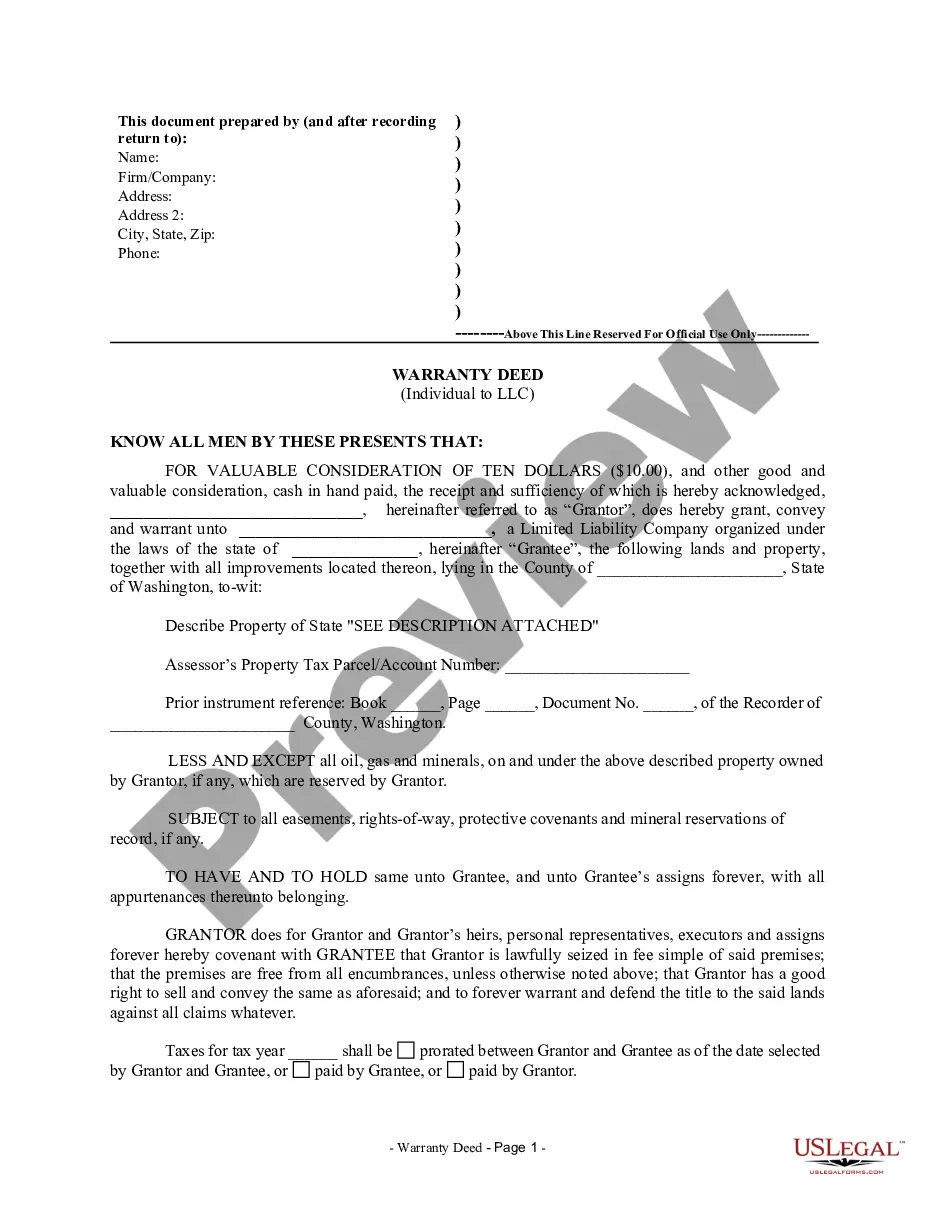

Illinois Agreement Admitting New Partner to Partnership

Description

How to fill out Agreement Admitting New Partner To Partnership?

It is feasible to dedicate hours online attempting to locate the legal document template that conforms to the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that can be examined by experts.

You can easily acquire or print the Illinois Agreement Admitting New Partner to Partnership from my service.

If available, use the Review button to preview the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Illinois Agreement Admitting New Partner to Partnership.

- Every legal document template you obtain is yours forever.

- To get another copy of an acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form description to ensure you have chosen the right template.

Form popularity

FAQ

The admission of a new partner is the process of integrating someone into an existing partnership, altering its structure and potentially its strategy. This can involve financial contributions, shared profits, and responsibilities. Utilizing an Illinois Agreement Admitting New Partner to Partnership simplifies this transition, ensuring clarity and compliance among all partners.

A new partner is admitted into a partnership firm through a clear and agreed-upon process among existing partners. This typically requires amendments to the partnership agreement and formal acceptance by the current partners. By creating an Illinois Agreement Admitting New Partner to Partnership, you ensure the new partner knows their role while safeguarding the partnership’s structure and obligations.

The admission of a new partner in an existing partnership refers to the formal process by which a new individual joins the partnership. This admission can change the dynamics of the partnership, including profit sharing and decision-making. It is vital to create an Illinois Agreement Admitting New Partner to Partnership to document this change and protect the interests of all parties involved.

To admit a new partner to an existing partnership, the existing partners must agree to the admission. This process typically involves reviewing the partnership agreement and ensuring it allows for new partners. After getting the necessary approvals, the partners should create an Illinois Agreement Admitting New Partner to Partnership to formalize the process and outline the new partner's rights and responsibilities.

To admit a new partner to a partnership, existing partners must reach a consensus on the proposed addition. Draft an Illinois Agreement Admitting New Partner to Partnership to detail the financial contributions, profit sharing, and decision-making powers. Using a platform like US Legal Forms can simplify this process by providing templates that ensure compliance with Illinois laws. By following these structured steps, you create a solid foundation for the new partnership.

A new partner is formally admitted to a partnership after the existing partners agree to the terms of the admission. This process typically involves drafting an Illinois Agreement Admitting New Partner to Partnership that outlines the rights and responsibilities of the new member. Ensure you follow the rules set in your partnership agreement for a smooth transition. This legal framework helps to avoid future disputes and clarify expectations.

When a partner is added to a partnership, it is crucial to update the partnership agreement. The Illinois Agreement Admitting New Partner to Partnership ensures that all current and future arrangements are documented legally. Changes made during this process can help streamline operations and foster a more unified approach to business management.

When a new partner is admitted to a partnership, the equity and decision-making power within the business may shift. The Illinois Agreement Admitting New Partner to Partnership provides clarifications regarding profit-sharing and role distribution. This clarity can lead to enhanced teamwork and shared vision among partners.

When a new partner joins a partnership, the dynamics of the business change significantly. The Illinois Agreement Admitting New Partner to Partnership helps in outlining the new partner's roles and responsibilities. This structured approach ensures that all partners are aligned on expectations and business objectives, promoting a successful partnership.

Yes, a new partner can be admitted into a partnership through a structured agreement. The Illinois Agreement Admitting New Partner to Partnership provides the necessary legal framework to facilitate this process. This ensures that all partners understand their rights, responsibilities, and profit-sharing arrangements, fostering a collaborative business environment.