Illinois Letter to Report Known Imposter Identity Theft to Social Security Administration

Description

How to fill out Letter To Report Known Imposter Identity Theft To Social Security Administration?

Are you in the situation in which you need to have paperwork for both business or individual purposes virtually every time? There are plenty of legal papers templates available on the net, but discovering types you can depend on isn`t effortless. US Legal Forms provides a large number of develop templates, much like the Illinois Letter to Report Known Imposter Identity Theft to Social Security Administration, that are published to fulfill state and federal needs.

In case you are already knowledgeable about US Legal Forms internet site and possess a free account, merely log in. Next, you can obtain the Illinois Letter to Report Known Imposter Identity Theft to Social Security Administration web template.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is for that appropriate metropolis/region.

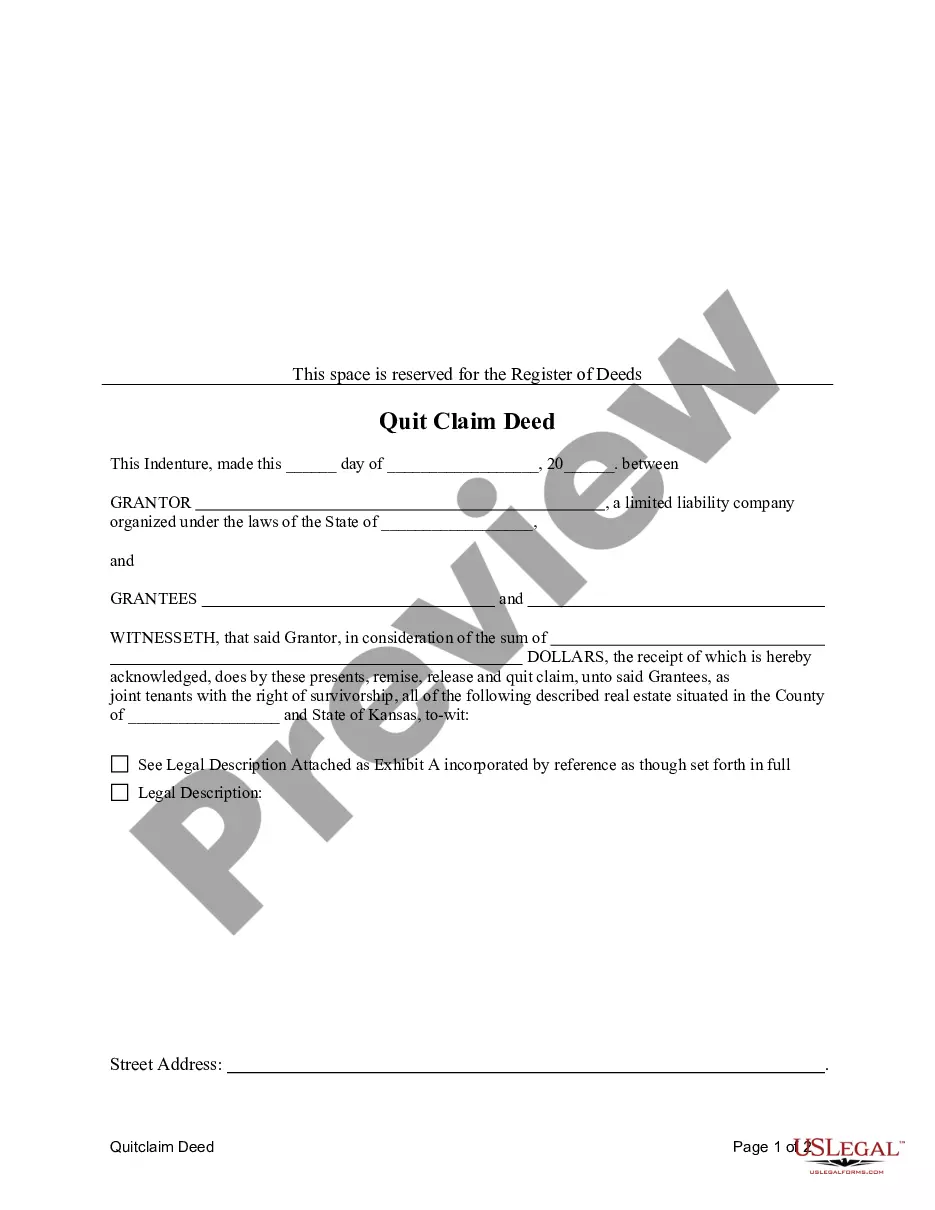

- Take advantage of the Review option to analyze the form.

- Browse the description to ensure that you have chosen the appropriate develop.

- In the event the develop isn`t what you`re searching for, take advantage of the Research area to find the develop that meets your requirements and needs.

- When you obtain the appropriate develop, click on Purchase now.

- Opt for the costs program you need, complete the specified information and facts to create your account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a convenient data file file format and obtain your duplicate.

Locate all the papers templates you might have bought in the My Forms food list. You may get a additional duplicate of Illinois Letter to Report Known Imposter Identity Theft to Social Security Administration at any time, if necessary. Just click on the required develop to obtain or print the papers web template.

Use US Legal Forms, probably the most comprehensive selection of legal forms, in order to save time and prevent errors. The assistance provides professionally produced legal papers templates which you can use for a variety of purposes. Generate a free account on US Legal Forms and start making your life easier.

Form popularity

FAQ

What should you do if you are a victim of identity theft or fraud? You should immediately notify the police, the bank, and the credit card holders.

Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Identity Theft Victim? Steps to Take Contact the company or companies where you believe the fraud occurred, and let them know you believe your identity may have been compromised. Check your credit reports. ... Consider placing an initial one-year fraud alert on your credit reports.

Explain that someone stole your identity and ask them to close or freeze the compromised account. Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

If you have been the victim of identity theft or believe your personal or financial information may have been compromised, please call the toll-free Identity Theft Hotline at: 1-866-999-5630. Individuals with hearing or speech disabilities can reach us by using the 7-1-1 relay service.

Reviewing your credit report is one of the most important steps you can take to ensure that you are not a victim of identity theft (ID theft). To review your credit report, contact one or all of the major consumer credit reporting agencies and request a copy of your credit report.

Do you suspect someone of committing fraud, waste, or abuse against Social Security? You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov.