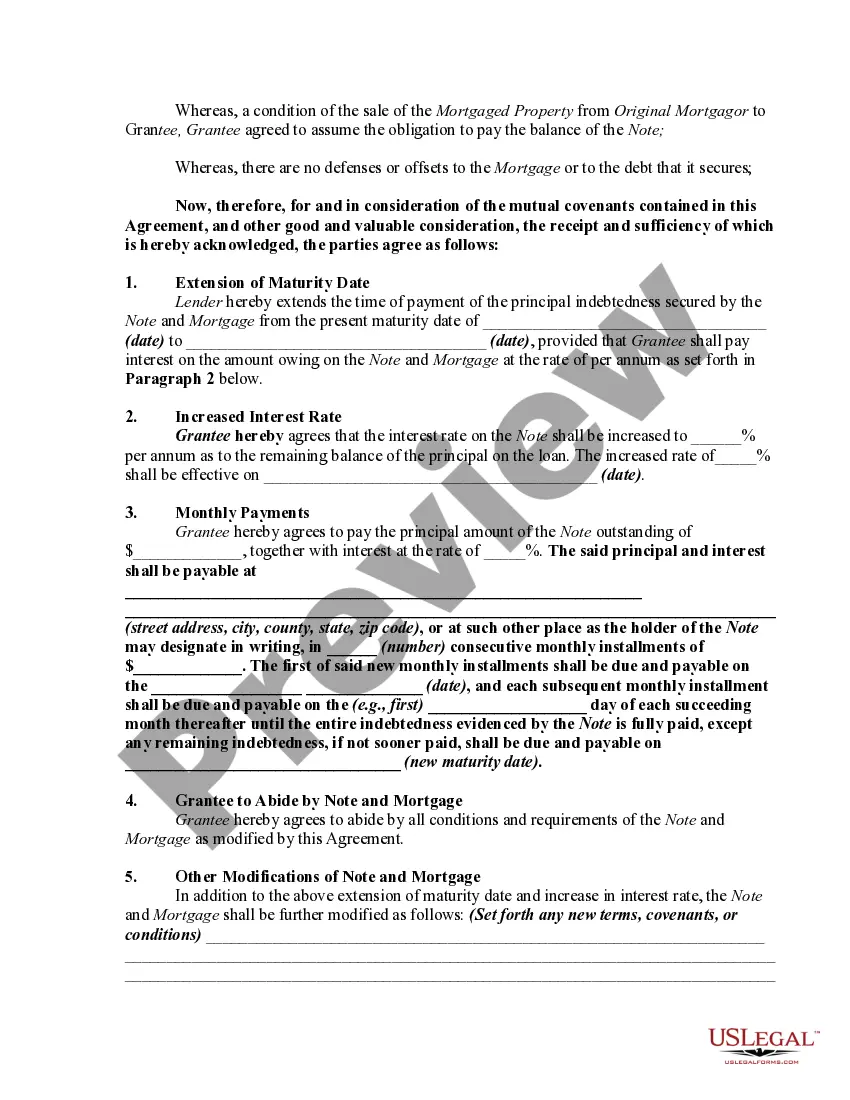

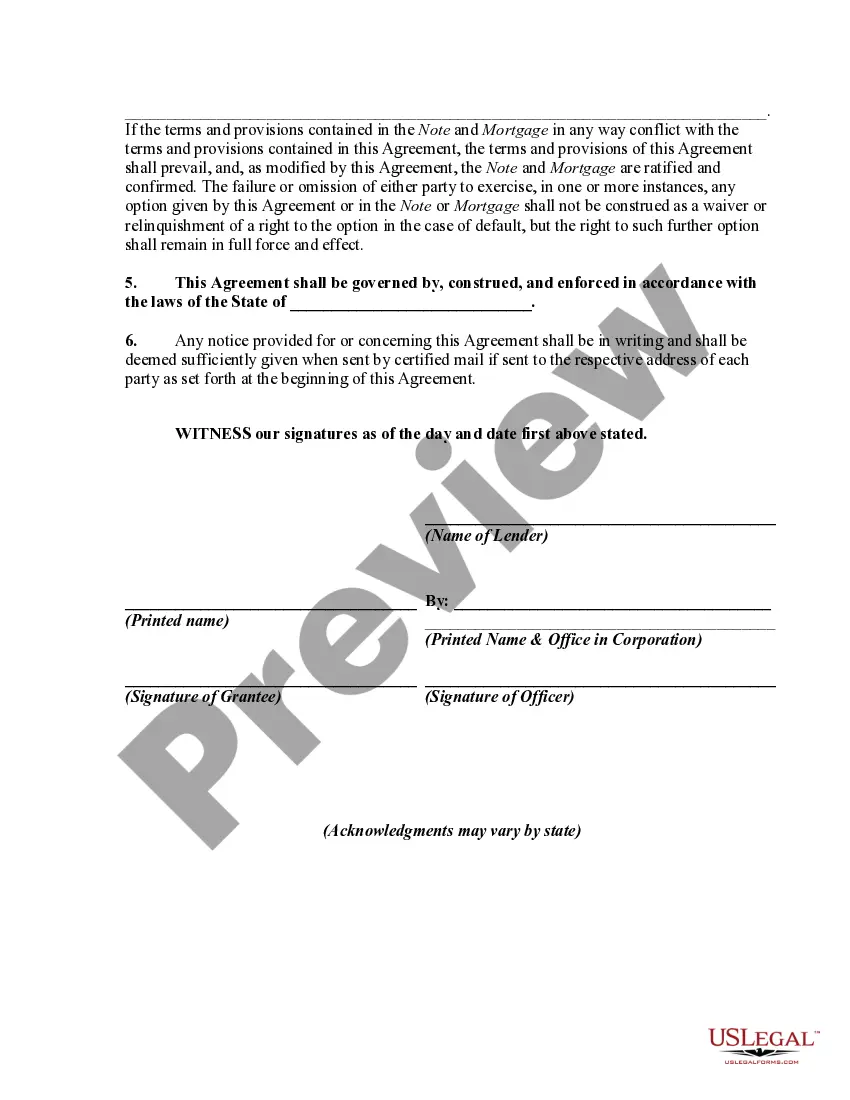

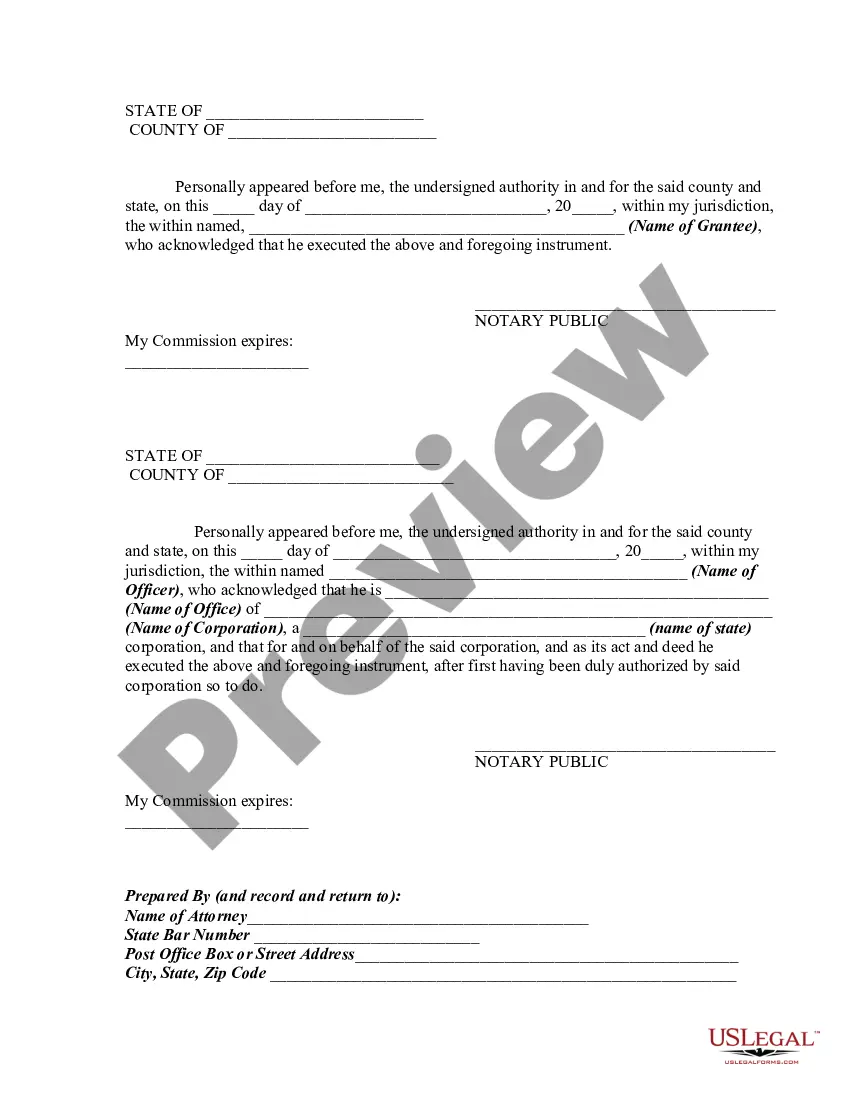

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

If you want to finish, obtain, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms accessible online. Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords. Utilize US Legal Forms to retrieve the Illinois Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest with just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and then click the Download button to access the Illinois Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest. You can also find forms you previously downloaded in the My documents section of your account.

Every legal document template you obtain is yours permanently. You have access to each form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Compete and download, and print the Illinois Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Confirm you have selected the form for your relevant area/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest.

Form popularity

FAQ

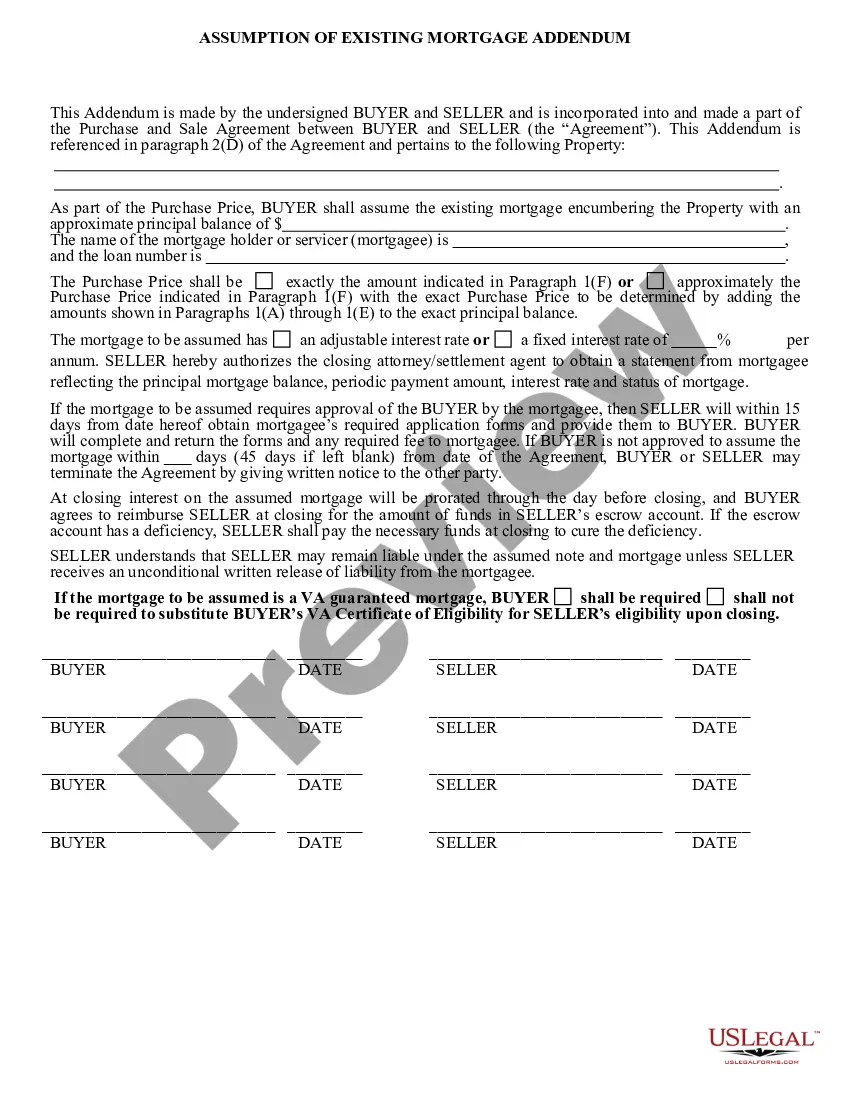

Buying a property "subject-to" means a buyer essentially takes over the seller's remaining mortgage balance without making it official with the lender. It's a popular strategy among real estate investors. When interest rates rise, it may also be an attractive financing option for general homebuyers.

A lender makes a final analysis of the borrower's creditworthiness and adds to that an evaluation of the property collateralizing the loan. If the lender is comfortable with the risks involved, a mortgage (loan) commitment is made.

An arrangement where the purchaser, or grantee, obtains title to real property and assumes the seller's liability for payment of an existing note secured by a mortgage that encumbers the real property at the time title is transferred.

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.

One way to significantly cut down on closing and recurring costs relative to buying a home is to buy a home subject to an existing loan. This basically means that you, as the buyer, unofficially take over the seller's existing mortgage payments.

Although the buyer makes the mortgage payments, the seller remains responsible for the loan. When the property is sold subject to the loan the buyer is not liable to pay the lender, the original borrower is still primarily liable to the lender.

A subject to mortgage will have the buyer take control of the property and make payments to the seller, who will then pay off the mortgage in their own name. A good subject to mortgage clause should be viewed by a real estate attorney before any decisions are made.

One risk is that the seller remains legally liable for the mortgage even after they've sold the property. If the buyer does not make the mortgage payments, the lender may still be able to come after the seller for payment.