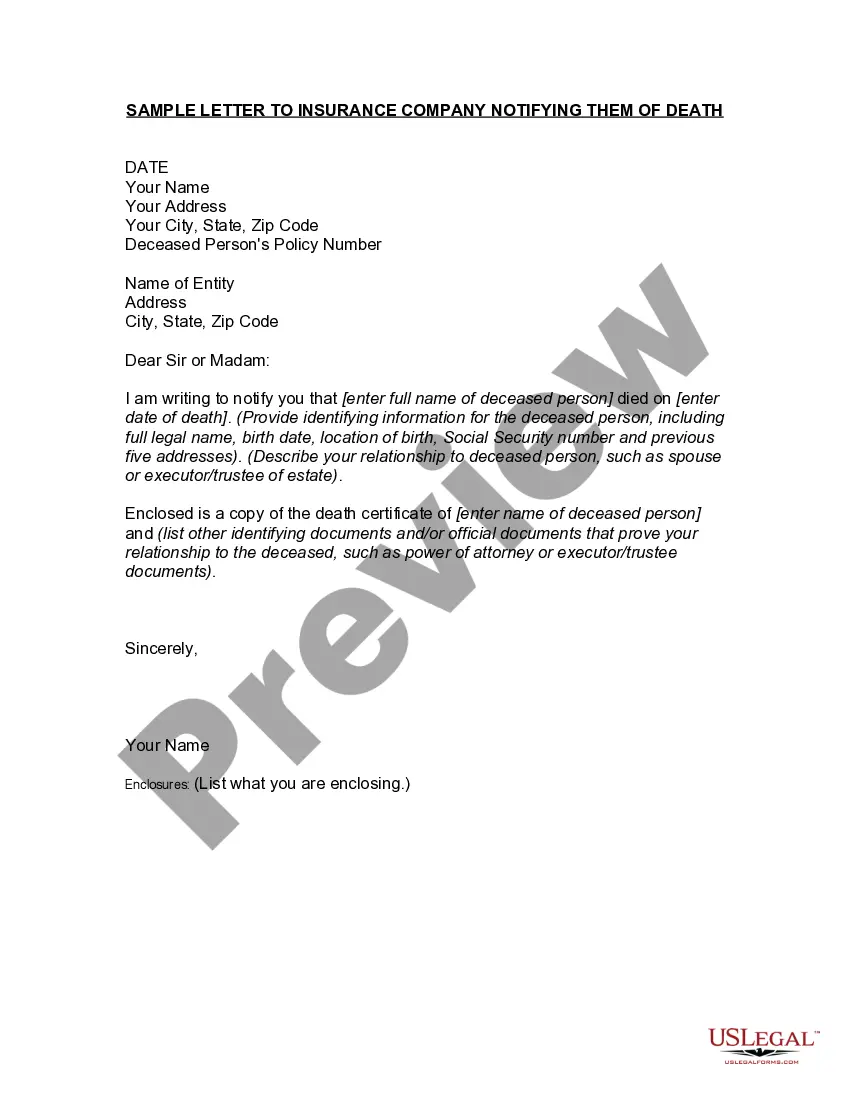

Illinois Letter to Insurance Company Notifying Them of Death is a formal communication sent by the executor or legal representative of the deceased's estate to an insurance company informing them about the policyholder's passing. This letter serves as a crucial step in the claims process, ensuring that the insurance company is aware of the policyholder's death and can initiate the necessary procedures for claim settlement. The content of an Illinois Letter to Insurance Company Notifying Them of Death should include the following information: 1. Basic Information: Begin by addressing the relevant insurance company's name, address, and contact details. Include the full legal name of the deceased policyholder, their address, policy number, and any relevant dates (date of death, policy issuance date, etc.). 2. Notification of Death: Clearly state that the purpose of the letter is to inform the insurance company of the policyholder's death. Mention the date of death, along with any supporting documentation or legal forms such as the death certificate. 3. Executor or Representative Details: Provide the name, contact information, and role (executor, legal representative, etc.) of the person sending the letter. Include their relationship to the deceased to establish their authority in representing the estate. 4. Policy Details: Mention the specifics of the insurance policy, such as the type of coverage (life insurance, health insurance, etc.), policy number, and any other relevant policy information. 5. Beneficiary Information: If the policyholder had designated beneficiaries, list their names and contact information, along with their relationship to the deceased. Remind the insurance company to contact the beneficiaries regarding the claims process. 6. Documentation Submission: Inform the insurance company about the documents that will be enclosed with the letter, such as the death certificate, original policy documents, identification documents of the deceased and the executor, and any other required forms. 7. Requested Actions: Clearly state the actions you expect the insurance company to take, such as initiating the claims process and providing instructions on how to proceed further. Specify any deadlines or additional information they may require. Common variations or types of Illinois Letter to Insurance Company Notifying Them of Death may include letters specific to different types of insurance policies, such as life insurance, health insurance, auto insurance, and property insurance. The content mentioned above remains consistent across these variations, adjusted to include policy-specific information. It is crucial to keep a copy of the letter and any enclosed documents for record-keeping purposes. It's recommended to send the letter via certified mail with a return receipt to ensure proof of delivery and track the progress of the claims process. Note: It is advisable to consult with an attorney or legal professional to ensure compliance with Illinois state laws and to handle any specific circumstances related to the deceased's estate.

Illinois Letter to Insurance Company Notifying Them of Death

Description

How to fill out Illinois Letter To Insurance Company Notifying Them Of Death?

If you want to comprehensive, down load, or print out lawful file web templates, use US Legal Forms, the largest variety of lawful forms, which can be found on the Internet. Make use of the site`s simple and convenient search to get the documents you want. Various web templates for business and personal reasons are categorized by groups and states, or keywords and phrases. Use US Legal Forms to get the Illinois Letter to Insurance Company Notifying Them of Death in just a number of click throughs.

When you are presently a US Legal Forms customer, log in for your bank account and click on the Download switch to obtain the Illinois Letter to Insurance Company Notifying Them of Death. You can even accessibility forms you formerly acquired from the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for your proper area/country.

- Step 2. Take advantage of the Review solution to check out the form`s information. Don`t overlook to see the outline.

- Step 3. When you are not happy together with the kind, take advantage of the Search field towards the top of the display to locate other types from the lawful kind design.

- Step 4. Once you have identified the form you want, click the Purchase now switch. Choose the prices plan you choose and put your references to sign up for the bank account.

- Step 5. Process the purchase. You can utilize your bank card or PayPal bank account to finish the purchase.

- Step 6. Pick the format from the lawful kind and down load it on the system.

- Step 7. Full, edit and print out or sign the Illinois Letter to Insurance Company Notifying Them of Death.

Each lawful file design you get is yours for a long time. You have acces to every single kind you acquired with your acccount. Click on the My Forms portion and decide on a kind to print out or down load once more.

Be competitive and down load, and print out the Illinois Letter to Insurance Company Notifying Them of Death with US Legal Forms. There are thousands of expert and express-particular forms you may use for your business or personal needs.

Form popularity

FAQ

I the undersigned ________ of Shri/Smt. __________________________________ here by inform you about the death of my_______________. I request you to settle the death claim under his policy no. _________________________________ at the earliest in my favour being the nominee of the above no.

At the death of an owner, the policy passes as a probate estate asset to the next owner either by will or by intestate succession, if no successor owner is named. This could cause ownership of the policy to pass to an unintended owner or to be divided among multiple owners.

The insurer must pay the death benefit when the insured dies if the policyholder pays the premiums as required, and premiums are determined in part by how likely it is that the insurer will have to pay the policy's death benefit based on the insured's life expectancy.

How do I file a life insurance claim? Get several copies of the death certificate. Call your insurance agent. He or she can help you fill out the necessary forms and act as an intermediary with the insurance company. ... Submit a certified copy of the death certificate from the funeral director with the policy claim.

Also, death certificates are issued by local government agencies who aren't required to notify life insurance companies every time a citizen passes away. So, insurance companies typically don't even know that a policyholder has passed away until someone submits a beneficiary claim.

Life Insurance. Life insurance is a contract with an insurance company that helps financially protect your loved ones if you pass away. You pay your premiums, and, if you pass away while coverage is in place, the company pays a lump sum (called a death benefit) to your beneficiaries.

An insurer is responsible for delivery of the insurance policy to the insured or such person that the insured designates, but the insurer may delegate such task to either its insurance agent or the insurance broker.

Of course, an insurer may have no way of knowing about the homeowner's death right away ? but they'll eventually find out. That's why a surviving spouse, family member, or estate executor should contact the insurer and submit a death certificate within 30 days of the homeowner's death.