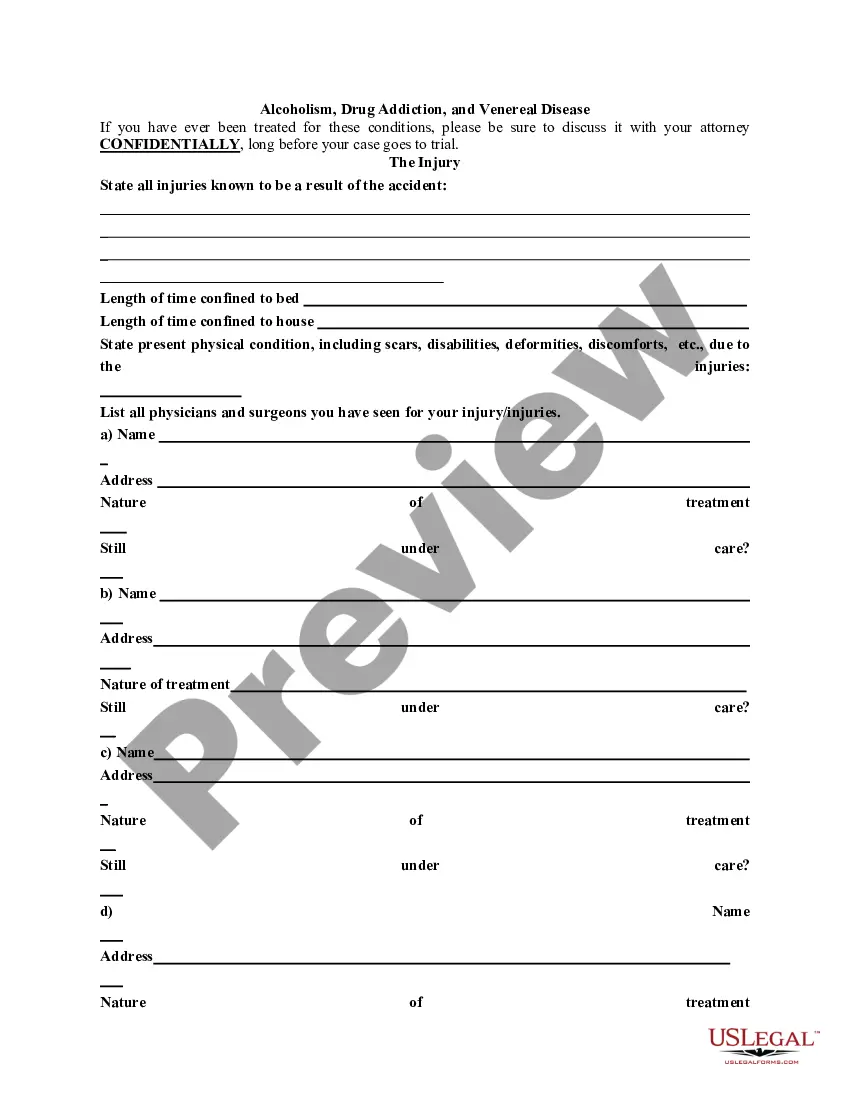

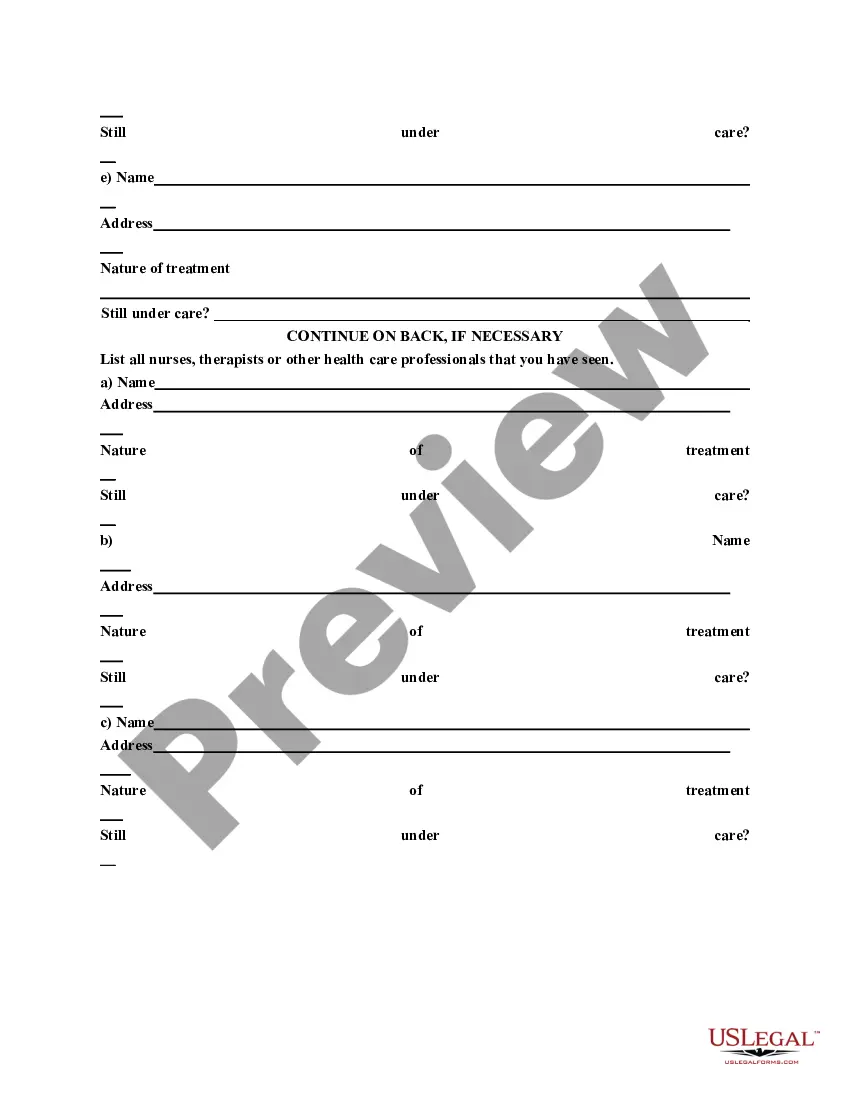

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Illinois General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you need to compile, obtain, or print authentic document templates, utilize US Legal Forms, the broadest selection of authentic forms available online. Take advantage of the site's user-friendly and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and regions, or keywords. Use US Legal Forms to locate the Illinois General Information Questionnaire in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Illinois General Information Questionnaire. You can also access forms you previously acquired in the My documents section of your account.

If this is your first time using US Legal Forms, follow the steps outlined below: Step 1. Ensure you have selected the form for the appropriate region/state. Step 2. Use the Review option to examine the form's content. Always remember to read the description. Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the authentic form template. Step 4. Once you have found the form you require, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment. Step 6. Choose the format of the authentic form and download it to your device. Step 7. Fill out, modify and print or sign the Illinois General Information Questionnaire.

- Every authentic document template you purchase is yours permanently.

- You have access to every form you downloaded in your account.

- Click the My documents section and select a form to print or download again.

- Complete and download, and print the Illinois General Information Questionnaire with US Legal Forms.

- There are countless professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date. The late-payment penalty for underpayment of estimated tax is based on the tax shown due on your original return.

What is the purpose of Schedule M? Schedule M, Other Additions and Subtractions for Individuals, allows you to figure the total amount of additions you must include on Form IL-1040, Individual Income Tax Return, Line 3 and subtractions you may claim on Form IL-1040, Line 7.

Electronically - Go to our website at MyTax.illinois.gov, scroll down to the section titled "Identity Verification", select the Identity Verification Documents link, enter your Letter ID, and follow the instructions. Note: Submitting your information electronically will result in a quicker and more secure process.

The original 2023 Illinois Withholding Tax Tables from the state estimated the personal exemption allowance at $2,625 for 2023. Note: The Illinois individual income tax rate has not changed. The rate remains 4.95 percent.

Schedule M (Form 990) is used by an organization that files Form 990 to report the types of noncash contributions received during the year by the organization and certain information regarding such contributions.

2022 Individual Income Tax Forms FormDescriptionIL-1040-VPayment Voucher for Individual Income TaxIL-1040-X-VPayment Voucher for Amended Individual Income TaxIL-505-IAutomatic Extension Payment for Individuals Filing Form IL-1040IL-1310Statement of Person Claiming Refund Due a Deceased Taxpayer19 more rows

What is the purpose of Schedule CR? Schedule CR, Credit for Tax Paid to Other States, allows you to take a credit for income taxes you paid to other states on income you received while a resident of Illinois.

Your Illinois income includes the adjusted gross income (AGI) amount figured on your federal return, plus any additional income that must be added to your AGI. Some of your income may be subtracted when figuring your Illinois base income.