US Legal Forms - one of the largest libraries of legitimate varieties in the United States - gives an array of legitimate document web templates you may acquire or print. Making use of the web site, you will get 1000s of varieties for organization and individual reasons, categorized by categories, states, or key phrases.You can find the newest types of varieties much like the Illinois Assignment of Certificate of Deposit Agreement in seconds.

If you already have a membership, log in and acquire Illinois Assignment of Certificate of Deposit Agreement in the US Legal Forms local library. The Obtain switch will appear on every single type you view. You gain access to all in the past delivered electronically varieties in the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, listed here are straightforward directions to help you get started:

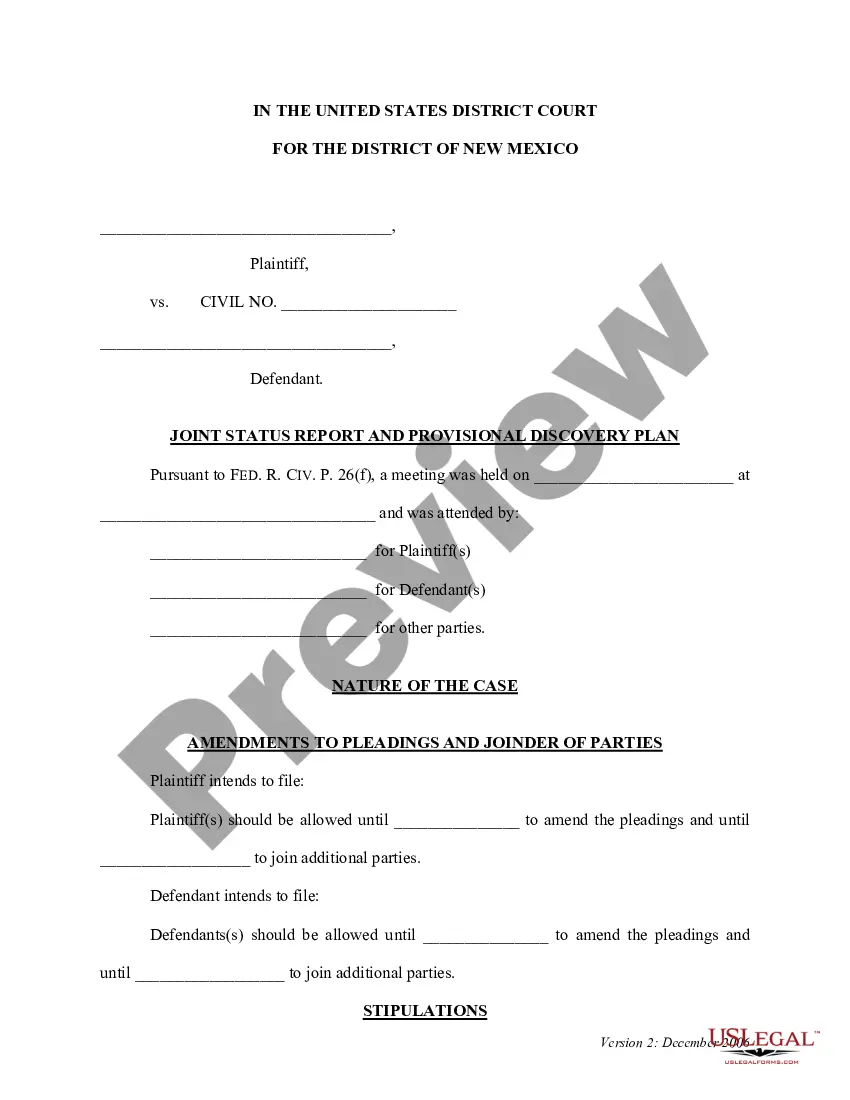

- Be sure you have chosen the correct type for your personal area/area. Click the Preview switch to analyze the form`s content material. Read the type outline to ensure that you have chosen the correct type.

- In case the type does not fit your needs, use the Search industry near the top of the monitor to discover the the one that does.

- In case you are satisfied with the shape, affirm your decision by visiting the Get now switch. Then, select the pricing program you favor and offer your references to register to have an bank account.

- Procedure the transaction. Make use of your charge card or PayPal bank account to finish the transaction.

- Find the formatting and acquire the shape on the gadget.

- Make changes. Fill up, revise and print and indicator the delivered electronically Illinois Assignment of Certificate of Deposit Agreement.

Every web template you included in your bank account does not have an expiration particular date which is yours forever. So, if you want to acquire or print another copy, just proceed to the My Forms segment and click around the type you will need.

Gain access to the Illinois Assignment of Certificate of Deposit Agreement with US Legal Forms, by far the most comprehensive local library of legitimate document web templates. Use 1000s of specialist and state-specific web templates that fulfill your company or individual demands and needs.