Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner An Illinois Limited Partnership Agreement between a Limited Liability Company (LLC) and a Limited Partner is a legal document that outlines the terms and conditions for forming a partnership, where the LLC acts as the general partner and the limited partner provides capital and enjoys limited liability. This agreement is specifically designed for partnerships formed in the state of Illinois, ensuring compliance with local laws and regulations. Keywords: Illinois, limited partnership agreement, limited liability company, limited partner, partnership, general partner, capital, limited liability, compliance, local laws and regulations. Types of Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner: 1. Equal Liability Limited Partnership (ELLA): This type of agreement allows the LLC to hold equal liability with the limited partner, sharing both profits and responsibilities equally. This arrangement is suitable when both parties are actively involved in the partnership's management and decision-making processes. 2. Limited Liability Limited Partnership (LL LP): In this type of agreement, the LLC retains limited liability protection for its general partnership role, similar to a traditional limited liability partnership, while the limited partner's liability remains limited solely to their investment in the partnership. This arrangement is useful when the limited partner prefers to have no management responsibilities but still wants protection from personal liability. 3. General Partners with Limited Liability Company as the Sole Limited Partner: This agreement establishes the LLC as the general partner, responsible for daily operations, decision-making, and management of the partnership, while the limited partner solely provides the required capital. This type of agreement may be suitable when the LLC wants full control over the partnership's operations. 4. General Partners with Multiple Limited Partners: This agreement involves multiple limited partners who contribute capital without any active management responsibilities, while the LLC acts as the general partner. This arrangement is commonly used when more than one limited partner is involved in the partnership. Each type of agreement will have its specific terms, including capital contributions, profit distributions, decision-making authorities, dispute resolution mechanisms, and dissolution procedures. It is crucial to consult legal professionals specializing in partnership agreements to draft and customize the document to suit the specific needs and objectives of the LLC and limited partner. By establishing an Illinois Limited Partnership Agreement between a Limited Liability Company and a Limited Partner, both parties can enjoy the benefits of a partnership structure while ensuring compliance with relevant state laws and protecting their interests.

Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Illinois Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are many legal document templates available online, but finding ones that you can rely on isn't simple.

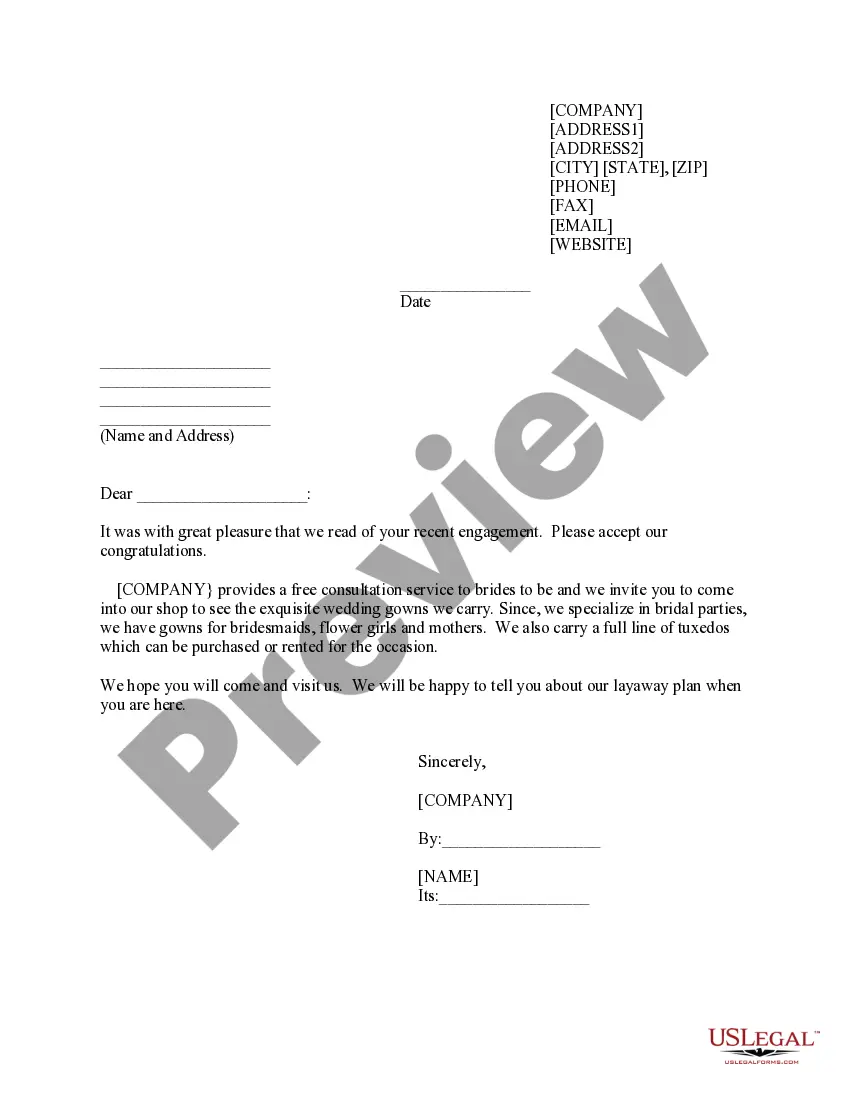

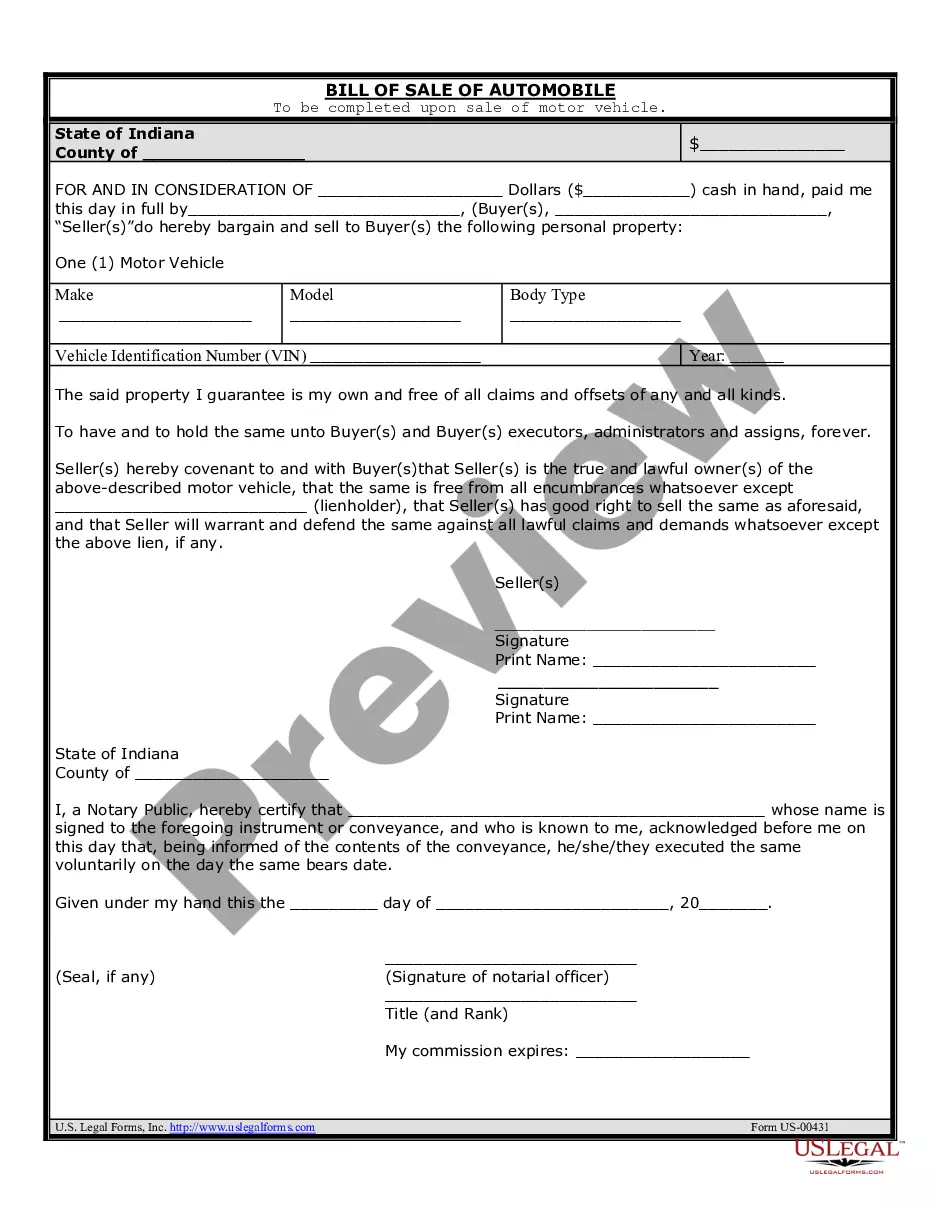

US Legal Forms offers thousands of document templates, including the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, which can be completed to satisfy state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner at any time, if needed. Click the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent mistakes. The service provides well-crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

- Use the Preview button to view the form.

- Check the details to confirm you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you locate the correct form, click Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and purchase the transaction using your PayPal or credit card.

Form popularity

FAQ

To form a partnership LLC in Illinois, select a unique name, designate members, and file your Articles of Organization with the Secretary of State. It's crucial to draft an Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner to delineate the roles and responsibilities within your LLC. Following these steps ensures that your partnership LLC functions smoothly and adheres to state regulations.

Yes, you can operate both a limited company and a partnership together, each focusing on different business areas. In practice, a limited company can manage operations while a partnership can facilitate investor contributions, allowing for greater financial flexibility. The Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner can be tailored to suit this dual structure.

Writing a partnership agreement example begins by defining each partner's role, ownership percentage, and how profits will be shared. It's essential to include dispute resolution mechanisms and procedures for adding new partners. This approach integrates seamlessly into the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, ensuring clarity and mutual understanding.

Creating a limited partnership involves selecting a unique name, filing the required documents with your state, and drafting an Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Once these elements are in place, you can begin to operate and enjoy the benefits of limited liability it offers. Ensure compliance with state regulations to maintain your partnership status.

To write a limited partnership agreement, clearly outline the roles of general and limited partners, their contributions, and profit-sharing methods. It is vital to detail duties, rights, and any specific terms that affect the partnership's operations. Using a structured template can streamline this process, and platforms like uslegalforms provide valuable resources to create a robust Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

If a limited partner decides to withdraw or fails to meet the terms outlined in the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it may lead to financial and operational consequences. The limited partnership may need to revise its agreement or find a suitable replacement partner. Understanding these implications is crucial before entering any partnership agreement.

A limited partnership consists of at least one general partner and one limited partner. The general partner manages the business, assuming full legal responsibility, while the limited partner contributes capital without participating in daily operations. This structure allows investors to enjoy limited liability under the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

Many countries have adopted the Limited Liability Partnership structure, including the United Kingdom, Canada, and India. This legal form allows partners to enjoy limited liability protection while maintaining flexibility in management. As you explore options such as the Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, consider how LLP structures can vary across countries. Understanding these differences can help you make informed decisions regarding your business structure.

To form a partnership in Illinois, you must choose a partnership type, such as a general partnership or a limited partnership. You need to create an agreement detailing the roles and responsibilities of each partner. If you seek to establish an Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, ensure that your document is clear and complies with state laws. Utilizing platforms like ulegalforms can simplify this process and ensure you cover all necessary elements.

Yes, an Illinois law firm can be structured as a Limited Liability Company. This allows the firm to benefit from limited liability while also enjoying flexibility in management and taxation. When forming an Illinois Limited Partnership Agreement Between Limited Liability Company and Limited Partner, law firms often consider this structure for its advantages. It is crucial to consult legal resources, like ulegalforms, for guidance on compliance and optimal structuring.

Interesting Questions

More info

They are not subject to state corporation laws and their boards of directors are not subject to public records laws. To be a limited partnership, you must qualify as a tax partner and agree to be bound by the limited partnership agreement. If you do not agree to follow the limited partnership agreement, you can apply to become a member. By becoming a member you will take part in the general operation of the limited partnership, and you will be subject to the limited partnership's laws. To be treated as a tax partner, a person must have: a US address; a US mailing address; sufficient assets (cash, property or securities) to prove his or her financial independence; an employer and an employee, an employer that is not a member of the limited partnership and a member of the limited partnership can not take a share of the corporation; a US business address; not have active business outside the United States; and Not become insolvent in the preceding 12 months.