The Illinois Subscription Agreement is a legally binding document that outlines the terms and conditions between the issuer of securities and its investors. This agreement governs the sale of securities, usually stocks or bonds, in the state of Illinois. The agreement serves to protect both the issuer and investor by clearly defining their rights, obligations, and expectations. One type of Illinois Subscription Agreement is the Common Stock Subscription Agreement. This agreement is used when a company offers its common stock to potential investors. It details the number of shares being purchased, the purchase price, and any specific conditions or restrictions associated with the shares. Another type is the Preferred Stock Subscription Agreement, which is used for the sale of preferred stock. Preferred stockholders typically enjoy certain privileges over common stockholders such as priority in receiving dividends or liquidation proceeds. This agreement outlines the specific terms and conditions for purchasing preferred stock and the associated rights and preferences. Additionally, there is the Bond Subscription Agreement, which is used when a company or government entity wishes to issue bonds to investors. Bonds are debt securities, and this agreement specifies the terms of the bond issuance, such as interest rate, maturity date, and repayment terms. The Illinois Subscription Agreement typically includes essential clauses such as representations and warranties, purchase price, payment terms, conditions of closing, and dispute resolution methods. It may also include provisions related to securities laws compliance, transferability of securities, and confidentiality agreements. It is important for both issuers and investors to carefully review and understand the terms of the Subscription Agreement before entering into any investment transaction. Seeking legal advice and conducting thorough due diligence can help ensure that all parties involved are protected and aware of their rights and responsibilities under Illinois securities laws.

Illinois Subscription Agreement

Description

How to fill out Illinois Subscription Agreement?

If you require to fully, download, or print out sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are grouped by categories and jurisdictions, or keywords.

Every legal document template you download is yours permanently. You have access to every form you downloaded in your account.

Navigate to the My documents section and select a form to print or download again. Complete, download, and print the Illinois Subscription Agreement with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the Illinois Subscription Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to get the Illinois Subscription Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to view the form’s details. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms within the legal form type.

- Step 4. Once you have found the form you require, click the Buy now button. Choose the pricing option you wish and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Illinois Subscription Agreement.

Form popularity

FAQ

Yes, Illinois offers a digital driver's license option for residents, making it easier to carry identification. This digital license can be accessed via a secure app, enabling you to present your ID at various locations easily. The digital driver's license is a modern solution for identification needs. Familiarizing yourself with the Illinois Subscription Agreement can provide further insights into the use and legality of digital licenses.

You can request a copy of your Illinois driver's license online through the Illinois Secretary of State's website. Be prepared to provide identification and other necessary information during the process. This convenient method allows you to manage your driving records without needing to visit a physical location. For clarity on what to expect when managing your records, consider referring to resources about the Illinois Subscription Agreement.

Yes, you can add your Illinois driver's license to Apple Wallet if you have a digital version. This feature allows you to keep your ID handy and accessible. Ensure your license is up to date and properly configured through the appropriate channels. Using an Illinois Subscription Agreement can facilitate smoother integration of your digital credentials.

To obtain an Illinois digital driver's license, you must first apply through the Illinois Secretary of State's website or your local DMV. The process involves submitting your application and required documents electronically. Once processed, your digital license will be available on your smartphone. Keep in mind that having an Illinois Subscription Agreement can simplify managing your digital documentation.

If you get pulled over in Illinois without your driver's license, law enforcement may issue a citation for not carrying the license. You can often provide proof of your license later, which may help reduce penalties. However, it is always best to carry your license to avoid complications. For matters related to agreements, the Illinois Subscription Agreement can provide a solid understanding of your obligations and rights.

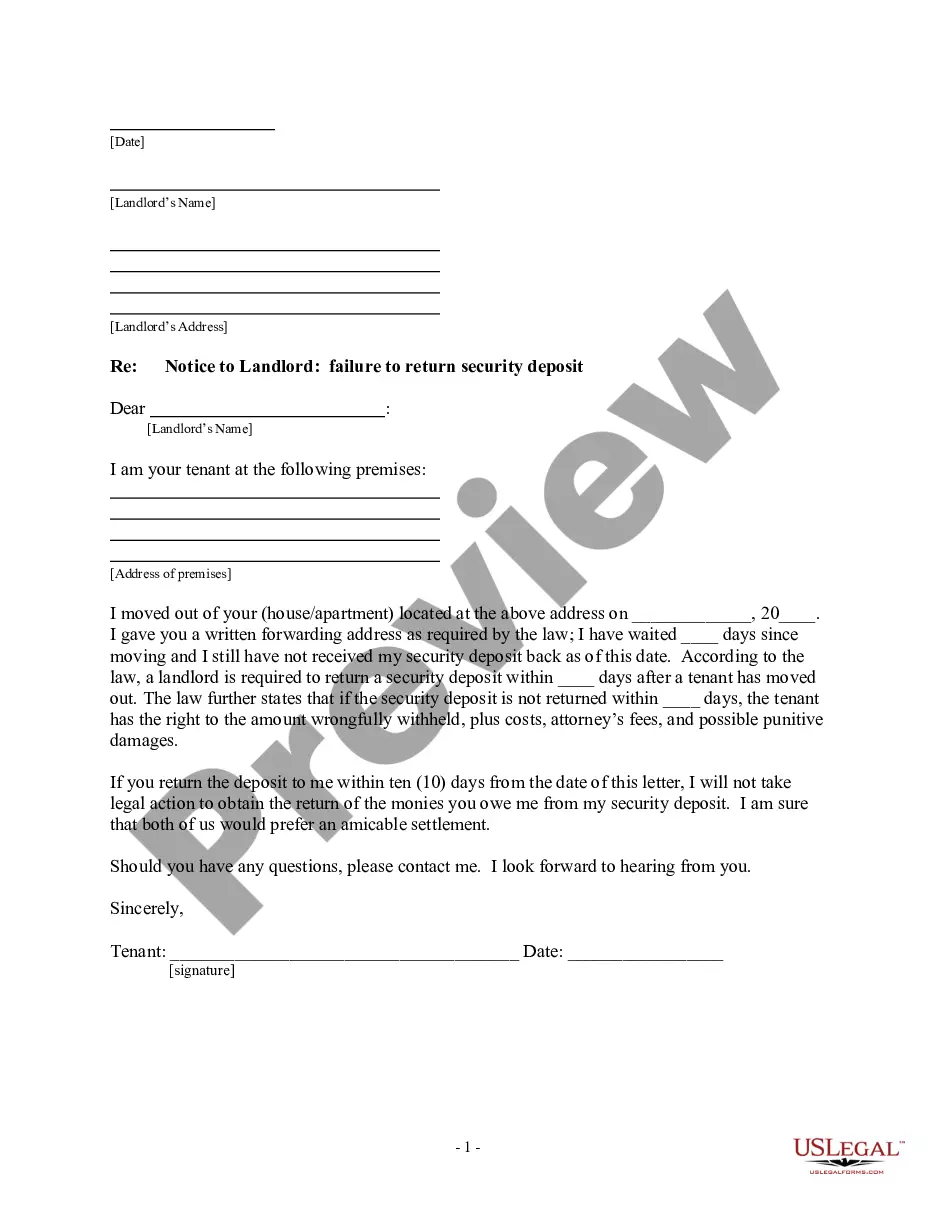

Filling out a contract form involves several key steps. Start by adding the names and addresses of all parties involved. Clearly state the terms and conditions, ensuring all details are specified, especially in an Illinois Subscription Agreement. Lastly, verify all entries for correctness before both parties sign the form to make the contract legally binding.

The requirements for a subscription agreement typically include the identification of parties, a description of the securities being purchased, and payment terms. For an Illinois Subscription Agreement, compliance with state laws and regulations is essential. Always include provisions that will protect both the issuer and subscriber. Consulting uslegalforms can help ensure you meet all necessary requirements.

Filling out an agreement form is a systematic process. Start by entering the parties' information, followed by the conditions and terms of the agreement. In the case of an Illinois Subscription Agreement, clearly specify what is being subscribed to and any payment schedules. Review each section carefully to ensure all information is accurate before submission.

To fill out an agreement, begin by entering the names and addresses of all parties. Specify the terms and obligations clearly, ensuring no ambiguity exists. When working with an Illinois Subscription Agreement, detail the subscription services or products offered, payment terms, and any conditions attached. Always double-check for accuracy before finalizing.

Writing a simple contract agreement involves a few straightforward steps. Start by clearly stating the purpose of the agreement, followed by the parties involved. Include key components like obligations, payment terms, and the duration of the agreement. For an Illinois Subscription Agreement, clarity ensures that both parties understand their rights and obligations.