Illinois Financial Consulting Agreement

Description

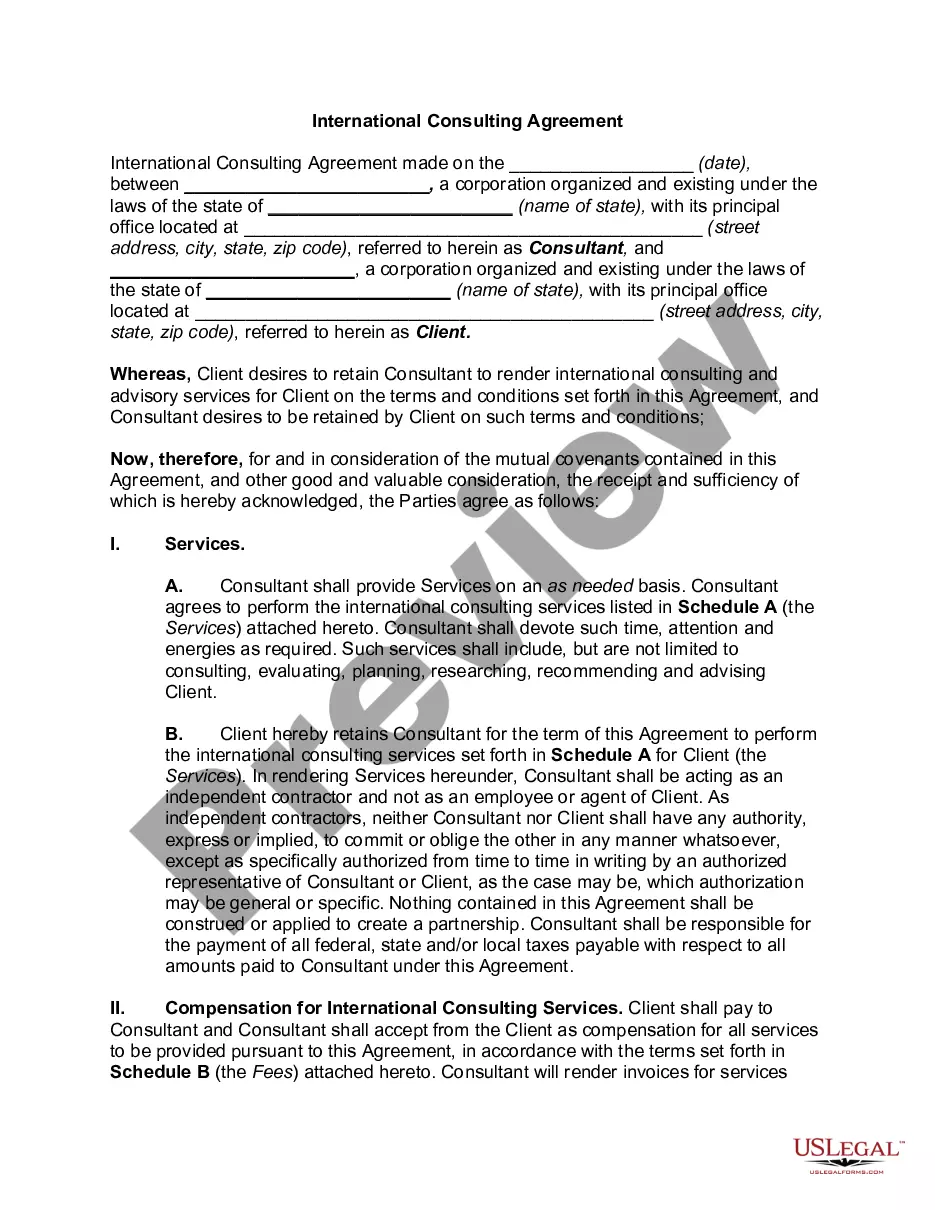

How to fill out Financial Consulting Agreement?

You may spend time online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the Illinois Financial Consulting Agreement from the service.

If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Illinois Financial Consulting Agreement.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the county/town of your choice.

- Review the form description to confirm you have picked the correct form.

- If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

To obtain a consulting contract, it is essential to first negotiate terms with your client to ensure mutual understanding. You can then draft the agreement based on those terms, or utilize platforms like USLegalForms to gain access to professional templates. This process will facilitate a smooth engagement, particularly for an Illinois Financial Consulting Agreement.

While all consulting agreements are contracts, not all contracts are consulting agreements. A consulting agreement specifically pertains to the relationship between a consultant and a client, detailing services, payments, and obligations. Recognizing this difference is vital when entering into an Illinois Financial Consulting Agreement to ensure clarity and legal compliance.

A consulting agreement focuses on specific projects and deliverables, while a Master Service Agreement (MSA) establishes a broader framework for a long-term relationship. The MSA covers general terms that will apply to multiple projects, making it more comprehensive. When related to an Illinois Financial Consulting Agreement, a consulting agreement may address particular tasks within the framework set by an MSA.

To draft a consultancy agreement, start by outlining the scope of services, payment terms, and duration of the agreement. Include clauses on confidentiality and dispute resolution to protect both parties. Using templates from USLegalForms can simplify your process, ensuring you meet all requirements for an Illinois Financial Consulting Agreement.

A SOW is typically a component of a consulting agreement. The consulting agreement outlines the general terms of the relationship, whereas the SOW provides detailed information about particular projects, timelines, and deliverables. This distinction can be crucial when creating an Illinois Financial Consulting Agreement.

The primary difference between a SOW and an agreement lies in their purpose and detail. A consulting agreement is a broader contract that sets the overall conditions of the consulting relationship, while a SOW focuses on specific project tasks and outcomes. Understanding these differences is essential when drawing up an Illinois Financial Consulting Agreement.

A consulting agreement is a formal contract that establishes a working relationship between a consultant and a client. It defines the scope of services, payment terms, and the responsibilities of each party. This document is crucial for ensuring that both sides are aligned, particularly when dealing with an Illinois Financial Consulting Agreement.

A Statement of Work (SOW) in consulting serves as a detailed document that outlines the specific tasks, deliverables, timelines, and expectations for a project. It helps both parties understand their roles and responsibilities clearly. This clarity can streamline collaboration and enhance project success, especially within an Illinois Financial Consulting Agreement.

While Illinois does not mandate LLCs to have an operating agreement, it is highly recommended to have one. This document outlines the management structure, operational procedures, and ownership stakes. An Illinois Financial Consulting Agreement can complement an operating agreement by detailing relationships with clients and service providers.

Consulting services refer to expert assistance offered by professionals to help businesses address specific challenges or improve operations. This can include financial analysis, strategic planning, or operational improvements. An Illinois Financial Consulting Agreement serves to formalize these services, providing essential protection and clarity for both parties.