Illinois Transfer of Property under the Uniform Transfers to Minors Act (TMA) refers to a legal mechanism that allows individuals to transfer assets or property to a minor without the need for establishing a formal trust. This Act provides a straightforward method for parents, guardians, or other individuals to transfer property to a minor, ensuring its effective management and use until the minor reaches a certain age. Under the TMA, a custodian is appointed to oversee the assets on behalf of the minor. The custodian can be a parent, a relative, or any other trusted individual eligible to handle the property. The Act offers various types of transfers within the state of Illinois, each serving different purposes and requirements: 1. Financial Account Transfers: One common type of Illinois Transfer of Property under the TMA involves transferring funds from a financial account to a minor's TMA account. This can include bank accounts, brokerage accounts, or other investment accounts. The transferred assets are held and managed by the custodian until the minor reaches the age of majority, typically 18 or 21, depending on the state laws. 2. Real Estate Transfers: Another type of property transfer under the TMA involves real estate. Although it may not be as common as financial account transfers, it is possible to transfer ownership of real estate to a minor through this Act. The custodian would manage and preserve the property until the minor becomes an adult. 3. Securities and Investment Transfers: This type of transfer involves transferring ownership of stocks, bonds, mutual funds, or other investment instruments to a minor. The custodian becomes responsible for managing these assets until the minor reaches the age of majority. 4. Personal Property Transfers: The TMA also allows for the transfer of personal property, such as vehicles, jewelry, or artwork, to a minor. The custodian assumes responsibility for the maintenance and preservation of these assets until the minor is of legal age. It is important to note that once the transfer is made, the property becomes the sole property of the minor, and the custodian's role is to manage the assets in the minor's best interest. The custodian must use the property for the minor's benefit and consider their future financial needs. In Illinois, the TMA provides a flexible and efficient method for transferring property and assets to minors, ensuring their proper management until they become adults. It offers an alternative to setting up formal trusts and allows for a straightforward transfer process. Understanding the various types of transfers available under the TMA can help individuals make informed decisions about managing and distributing their assets to minors.

Uniform Transfers To Minors Act Illinois

Description

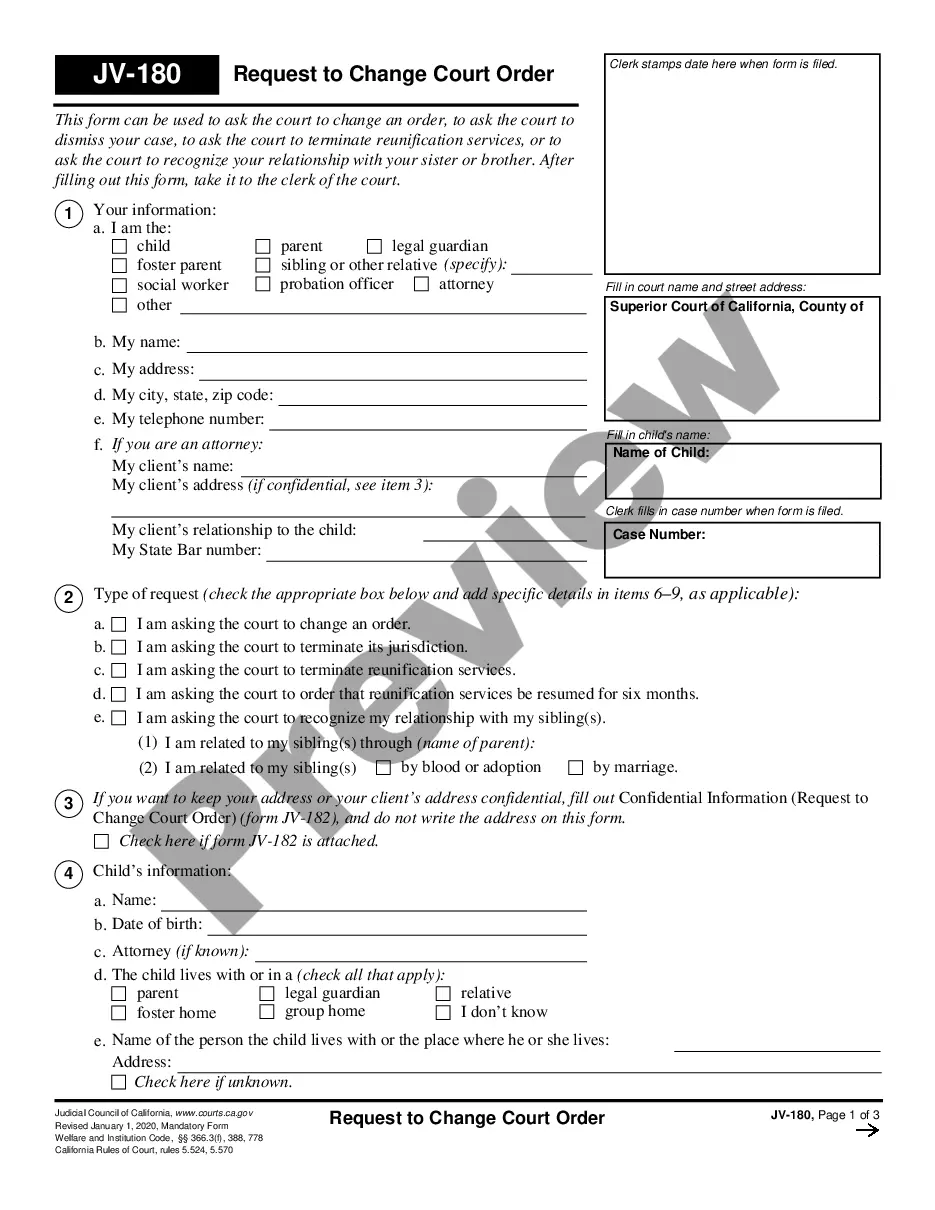

How to fill out Illinois Transfer Of Property Under The Uniform Transfers To Minors Act?

Are you in a place the place you need files for possibly organization or specific uses almost every working day? There are tons of authorized document templates available on the net, but finding types you can depend on is not easy. US Legal Forms delivers a huge number of type templates, like the Illinois Transfer of Property under the Uniform Transfers to Minors Act, that are composed to satisfy state and federal specifications.

When you are already informed about US Legal Forms internet site and also have an account, simply log in. Next, you can down load the Illinois Transfer of Property under the Uniform Transfers to Minors Act template.

Unless you provide an account and want to begin to use US Legal Forms, adopt these measures:

- Find the type you need and ensure it is to the right metropolis/region.

- Use the Preview button to analyze the shape.

- Browse the information to actually have selected the proper type.

- In case the type is not what you`re looking for, utilize the Search field to find the type that fits your needs and specifications.

- When you obtain the right type, simply click Get now.

- Pick the prices plan you would like, complete the necessary details to generate your account, and pay for your order with your PayPal or bank card.

- Pick a handy paper file format and down load your duplicate.

Discover every one of the document templates you might have bought in the My Forms menus. You can get a extra duplicate of Illinois Transfer of Property under the Uniform Transfers to Minors Act any time, if possible. Just click on the needed type to down load or produce the document template.

Use US Legal Forms, probably the most considerable selection of authorized varieties, to save time as well as stay away from errors. The service delivers appropriately made authorized document templates which can be used for a variety of uses. Create an account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

What is the Illinois Uniform Transfers to Minor Act? The Illinois Uniform Transfers to Minors Act (UTMA) allows you to make a gift to a minor child without them worrying about paying a gift tax on the asset. If you have heard of the UGMA (Uniform Gift to Minors Act), the UTMA is simply an extension.

UTMA withdrawals and tax rules However, the funds belong to the minor from the moment of transfer, so the funds can only be used for the direct benefit of the minor. Can parents take money out of UTMA accounts? Yes, but only for purposes related to the minor.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

The Uniform Transfers to Minors Act (UTMA) allows a person to make a gift to a minor child that is free of tax burdens. The UTMA was formerly called the Uniform Gifts to Minors Act. Any money or property transferred under the UTMA is under the control of a custodian until the minor child reaches age 21.

If the minor has not attained the age of 14 years or fails to act within 60 days after the ineligibility, death, or incapacity, the guardian of the minor becomes successor custodian.

Property can be left to a child in a will or trust under the Illinois Uniform Transfers to Minors Act (UTMA, 760 ILCS 20/1 et seq.) Transfers under the terms of this statute are irrevocable gifts ? the minor becomes the legal owner of the property, which is managed in his or her name by someone else.