Illinois Tax Free Exchange Agreement Section 1031, also known as a 1031 exchange, is a provision within the Illinois tax code that allows individuals or businesses to defer the payment of capital gains taxes on the sale of certain qualifying properties. This provision is based on the federal tax code section 1031, which allows for tax-free exchanges of similar properties. Under the Illinois Tax Free Exchange Agreement Section 1031, individuals or businesses can sell an investment property and reinvest the proceeds into a like-kind property, thus deferring the capital gains tax that would normally be due upon the sale. This provision is particularly beneficial for real estate investors or businesses looking to sell and reinvest in similar properties, without incurring immediate tax liabilities. To qualify for the Illinois Tax Free Exchange Agreement Section 1031, the property being sold and the property being acquired must be held for investment or for productive use in a trade or business. Like-kind refers to properties that are of the same nature or character, regardless of differences in quality or grade. For example, an individual can exchange a residential rental property for a commercial property, or vice versa, and still qualify for the tax deferral. It is important to note that not all types of exchanges are eligible for tax deferral under Section 1031 of the Illinois tax code. Some types of exchanges specifically excluded from qualification include exchanges of personal residences or vacation homes. Additionally, exchanges involving inventory, stocks, bonds, or partnership interests do not qualify for tax deferral. There are different types of exchanges that fall under the Illinois Tax Free Exchange Agreement Section 1031, including simultaneous exchanges, delayed exchanges, and reverse exchanges. 1. Simultaneous Exchange: This type of exchange requires the transfer of the relinquished property (property being sold) and the acquisition of the replacement property to occur at the same time, often with the help of a qualified intermediary. 2. Delayed Exchange: In a delayed exchange, the taxpayer sells the relinquished property first and then has a specific timeframe (usually 180 days) to identify and acquire the replacement property. This is the most common type of 1031 exchange. 3. Reverse Exchange: A reverse exchange involves the acquisition of the replacement property before the sale of the relinquished property. This type of exchange requires the use of an Exchange Accommodation Titleholder (EAT) and is more complex and less commonly used than other types of exchanges. Overall, the Illinois Tax Free Exchange Agreement Section 1031 provides individuals and businesses with a valuable tax planning tool to defer capital gains taxes on the sale of investment properties. However, it is crucial for taxpayers to consult with tax professionals and adhere to the specific requirements and timelines outlined in the tax code to ensure compliance and maximize the benefits of this provision.

Illinois Tax Free Exchange Agreement Section 1031

Description

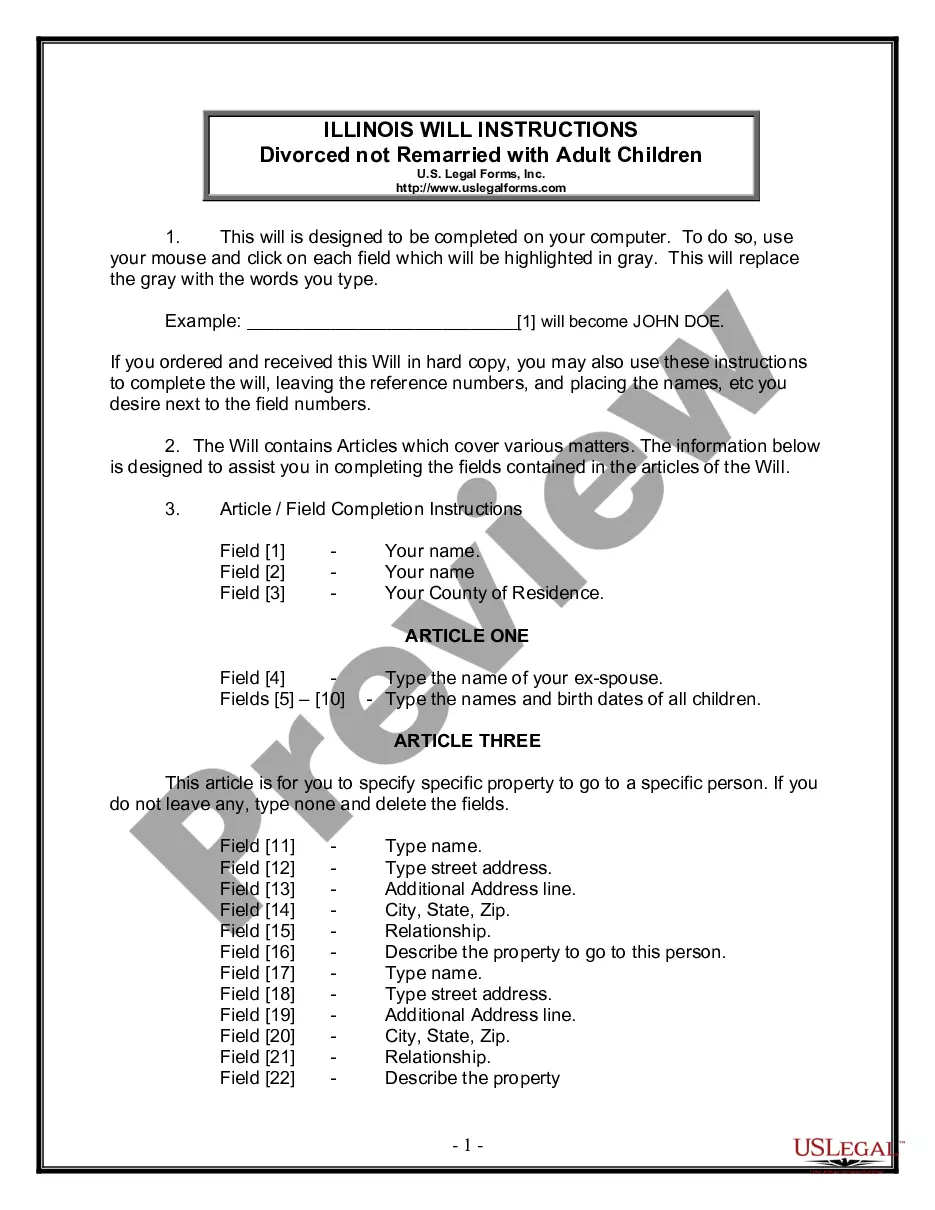

How to fill out Illinois Tax Free Exchange Agreement Section 1031?

Selecting the appropriate legal document format can be challenging.

Of course, numerous templates exist online, but how can you find the legal document you need.

Utilize the US Legal Forms website.

First, ensure you have chosen the correct form for the city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for your needs.

- The service offers a vast array of templates, including the Illinois Tax-Free Exchange Agreement Section 1031, suitable for both business and personal purposes.

- All documents are reviewed by experts and comply with both state and federal requirements.

- If you are already registered, Log In to your account and click the Obtain button to access the Illinois Tax-Free Exchange Agreement Section 1031.

- Use your account to view the legal forms you have previously acquired.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state.

The short answer to this is yes. Because Section 1031 is a federal tax code, it is technically recognized in all states. Going one step further, swapping a relinquished property in one state into a replacement property in another is known, appropriately enough, as a state-to-state 1031 exchange.

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value.

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Illinois doesn't have any specific statewide laws governing 1031 exchanges, so an Illinois 1031 exchange will generally be a straightforward affair. But that doesn't mean it's any less important to find the right qualified intermediary (QI) to help execute your Illinois 1031 exchange.

A 1031 exchange allows the seller of real estate to avoid the payment of taxes by acquiring new real estate. As long as the proper procedures are followed, the Internal Revenue Service will recognize the transaction, not as a sale and purchase, but as an exchange of a relinquished property for a replacement property.

Interesting Questions

More info

Aviation Falcon aircraft bearing manufacturer serial number currently registered with Federal Aviation Administration equipped with Honeywell Model engines bearing manufacturer serial numbers collectively treated property referred herein RELIC of Assault Aviation Falcon aircraft with Manufacturer serial number 71030 and Model Serial No. 31004 and Relics of Aircraft and Relics of Relics herein are to be exchanged for the price listed below per Aircraft model and Serial Number in relation to which the foregoing Relics were purchased and on which such Relics had been registered under, Exchangers name and address provided hereinafter with Respect to the exchange of such Relics for the listed price hereunder Docket No.