Illinois Affidavit of Amount Due on Open Account is a legal document used in the state of Illinois to provide a detailed account of the outstanding amount owed on an open account between a creditor and debtor. This affidavit plays a crucial role in the debt collection process, allowing creditors to pursue legal action to recover the amount owed. Keywords: Illinois, Affidavit of Amount Due, Open Account, creditor, debtor, legal document, outstanding amount, debt collection, legal action. The Illinois Affidavit of Amount Due on Open Account serves as a sworn statement by the creditor, attesting to the accuracy and authenticity of the outstanding debt. It provides essential information such as the name and contact details of both the creditor and debtor, their respective addresses, the account number, and a breakdown of the amount owed. This affidavit is especially important in cases where a debtor fails to make payments or disputes the debt's validity. By filing this document with the appropriate court, the creditor can initiate legal proceedings to obtain a judgment against the debtor, ultimately leading to potential wage garnishment, property liens, or bank account seizures. Different types of Illinois Affidavit of Amount Due on Open Account may exist depending on the specific circumstances. For instance, there could be variations specifically for commercial transactions, personal loans, or credit card debts. However, the fundamental purpose of all these affidavits remains the same — to present a comprehensive record of the unpaid debt in a legally acceptable format. In summary, the Illinois Affidavit of Amount Due on Open Account is an integral part of the debt collection process in the state. It serves as a vital legal document providing an accurate account of the outstanding debt owed by a debtor to a creditor. By initiating legal proceedings with this affidavit, creditors can take appropriate actions to recover the amount owed.

Illinois Affidavit of Amount Due on Open Account

Description

How to fill out Illinois Affidavit Of Amount Due On Open Account?

If you have to complete, acquire, or print out legal papers layouts, use US Legal Forms, the most important collection of legal types, which can be found on the Internet. Take advantage of the site`s basic and practical look for to get the documents you require. Numerous layouts for business and specific uses are sorted by groups and says, or search phrases. Use US Legal Forms to get the Illinois Affidavit of Amount Due on Open Account within a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the account and click the Down load button to obtain the Illinois Affidavit of Amount Due on Open Account. You may also access types you previously acquired from the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for the correct area/nation.

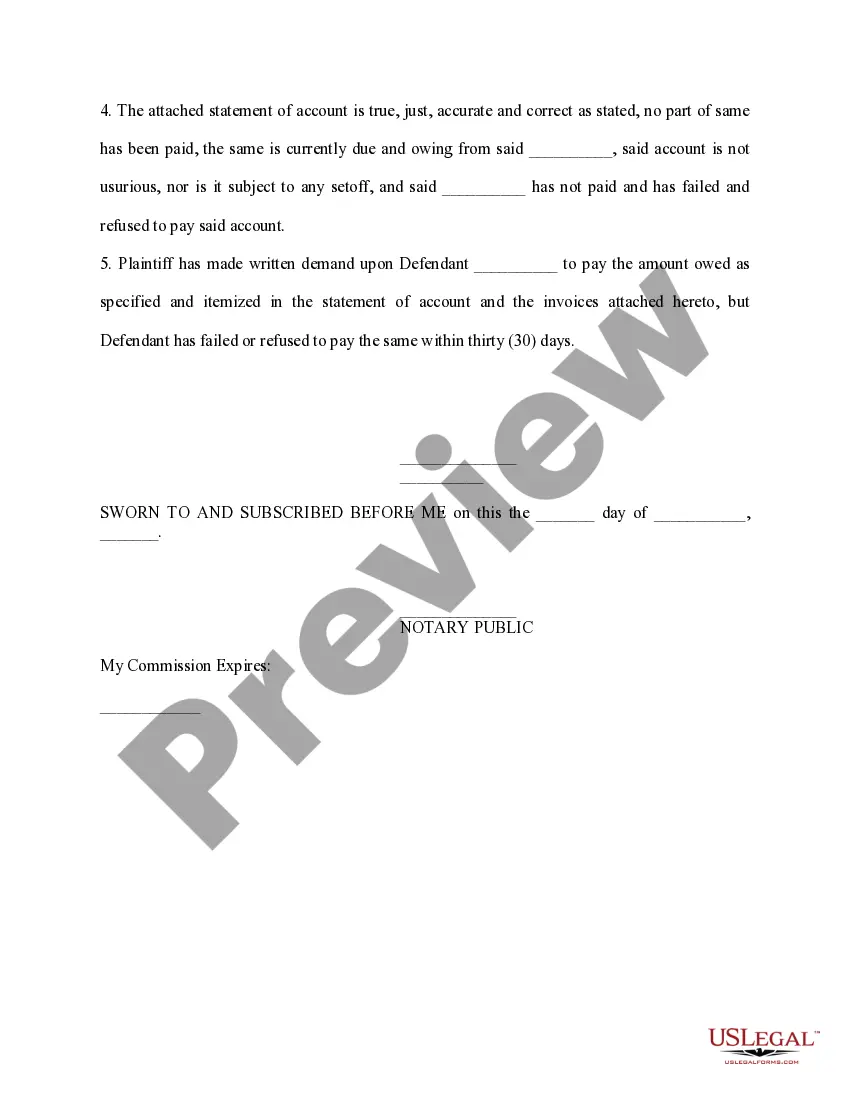

- Step 2. Take advantage of the Review option to examine the form`s articles. Never forget about to read the information.

- Step 3. Should you be unsatisfied with the kind, use the Research discipline on top of the screen to locate other types of the legal kind web template.

- Step 4. Once you have found the form you require, select the Acquire now button. Select the rates program you prefer and add your credentials to sign up to have an account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Find the structure of the legal kind and acquire it on the product.

- Step 7. Comprehensive, change and print out or indication the Illinois Affidavit of Amount Due on Open Account.

Every legal papers web template you purchase is your own eternally. You may have acces to each and every kind you acquired inside your acccount. Click on the My Forms portion and select a kind to print out or acquire yet again.

Compete and acquire, and print out the Illinois Affidavit of Amount Due on Open Account with US Legal Forms. There are thousands of specialist and condition-distinct types you can use for your personal business or specific demands.