Illinois Contract with Employee to Work in a Foreign Country: A Comprehensive Guide Introduction: An Illinois Contract with Employee to Work in a Foreign Country is a legally binding agreement between an employer based in Illinois and an employee who will be working in a foreign country. This contract outlines the terms and conditions of employment along with the rights and responsibilities of both parties involved. It ensures that all parties are aware of the specific details of the assignment and provides a solid framework for a successful working relationship abroad. Keywords: Illinois Contract, Employee, Work in a Foreign Country, Terms and Conditions, Rights and Responsibilities, Assignment, Working Relationship. Types of Illinois Contracts with Employees to Work in a Foreign Country: 1. Fixed-Term Employment Contract: This type of contract defines a specific duration for the employee's assignment in the foreign country. It stipulates the start and end dates of employment, covering a predetermined time frame. Fixed-term contracts are commonly used when there is a temporary need for an employee's expertise overseas. 2. Open-Ended Employment Contract: Unlike the fixed-term contract, an open-ended employment contract does not have a specified end date. This agreement is suitable for longer-term assignments or when the nature of the work requires flexibility in terms of the duration of the assignment. It allows the employer and employee to continue the employment relationship indefinitely until either party terminates the contract. 3. Secondment Agreement: A secondment agreement is a specialized type of contract where an employee is temporarily assigned to work in a foreign country. In this arrangement, the employee remains employed by their original Illinois-based employer, but undertakes work or projects for another entity in the foreign country. This type of contract emphasizes the temporary nature of the assignment and includes provisions for the employee's return to their original position after completion. 4. Expatriate Agreement: An expatriate agreement is specifically tailored for employees who are permanently or semi-permanently relocated to a foreign country. It contains provisions regarding various aspects such as tax implications, housing, healthcare, education for family members, and repatriation benefits. Expatriate contracts typically cover a longer duration and consider additional factors related to living and working abroad. Main Components of an Illinois Contract with Employee to Work in a Foreign Country: 1. Personal Details: The contract should include the names, addresses, and contact information of both the employer and the employee, ensuring clarity regarding identities and roles. 2. Scope of Employment: This section outlines the specific job responsibilities, tasks, and objectives that the employee will be expected to fulfill during their assignment in the foreign country. 3. Employment Terms: This part of the contract defines the duration of the contract, working hours, compensation, benefits, vacation time, and any other terms relevant to the employment relationship. 4. Taxation and Social Security: To avoid any misunderstandings or complications, the contract should detail how taxes and social security contributions will be handled, specifying whether the Illinois employer or the employee will be responsible for compliance with local laws. 5. Accommodation and Living Expenses: If the employer is responsible for providing accommodation or covering living expenses, these details should be clearly stated in the contract, including any limitations or reimbursement processes. 6. Repatriation: For assignment contracts with a fixed duration or expatriate agreements, the contract should include provisions outlining repatriation benefits and procedures for the employee's return to Illinois once the assignment or employment period ends. Conclusion: An Illinois Contract with Employee to Work in a Foreign Country is a crucial document that ensures all parties involved are aware of their rights, responsibilities, and the terms of employment. By delineating the specifics of the employment relationship, this contract helps foster a successful working arrangement while providing legal protection for both the employer and employee.

Illinois Contract with Employee to Work in a Foreign Country

Description

How to fill out Illinois Contract With Employee To Work In A Foreign Country?

Are you within a situation in which you need to have papers for sometimes business or individual functions nearly every day time? There are tons of legal document layouts available online, but finding types you can rely on isn`t simple. US Legal Forms delivers thousands of develop layouts, just like the Illinois Contract with Employee to Work in a Foreign Country, that are written in order to meet federal and state requirements.

If you are already knowledgeable about US Legal Forms internet site and also have an account, simply log in. After that, you may down load the Illinois Contract with Employee to Work in a Foreign Country format.

Should you not come with an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for your proper town/state.

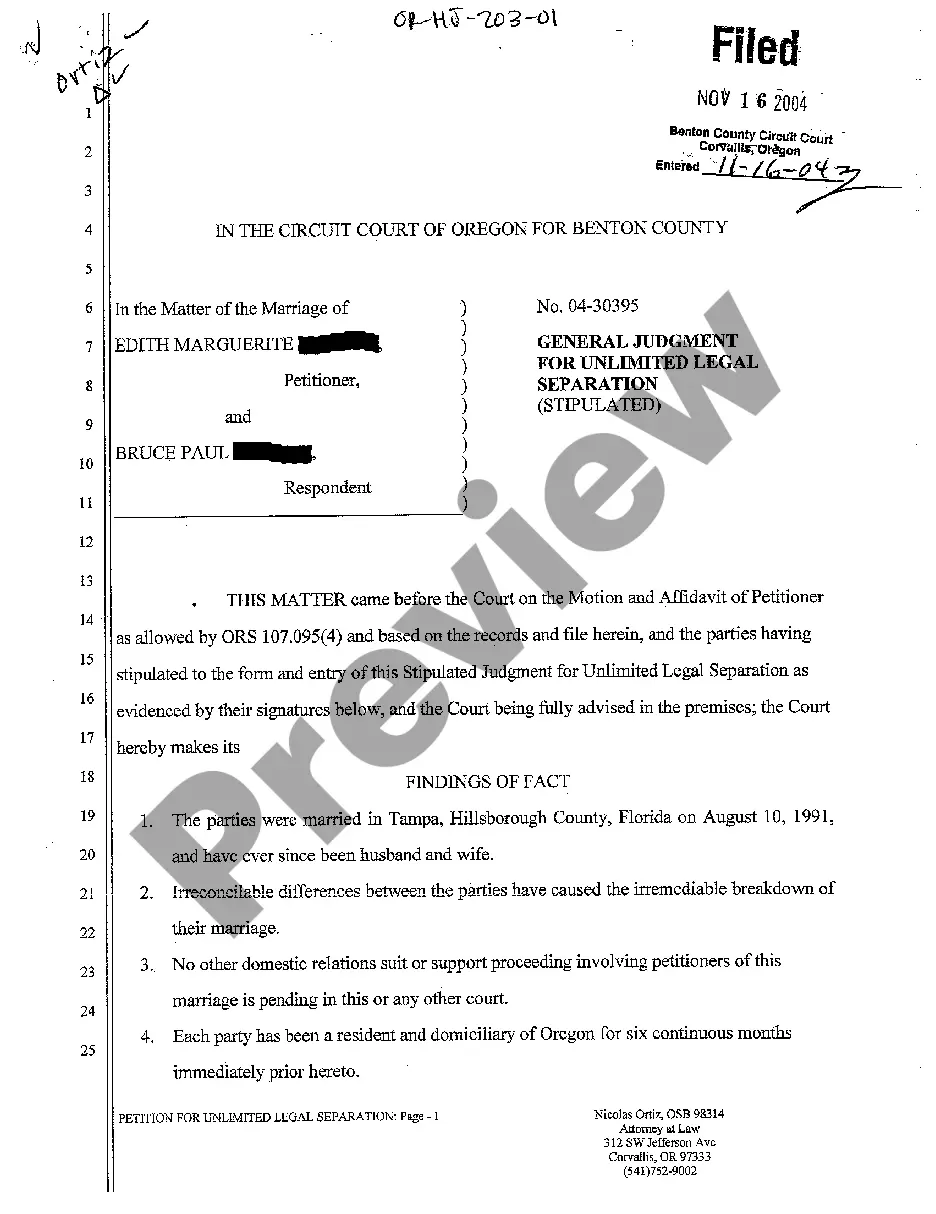

- Take advantage of the Review button to check the shape.

- Look at the information to ensure that you have selected the right develop.

- When the develop isn`t what you are searching for, utilize the Lookup discipline to obtain the develop that fits your needs and requirements.

- Once you discover the proper develop, just click Buy now.

- Opt for the rates plan you need, fill out the desired information and facts to make your money, and pay money for the order utilizing your PayPal or charge card.

- Choose a practical document formatting and down load your version.

Locate all the document layouts you have purchased in the My Forms menus. You can get a additional version of Illinois Contract with Employee to Work in a Foreign Country any time, if possible. Just click the necessary develop to down load or produce the document format.

Use US Legal Forms, probably the most extensive collection of legal kinds, to conserve time as well as avoid mistakes. The assistance delivers professionally manufactured legal document layouts that you can use for an array of functions. Create an account on US Legal Forms and initiate creating your life a little easier.