A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary

Description

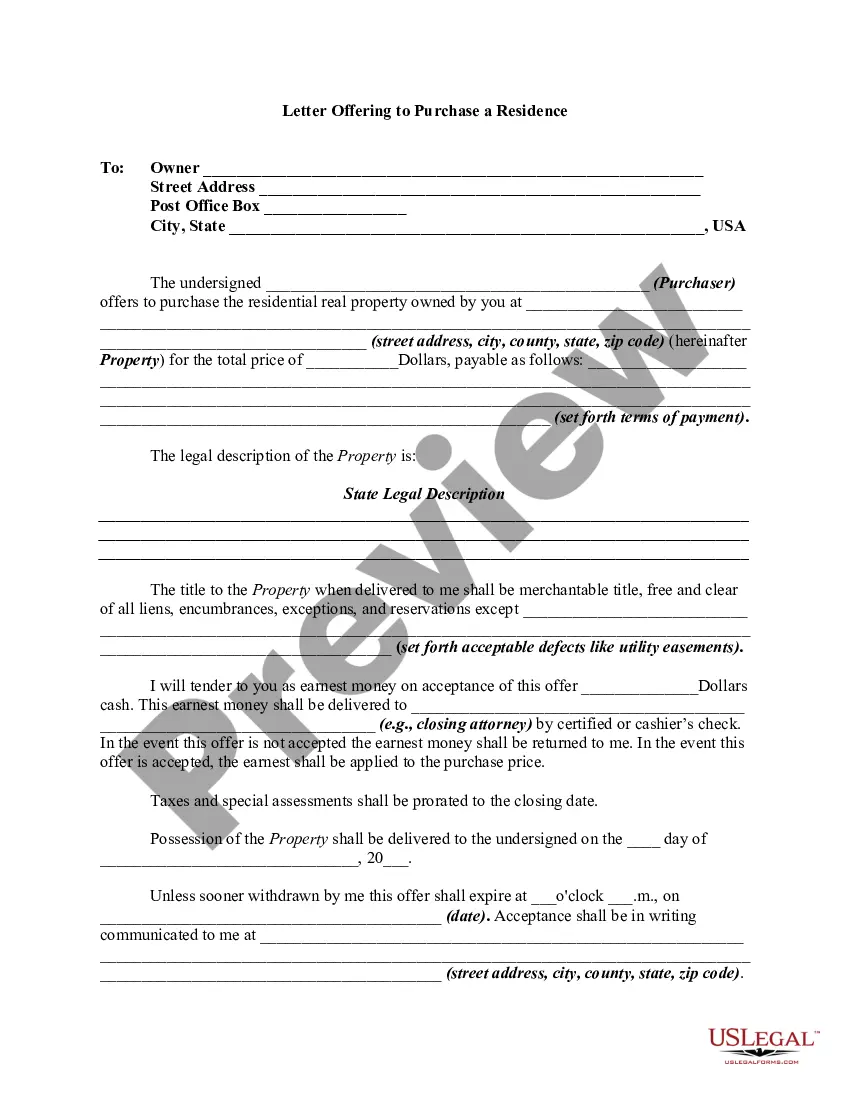

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

Locating the appropriate legal document web template can be a challenge. It goes without saying that there are numerous formats accessible online, but how do you identify the legal type you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Illinois Agreement between Trustor and Trustee Ending Trust after Disclaimer by Beneficiary, which you can utilize for both commercial and personal needs.

Every form is verified by specialists and meets federal and state regulations.

Once you are confident that the form is suitable, click the Purchase now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Illinois Agreement between Trustor and Trustee Ending Trust after Disclaimer by Beneficiary. US Legal Forms is the premier collection of legal documents where you can find diverse document formats. Utilize the service to download professionally crafted paperwork that complies with state regulations.

- If you are already registered, sign in to your account and click the Acquire button to download the Illinois Agreement between Trustor and Trustee Ending Trust after Disclaimer by Beneficiary.

- Use your account to browse the legal forms you have obtained previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure that you have selected the correct type for your region/area. You can review the form using the Review button and examine the form details to ensure it is the correct one for you.

- If the form does not meet your needs, utilize the Search field to find the correct form.

Form popularity

FAQ

In Illinois, a trustee must notify beneficiaries within a reasonable time after their appointment or significant changes related to the trust. This includes notifying beneficiaries about the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Timely notifications are essential to safeguard the interests of all parties involved and ensure compliance with state laws.

In Illinois, beneficiaries are entitled to receive a copy of the trust document. This right allows beneficiaries to fully understand the terms and conditions outlined in the trust, including details regarding the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Having access to this information can be crucial for beneficiaries in asserting their rights and making informed decisions.

Yes, a trustee is generally required to communicate with beneficiaries regarding the trust. This includes providing information about the trust assets, administration, and any changes that may occur, such as in an Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Clear communication helps maintain trust and transparency and ensures that beneficiaries understand their rights and interests.

Section 813.1 of the Illinois Trust Code addresses the procedures involved when a beneficiary disclaims their interest in a trust. This section outlines how the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary becomes applicable. It emphasizes the legal implications of such disclaimers and ensures that the intentions of the Trustor are adhered to. Understanding these provisions can help ensure compliance and prevent misunderstandings in trust administration.

The risks of a trust fund include potential mismanagement and the possibility of disputes among beneficiaries. If the terms of the trust are unclear, it can lead to confusion. Familiarity with the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can provide clarity and reduce misunderstandings.

A common mistake is failing to communicate their intentions clearly with heirs. Parents may neglect to update the trust after major life changes, such as births or deaths. Understanding the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can help avoid these pitfalls.

One downside of placing assets in a trust is the potential loss of control over those assets during the Trustor's lifetime. Additionally, setting up a trust can involve legal fees and ongoing administrative costs. Understanding the implications of an Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can help mitigate these concerns.

Yes, a trust can terminate if all beneficiaries agree. This agreement must typically be documented properly to avoid future disputes. The Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can serve as a legal foundation for this termination.

Placing assets in a trust can provide significant benefits, such as avoiding probate and managing distribution. It can simplify the process for heirs and protect assets from creditors. However, it is essential that your parents review the Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary to understand the implications fully.

To terminate a trust in Illinois, you typically need the agreement of all beneficiaries or an explicit provision in the trust document. An Illinois Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary sets the framework for this process. It's advisable to consult a legal professional to ensure compliance with state laws.