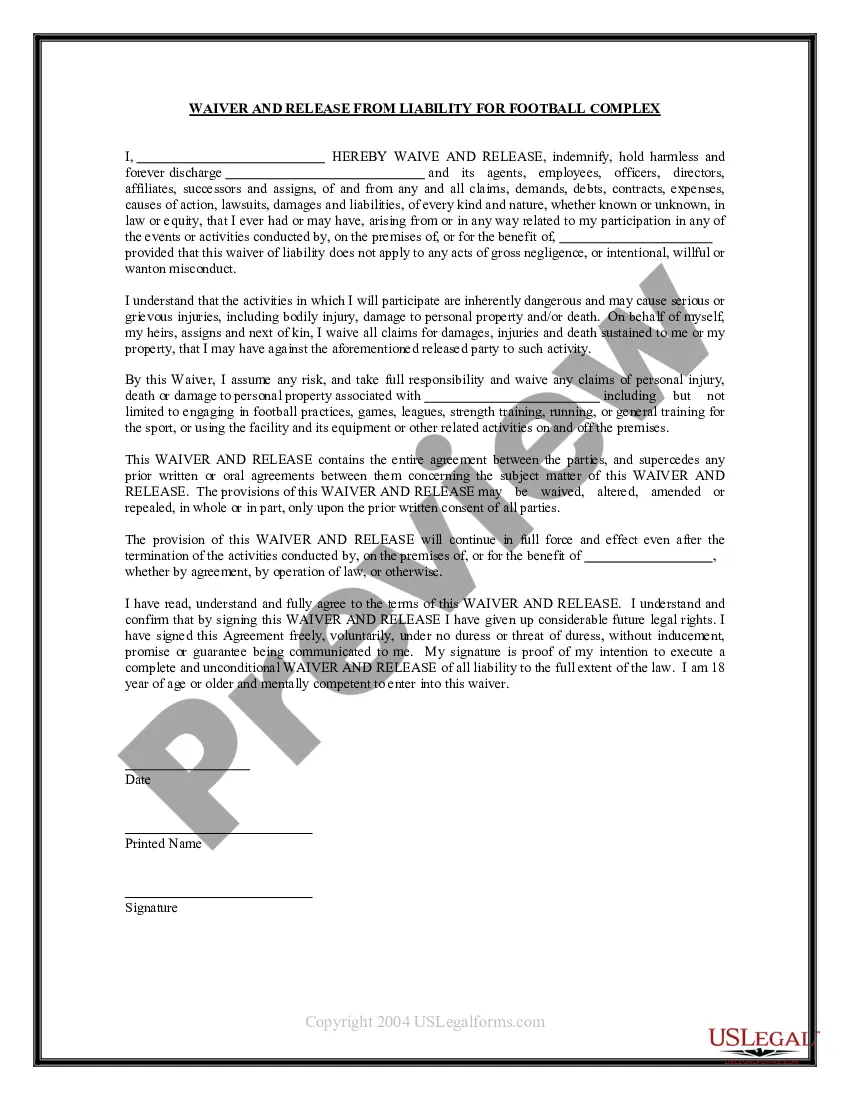

In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

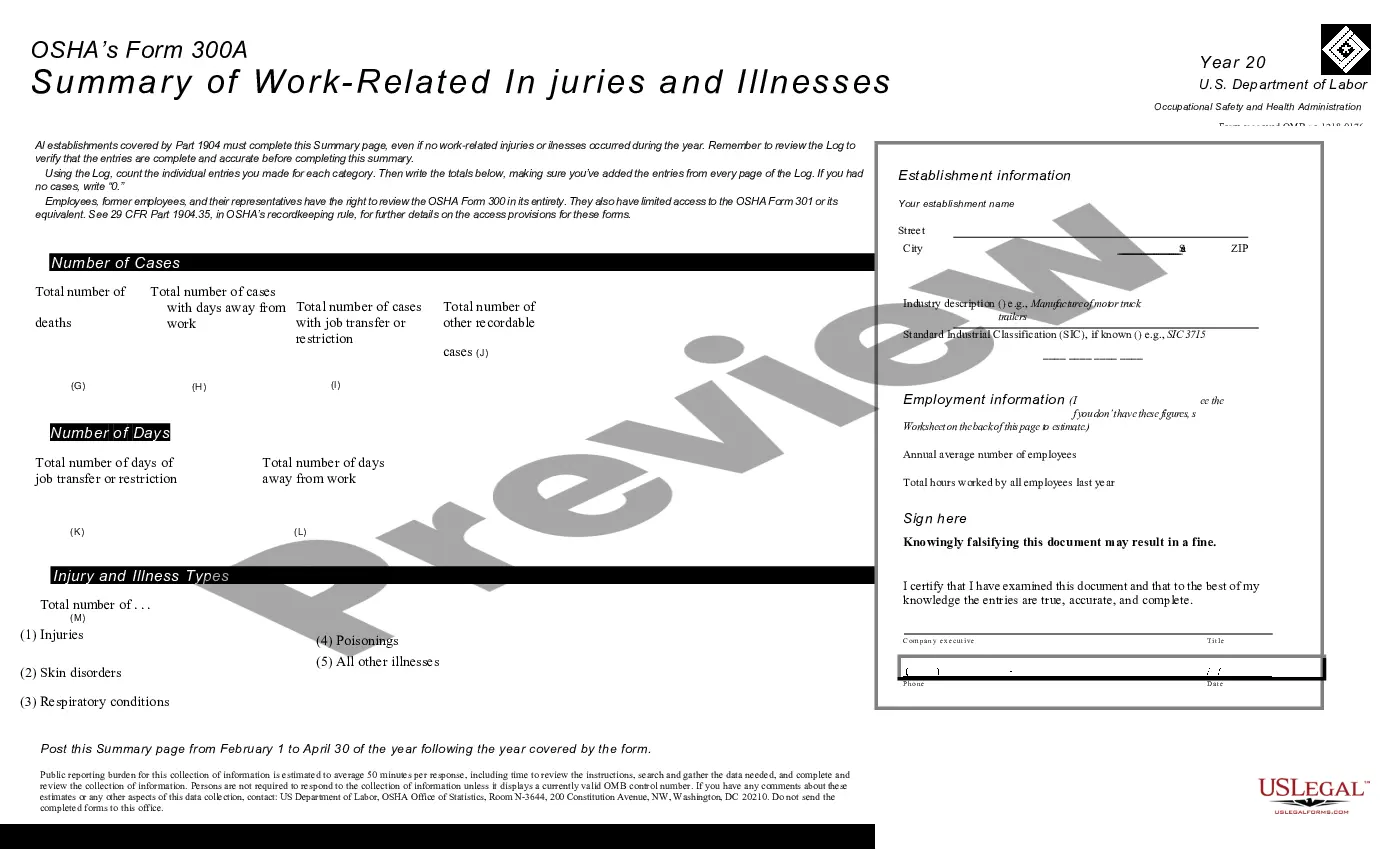

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can find numerous forms for business and personal purposes, categorized by types, states, or keywords. You can discover the most recent forms such as the Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary in mere moments.

If you already have a subscription, Log In to obtain the Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Make alterations. Fill out, edit, print, and sign the downloaded Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

Each template you add to your account has no expiration and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are straightforward steps to help you get started.

- Make sure you have selected the correct form for your region/area. Click on the Preview button to check the form’s details. Review the form summary to confirm you have chosen the right form.

- If the form does not meet your needs, utilize the Search area at the top of the display to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you wish to use and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

A trustee can terminate a trust by following the guidelines established in the trust document, which may include notifying all beneficiaries and distributing the trust assets. After fulfilling any obligations and preparing the necessary legal documentation, the trustee may also complete the Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary forms. This ensures that all aspects of the trust termination are legally recognized and that beneficiaries acknowledge receipt of their funds, providing clear closure for all parties involved.

To remove a beneficiary from a trust in Illinois, the trustee generally needs to execute a formal document, often called a trust amendment, that clearly outlines the decision. This process may require the trustee to follow the terms set forth in the trust document itself, ensuring compliance with Illinois law. It’s crucial to maintain proper records of this action, particularly the Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary forms, which can signal the completion of these processes.

Firing a trustee involves a formal process that generally requires the consent of the beneficiaries or a court’s approval in Illinois. It is crucial to follow the instructions set forth in the trust document, ensuring the transition is handled legally and smoothly. After removing a trustee, beneficiaries must ensure proper documentation, especially regarding any Acknowledgment of Receipt of Trust Funds, to safeguard their interests moving forward.

An example of a termination of a trust might involve a settlor who decides to revoke a revocable trust after realizing their financial situation has changed. Additionally, if the trust's purpose has been fulfilled or becomes obsolete, it may also lead to its termination. In these cases, proper documentation and Acknowledgment of Receipt of Trust Funds By Beneficiary are essential to confirm the trust's closure.

In Illinois, beneficiaries typically have the right to request a copy of the trust document, especially if the trust is being administered. Understanding this right is crucial for beneficiaries, as it allows them to stay informed about their entitlements under the trust. When a trust is terminated, beneficiaries should receive the Acknowledgment of Receipt of Trust Funds to confirm their understanding of distributions.

Shutting down a trust involves legally terminating its existence in accordance with Illinois law. This process may vary based on the trust's terms and can require the trustee to provide detailed records to beneficiaries, particularly when it comes to the Acknowledgment of Receipt of Trust Funds By Beneficiary. Engaging with proper legal guidance helps streamline this process and ensures compliance with relevant regulations.

To terminate a trust in Illinois, the trustee or settlor must follow the specific procedures outlined in the Illinois Trust Code. This can involve filing a petition with the court if the trust language does not allow for termination by other means. Additionally, all beneficiaries must typically agree to the termination and provide an acknowledgment of receipt of trust funds to ensure a smooth and legal dissolution of the trust.

Trusts can be terminated in several ways, typically through revocation by the settlor, through a court order, or upon the occurrence of a specific event outlined in the trust document. Understanding these methods is vital, especially in the context of Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. This knowledge empowers beneficiaries and trustees alike in managing trust assets effectively.

A trust may be considered void if it lacks a clear purpose, if it was created without legal capacity, or if it violates public policy. In Illinois, laws regarding the formation and maintenance of trusts play an essential role in determining their validity. To avoid creating a void trust, it is crucial to ensure compliance with the legal requirements established by Illinois law.

To bring a trust to an end, the trustee must follow the guidelines set out in the trust document and comply with Illinois law. This process often involves gathering input from beneficiaries, safeguarding assets, and ensuring that all outstanding obligations are satisfied. Understanding the Illinois Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary can help facilitate this process effectively. Utilizing services like US Legal Forms can provide you with the necessary tools and templates to manage this process smoothly.