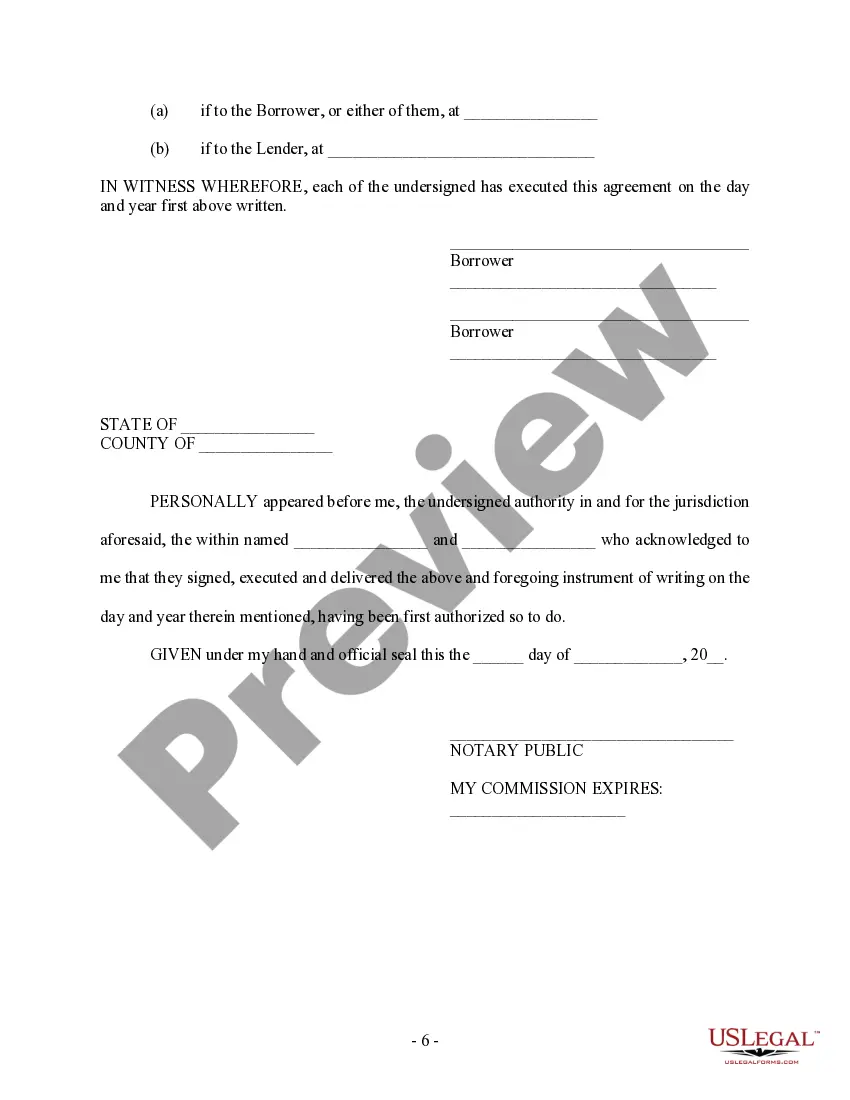

The Illinois Security Agreement for Promissory Note is a legal document that establishes a security interest in collateral for a promissory note in the state of Illinois. This agreement defines the rights and obligations of the borrower (also known as the debtor) and the lender (also known as the secured party), providing a legal framework for the protection of the lender's interest in case the debtor defaults on the loan. The agreement highlights the terms and conditions for the security interest, including the specific collateral that is being pledged as security. Collateral can include various types of assets such as real estate, personal property, inventory, equipment, accounts receivable, and more. The agreement outlines a detailed description of the collateral being pledged to secure the promissory note, including the value and location of the collateral. The Illinois Security Agreement for Promissory Note also includes provisions regarding default and remedies. It specifies the conditions under which a default would occur, such as non-payment or violation of other terms of the promissory note. In case of default, the agreement outlines the lender's rights and remedies, such as the right to take possession of the collateral, sell it, and apply the proceeds to the outstanding debt. It is important to note that there may be different types or variations of the Illinois Security Agreement for Promissory Note, depending on the specific circumstances and nature of the loan. These variations can include specific provisions for different types of collateral, additional borrower covenants, or different default and remedies clauses. Some common types of Illinois Security Agreements for Promissory Notes may include: 1. Real Estate Security Agreement: This type of agreement is used when real estate is being pledged as collateral for the promissory note. It includes specific provisions related to the real estate, such as property description, mortgage rights, and foreclosure procedures. 2. Equipment Security Agreement: When equipment or machinery is being pledged as collateral, this type of agreement is utilized. It outlines the details of the equipment, including serial numbers, model, and condition, as well as specific provisions related to repossession and sale of the equipment. 3. Accounts Receivable Security Agreement: This agreement is designed for situations where accounts receivable are being used as collateral. It includes provisions regarding the verification of the accounts, the assignment of payments, and the priority of the lender's rights to the accounts. These are just a few examples, as the specific type of Illinois Security Agreement for Promissory Note can vary depending on the nature of the collateral and the specific terms and conditions agreed upon by the parties involved.

Illinois Security Agreement for Promissory Note

Description

How to fill out Illinois Security Agreement For Promissory Note?

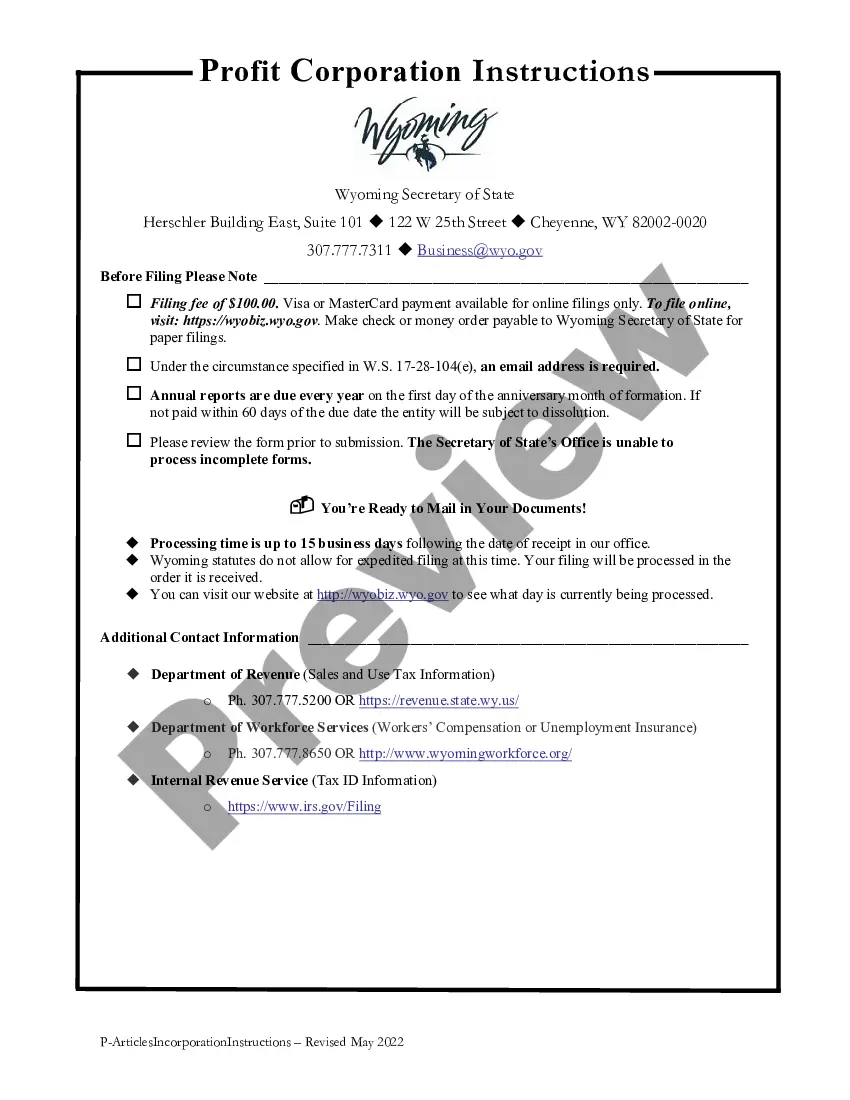

Finding the right legitimate papers format might be a have difficulties. Needless to say, there are a lot of templates accessible on the Internet, but how would you find the legitimate form you need? Use the US Legal Forms web site. The services provides 1000s of templates, for example the Illinois Security Agreement for Promissory Note, that you can use for organization and personal demands. All the kinds are examined by pros and fulfill state and federal specifications.

If you are already authorized, log in to the profile and then click the Download key to find the Illinois Security Agreement for Promissory Note. Utilize your profile to search from the legitimate kinds you have ordered formerly. Check out the My Forms tab of the profile and have yet another duplicate from the papers you need.

If you are a new customer of US Legal Forms, listed below are basic directions so that you can comply with:

- Very first, ensure you have selected the appropriate form for the metropolis/state. It is possible to check out the form making use of the Preview key and look at the form outline to guarantee this is the best for you.

- In the event the form is not going to fulfill your expectations, take advantage of the Seach discipline to discover the right form.

- Once you are positive that the form would work, select the Purchase now key to find the form.

- Choose the pricing plan you would like and enter the needed information. Build your profile and pay money for an order making use of your PayPal profile or charge card.

- Pick the submit file format and obtain the legitimate papers format to the gadget.

- Comprehensive, revise and print out and indication the attained Illinois Security Agreement for Promissory Note.

US Legal Forms is definitely the most significant collection of legitimate kinds where you can find numerous papers templates. Use the service to obtain appropriately-created papers that comply with condition specifications.