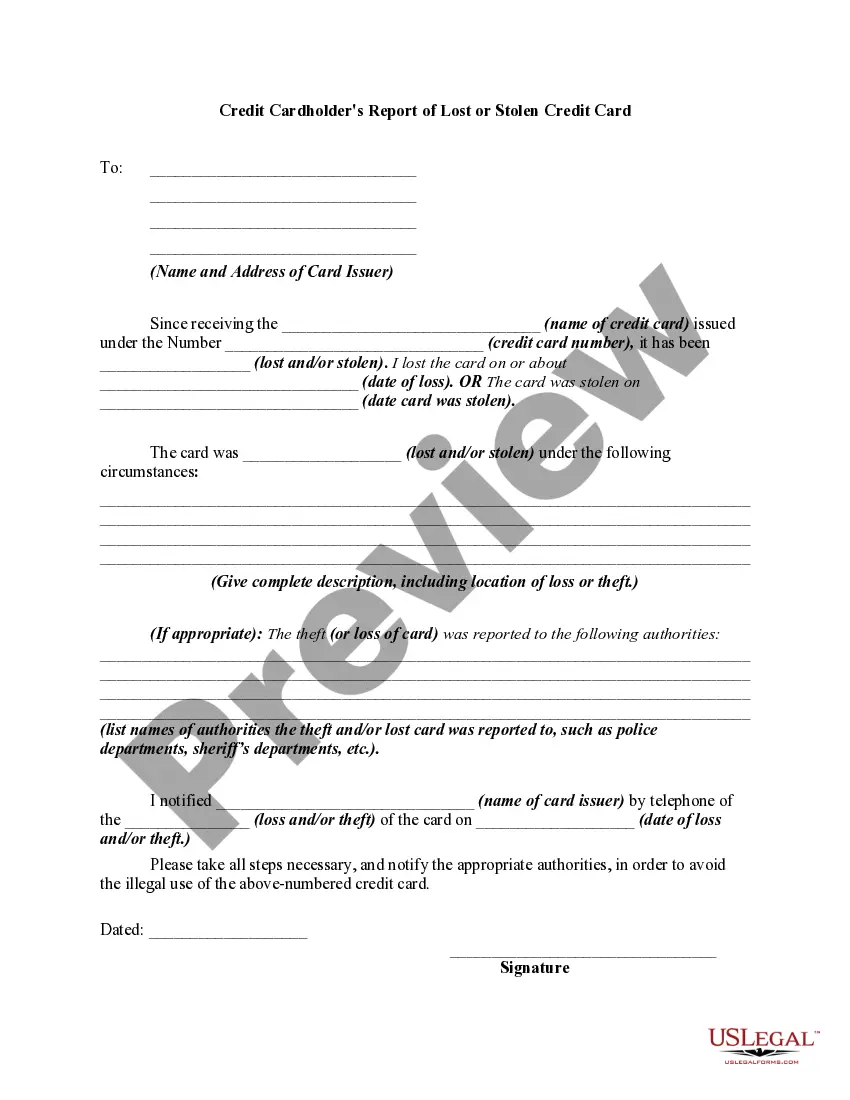

The Illinois Credit Cardholder's Report of Lost or Stolen Credit Card is a crucial document that individuals need to be familiar with in case they misplace or have their credit card stolen in the state of Illinois. This detailed description will outline the importance of this report and cover different types of reports associated with it. The Illinois Credit Cardholder's Report of Lost or Stolen Credit Card serves as a standardized form provided by credit card companies and financial institutions to cardholders. This form is intended to document any incidences of lost or stolen credit cards promptly and accurately, enabling the cardholder to report the incident to their credit card issuers and take appropriate measures to protect their financial security. The report contains vital information that credit card companies require to process the customer's request efficiently. When it comes to different types of Illinois Credit Cardholder's Report of Lost or Stolen Credit Card, there are two main variations: 1. Report of Lost Credit Card: This type of report is used when a credit cardholder inadvertently loses their credit card. The report includes information such as the cardholder's name, address, credit card number, date of card loss, and any additional relevant details required by the credit card company for verification purposes. It is essential to file this report as soon as possible to prevent unauthorized charges and potential fraudulent activities. 2. Report of Stolen Credit Card: If a credit cardholder's credit card is stolen, it is crucial to file a Report of Stolen Credit Card immediately. This type of report includes all the necessary information as mentioned in the Report of Lost Credit Card, but additionally requires providing details about how the card was stolen, including the location, date, and circumstances of the theft. Providing specific information aids authorities in their investigation and enhances the chances of apprehending the perpetrator. Moreover, both types of reports should include contact information for the cardholder, such as phone number and email address, to facilitate communication between the credit card company and the affected individual. When a credit cardholder notices the loss or theft of their credit card, it is recommended to: 1. Begin by locating the Illinois Credit Cardholder's Report of Lost or Stolen Credit Card form on the respective issuing institution's website or by contacting their customer support. 2. Fill out the form accurately and completely, ensuring the inclusion of all crucial information without any errors. 3. Submit the form along with any additional documentation that the credit card company may request, such as a police report if the card was stolen. 4. Follow up with the credit card company to confirm they have received the report and inquire about any further steps that need to be taken. 5. Be vigilant about monitoring credit card statements for any unauthorized transactions and request a replacement credit card promptly. By promptly submitting the Illinois Credit Cardholder's Report of Lost or Stolen Credit Card and acting proactively, individuals can protect themselves from financial losses and potential identity theft. It is vital to remember that all credit cardholders should review their credit card provider's specific guidelines and reporting procedures to accurately complete the report and prevent any delays in resolving the situation.

Illinois Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Illinois Credit Cardholder's Report Of Lost Or Stolen Credit Card?

It is possible to commit time on the web looking for the lawful record template that fits the federal and state requirements you want. US Legal Forms provides a huge number of lawful forms that happen to be evaluated by pros. You can actually acquire or print the Illinois Credit Cardholder's Report of Lost or Stolen Credit Card from your support.

If you already possess a US Legal Forms bank account, you may log in and click on the Obtain option. Afterward, you may complete, change, print, or signal the Illinois Credit Cardholder's Report of Lost or Stolen Credit Card. Every single lawful record template you acquire is the one you have for a long time. To have an additional duplicate of any purchased kind, go to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site the very first time, keep to the straightforward guidelines listed below:

- Initially, ensure that you have chosen the right record template for the state/area of your choosing. Look at the kind explanation to make sure you have picked out the right kind. If offered, utilize the Review option to appear from the record template as well.

- If you would like locate an additional variation of the kind, utilize the Research field to get the template that suits you and requirements.

- Once you have located the template you would like, click Buy now to carry on.

- Choose the pricing plan you would like, key in your credentials, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to fund the lawful kind.

- Choose the formatting of the record and acquire it for your device.

- Make adjustments for your record if possible. It is possible to complete, change and signal and print Illinois Credit Cardholder's Report of Lost or Stolen Credit Card.

Obtain and print a huge number of record layouts making use of the US Legal Forms Internet site, that provides the greatest assortment of lawful forms. Use professional and state-certain layouts to tackle your organization or person requires.

Form popularity

FAQ

Online: The card issuer's website usually has an option to request a new credit card online. Mobile app: You can use many credit cards' mobile apps to request a replacement credit card directly within the app.

5 steps to take immediately if your credit card is lost or stolen How to report credit card fraud. ... Contact your credit card issuer. ... Change your login information. ... Monitor your credit card statement. ... Review your credit report and dispute any fraud on it. ... Protect yourself from future credit card fraud. ... Bottom line.

Step 1. Call your credit card issuer. Call your credit card issuer immediately to report the loss or theft of your missing card. Typically, you would check the back of the card for the telephone number to call.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.

When you report a card as lost or stolen, your credit card company will deactivate or cancel your current credit card number. The card number previously assigned to you will no longer be active and you will be mailed a replacement credit card with a new number.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

Scammers can use a lost credit card to make fraudulent purchases. But they can also use the information on your card to scam your lender or bank into giving them access to your funds or even opening new accounts in your name.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.