Illinois Complaint for Breach of Fiduciary Duty — Trust is a legal document filed by a beneficiary of a trust in the state of Illinois against a trustee who has allegedly violated their fiduciary duties. A fiduciary duty is a legal obligation where the trustee is expected to act in the best interest of the beneficiary and manage the trust's assets responsibly. The complaint serves as the initial step in bringing a legal action against a trustee for breaching their fiduciary duties. Keywords: Illinois Complaint, Breach of Fiduciary Duty, Trust, Beneficiary, Trustee, Legal Document, Fiduciary Duties, Assets, Legal Action. Types of Illinois Complaint for Breach of Fiduciary Duty — Trust may include: 1. Complaint for Breach of Fiduciary Duty — Mismanagement of Trust Assets: This type of complaint is filed when the trustee has mismanaged the trust assets by making improper investments, commingling trust funds with personal funds, or failing to exercise due diligence in handling the assets. 2. Complaint for Breach of Fiduciary Duty — Self-Dealing: This type of complaint is filed when the trustee has engaged in self-dealing, meaning they have used the trust assets for their personal benefit, such as borrowing money from the trust, purchasing property for personal use, or failing to disclose conflicts of interest. 3. Complaint for Breach of Fiduciary Duty — Failure to Distribute Trust Assets: This type of complaint is filed when the trustee fails to distribute the trust assets to the beneficiaries as required by the terms of the trust. The trustee may deliberately withhold assets or fail to act in a timely manner to distribute them. 4. Complaint for Breach of Fiduciary Duty — Accounting Irregularities: This type of complaint is filed when the trustee fails to provide accurate and transparent accounting of the trust's assets and transactions. It may include allegations of withholding information, providing false or incomplete statements, or intentionally misrepresenting financial information. 5. Complaint for Breach of Fiduciary Duty — Negligence or Incompetence: This type of complaint is filed when the trustee's actions or lack thereof demonstrate negligence or incompetence in managing the trust. It may include failure to invest prudently, maintain proper records, pay taxes, or fulfill other fiduciary responsibilities. In conclusion, an Illinois Complaint for Breach of Fiduciary Duty — Trust is a crucial legal tool for beneficiaries seeking redress when a trustee fails to fulfill their fiduciary duties. Various types of complaints may be filed, depending on the specific allegations of breach, such as mismanagement of trust assets, self-dealing, failure to distribute assets, accounting irregularities, or negligence/incompetence.

Illinois Complaint for Breach of Fiduciary Duty - Trust

Description

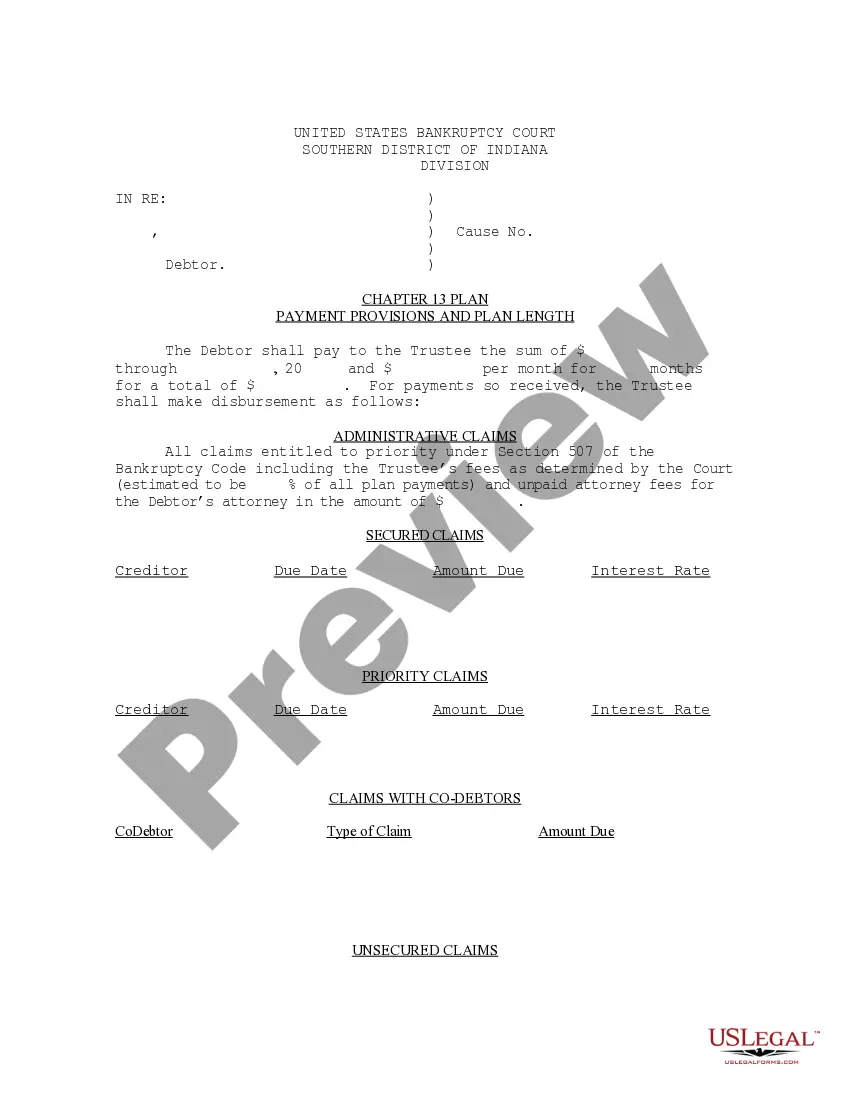

How to fill out Illinois Complaint For Breach Of Fiduciary Duty - Trust?

If you want to full, download, or printing legal file layouts, use US Legal Forms, the most important assortment of legal kinds, that can be found on-line. Take advantage of the site`s basic and hassle-free lookup to get the paperwork you need. Numerous layouts for business and person reasons are categorized by types and states, or search phrases. Use US Legal Forms to get the Illinois Complaint for Breach of Fiduciary Duty - Trust within a couple of clicks.

Should you be already a US Legal Forms client, log in for your profile and click the Obtain button to get the Illinois Complaint for Breach of Fiduciary Duty - Trust. You can also entry kinds you formerly downloaded inside the My Forms tab of your own profile.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the proper city/nation.

- Step 2. Utilize the Review option to look through the form`s content material. Don`t forget about to read the explanation.

- Step 3. Should you be not satisfied with all the develop, make use of the Lookup area on top of the monitor to get other variations in the legal develop format.

- Step 4. After you have located the shape you need, click on the Buy now button. Choose the pricing program you choose and include your references to sign up on an profile.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Find the format in the legal develop and download it on your own gadget.

- Step 7. Total, edit and printing or indicator the Illinois Complaint for Breach of Fiduciary Duty - Trust.

Every single legal file format you buy is yours permanently. You may have acces to every develop you downloaded in your acccount. Go through the My Forms section and decide on a develop to printing or download once more.

Compete and download, and printing the Illinois Complaint for Breach of Fiduciary Duty - Trust with US Legal Forms. There are thousands of skilled and express-certain kinds you may use to your business or person demands.

Form popularity

FAQ

The four elements are: The defendant was acting as a fiduciary of the plaintiff; The defendant breached a fiduciary duty to the plaintiff; The plaintiff suffered damages as a result of the breach; and. The defendant's breach of fiduciary duty caused the plaintiff's damages.

What Is A Breach Of Fiduciary Duty? A breach of fiduciary duty happens when someone has a responsibility to act in the best interests of another party but fails to do so. A lawsuit can help an impacted firm or group to recover damages for the injuries they sustained as a result of the breach of fiduciary duty.

The fiduciary will typically be removed from his role of trust. If financial loss occurred because of the fiduciary's breach of duty, it is possible that the fiduciary will be held accountable for those losses and money will be awarded to those who were damaged which the fiduciary would have to pay.

Proving an Actual Breach of Fiduciary Duty Is Difficult In a personal injury case, proving a breach of duty is often the most contested part. Here, you must demonstrate what the fiduciary did that fell short of their duty.

Exposing the partnership to liability through negligence or malfeasance; Damaging the goodwill of the company through illegal or wrongful behavior; Concealing important information from partners; Failing to disclose conflicts of interest; or.

A breach of fiduciary duty occurs when the fiduciary acts in his or her own self-interest rather than in the best interests of those to whom they owe the duty.

To prevail on a claim for breach of fiduciary duty under Illinois law, a plaintiff must prove that: (1) a fiduciary duty existed; (2) the defendant breached that duty; and (3) the breach proximately caused the plaintiff's injury.

A breach of fiduciary duty occurs when the fiduciary acts in his or her own self-interest rather than in the best interests of those to whom they owe the duty.