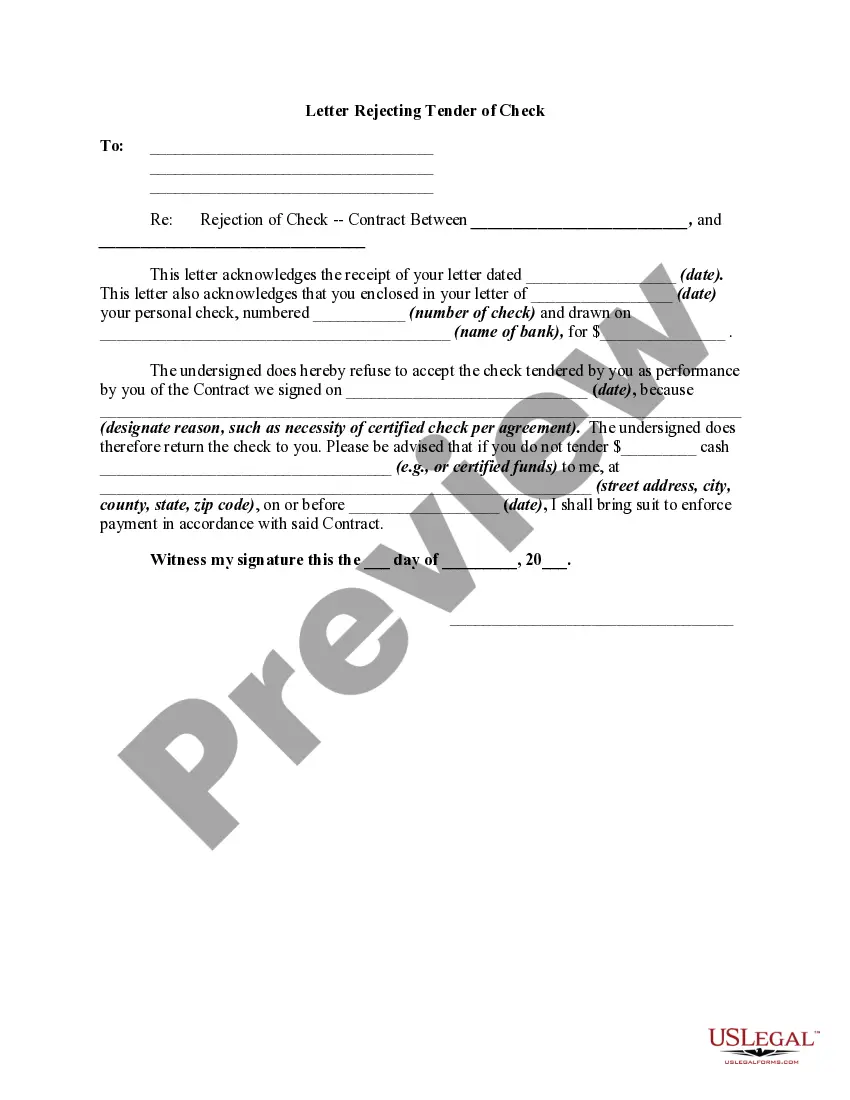

The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

Title: Understanding the Illinois Letter Rejecting Tender of Check: Types and Detailed Description Introduction: In the state of Illinois, the "Letter Rejecting Tender of Check" serves as a formal method to decline or deny a submitted check payment. This crucial letter is utilized when the recipient (or payee) wishes to reject the tendered payment due to various reasons, such as a discrepancy in payment amount, issues with the check itself, or any other relevant factors. In this article, we will delve into the different types of Illinois Letters Rejecting Tender of Check, outlining their specific purposes and providing a detailed description of each. Types of Illinois Letters Rejecting Tender of Check: 1. Illinois Letter Rejecting Tender of Check — Insufficient Funds: This type of letter is used when the recipient deposits a check that eventually bounces due to insufficient funds in the issuer's account. The payee can write an Illinois Letter Rejecting Tender of Check — Insufficient Funds to notify the issuer about the unpaid amount and request a proper payment option or settlement to rectify the situation. 2. Illinois Letter Rejecting Tender of Check — Incorrect Payment Amount: In cases where the payment amount mentioned on the submitted check varies from the actual outstanding amount owed, a payee can issue an Illinois Letter Rejecting Tender of Check — Incorrect Payment Amount. This letter serves as a notification to the issuer, highlighting the discrepancy and requesting a revised check with the accurate payment figure. 3. Illinois Letter Rejecting Tender of Check — Damaged Check: When a recipient receives a damaged check that cannot be processed by their bank or financial institution, they can use an Illinois Letter Rejecting Tender of Check — Damaged Check to inform the issuer about the situation. This letter notifies the issuer of the unusable state of the check and allows them to provide a replacement check or alternative payment method. 4. Illinois Letter Rejecting Tender of Check — Payment Policy Violation: In some cases, a payee might refuse a check payment if the issuer violates certain payment policies, such as issuing a post-dated check or one from a closed account. With an Illinois Letter Rejecting Tender of Check — Payment Policy Violation, the recipient can formally address the issue to the issuer, outlining the violation and requesting a proper payment resolution. 5. Illinois Letter Rejecting Tender of Check — Incorrect Payee Information: If the payee receives a check with incorrect or mismatched payee information, such as an incorrect name or business entity, they can present an Illinois Letter Rejecting Tender of Check — Incorrect Payee Information. This letter informs the issuer about the discrepancy, requesting a new check or correction to ensure the correct payee receives the payment. Conclusion: Illinois Letters Rejecting Tender of Check play a vital role in establishing clear communication between payees and issuers, ensuring proper payment processes and resolving any payment-related issues. By understanding the different types of these letters, individuals can navigate various situations effectively and efficiently, promoting transparency and professionalism in financial dealings.Title: Understanding the Illinois Letter Rejecting Tender of Check: Types and Detailed Description Introduction: In the state of Illinois, the "Letter Rejecting Tender of Check" serves as a formal method to decline or deny a submitted check payment. This crucial letter is utilized when the recipient (or payee) wishes to reject the tendered payment due to various reasons, such as a discrepancy in payment amount, issues with the check itself, or any other relevant factors. In this article, we will delve into the different types of Illinois Letters Rejecting Tender of Check, outlining their specific purposes and providing a detailed description of each. Types of Illinois Letters Rejecting Tender of Check: 1. Illinois Letter Rejecting Tender of Check — Insufficient Funds: This type of letter is used when the recipient deposits a check that eventually bounces due to insufficient funds in the issuer's account. The payee can write an Illinois Letter Rejecting Tender of Check — Insufficient Funds to notify the issuer about the unpaid amount and request a proper payment option or settlement to rectify the situation. 2. Illinois Letter Rejecting Tender of Check — Incorrect Payment Amount: In cases where the payment amount mentioned on the submitted check varies from the actual outstanding amount owed, a payee can issue an Illinois Letter Rejecting Tender of Check — Incorrect Payment Amount. This letter serves as a notification to the issuer, highlighting the discrepancy and requesting a revised check with the accurate payment figure. 3. Illinois Letter Rejecting Tender of Check — Damaged Check: When a recipient receives a damaged check that cannot be processed by their bank or financial institution, they can use an Illinois Letter Rejecting Tender of Check — Damaged Check to inform the issuer about the situation. This letter notifies the issuer of the unusable state of the check and allows them to provide a replacement check or alternative payment method. 4. Illinois Letter Rejecting Tender of Check — Payment Policy Violation: In some cases, a payee might refuse a check payment if the issuer violates certain payment policies, such as issuing a post-dated check or one from a closed account. With an Illinois Letter Rejecting Tender of Check — Payment Policy Violation, the recipient can formally address the issue to the issuer, outlining the violation and requesting a proper payment resolution. 5. Illinois Letter Rejecting Tender of Check — Incorrect Payee Information: If the payee receives a check with incorrect or mismatched payee information, such as an incorrect name or business entity, they can present an Illinois Letter Rejecting Tender of Check — Incorrect Payee Information. This letter informs the issuer about the discrepancy, requesting a new check or correction to ensure the correct payee receives the payment. Conclusion: Illinois Letters Rejecting Tender of Check play a vital role in establishing clear communication between payees and issuers, ensuring proper payment processes and resolving any payment-related issues. By understanding the different types of these letters, individuals can navigate various situations effectively and efficiently, promoting transparency and professionalism in financial dealings.