Are you presently inside a place the place you need to have documents for possibly company or specific functions almost every day? There are a lot of authorized document themes accessible on the Internet, but finding types you can depend on isn`t straightforward. US Legal Forms gives a large number of kind themes, much like the Illinois Partial Release or Satisfaction of Mortgage by a Corporation, which are created in order to meet federal and state requirements.

When you are currently knowledgeable about US Legal Forms website and get your account, just log in. After that, you are able to download the Illinois Partial Release or Satisfaction of Mortgage by a Corporation design.

Unless you come with an bank account and need to start using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is to the proper city/county.

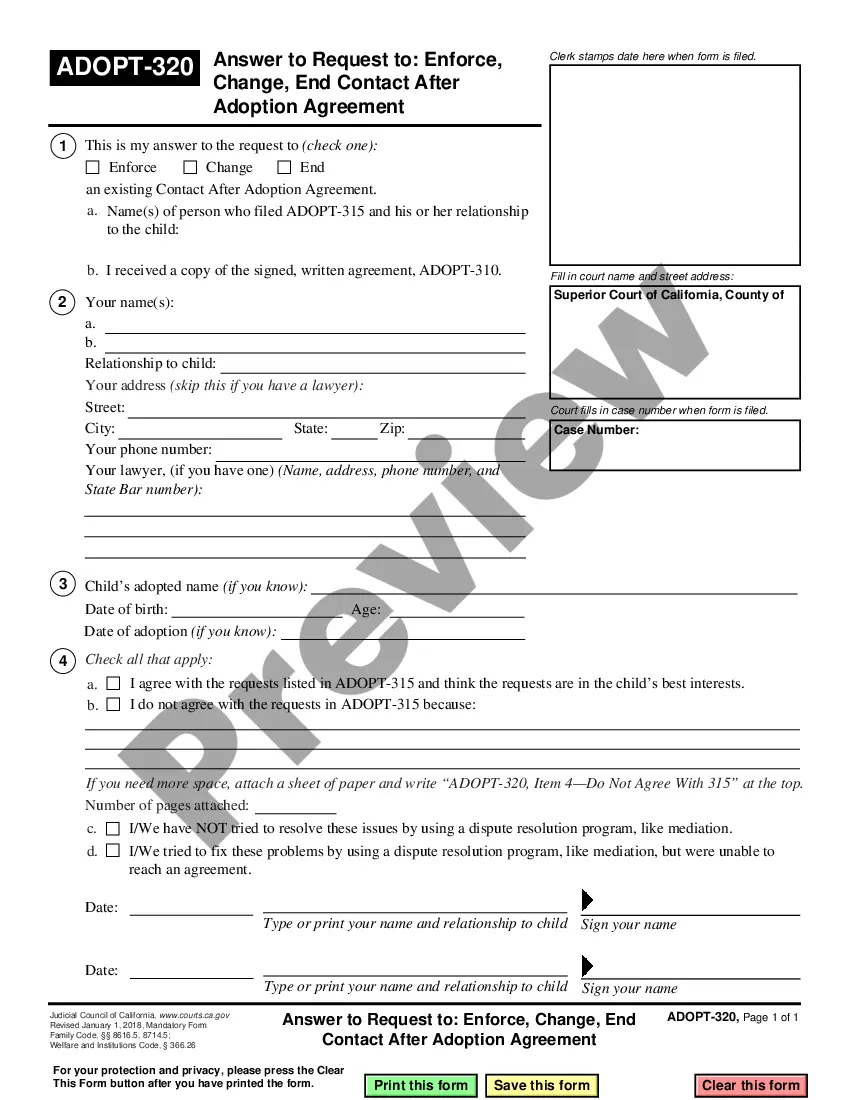

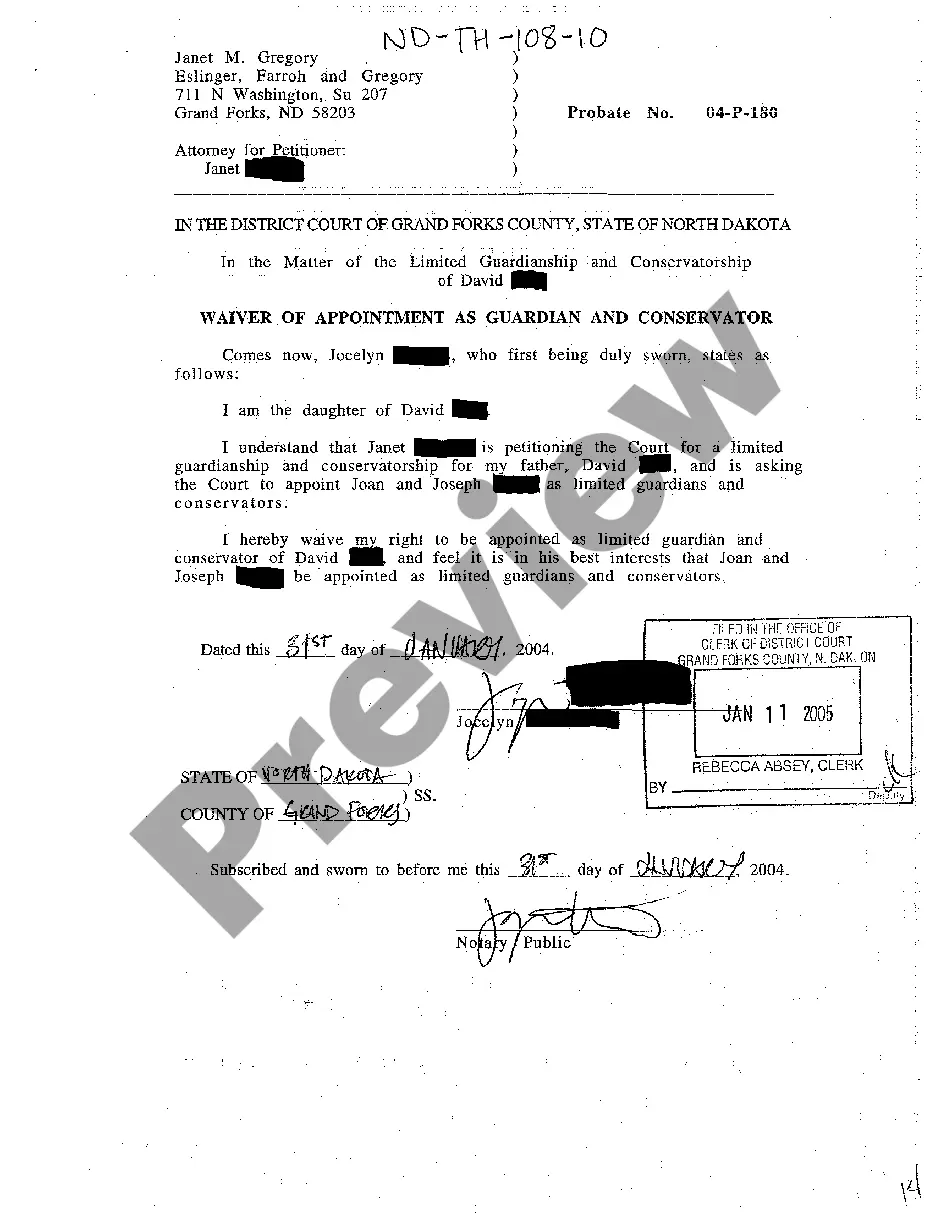

- Utilize the Preview button to examine the shape.

- Read the outline to ensure that you have chosen the correct kind.

- When the kind isn`t what you`re looking for, take advantage of the Look for discipline to discover the kind that meets your needs and requirements.

- Whenever you obtain the proper kind, simply click Buy now.

- Select the prices plan you want, fill out the necessary information to generate your money, and buy your order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free document format and download your backup.

Discover all of the document themes you possess bought in the My Forms food list. You can obtain a extra backup of Illinois Partial Release or Satisfaction of Mortgage by a Corporation at any time, if necessary. Just select the required kind to download or printing the document design.

Use US Legal Forms, the most substantial collection of authorized varieties, to conserve efforts and steer clear of blunders. The services gives skillfully created authorized document themes which you can use for an array of functions. Generate your account on US Legal Forms and begin creating your lifestyle a little easier.