The Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legal document that outlines the terms and conditions of a business sale between a sole proprietorship seller and a buyer. This agreement is specifically designed for transactions taking place in the state of Illinois. In this agreement, the seller agrees to sell their business to the buyer, who will assume ownership and operation of the sole proprietorship. The seller also agrees to finance a portion of the purchase price, allowing the buyer to make payments over a specified period of time. The key elements included in this agreement are as follows: 1. Parties involved: The agreement includes the legal names and contact information of both the seller and the buyer. 2. Business details: A detailed description of the business being sold is provided, including its name, address, assets, inventory, and any existing liabilities. 3. Purchase price and payment terms: The agreement outlines the total purchase price of the business, as well as the portion to be financed by the seller. The payment terms, including interest rates, due dates, and the duration of the payment period, are also specified. 4. Seller financing terms: The specific terms and conditions of the seller's financing are detailed, including the down payment amount, interest rate, and any late payment penalties. 5. Representations and warranties: Both parties provide assurances regarding the accuracy of the information they have provided and their legal authority to enter into the agreement. 6. Confidentiality and non-compete clauses: This agreement may also include provisions to protect the seller's confidential information and prevent the buyer from competing with the business after the sale. Different types of Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price include variations based on the specific terms negotiated between the parties. For example, there could be agreements that include additional provisions for assets, intellectual property, or employee matters. Additionally, there may be agreements tailored for specific industries or business types, such as retail, service-oriented, or professional businesses. In conclusion, the Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a comprehensive legal document that protects the interests of both the seller and the buyer in a business sale transaction. It ensures clarity and security by defining the purchase price, payment terms, and various obligations of both parties involved in the transaction.

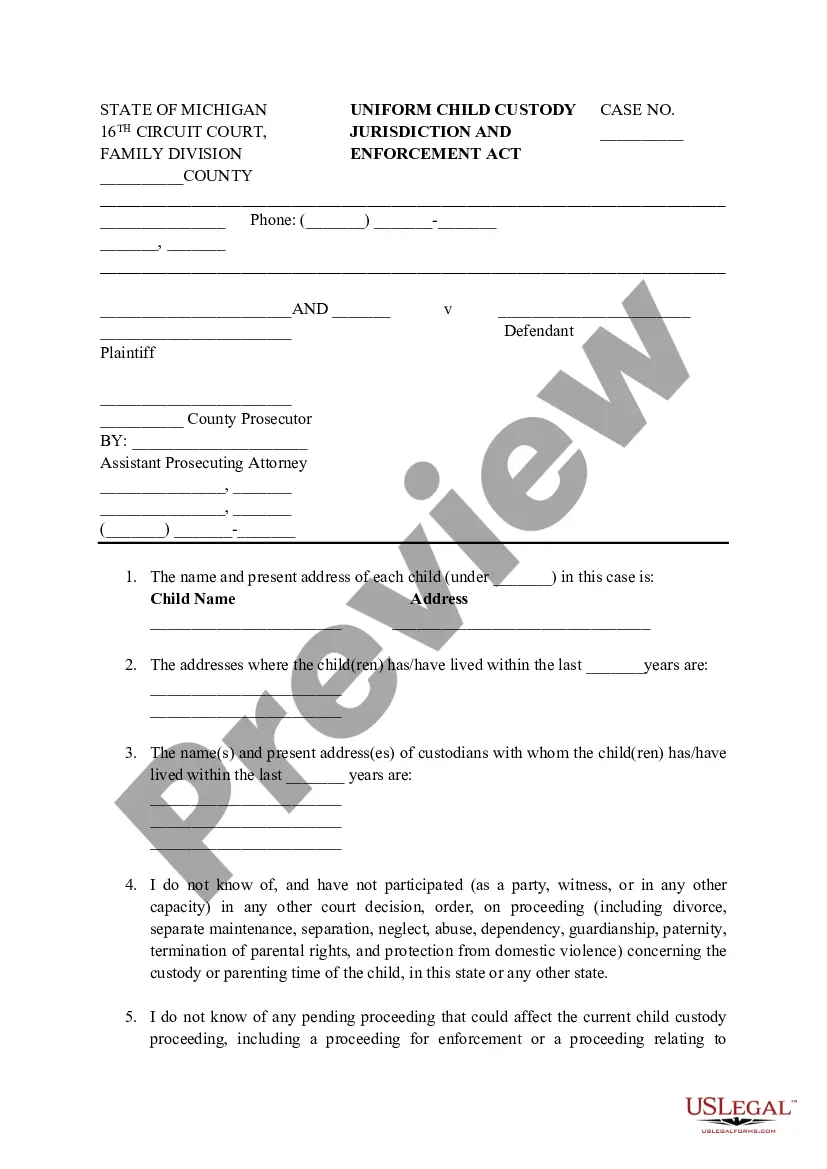

Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a selection of legal template documents you can obtain or create.

While navigating the site, you will discover thousands of documents for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Portion of Purchase Price in just moments.

If the form does not meet your needs, use the Research field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred payment plan and provide your information to register for an account.

- If you have an account, Log In and acquire Illinois Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Portion of Purchase Price in the US Legal Forms library.

- The Acquire button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, follow these simple guidelines:

- Ensure you have selected the correct form for your jurisdiction. Click the Review button to examine the form’s content.

- Check the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Legal Documents Needed to Sell a BusinessNon-Disclosure Confidentiality Agreement.Personal Financial Statement Form for Buyer to Complete.Offer-to-Purchase Agreement.Note of Seller Financing.Financial Statements for Current and Past Two to Three Years.Statement of Seller's Discretionary Earnings and Cash Flow.More items...

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

For a contract to be legally binding it must contain four essential elements:an offer.an acceptance.an intention to create a legal relationship.a consideration (usually money).

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

Interesting Questions

More info

Join Newsletter Services Directory Guides Features Buying Articles Raising Finance Buyers Guides Popular Categories Businesses Stations Convenience Stores Drugstores Laundries Internet Businesses Automotive Shops Plumbing Businesses Food Businesses Advanced Search Businesses Buyer Services Register Buyer Email Alerts Join Newsletter Services Directory Guides Features Buying Articles Raising Finance Buy Buyers Guides Popular Categories Businesses The Buyers Guide Business Sellers Businesses Buyers Guides Popular Categories Businesses Buyer Deals Search Join Newsletter Email.