Illinois Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

Selecting the appropriate legitimate document format can be a challenge.

Clearly, there is a wide array of templates available online, but how can you obtain the official form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Illinois Triple Net Lease for Residential Property, suitable for business and personal purposes.

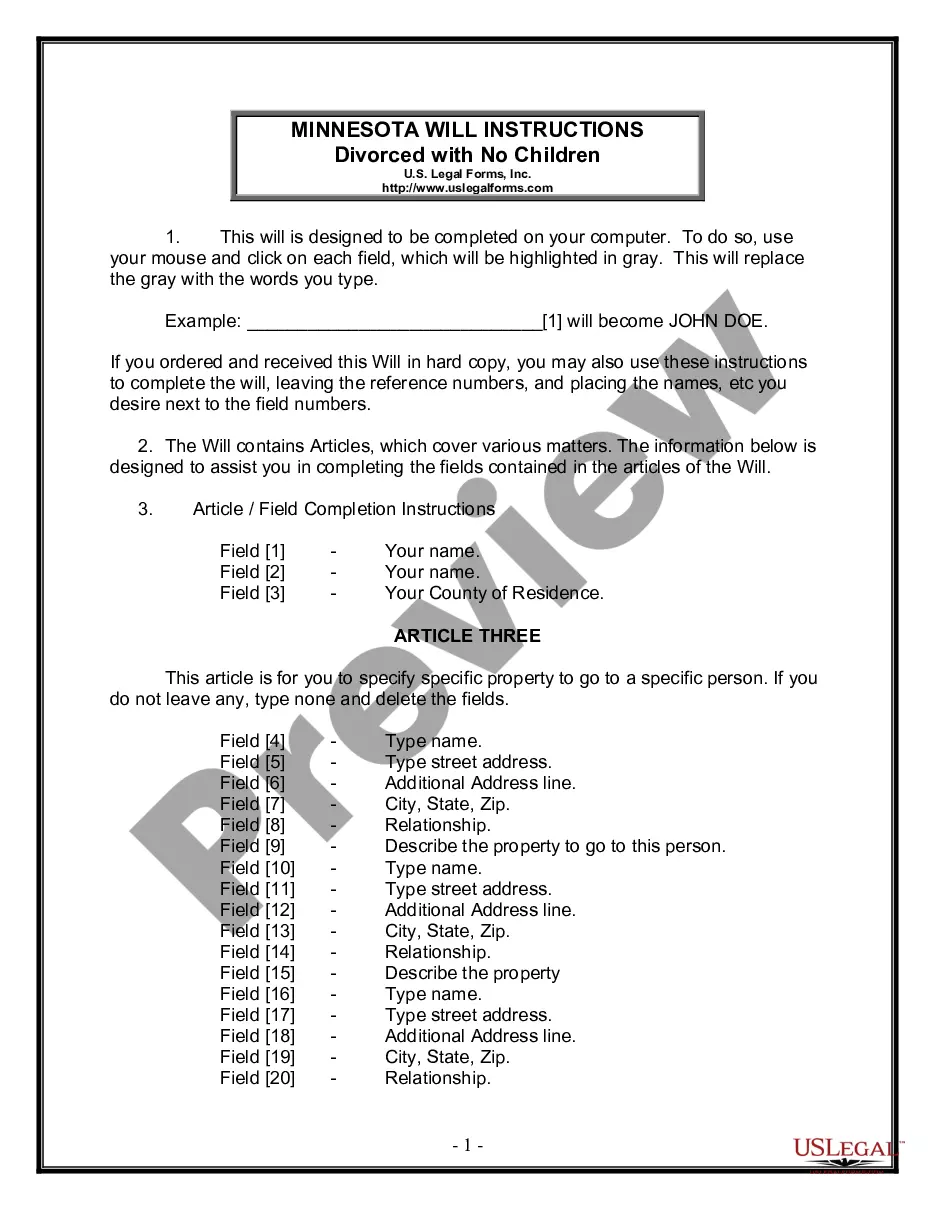

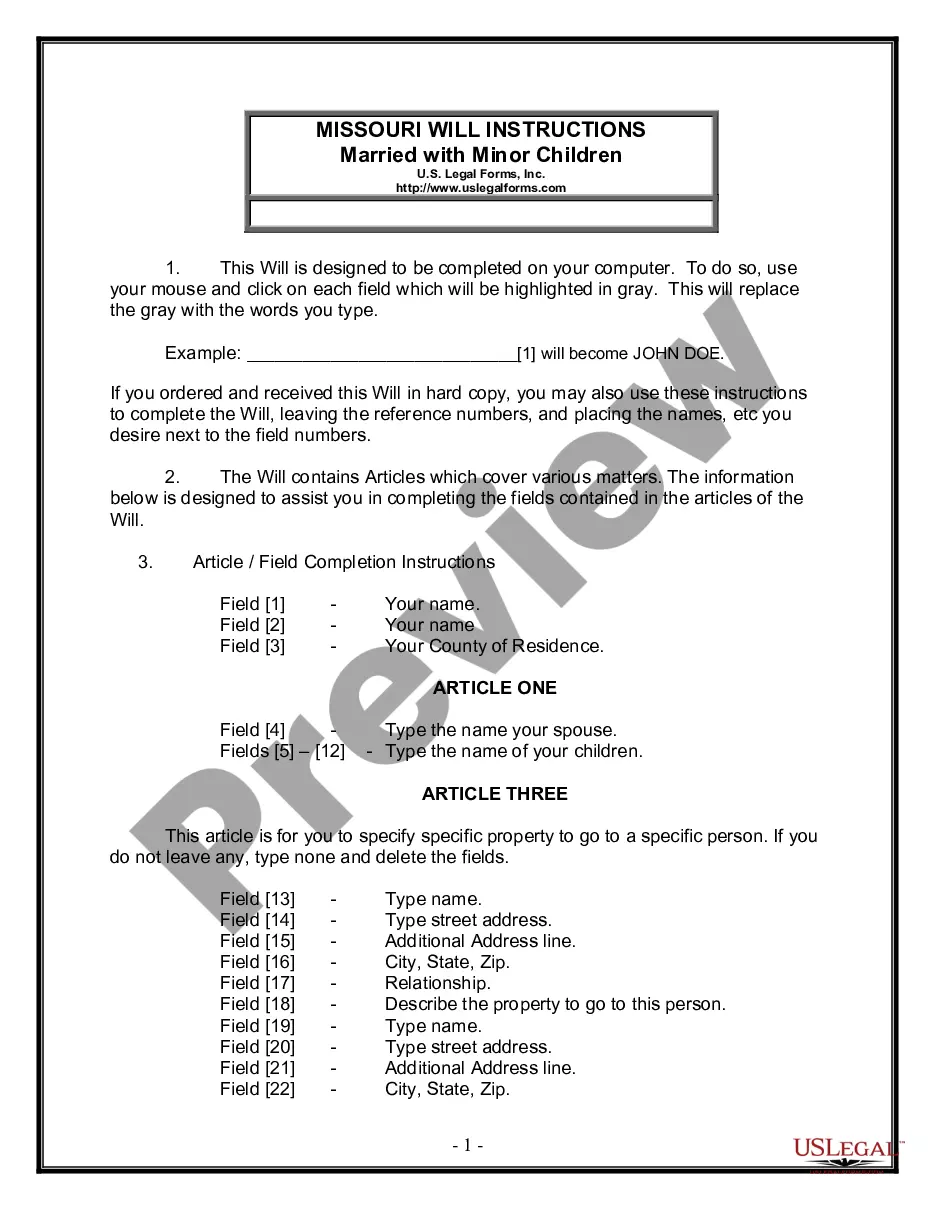

First, ensure that you have selected the correct form for your city/state. You can browse the form using the Review button and examine the form details to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to access the Illinois Triple Net Lease for Residential Property.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

When you come across $12 nnn in the context of an Illinois Triple Net Lease for Residential Property, it typically refers to a rental rate of $12 per square foot on a triple net lease basis. This means that the tenant is responsible for all operating expenses, including property taxes, insurance, and maintenance costs, in addition to the base rent. Understanding this structure helps you appreciate how costs can add up under this leasing agreement. If you are considering an Illinois Triple Net Lease for Residential Property, it is crucial to evaluate these expenses to budget effectively.

Whether an Illinois Triple Net Lease for Residential Property is worth it often depends on the individual tenant's situation. While these leases can lower upfront costs, tenants must be prepared for ongoing expenses and potential liabilities. It fosters a sense of ownership and direct involvement in the property. Ultimately, thorough research and a clear understanding of the lease terms can help determine if it meets your needs.

A key downside of an Illinois Triple Net Lease for Residential Property is the tenant's responsibility for all operating costs. This includes maintenance, repairs, and taxes, which may vary over time. If property management is lacking, tenants could end up spending more than expected. Hence, it's crucial to weigh the commitment and assess personal financial situations carefully.

The risks of an Illinois Triple Net Lease for Residential Property include financial liability for unanticipated repairs and maintenance costs. If a major repair arises, the tenant must bear the expense, which could strain their budget. Furthermore, market fluctuations might impact the property value, affecting the rental environment. It's essential for tenants to understand these risks before committing.

Tenants might opt for an Illinois Triple Net Lease for Residential Property because it often results in lower base rent. This lease structure allows tenants to have greater control over the property by covering operational costs. Additionally, tenants can benefit from potential tax deductions associated with these expenses. Overall, it helps tenants take a more active role in property management.

One notable disadvantage of an Illinois Triple Net Lease for Residential Property is the potential for unpredictable expenses. Tenants may face unexpected costs for property maintenance, insurance, and property taxes. This can make budgeting challenging. Moreover, if the landlord does not manage these expenses well, it can lead to disputes.

To determine if a lease is a triple net lease, carefully review the lease agreement. An Illinois Triple Net Lease for Residential Property will clearly specify the tenant's responsibilities for paying property taxes, insurance, and maintenance costs along with rent. Look for terms that explicitly outline these duties to confirm the lease type before signing.

Triple net leases are most commonly associated with commercial properties but can also be found in residential settings. An Illinois Triple Net Lease for Residential Property may apply to specific types of single-family homes or multi-family units. The suitability often depends on the unique structure and market conditions of the area.

Not all residential leases are structured as triple net leases. An Illinois Triple Net Lease for Residential Property specifically places the responsibility for certain operating expenses on the tenant. This arrangement typically includes taxes, insurance, and maintenance costs. Therefore, it's important to clarify the lease terms before signing.

Getting approved for an Illinois Triple Net Lease for Residential Property involves several important steps. First, ensure your financial documents, including income verification and credit history, are in order. Next, be prepared to demonstrate your understanding of the responsibilities associated with a triple net lease, such as property taxes, insurance, and maintenance costs. If you find the application process overwhelming, consider using platforms like uslegalforms to simplify document preparation and ensure a smooth experience.