One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Illinois Irrevocable Trust Funded by Life Insurance

Description

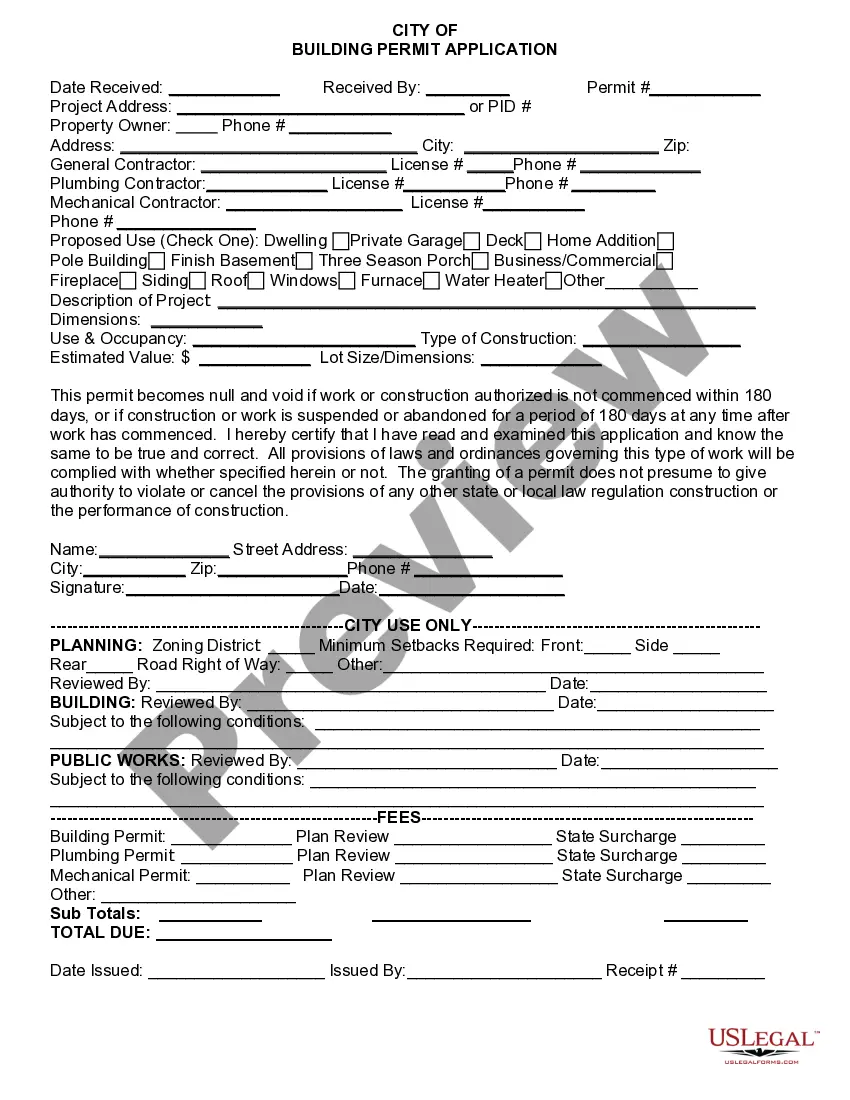

How to fill out Irrevocable Trust Funded By Life Insurance?

You may dedicate numerous hours online trying to locate the appropriate legal document template that complies with both state and federal requirements you require.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can download or print the Illinois Irrevocable Trust Funded by Life Insurance from their service.

If available, use the Review button to check the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Illinois Irrevocable Trust Funded by Life Insurance.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you selected the accurate form.

Form popularity

FAQ

An Illinois Irrevocable Trust Funded by Life Insurance can limit your control over the assets once the trust is established. You cannot easily modify or dissolve the trust without going through legal processes, which can be time-consuming and costly. Additionally, the assets held in the trust may not be accessible for your personal needs, as they are specifically designated for the beneficiaries. Understanding these limitations is crucial for anyone considering this type of trust.

The IRS treats irrevocable trusts as separate tax entities. This means that trusts must report their income and can be taxed independently from the grantor. It's important to understand the rules governing your Illinois Irrevocable Trust Funded by Life Insurance and seek guidance from tax professionals to navigate these regulations effectively.

The necessity for filing a tax return for an irrevocable trust depends on the income it generates. If the trust has taxable income, it must file Form 1041 with the IRS. Engaging with a seasoned tax expert can simplify this process while ensuring your Illinois Irrevocable Trust Funded by Life Insurance remains compliant.

If your irrevocable life insurance trust earns taxable income, you must file a tax return for it. Although an Illinois Irrevocable Trust Funded by Life Insurance primarily serves to manage benefits, the investment income or interest may trigger filing obligations. Regular consultations with a tax advisor can help manage this aspect properly.

Yes, an irrevocable life insurance trust may need to file a tax return if it generates income. While the Illinois Irrevocable Trust Funded by Life Insurance itself is typically not subject to estate tax, any income earned by the trust must be reported. Consulting a tax professional can help ensure compliance with filing requirements.

Generally, life insurance proceeds are not taxable to an irrevocable trust. When you establish an Illinois Irrevocable Trust Funded by Life Insurance, the trust receives the death benefit, and it is excluded from the insured's taxable estate. This arrangement often helps preserve the full value of the policy for beneficiaries while minimizing tax implications.

Yes, you can place life insurance in an irrevocable trust. When you transfer ownership of your policy to the trust, you remove it from your estate, which can offer significant tax advantages. This approach is particularly beneficial when considering an Illinois Irrevocable Trust Funded by Life Insurance, as it ensures that the trust can manage the proceeds efficiently for your beneficiaries. Just remember to follow the necessary legal steps to complete the transfer.

To leave life insurance to a trust, you first designate the trust as the beneficiary on your policy. This process involves completing the appropriate forms provided by your insurance company. By doing this, you ensure that the death benefit goes directly to your trust, allowing for better management of the funds. Overall, this method aligns well with an Illinois Irrevocable Trust Funded by Life Insurance, providing the intended beneficiaries with optimal protection.

Putting life insurance in an irrevocable trust offers numerous benefits, including tax savings and control over benefit distribution. This approach ensures that the death benefits are used according to your wishes, protecting your assets. Ultimately, an Illinois Irrevocable Trust Funded by Life Insurance serves as a strategic tool for securing your family's financial future.

Placing life insurance in a trust is often a smart decision for many. It allows for better management of the policy's proceeds, providing financial protection for your loved ones. An Illinois Irrevocable Trust Funded by Life Insurance can also help in minimizing estate taxes and ensuring that benefits reach your chosen beneficiaries without delays.