The Illinois HIPAA Release Form for Insurance is a vital document that ensures the protection and privacy of patients' medical information under the stringent regulations of the Health Insurance Portability and Accountability Act (HIPAA). This form enables the authorized disclosure of an individual's health records to insurance companies, enabling them to process insurance claims, provide coverage, or determine eligibility for benefits. The Illinois HIPAA Release Form for Insurance contains several crucial components to guarantee the confidentiality and security of a patient's medical data. It requires the explicit consent of the patient or their legal representative for the release and disclosure of their protected health information (PHI). This form empowers patients to choose the specific information they wish to disclose, the intended recipient(s), and the purpose for which the information will be used. Keywords: Illinois HIPAA Release Form for Insurance, patient information privacy, medical records, health insurance claims, eligibility for benefits, Health Insurance Portability and Accountability Act, HIPAA, insurance coverage, protected health information, PHI, explicit consent, medical data disclosure. In addition to the standard Illinois HIPAA Release Form for Insurance, there might be several variations designed for specific purposes within the insurance industry. Some types of Illinois HIPAA Release Forms for Insurance may include: 1. Health Insurance Claim Release Form: This form authorizes the disclosure of medical information to insurance companies for the purpose of processing insurance claims, ensuring accurate billing, and providing reimbursement for medical services rendered. 2. Insurance Coverage Verification Form: This specific release form allows the sharing of patient information with insurance providers to verify coverage, determine policy limitations, and confirm the benefits available to the patient. 3. Benefits Eligibility Release Form: This type of HIPAA release form permits insurance companies to access and review a patient's medical records to assess their eligibility for insurance benefits, such as disability benefits or long-term care coverage. 4. Preauthorization Release Form: This form grants insurance companies the authority to review the patient's medical information ahead of a specific medical procedure or treatment to determine if it meets the necessary criteria for coverage. Remember that the Illinois HIPAA Release Form for Insurance is a critical document that ensures compliance with the state and federal laws governing the protection of patients' medical information. It is essential for both patients and insurance providers to understand the significance of this form and to utilize it correctly to safeguard patient privacy and maintain the integrity of the insurance process.

Illinois Hippa Release Form for Insurance

Description

How to fill out Illinois Hippa Release Form For Insurance?

Discovering the right legitimate file template can be quite a have difficulties. Needless to say, there are a lot of themes available online, but how can you get the legitimate kind you will need? Make use of the US Legal Forms web site. The service offers a large number of themes, like the Illinois Hippa Release Form for Insurance, which can be used for enterprise and personal requires. All of the forms are checked by pros and fulfill federal and state specifications.

Should you be currently authorized, log in for your profile and click the Obtain key to have the Illinois Hippa Release Form for Insurance. Make use of profile to appear through the legitimate forms you possess purchased formerly. Go to the My Forms tab of the profile and acquire another backup in the file you will need.

Should you be a whole new consumer of US Legal Forms, allow me to share easy guidelines that you can follow:

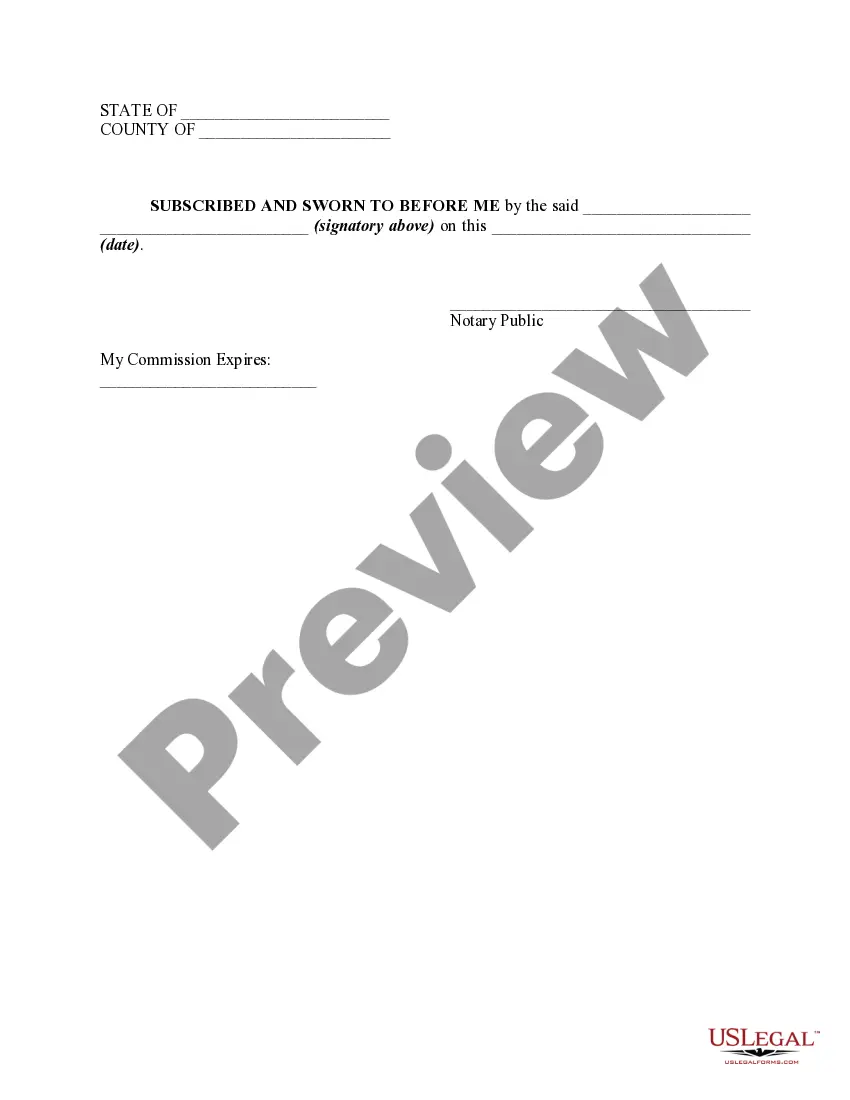

- First, make certain you have selected the right kind for your city/area. You can examine the form utilizing the Review key and study the form description to make certain it will be the best for you.

- When the kind does not fulfill your needs, take advantage of the Seach field to obtain the right kind.

- When you are certain the form is acceptable, click the Buy now key to have the kind.

- Opt for the costs plan you desire and enter the needed information. Make your profile and purchase the order using your PayPal profile or charge card.

- Select the document formatting and obtain the legitimate file template for your system.

- Full, change and print and indication the obtained Illinois Hippa Release Form for Insurance.

US Legal Forms will be the greatest catalogue of legitimate forms in which you can see a variety of file themes. Make use of the service to obtain appropriately-created files that follow status specifications.