The Illinois Partial Assignment of Life Insurance Policy as Collateral is a legal agreement that allows policyholders to use a portion of their life insurance policy as collateral for a loan. This means that the policyholder can obtain a loan by pledging a fixed amount of the death benefit payable under their life insurance policy to the lender. In the context of Illinois, this type of arrangement is governed by specific laws and regulations. The partial assignment of a life insurance policy as collateral is a popular option for individuals who need immediate access to funds but want to retain a portion of their policy's death benefit. There are different types of partial assignment of life insurance policies as collateral available in Illinois: 1. Fixed Amount Assignment: Under this type of partial assignment, the policyholder designates a specific dollar amount from the death benefit as collateral for the loan. The lender will be limited to accessing the assigned amount in case of default on the loan. 2. Percentage Assignment: In this type of partial assignment, the policyholder assigns a percentage of the death benefit as collateral. For example, 50% of the death benefit can be designated as collateral, leaving the remaining 50% untouched. 3. Loan-based Assignment: With this type of partial assignment, the assigned amount depends on the loan amount taken by the policyholder. The policyholder can assign an amount equal to or less than the loan value, ensuring the lender's repayment. The Illinois Partial Assignment of Life Insurance Policy as Collateral grants temporary control over a specified portion of the policy's death benefit to the lender. It is important to note that the policyholder remains the owner of the policy and retains control over the unassigned portion of the death benefit. The assignment only comes into effect if the loan defaults. This arrangement provides flexibility to policyholders, allowing them to secure loans using their life insurance policies without surrendering the entire death benefit. It is vital for individuals considering this option to thoroughly understand the terms and conditions of the partial assignment and consult with legal professionals to ensure compliance with Illinois laws and safeguard their interests. In summary, the Illinois Partial Assignment of Life Insurance Policy as Collateral enables policyholders to use a specific percentage or fixed amount of their policy's death benefit as loan collateral. This arrangement offers a convenient solution for those seeking immediate funds while still preserving a portion of their life insurance coverage.

Illinois Partial Assignment of Life Insurance Policy as Collateral

Description

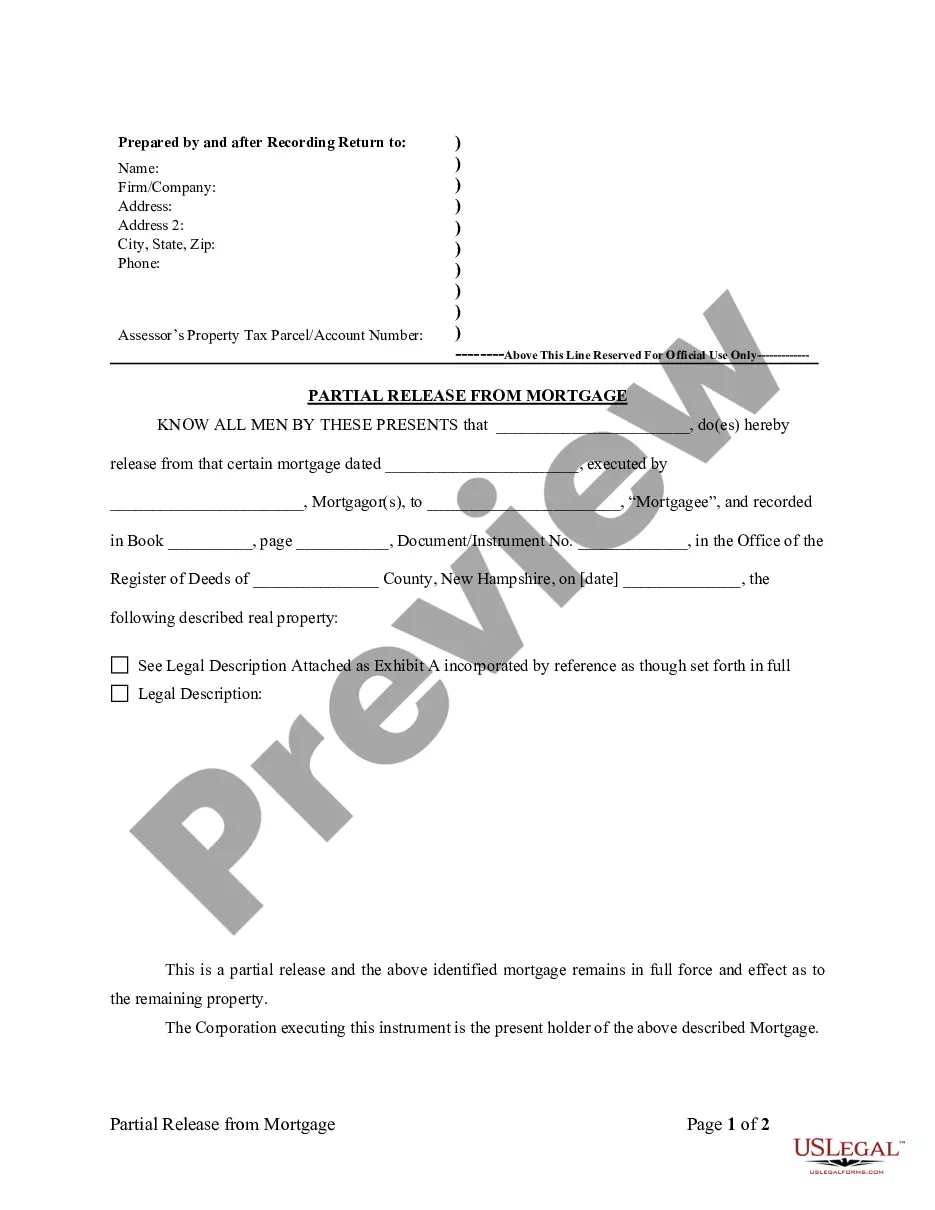

How to fill out Illinois Partial Assignment Of Life Insurance Policy As Collateral?

If you wish to total, acquire, or printing legal papers templates, use US Legal Forms, the most important assortment of legal forms, which can be found on the web. Use the site`s simple and convenient research to discover the papers you need. Various templates for organization and person purposes are categorized by types and claims, or keywords. Use US Legal Forms to discover the Illinois Partial Assignment of Life Insurance Policy as Collateral with a handful of mouse clicks.

When you are previously a US Legal Forms buyer, log in for your accounts and then click the Download button to have the Illinois Partial Assignment of Life Insurance Policy as Collateral. You may also accessibility forms you previously downloaded from the My Forms tab of your accounts.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for your correct city/region.

- Step 2. Take advantage of the Review method to check out the form`s articles. Never forget about to read through the outline.

- Step 3. When you are not happy together with the kind, utilize the Lookup field near the top of the screen to get other models from the legal kind format.

- Step 4. Once you have discovered the shape you need, go through the Get now button. Pick the costs strategy you like and include your accreditations to register to have an accounts.

- Step 5. Method the transaction. You may use your charge card or PayPal accounts to finish the transaction.

- Step 6. Find the formatting from the legal kind and acquire it in your product.

- Step 7. Comprehensive, revise and printing or signal the Illinois Partial Assignment of Life Insurance Policy as Collateral.

Every legal papers format you get is your own property eternally. You possess acces to each and every kind you downloaded in your acccount. Click on the My Forms portion and pick a kind to printing or acquire yet again.

Be competitive and acquire, and printing the Illinois Partial Assignment of Life Insurance Policy as Collateral with US Legal Forms. There are many skilled and condition-distinct forms you may use for your organization or person requirements.

Form popularity

FAQ

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

You can request a loan from your life insurance company for any reason, and there isn't an approval process. The only requirement is that you have sufficient cash value to borrow against (minimum amounts vary by insurer).

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

People often assign their life insurance policies to banks. A bank becomes the policy owner in this case, while the original policyholder continues to be the life assured whose death may be claimed by either the bank or the policy owner.

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.