Title: Illinois Sample Letter for Judgment Confirming Tax Title — Detailed Description Introduction: In the state of Illinois, the process of obtaining a tax title can be finalized through a judgment confirming tax title. To facilitate this legal procedure, individuals or entities involved may utilize an Illinois Sample Letter for Judgment Confirming Tax Title. This letter serves as a formal document submitted to the appropriate authorities, outlining the necessary information and legal requirements. Read on to understand the purpose, content, and types of Illinois Sample Letters for Judgment Confirming Tax Title. 1. Purpose of the Sample Letter: The purpose of an Illinois Sample Letter for Judgment Confirming Tax Title is to request a hearing before a court to secure a judgment that validates the tax titleholder's ownership rights following the completion of the tax sale procedures. It seeks to affirm the titleholder's ownership through a legal confirmation, allowing them to further utilize or dispose of the property. 2. Essential Contents of the Sample Letter: a. Contact Information: Begin the letter by providing the sender's and recipient's contact details, including names, addresses, phone numbers, and email addresses if applicable. b. Introduction and Identification: Introduce the purpose of the letter concisely and provide relevant identification information such as the address or legal description of the property. Mention the specific tax sale proceedings or tax certificate numbers relating to the property in question. c. Background and Timeline: Present a concise background of the tax sale process, highlighting key dates, notices sent, and legal procedures followed. This demonstrates compliance with the necessary requirements for pursuing a judgment confirming tax title. d. Request for a Judgment Confirming Tax Title Hearing: Clearly state your request for a hearing to confirm the tax title. Express the desire for a fair, impartial judgment that recognizes the titleholder's rights and certifies the transfer of ownership. e. Supporting Documentation: Include any supporting evidence to strengthen the case, such as copies of the tax sale notices, deed to the property, tax sale redemption records, affidavits of compliance, and other relevant documents. f. Conclusion and Next Steps: Close the letter with a professional and courteous conclusion, expressing gratitude for their consideration and providing contact information for any further communication. Mention any additional steps required from the recipient or any relevant deadline that needs to be met. 3. Types of Illinois Sample Letters for Judgment Confirming Tax Title: Although varying circumstances may require specific adjustments, there are no distinct types of sample letters for judgment confirming tax title in Illinois. The structure and basic content remain the same, with modifications made according to the specific case's details. Conclusion: Submitting an Illinois Sample Letter for Judgment Confirming Tax Title plays a crucial role in securing legal confirmation of ownership rights after the tax sale process. By providing necessary information, asserting compliance, and requesting a judgment confirming tax title hearing, this letter aids in transferring ownership and validating the tax titleholder's rights. Whether it's a residential or commercial property, adhering to the guidelines of this letter establishes a solid foundation for the legal process.

Illinois Sample Letter for Judgment Confirming Tax Title

Description

How to fill out Illinois Sample Letter For Judgment Confirming Tax Title?

Have you been within a position in which you require papers for either company or person functions virtually every day time? There are a variety of legal papers templates available on the Internet, but getting ones you can depend on isn`t straightforward. US Legal Forms gives thousands of form templates, much like the Illinois Sample Letter for Judgment Confirming Tax Title, which are written to fulfill state and federal requirements.

When you are previously knowledgeable about US Legal Forms internet site and also have an account, merely log in. Afterward, you are able to down load the Illinois Sample Letter for Judgment Confirming Tax Title format.

If you do not provide an accounts and want to start using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for the correct town/region.

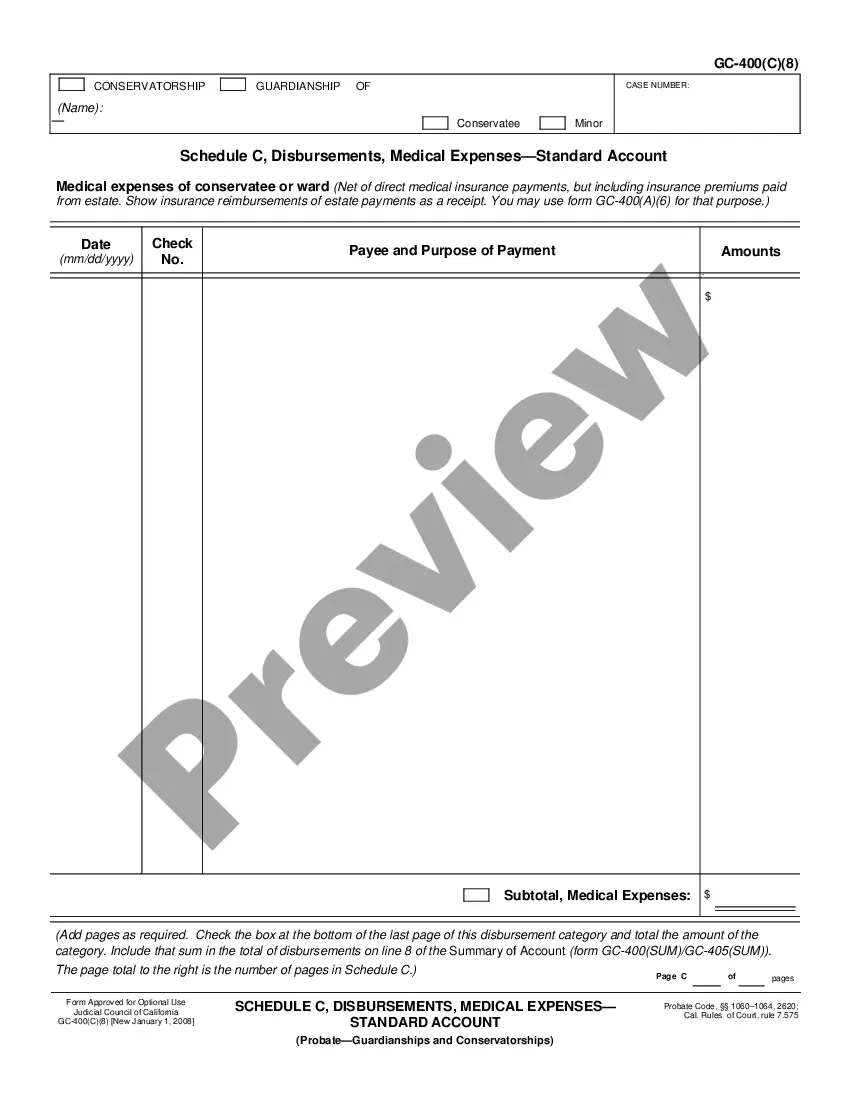

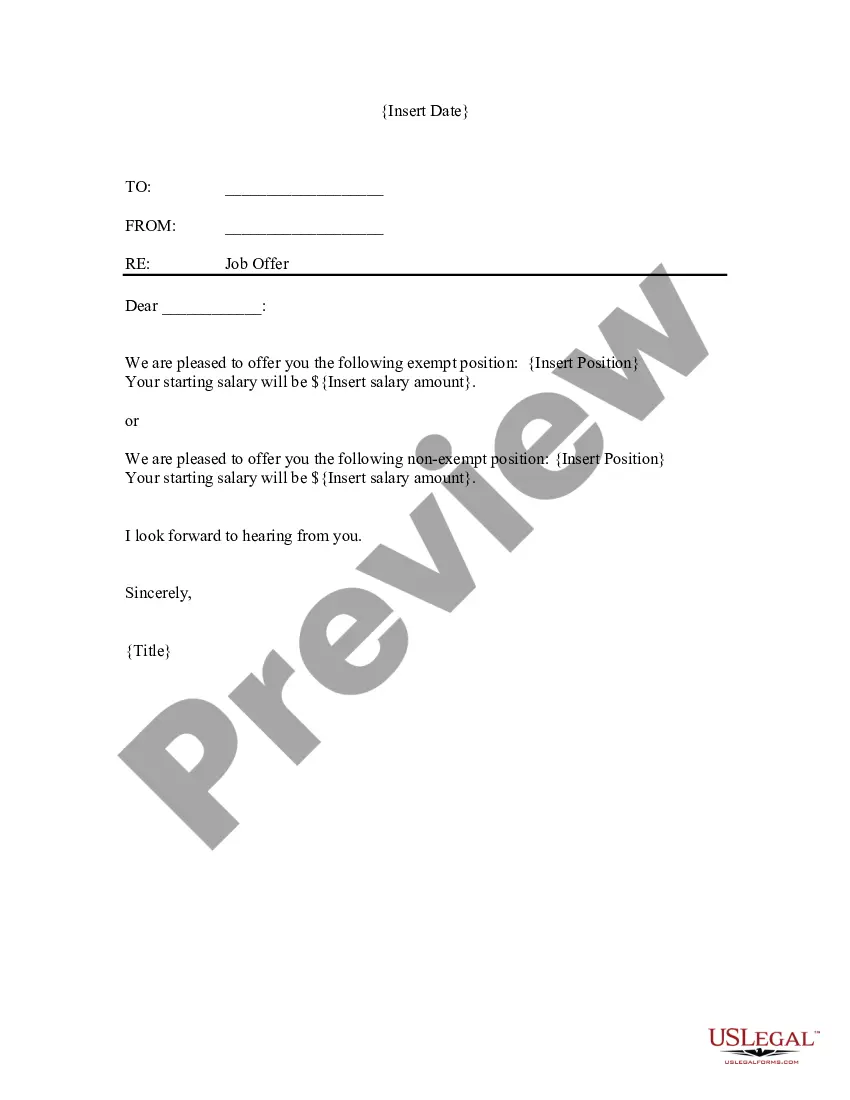

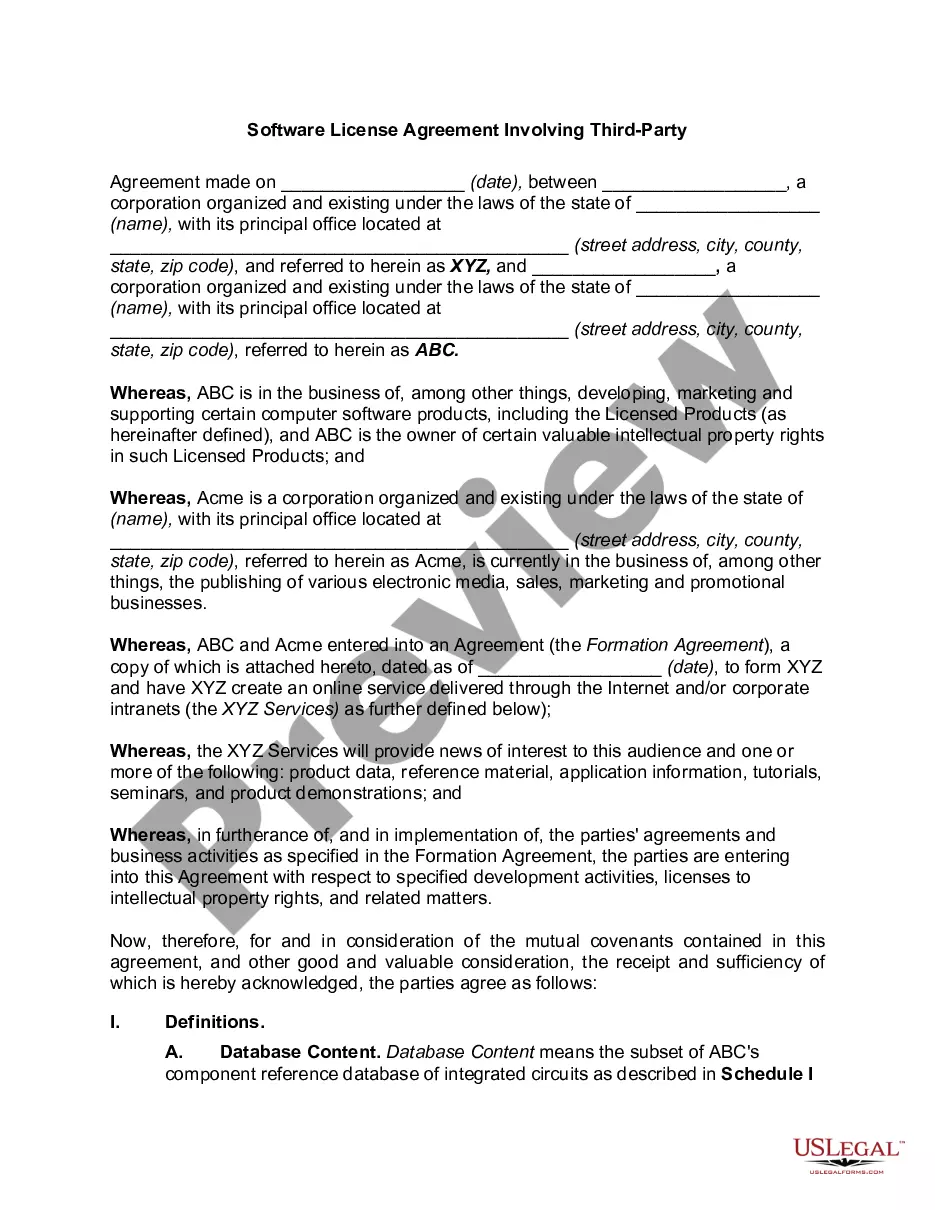

- Make use of the Review switch to analyze the form.

- Read the outline to ensure that you have chosen the correct form.

- In case the form isn`t what you are seeking, make use of the Look for industry to get the form that meets your needs and requirements.

- Once you find the correct form, click on Purchase now.

- Select the pricing program you need, complete the specified information to make your money, and purchase the transaction with your PayPal or credit card.

- Pick a hassle-free file structure and down load your copy.

Find each of the papers templates you might have purchased in the My Forms food selection. You may get a more copy of Illinois Sample Letter for Judgment Confirming Tax Title whenever, if needed. Just click on the necessary form to down load or printing the papers format.

Use US Legal Forms, by far the most extensive assortment of legal kinds, to conserve time as well as stay away from mistakes. The assistance gives expertly created legal papers templates which can be used for a range of functions. Produce an account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

To respond through MyTax Illinois, simply login to your existing account or create a new account at mytax.illinois.gov. Note: Activate your MyTax Account within 90 days of the date on your letter or notice. After this time period, you will be required to request a new Letter ID to activate your account.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

If you receive an Identity Verification letter after you file your Illinois tax return, it does not mean your identity has been compromised. It is simply a check to make sure YOU or your authorized designee filed the return, and it was not an unauthorized individual attempting to commit fraud.

Go to MyTax Illinois. Individuals will need to obtain a Letter ID. If you do not have a recent notice issued to you by the Illinois Department of Revenue from which you can obtain a Letter ID, then you can select the link "Request a Letter ID" under the 'Individuals' panel on the MyTax Illinois homepage.

The Letter ID you enter must have been issued within the last 90 days. If you do not have a Letter ID, use the "Request a Letter ID" feature on the 'Individuals' menu of the MyTax Illinois home screen to have a letter sent to you. You will not be able to create your account until you receive the letter ID.

When a property owner fails to redeem their property within the statutory period, the tax lien buyer has the option of obtaining the tax deed. The tax deed gives the buyer ownership and possession of the property free and clear of most encumbrances and liens.

Illinois Income Tax Lien (35 ILCS 5/1101) This is a state lien on the property of any person who fails to pay his or her state income tax. The statute of limitations is 20 years from the date of recording of the lien. The previous five year statute of limitations was extended to 20 years effective 1984.

Electronically - Go to our website at MyTax.illinois.gov, scroll down to the section titled "Identity Verification", select the Identity Verification Documents link, enter your Letter ID, and follow the instructions. Note: Submitting your information electronically will result in a quicker and more secure process.