Illinois Oil, Gas, and Mineral Royalty Transfer refers to a process where the legal ownership and rights to receive royalty payments from oil, gas, and mineral production are transferred from one party to another. This type of transfer is commonly seen when individuals or companies decide to sell their royalty interests in Illinois-based oil, gas, and mineral properties. Royalty transfer agreements are legally binding contracts that outline the terms and conditions of the transfer, including the specific interest being transferred, the purchase price, and any additional terms negotiated between the buyer and seller. These transfers enable sellers to monetize their royalty interests upfront, providing immediate cash flow, while buyers gain rights to future royalty payments. In Illinois, various types of oil, gas, and mineral royalty transfers exist, including: 1. Mineral Royalty Transfer: This refers to the transfer of royalty interests related to minerals such as coal, limestone, sand, gravel, or other nonmetallic materials extracted from the state. Mineral royalties are typically calculated as a percentage of the market value of the minerals produced. 2. Oil Royalty Transfer: This specific transfer revolves around the rights to receive royalty payments from the production and sale of oil within Illinois territories. Oil royalties can be based on a percentage of the revenue generated or a fixed amount per barrel produced. 3. Gas Royalty Transfer: Similarly, this transfer primarily involves the transfer of royalty interests related to natural gas production. Royalties in natural gas production are usually calculated based on a percentage of the wellhead price or the market value of the gas produced. 4. Combined Oil, Gas, and Mineral Royalty Transfer: Sometimes, a royalty transfer may include multiple types of resources, such as both oil, gas, and minerals. In such cases, the transfer encompasses the rights to royalty payments from the production and sale of all relevant resources found on the property. Illinois oil, gas, and mineral royalty transfers provide a wide range of opportunities for both buyers and sellers. Sellers can access immediate cash for their royalty interests, while buyers can acquire valuable future revenue streams. However, it is important for both parties to carefully evaluate the terms and negotiate a fair price to ensure a mutually beneficial transfer of rights.

Illinois Oil, Gas and Mineral Royalty Transfer

Description

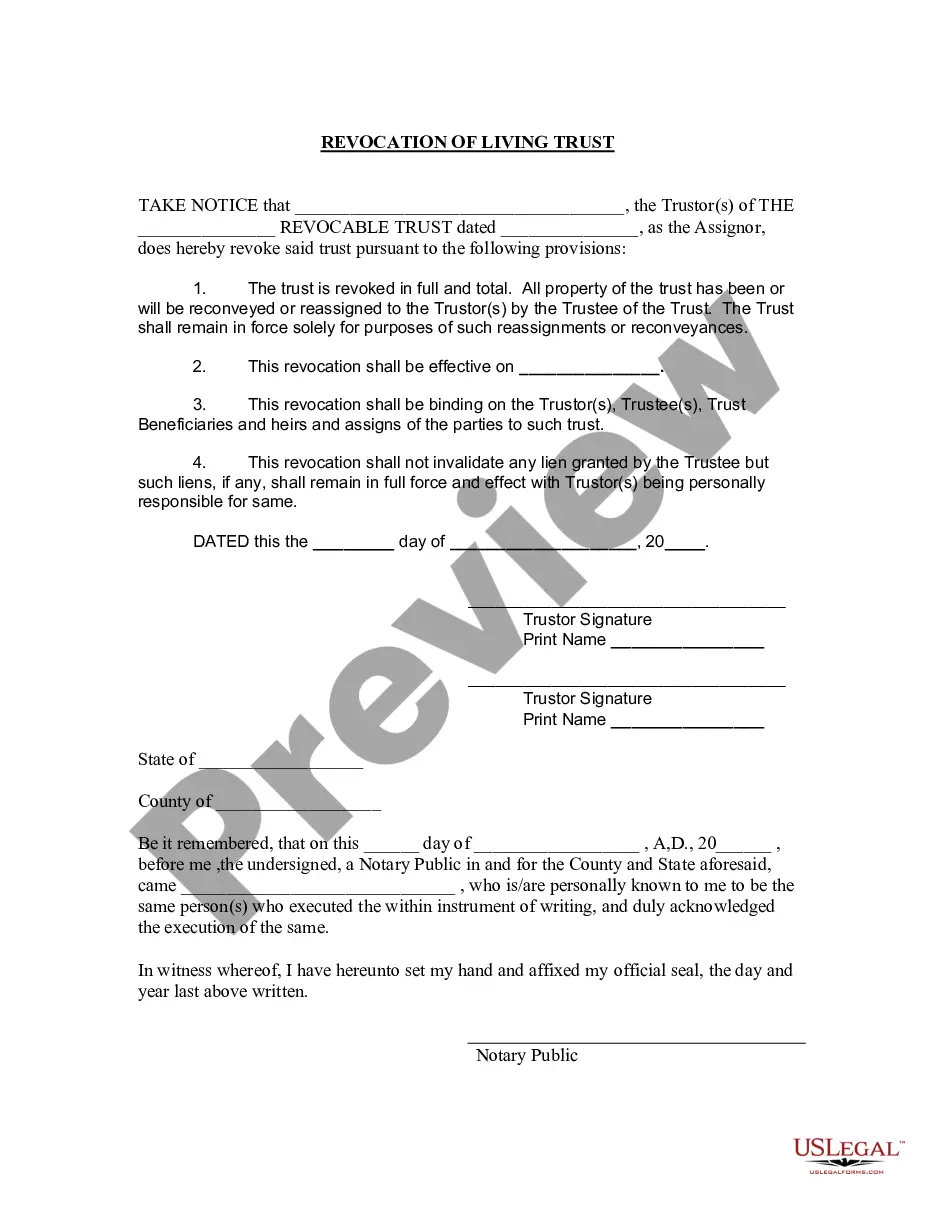

How to fill out Oil, Gas And Mineral Royalty Transfer?

You are able to devote hrs online trying to find the authorized record web template that fits the state and federal specifications you will need. US Legal Forms supplies thousands of authorized forms that are analyzed by pros. It is simple to obtain or print the Illinois Oil, Gas and Mineral Royalty Transfer from our assistance.

If you already possess a US Legal Forms bank account, you may log in and click on the Download option. After that, you may total, change, print, or indication the Illinois Oil, Gas and Mineral Royalty Transfer. Every single authorized record web template you get is your own property eternally. To have one more duplicate of the obtained type, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms web site for the first time, stick to the straightforward directions beneath:

- Initially, ensure that you have selected the proper record web template to the region/town of your choosing. Browse the type information to make sure you have picked the proper type. If offered, take advantage of the Preview option to appear with the record web template as well.

- In order to find one more edition in the type, take advantage of the Research discipline to find the web template that fits your needs and specifications.

- After you have discovered the web template you want, click Purchase now to continue.

- Choose the prices plan you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal bank account to fund the authorized type.

- Choose the format in the record and obtain it in your system.

- Make modifications in your record if possible. You are able to total, change and indication and print Illinois Oil, Gas and Mineral Royalty Transfer.

Download and print thousands of record layouts making use of the US Legal Forms Internet site, that provides the most important selection of authorized forms. Use expert and state-specific layouts to take on your business or personal requires.

Form popularity

FAQ

A corporate tax is a tax on the profits of a corporation. The taxes are paid on a company's taxable income, which includes revenue minus cost of goods sold (COGS), general and administrative (G&A) expenses, selling and marketing, research and development, depreciation, and other operating costs.

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

The legal process for inheriting royalties involves obtaining a deed from the deceased's estate and transferring ownership.

What is Royalty Income? Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

WHO OWNS THESE MINERAL RIGHTS? In Canada, property owners generally hold the surface rights, while mineral rights are usually owned by the provincial government.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Taxability of Inherited Mineral Rights If they are transferred through a will or estate plan, they are considered a part of the estate and are subject to taxation. If they are transferred through a lease, the value of the mineral rights may be taxable. However, this will depend on the terms of the lease agreement.

If your royalties are from a work or invention and there are no associated expenses, report the income on line 10400 of your return. If there were associated expenses, report the income on line 13500 of your return. Report all other royalties on line 12100 of your return.