No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Illinois Collection Agency's Return of Claim as Uncollectible

Description

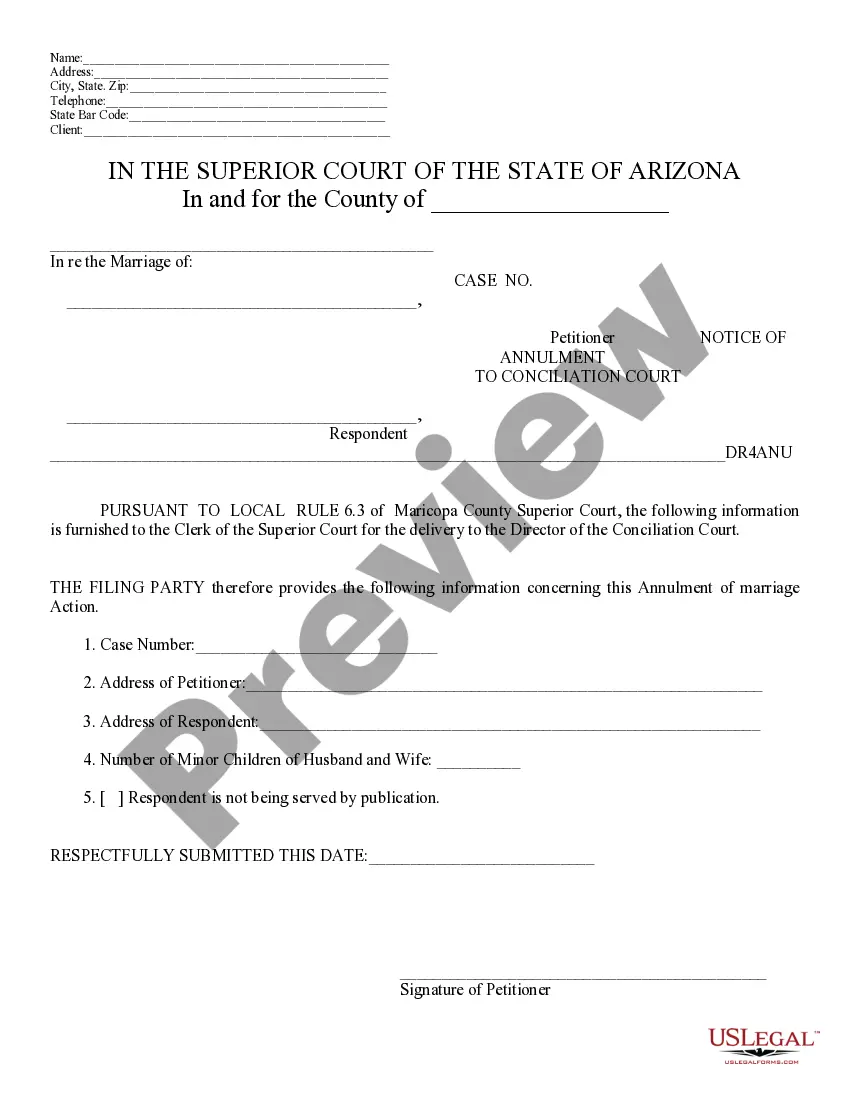

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Are you presently in a situation where you frequently require documents for potential business or specific objectives.

There is an array of official document templates accessible on the internet, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of document templates, like the Illinois Collection Agency's Return of Claim as Uncollectible, designed to meet federal and state requirements.

When you find the correct document, click Purchase now.

Choose your desired pricing plan, fill out the required information to create your account, and make a purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Collection Agency's Return of Claim as Uncollectible template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and make sure it is for the correct area/county.

- Utilize the Review option to examine the document.

- Check the summary to ensure you have selected the right document.

- If the document is not what you are looking for, use the Lookup field to identify a template that meets your needs.

Form popularity

FAQ

Illinois Department of Revenue collections kick off when the agency believes you haven't paid your full tax bill. This can include income tax, sales and use tax, and more. Businesses are often the target of IDOR's collection activity, but individuals can face the wrath of the agency, as well.

The IRS works with private collection agencies that work with taxpayers who have overdue tax bills. These agencies help taxpayers settle their tax debts.

On debts based on written contracts, the statute of limitation is 10 years. On unwritten contracts, it's 5 years.

Many debt collectors would like to charge interest on a charged-off debt, but courts in Illinois have recently ruled against collectors who do so. If you have purchased a charged-off debt, you risk violating the Fair Debt Collection Practices Act if you charge interest on the debt without authorization.

On debts based on written contracts, the statute of limitation is 10 years. On unwritten contracts, it's 5 years. Most credit card debit is considered to be based on unwritten contracts, as is most medical debt.

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

If you owe several debts, any payment you make must be applied to the debt you choose. A debt collector may not apply a payment to any debt you believe you do not owe. You have the right to sue a debt collector in a state or federal court within one year from the date you believe the law was violated.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

They can sue you, or threaten to sue you, in court. They can send you letters or call you. Within 5 days of the first time they contact you, debt collectors have to send you a written notice about the debt (see below). If you receive a Complaint and Summons , this means a lawsuit has been filed.

There are certain protected things that a creditor cannot take, such as:Necessary clothing.Income from:Take home pay up to $540 per week after all state and federal taxes have been taken out.$15,000 worth of equity in the home you live in (including a mobile home or condominium).A vehicle (car, truck, van, etc.)More items...