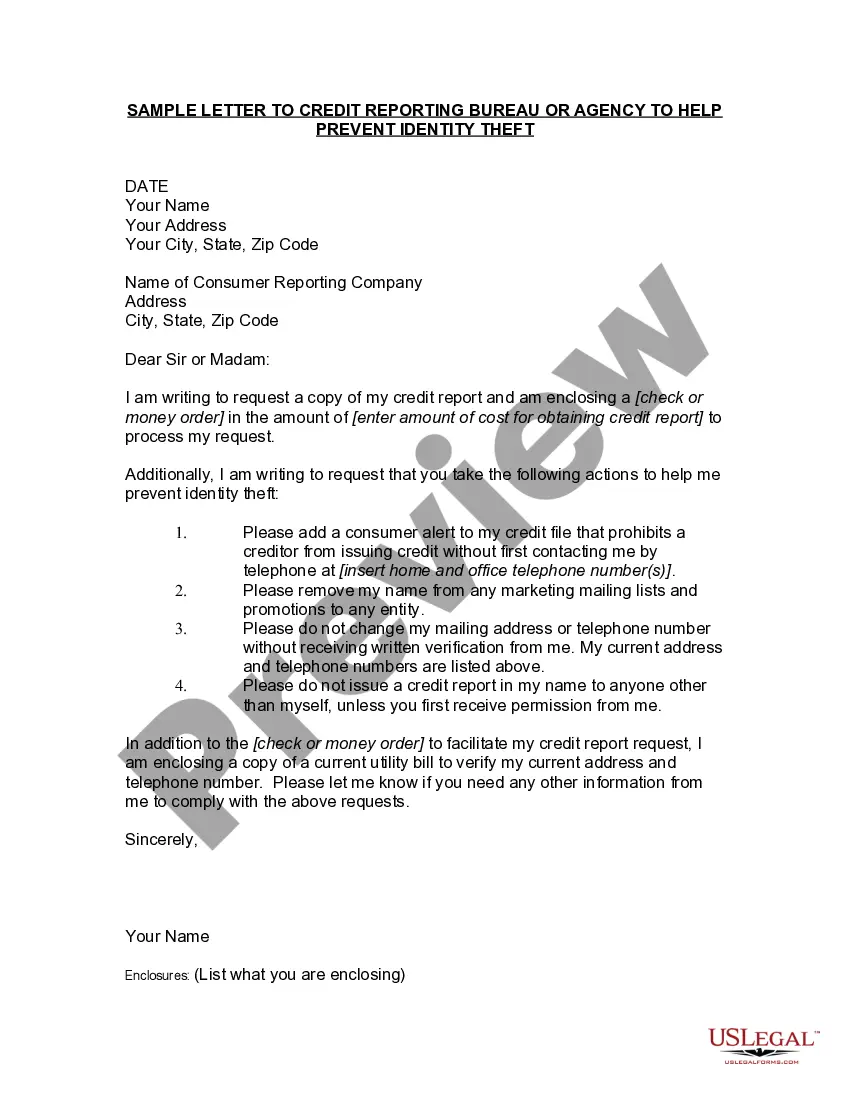

Title: Comprehensive Guide to Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft Introduction: Identity theft has become an increasingly prevalent issue in our digital age, leaving many individuals vulnerable to financial fraud and damages. Thankfully, there are measures you can take to protect yourself, such as sending a letter to credit reporting bureaus or agencies in Illinois. This article provides a detailed description of how to compose an effective Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft, ensuring the safeguarding of your personal information. Keywords: Illinois, sample letter, credit reporting bureau, credit reporting agency, prevent identity theft. 1. Purpose of the Illinois Sample Letter: The primary objective of an Illinois Sample Letter to Credit Reporting Bureau or Agency is to prevent identity theft by requesting the implementation of security measures and freezing your credit reports. 2. Addressing the Credit Reporting Bureau or Agency: Introduce the letter by addressing the specific credit reporting bureau or agency you wish to contact. Examples include Equifax, Experian, and TransUnion. 3. Personal Information Verification: Clearly state your full name, address, and contact information in the letter to ensure accurate identification and correspondence. 4. Request for Credit Freeze: One crucial step in preventing identity theft is to request a credit freeze on your accounts. Outline the reasons for requesting a credit freeze and inform the credit reporting bureau or agency that you want your credit reports inaccessible to unauthorized parties. 5. Temporary Lift of Credit Freeze: If you anticipate the need for a credit inquiry, provide instructions concerning the procedure to temporarily lift the credit freeze for authorized individuals or entities. Include the duration for which the lift will be in effect. 6. Identity Verification Documentation: To verify your identity, provide copies of relevant identification documents such as your driver's license, Social Security card, and utility bills. State that these documents are enclosed and should be processed securely. 7. Reporting Potential Identity Theft: If you suspect or have evidence of identity theft, include all pertinent details, such as fraudulent activities or suspicious inquiries. Request an investigation and prompt action to rectify the situation. 8. Request Confirmation and Documentation: Ask the credit reporting bureau or agency to confirm receipt of your letter. Request that they provide written documentation of the actions taken to prevent identity theft or resolve any fraudulent activities. Conclusion: By crafting a formal and detailed Illinois Sample Letter to Credit Reporting Bureau or Agency, you can take an essential preventive step against identity theft. Safeguarding your personal information and ensuring credit report security is crucial in today's digital landscape.

Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

How to fill out Illinois Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

If you need to total, acquire, or print legal document templates, use US Legal Forms, the greatest collection of legal types, which can be found on the Internet. Use the site`s basic and practical search to discover the papers you will need. Numerous templates for organization and person functions are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with a number of click throughs.

Should you be currently a US Legal Forms buyer, log in for your profile and then click the Down load option to find the Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft. You may also gain access to types you in the past saved within the My Forms tab of your profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the appropriate city/land.

- Step 2. Take advantage of the Preview solution to examine the form`s content material. Do not overlook to learn the explanation.

- Step 3. Should you be not happy with the develop, take advantage of the Lookup industry on top of the monitor to discover other models of the legal develop design.

- Step 4. Upon having identified the shape you will need, go through the Get now option. Opt for the pricing strategy you prefer and add your accreditations to register to have an profile.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Pick the structure of the legal develop and acquire it on your device.

- Step 7. Full, edit and print or indicator the Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft.

Every legal document design you buy is the one you have forever. You possess acces to each develop you saved in your acccount. Go through the My Forms segment and select a develop to print or acquire again.

Compete and acquire, and print the Illinois Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with US Legal Forms. There are millions of expert and express-particular types you can use for your organization or person requirements.

Form popularity

FAQ

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.