Illinois Letter Notifying Postal Authorities of Identity Theft

Description

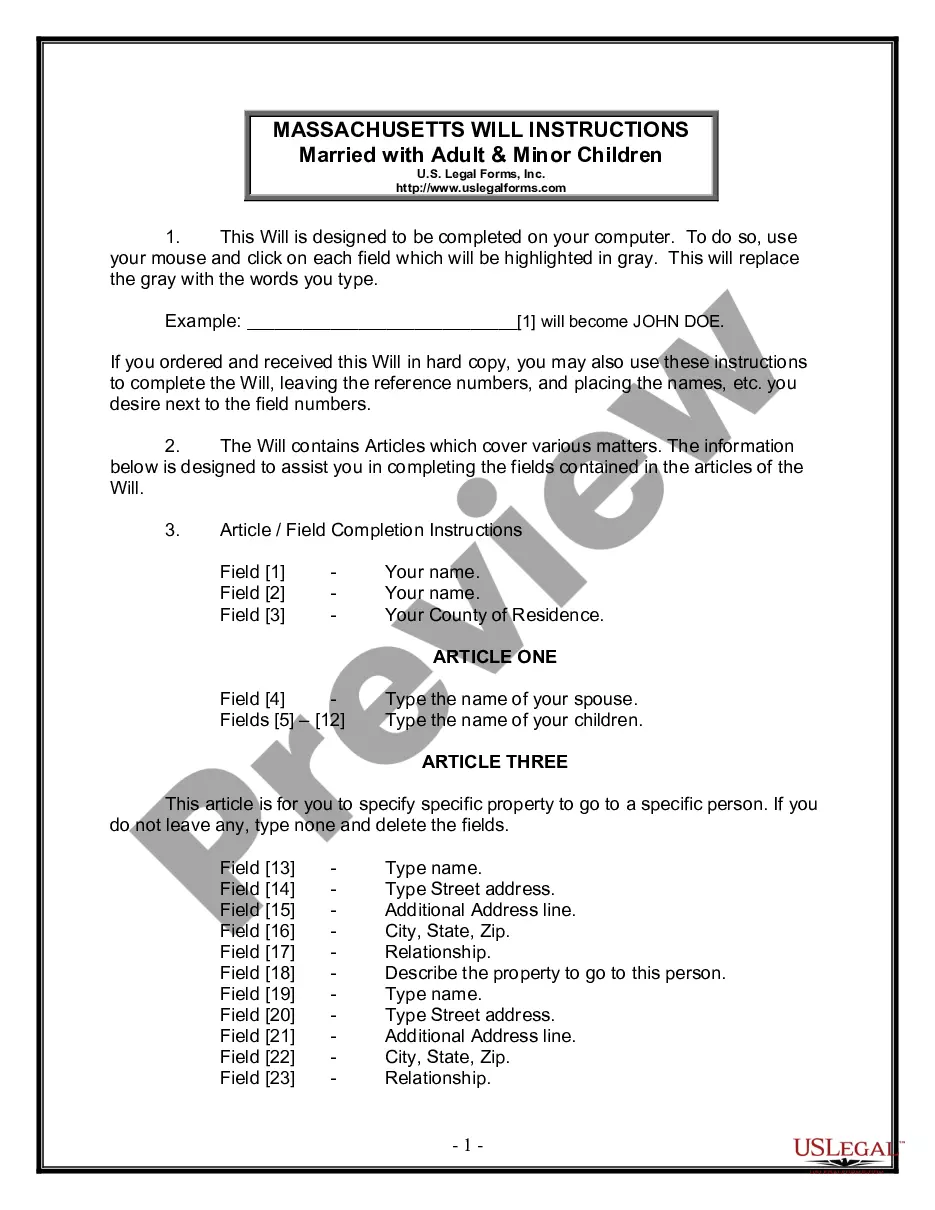

How to fill out Letter Notifying Postal Authorities Of Identity Theft?

Are you presently in a position where you need documents for either business or personal activities almost daily.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers thousands of form templates, such as the Illinois Letter Informing Postal Authorities of Identity Theft, that are created to meet state and federal requirements.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Illinois Letter Informing Postal Authorities of Identity Theft template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

- Utilize the Review option to examine the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- If you find the correct form, click Purchase now.

- Select the pricing plan you want, provide the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

- Choose a suitable document format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Illinois Letter Informing Postal Authorities of Identity Theft at any time, if needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

If you have been the victim of identity theft or believe your personal or financial information may have been compromised, please call the toll-free Identity Theft Hotline at: 1-866-999-5630. Individuals with hearing or speech disabilities can reach us by using the 7-1-1 relay service.

(i) Identity theft of credit, money, goods, services, or other property not exceeding $300 in value is a Class 4 felony. A person who has been previously convicted of identity theft of less than $300 who is convicted of a second or subsequent offense of identity theft of less than $300 is guilty of a Class 3 felony.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

(i) Identity theft of credit, money, goods, services, or other property not exceeding $300 in value is a Class 4 felony. A person who has been previously convicted of identity theft of less than $300 who is convicted of a second or subsequent offense of identity theft of less than $300 is guilty of a Class 3 felony.

ID theft victims should reach out to law enforcement Copies of bills or collection notices. Credit reports with fraudulent charges. Bank or credit card statements.

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.