Title: Illinois Sample Letter for Land Deed of Trust — Comprehensive Guide and Examples Introduction: A Land Deed of Trust is a crucial document that establishes a legal framework for securing a loan with real property in Illinois. This heavy-duty agreement protects the lender's interests in case of default by outlining the terms and conditions for the loan. In this article, we will provide a detailed description of what an Illinois Sample Letter for Land Deed of Trust includes, along with different types that are commonly used. 1. Purpose of an Illinois Land Deed of Trust: The Illinois Land Deed of Trust serves as an important tool to secure a loan by voluntarily granting a security interest in real property. It ensures the lender's ability to recover the loan amount by allowing foreclosure on the property if the borrower fails to fulfill their obligation. 2. Key Elements Included in an Illinois Land Deed of Trust: a. Parties Involved: The letter typically identifies the borrower, lender, and trustee. b. Property Description: Accurate and detailed information about the property being used as collateral. c. Loan Amount and Terms: Clearly specifies the loan amount, interest rates, repayment terms, and due dates. d. Default and Procedure: Outlines the consequences of default and the procedure for foreclosure or sale of the property. e. Warranty and Covenants: Includes provisions related to the borrower's warranties, such as good title and no undisclosed liens. f. Escrow Account Details: If applicable, provides information about the escrow account for property taxes and insurance. g. Signatures and Notarization: Requires signatures of all parties involved and must be notarized to ensure validity. 3. Different Types of Illinois Land Deed of Trust: a. Fixed-Rate Land Deed of Trust: This variation stipulates a fixed interest rate throughout the loan term, ensuring predictable payments. b. Adjustable-Rate Land Deed of Trust: Involves an interest rate that can fluctuate over time, providing flexibility but potentially resulting in changes in payment amounts. c. Wraparound Land Deed of Trust: Allows an existing loan to be replaced by a new loan, which incorporates the remaining balance on the old loan. This is commonly used when sellers provide financing. d. Balloon Land Deed of Trust: Includes smaller monthly payments for a specified period, with a larger final payment (balloon payment) due at the end of the loan term. Conclusion: Having a properly drafted Illinois Sample Letter for Land Deed of Trust is essential for protecting the interests of both borrowers and lenders in a loan agreement. By including all the necessary elements and provisions, this legally binding document ensures transparency and clarity throughout the loan process. Whether opting for a fixed-rate, adjustable-rate, wraparound, or balloon land deed of trust, the appropriate agreement can be tailored to meet the specific needs of the parties involved.

Illinois Sample Letter for Land Deed of Trust

Description

How to fill out Illinois Sample Letter For Land Deed Of Trust?

If you wish to full, down load, or printing legal file templates, use US Legal Forms, the greatest variety of legal varieties, that can be found online. Use the site`s basic and hassle-free research to obtain the documents you want. Various templates for organization and personal functions are categorized by categories and says, or keywords. Use US Legal Forms to obtain the Illinois Sample Letter for Land Deed of Trust within a handful of mouse clicks.

Should you be presently a US Legal Forms client, log in to the profile and click the Down load switch to find the Illinois Sample Letter for Land Deed of Trust. You can also access varieties you earlier acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form to the correct city/region.

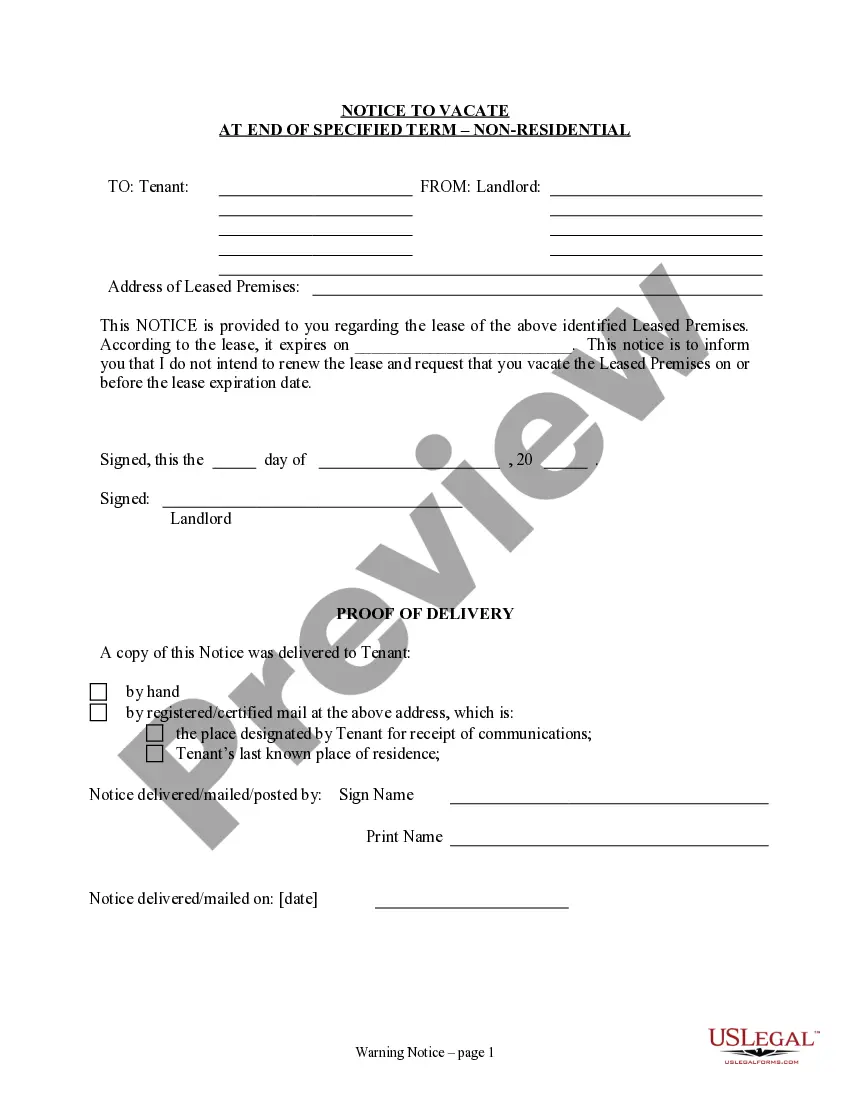

- Step 2. Make use of the Review solution to look through the form`s articles. Do not overlook to learn the information.

- Step 3. Should you be not happy together with the develop, use the Search industry towards the top of the monitor to find other models of your legal develop design.

- Step 4. After you have found the form you want, click the Purchase now switch. Opt for the costs program you prefer and add your references to register on an profile.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Choose the structure of your legal develop and down load it in your system.

- Step 7. Complete, revise and printing or signal the Illinois Sample Letter for Land Deed of Trust.

Every single legal file design you get is your own permanently. You might have acces to every single develop you acquired within your acccount. Click on the My Forms segment and select a develop to printing or down load once again.

Remain competitive and down load, and printing the Illinois Sample Letter for Land Deed of Trust with US Legal Forms. There are thousands of specialist and status-distinct varieties you can use to your organization or personal requirements.

Form popularity

FAQ

How do I establish a Land Trust? It's Easy as One-Two-Three? First, the beneficiary must sign a Land Trust Agreement formulated by the Grantor. ... Second, a Deed of Trust, when properly recorded with the County Recorder of Deeds, will transfer the property from the current owner to the name of the land trust.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults. What is a Deed of Trust? | LendingTree lendingtree.com ? deed-of-trust-vs-mortgage lendingtree.com ? deed-of-trust-vs-mortgage

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ... Deed of trust (real estate) - Wikipedia wikipedia.org ? wiki ? Deed_of_trust_(real_est... wikipedia.org ? wiki ? Deed_of_trust_(real_est...

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full. Deed Of Trust: A Definition | Rocket Mortgage rocketmortgage.com ? learn ? deed-of-trust rocketmortgage.com ? learn ? deed-of-trust

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Under a land trust agreement, the beneficiary retains complete control of the real estate in the same manner as if the recorded title were in his or her name. The beneficiary may terminate the trust whenever desired and may add additional property to the trust at any time. Chicago Title | Land Trust - FAQs ctlandtrust.com ? FAQs ctlandtrust.com ? FAQs