This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Are you in a scenario where you frequently need documents for either business or personal purposes.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of document templates, such as the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which are designed to comply with state and federal requirements.

Once you find the appropriate document, click on Purchase now.

Select the pricing plan you want, complete the necessary information to process your payment, and finalize the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your correct area/state.

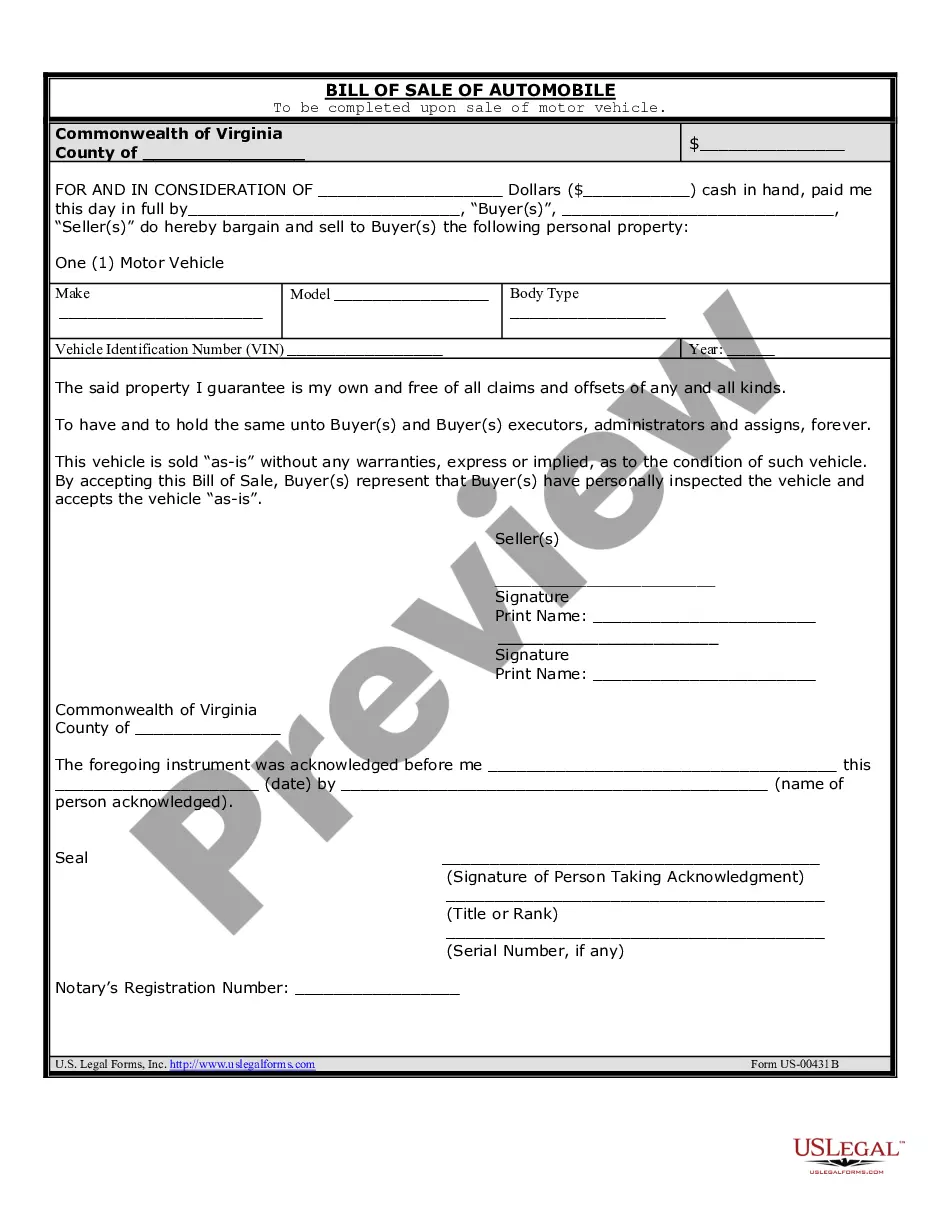

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct template.

- If the document isn't what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

Trustees have a fiduciary duty to act in the best interest of beneficiaries, which includes considering their input. While trustees must take beneficiaries' concerns seriously, they retain discretion in how they manage the trust. If you believe important issues are being overlooked, sending an Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust might help underscore your importance and rights within the trust structure.

In Illinois, beneficiaries typically have the right to receive a copy of the trust document. This right ensures that beneficiaries stay informed regarding their interests and the terms of the trust. Additionally, if a beneficiary wishes to assign their interest, they may need to issue an Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust to formally notify the trustee.

The new Illinois trust law introduced significant updates that impact how trusts operate within the state. These changes aim to clarify the roles and responsibilities of both trustees and beneficiaries. It's essential to understand how the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust fits into this law, as it can influence trust assignments and beneficiary notifications.

To write a letter to a trustee regarding an Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust, start by addressing the trustee by name. Clearly state your intention at the beginning of the letter, and include relevant details about the trust and your relationship to it. Use a formal tone, and provide any necessary documentation that supports your request, ensuring clarity throughout your message.

To appoint a trustee, you need to include their name and relevant details in your written trust document. It is essential to ensure that the person is willing to accept the role and understands what it entails. For additional help, US Legal Forms offers resources that explain the process in relation to the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

The procedure for appointing trustees usually starts with drafting a trust document that clearly states your choice of trustee. This document should outline the powers and responsibilities of the trustee in relation to the trust. Familiarizing yourself with the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust can ensure you meet all necessary legal requirements when appointing trustees.

The best person to appoint as a trustee is someone who is trustworthy, responsible, and knowledgeable about financial matters. It is often advisable to choose someone with experience in managing assets and a sound understanding of fiduciary duties. Remember, the right trustee will facilitate the smooth operation of the trust and uphold the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Assigning a trustee involves formally designating an individual or organization to manage the trust. You typically need to follow specific steps outlined in your trust document to ensure legality and compliance. It's beneficial to refer to the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust for guidance on this process.

Yes, a beneficiary can sue a trustee in Illinois if they believe the trustee has violated their fiduciary duties. This could relate to mismanagement of trust assets or failure to communicate essential information about the trust. Knowing your rights as a beneficiary can help you take necessary actions, and the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust may be relevant in these discussions.

To nominate a trustee, you typically include this decision in your trust document, specifying the individual or institution you'd like to manage the trust. It is important to communicate openly with the nominee to ensure they are willing and able to serve. If you need guidance, consider resources available through US Legal Forms, which can provide templates and legal insights regarding the Illinois Notice to Trustee of Assignment by Beneficiary of Interest in Trust.