A revocable trust is a legal document that allows individuals to protect, manage, and distribute their assets, including lottery winnings, during their lifetime and after their death. In the state of Illinois, there are specific types of revocable trusts tailored specifically for lottery winnings. These trusts provide various benefits such as anonymity, asset protection, and efficient estate planning. The Illinois Revocable Trust for Lottery Winnings offers winners the option to remain anonymous. Lottery winners often face overwhelming publicity, unwanted attention, and potential threats, which can impact their personal lives negatively. By placing their winnings into a revocable trust, winners can shield their identity and maintain privacy while still enjoying the benefits of their newfound wealth. Moreover, the Illinois Revocable Trust for Lottery Winnings provides asset protection. Placing lottery winnings into a trust can safeguard the funds from creditors, lawsuits, and other potential financial liabilities. This protection ensures that the winnings are preserved for the winner and their intended beneficiaries, rather than being subject to potential claims. Additionally, Illinois provides two main types of revocable trusts for lottery winnings: the individual revocable trust and the family revocable trust. The individual revocable trust is tailored for single individuals who have won the lottery, while the family revocable trust is designed for lottery winners who wish to distribute their winnings among family members. The individual revocable trust allows the winner to designate themselves as both the granter (the creator of the trust) and the beneficiary (the person who will benefit from the trust). It provides flexibility for the winner to manage and control their wealth during their lifetime, and upon their death, the trust's assets will be distributed according to the terms specified in the trust document. On the other hand, the family revocable trust is a suitable option for lottery winners who wish to distribute their winnings among their loved ones. This trust allows for the management and control of the winnings during the winner's lifetime, but also enables the seamless transfer of assets to designated family members after the winner's passing. By utilizing the family revocable trust, lottery winners can ensure their loved ones are financially secure and protected. In conclusion, the Illinois Revocable Trust for Lottery Winnings offers lottery winners the opportunity to safeguard their wealth, maintain anonymity, and efficiently plan for the distribution of their assets. The individual and family revocable trusts are two types specifically tailored to meet the unique needs of lottery winners. By carefully considering these options and consulting with legal professionals, lottery winners can make informed decisions regarding the management and protection of their winnings.

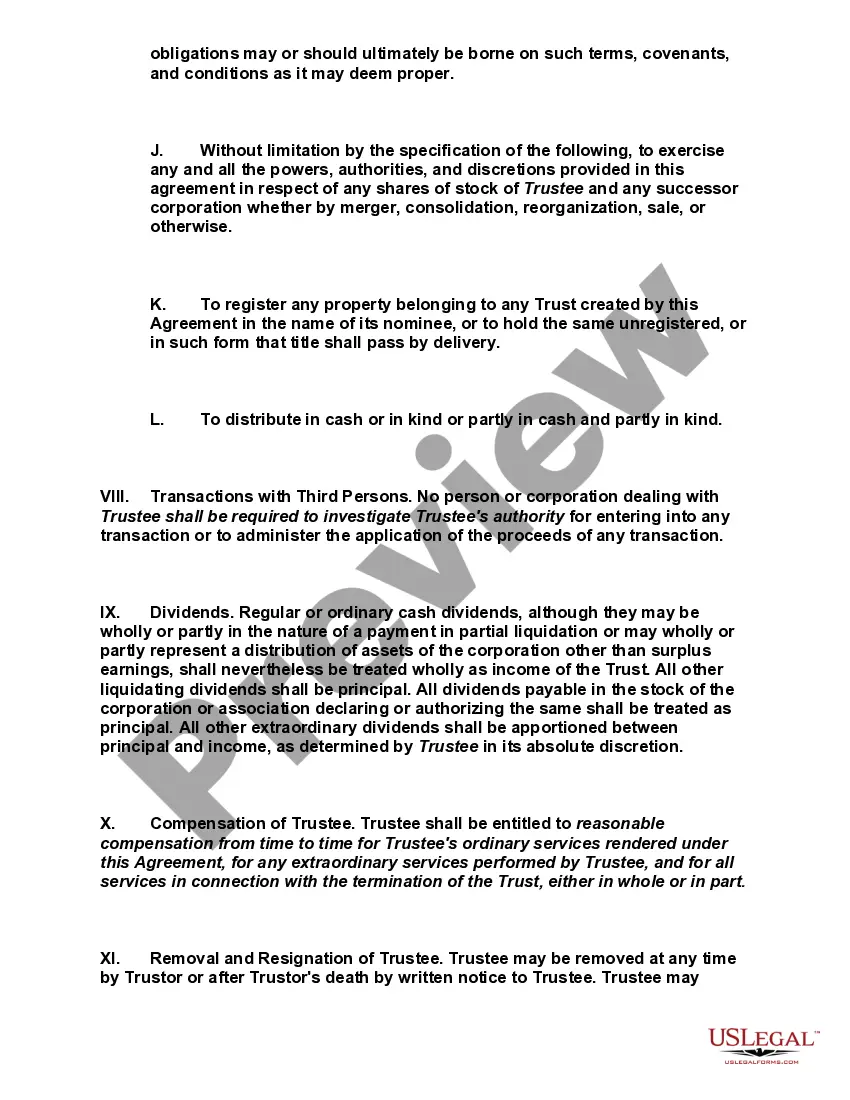

Irrevocable Living Trust

Description

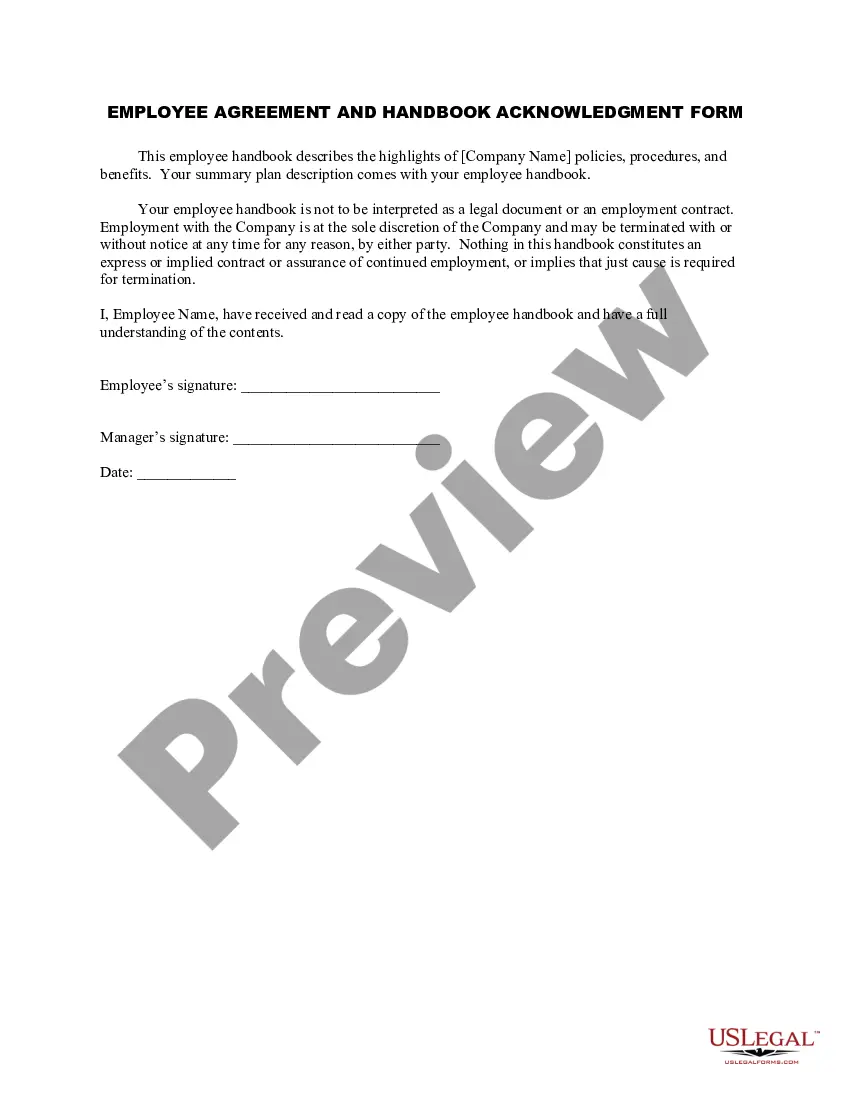

How to fill out Illinois Revocable Trust For Lottery Winnings?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an array of legal document templates that you can download or create.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms such as the Illinois Revocable Trust for Lottery Winnings in just a few minutes.

If you already have a membership, Log In and retrieve the Illinois Revocable Trust for Lottery Winnings from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Download the form to your device, select the format, and edit it. Fill out, modify, print, and sign the downloaded Illinois Revocable Trust for Lottery Winnings. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Read the form details to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

If you win the lottery in Illinois, the first step is to secure your ticket and consider legal and financial advice promptly. You might want to explore setting up an Illinois revocable trust for lottery winnings for better asset management and tax planning. Afterward, you can claim your prize either in person or by mail, depending on the amount. Remember, this is a significant event, so taking the time to plan is vital.

Winning the lottery anonymously is possible in several states, including Delaware, Maryland, and South Carolina. However, Illinois does not allow complete anonymity for lottery winners. Establishing an Illinois revocable trust for lottery winnings may provide some privacy by allowing the trust to claim the prize. This approach can help keep your identity out of the public eye while efficiently managing your lottery winnings.

When you win the lottery in Illinois, you can expect a state tax of 25% on your winnings, plus a federal tax of 24%. This brings your total tax liability to a significant portion of your prize. An Illinois revocable trust for lottery winnings may help you manage your taxes more effectively by providing potential tax advantages and better estate planning. Always consider consulting a tax professional for detailed advice tailored to your situation.

Setting up an Illinois revocable trust for lottery winnings involves several straightforward steps. First, you need to draft a trust document that outlines the terms of the trust, including how you want your winnings to be managed. You can create this document yourself, or utilize resources from platforms like uslegalforms to ensure you have everything covered legally. Finally, you'll need to transfer your lottery winnings into the trust, ensuring that your assets are appropriately managed according to your wishes.

If you win the lottery, opening a specialized bank account designed for high-value clients is a smart choice. Look for accounts that cater to significant deposits, which may also provide added benefits like higher interest rates or investment options. Additionally, consider establishing an Illinois Revocable Trust for Lottery Winnings in tandem with your account for better asset management. This combination ensures that your lottery winnings remain secure and accessible while allowing you to strategize your financial future effectively.

The best place to deposit your lottery winnings is in a reputable bank that offers financial services tailored to your needs. Consider a bank that allows you to open an Illinois Revocable Trust for Lottery Winnings, which can help manage and protect your newfound wealth. This type of trust provides a structured way to distribute your funds, ensuring they are handled according to your wishes. By choosing a strong financial institution, you enhance the security of your assets while making the most of your lottery winnings.

Yes, you can claim lottery winnings through an Illinois Revocable Trust for Lottery Winnings. This method allows for enhanced privacy and effective management of your assets. By setting up the trust prior to claiming your prize, you ensure that your winnings are properly allocated and distributed according to your wishes. Consulting with a legal professional is beneficial to navigate the setup and claim process smoothly.

The best investment after winning the lottery varies based on your financial goals and risk tolerance. However, utilizing an Illinois Revocable Trust for Lottery Winnings can facilitate smart investment decisions. This trust structure allows you to allocate funds into solid investments such as real estate or diversified stock portfolios while ensuring your wealth remains protected. Consulting with a financial planner can help identify the right strategies for your situation.

For lottery winnings, an Illinois Revocable Trust for Lottery Winnings is typically the most suitable choice. This type of trust offers the benefit of being easily amendable while allowing you to retain control over your assets. It helps shield your winnings from exposure to creditors and eases the transfer of assets to your loved ones upon your passing. When establishing your trust, consider working with experts to tailor it to your needs.

In Illinois, a revocable living trust, like the Illinois Revocable Trust for Lottery Winnings, does not generally need to be filed with the court. Unlike wills that go through probate, revocable trusts allow you to maintain privacy and avoid lengthy court processes. However, it is crucial to fund the trust properly to ensure your winnings are protected. This approach simplifies the management of your lottery winnings while keeping your assets safeguarded.