Illinois Option for the Sale and Purchase of Real Estate — Farm Land: A Comprehensive Guide The Illinois Option for the Sale and Purchase of Real Estate — Farm Land is a legal agreement that allows individuals or entities to secure the right to buy or sell farm land in the state of Illinois. This option contract provides flexibility and protection for both the buyer and the seller, ensuring a smooth transaction process. Keywords: Illinois Option, Sale and Purchase, Real Estate, Farm Land, option contract, buyer, seller, transaction process. Types of Illinois Option for the Sale and Purchase of Real Estate — Farm Land: 1. Standard Option Contract: This is the most common type of option contract used for the sale and purchase of farm land in Illinois. It provides the buyer with the exclusive right to purchase the designated property within a specified time period. During this period, the seller cannot sell the property to any other party. 2. Lease with Option to Buy: This type of option contract combines a lease agreement and an option contract. The buyer leases the farm land from the seller for a specified period, with the option to purchase the property at a predetermined price within the lease term. 3. Purchase Option Agreement: This is a simplified version of the option contract that outlines the terms and conditions for a potential sale. It grants the buyer the right to purchase the farm land within a specific time frame, usually at an agreed-upon price. 4. Right of First Refusal: In this type of option contract, the seller agrees to give the buyer the first opportunity to purchase the farm land if they decide to sell it. The buyer has the right to match any third-party offer and proceed with the purchase transaction if they exercise their right of first refusal. 5. Option with Earnest Money: This variation of an option contract requires the buyer to submit a specified amount of earnest money along with the option fee. The earnest money serves as a deposit and shows the buyer's commitment to purchasing the property if they decide to exercise the option. Regardless of the type of Illinois Option for the Sale and Purchase of Real Estate — Farm Land, it is crucial to consult a real estate attorney to ensure all legal requirements are met and to protect your rights and interests throughout the transaction process. In conclusion, the Illinois Option for the Sale and Purchase of Real Estate — Farm Land offers various types of option contracts to facilitate the purchase or sale of farm land in the state. This agreement provides flexibility for buyers and sellers, ensuring a transparent and efficient transaction process.

Option To Purchase Agreement Template

Description

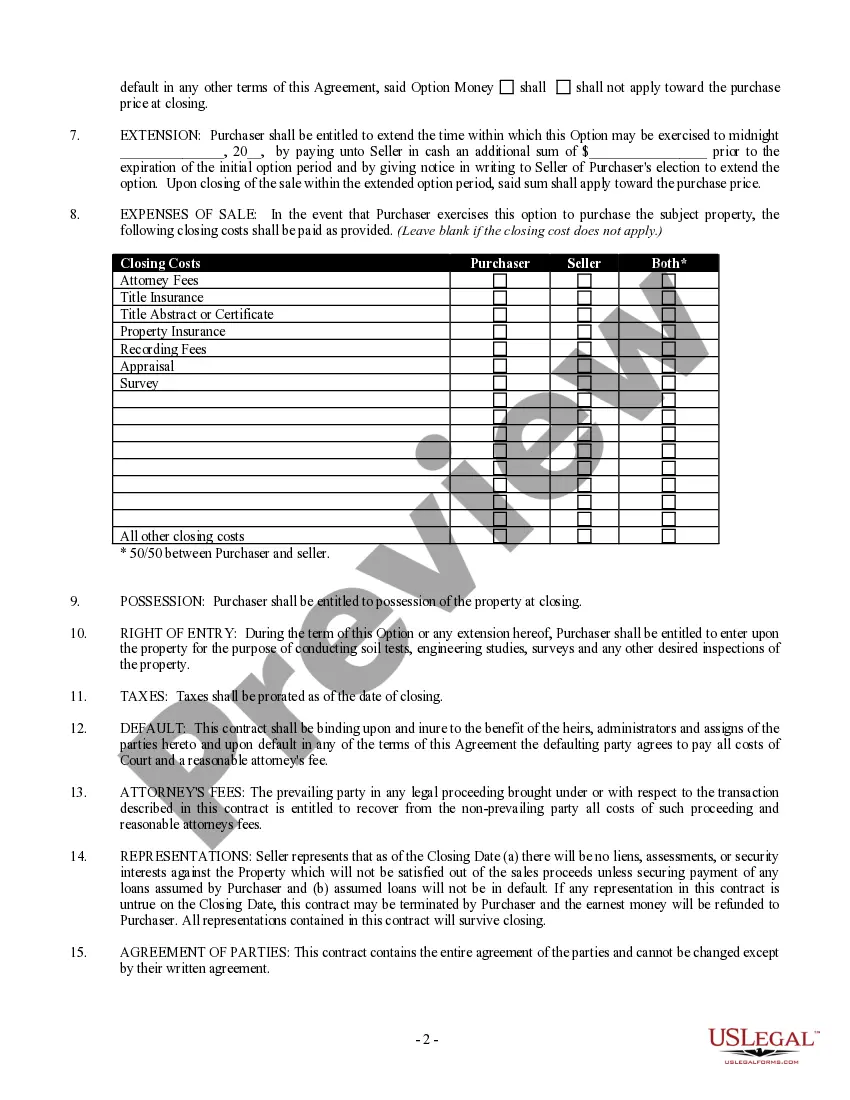

How to fill out Illinois Option For The Sale And Purchase Of Real Estate - Farm Land?

You have the capability to spend hours online looking for the appropriate legal document format that satisfies the federal and state regulations you require.

US Legal Forms offers an extensive selection of legal documents that are reviewed by experts.

You can download or print the Illinois Option For the Sale and Purchase of Real Estate - Farm Land through our services.

If available, use the Review option to check the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, edit, print, or sign the Illinois Option For the Sale and Purchase of Real Estate - Farm Land.

- Every legal document format you obtain is yours forever.

- To obtain an additional copy of any purchased document, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county or city of your choice.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

In Illinois, there is no specific age at which individuals automatically stop paying property taxes. However, certain exemptions are available for seniors that can reduce their tax burden. To take advantage of these benefits, seniors should apply for the General Homestead Exemption and consult with local tax officials for further guidance on eligibility. Resources provided by USLegalForms can help seniors navigate the process.

Certain organizations and individuals may qualify for property tax exemptions in Illinois, including non-profit organizations and veterans. Additionally, agricultural properties that meet established criteria can also receive exemptions. Knowing if you qualify for such exemptions can save you a considerable amount annually. Using platforms like USLegalForms allows you to easily determine eligibility and complete necessary paperwork.

Farm land in Illinois is taxed based on its current use, which may differ from its market value. The property tax system often considers agricultural productivity, applying a lower rate than what residential properties might encounter. This approach encourages farming activities and supports local agriculture. Understanding the specifics can be simplified through the resources provided by USLegalForms.

To qualify for a farm tax exemption in Illinois, your land must be primarily used for agricultural purposes. This includes growing crops, raising livestock, or engaging in other activities related to farming. Additionally, the property must meet specific requirements set by local authorities to ensure it contributes to the agricultural community. Utilizing resources like the USLegalForms platform can help guide you through the necessary documentation.

You can directly invest in portions of a farm through AcreTrader and FarmTogether, LLC. They are not REITs, but they work in a similar way. You pick out the fields or farms you want to buy and then you purchase shares in the entity that owns it.

You might see farmland included in a miscellaneous land category in real estate investing, but it's more similar to a specialized type of CRE akin to industrial.

While the roots of tenant farming in America date to around the end of the Civil War, the farming sector remains a nontraditional asset category for real estate investors. That's largely because farmers, both operators and retirees, own the majority of the country's cropland and pastureland.

In 2020 the Karnataka government removed limitations on non-agriculturists for buying and selling agricultural plots, thereby repealing a decades-old rule.

According to the United States Department of Agriculture, A farm is defined as any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.