Illinois Non-Disclosure Agreement for Potential Investors: A Comprehensive Guide Keywords: Illinois, non-disclosure agreement, potential investors, types Introduction: A non-disclosure agreement (NDA) is an essential legal document utilized in various business transactions, including potential investment partnerships. In the state of Illinois, a specific type of NDA, commonly known as the Illinois Non-Disclosure Agreement for Potential Investors, ensures the confidentiality of sensitive information shared during negotiations or due diligence processes. This detailed description will delve into the specifics of this agreement, its purpose, key provisions, and potential variations. Purpose: The primary purpose of an Illinois Non-Disclosure Agreement for Potential Investors is to safeguard the exchange of confidential information between a company or individual seeking investments ("Disclosing Party") and potential investors or venture capitalists ("Receiving Party"). By signing the NDA, both parties acknowledge their obligation to maintain the confidentiality of information deemed proprietary, technological, financial, operational, or business-related. This agreement ensures that valuable trade secrets, business strategies, financial statements, customer lists, intellectual property, and other sensitive data remain protected and undisclosed to third parties. Key Provisions: 1. Definition of Confidential Information: The NDA clearly identifies the specific types of information deemed confidential and protected by the agreement. This includes trade secrets, financial data, business plans, designs, formulas, technology, customer lists, marketing strategies, and any other proprietary knowledge unique to the Disclosing Party's operations. 2. Obligations and Restrictions: The agreement outlines the Receiving Party's responsibilities regarding the non-disclosure of confidential information. It may include clauses that prohibit the copy, reproduction, distribution, or public disclosure of the disclosed data. Additionally, provisions may require the Receiving Party to limit access to confidential information only to its key personnel directly involved in the investment evaluation process while exercising reasonable care to maintain confidentiality. 3. Duration: The NDA specifies the duration for which the Receiving Party must keep the information confidential. The timeframe can vary based on the nature of the information and the Disclosing Party's requirements. Generally, NDAs have a finite duration, often ranging from one to five years, after which the Receiving Party's obligation to confidentiality ends. Types of Illinois Non-Disclosure Agreement for Potential Investors: 1. Mutual Non-Disclosure Agreement (M-NDA): This type of NDA is signed when both parties, the Disclosing Party and the Receiving Party, intend to share confidential information. The M-NDA ensures that both parties mutually agree to keep the disclosed data confidential and outlines the rights and obligations of each party. 2. Unilateral Non-Disclosure Agreement (U-NDA): A U-NDA is executed when only one party, typically the Disclosing Party, desires to safeguard their information from being disclosed to the Receiving Party. This agreement lays out the obligations and responsibilities of the Receiving Party to maintain confidentiality. Conclusion: An Illinois Non-Disclosure Agreement for Potential Investors acts as a critical legal tool in establishing trust and protecting confidential information during investment discussions. Whether a mutual or unilateral agreement, NDAs play an indispensable role in promoting open communication while safeguarding valuable proprietary knowledge. Potential investors and businesses operating in Illinois should carefully draft, review, and execute NDAs to ensure confidentiality and foster successful investment opportunities.

Illinois Non-Disclosure Agreement for Potential Investors

Description

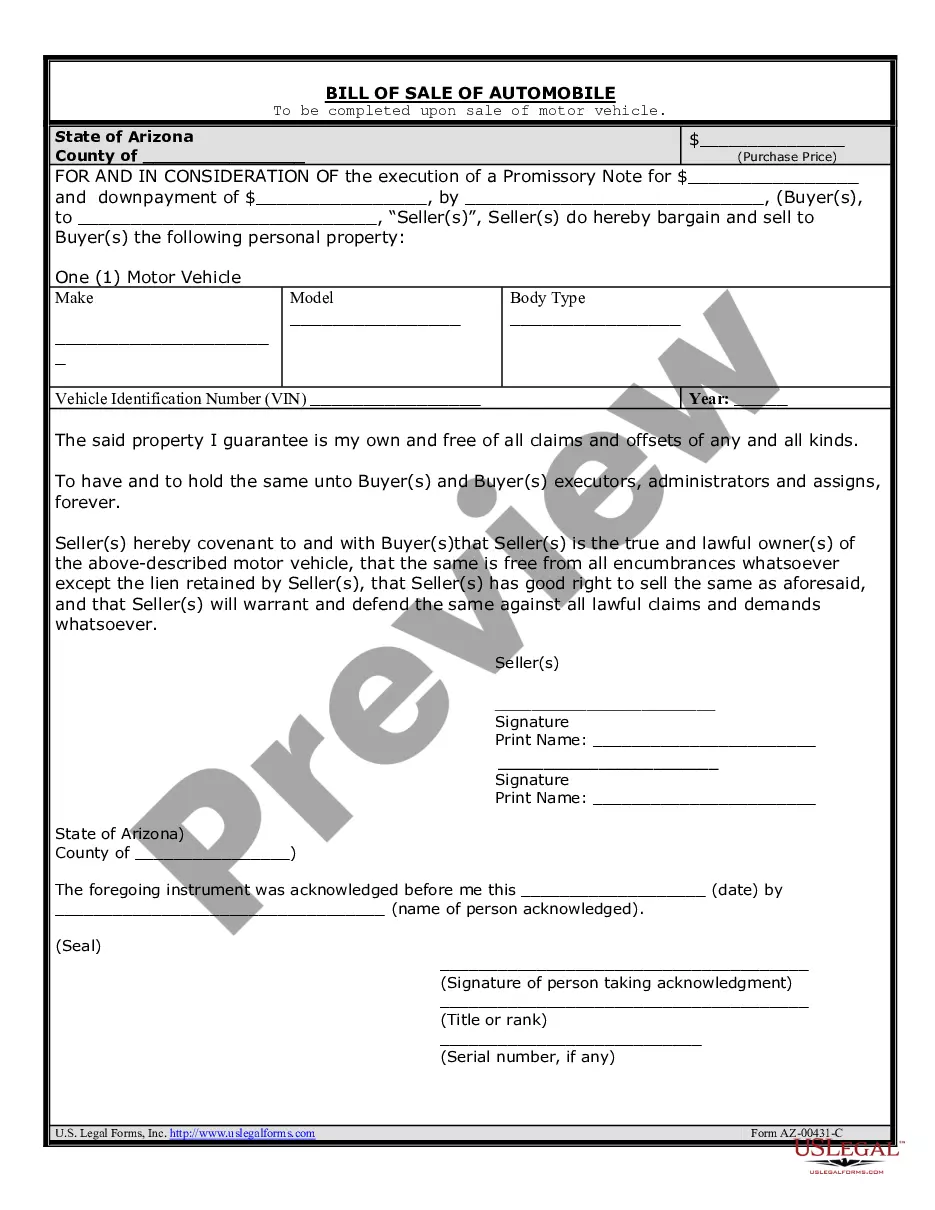

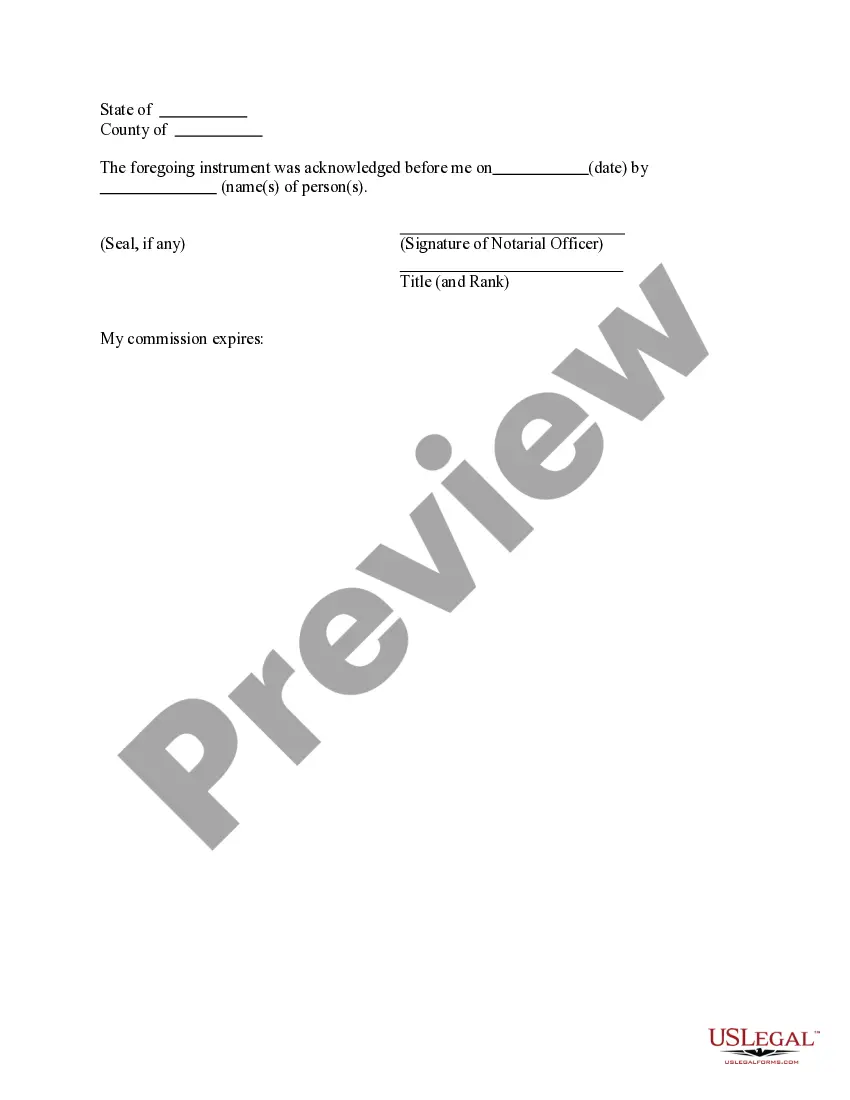

How to fill out Illinois Non-Disclosure Agreement For Potential Investors?

Are you in a situation where you frequently need to have documents for both business or personal use? There are numerous legal document templates available online, but locating dependable versions is not easy.

US Legal Forms provides a vast array of form templates, such as the Illinois Non-Disclosure Agreement for Potential Investors, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Illinois Non-Disclosure Agreement for Potential Investors template.

Select a preferred file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Illinois Non-Disclosure Agreement for Potential Investors whenever necessary. Simply click on the required form to download or print the document template. Use US Legal Forms, which offers one of the largest selections of legal forms, to save time and minimize mistakes. This service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct jurisdiction/state.

- Use the Review button to evaluate the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, utilize the Search section to locate the form that fits your requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

How to terminate the NDARead the Duration clauses. Good NDAs will have two different terms of duration.Read the termination clause. Like any other relationship, business partnerships can come to an early end unexpectedly.Read the Return of Information clause.31-Aug-2021

Violating an NDA leaves you open to lawsuits from your employer, and you could be required to pay financial damages and possibly associated legal costs. It's illegal to reveal trade secrets or sensitive company information to a competitor.

The employer cannot enforce the agreement until the seven-day revocation period has elapsed, unless the individual has voluntarily waived the right to revoke. If an employer fails to meet all of these requirements, the NDA may be deemed void as against public policy.

2. When are non-disclosure agreements signed by employees enforceable? While the rules can certainly vary from state to state, most jurisdictions consider non-disclosure agreements to be enforceable as long as they are drafted and executed properly.

The contractual consequences of a breach of a NDA could include a compensation claim or securing an injunction order to prevent further damage or loss arising from the breach of confidentiality.

The NDA is unreasonably onerous, or too anti-competition. Your actions do not amount to breach of contract, so your former employer has no legal standing. The NDA is not enforceable because it does not comply with Illinois law.

disclosure agreement is a legally binding contract that establishes a confidential relationship. The party or parties signing the agreement agree that sensitive information they may obtain will not be made available to any others. An NDA may also be referred to as a confidentiality agreement.

Violating an NDA leaves you open to lawsuits from your employer, and you could be required to pay financial damages and possibly associated legal costs. It's illegal to reveal trade secrets or sensitive company information to a competitor.

NDAs, or non-disclosure agreements, are legally enforceable contracts that create a confidential relationship between a person who has sensitive information and a person who will gain access to that information. A confidential relationship means one or both parties has a duty not to share that information.

The Key Elements of Non-Disclosure AgreementsIdentification of the parties.Definition of what is deemed to be confidential.The scope of the confidentiality obligation by the receiving party.The exclusions from confidential treatment.The term of the agreement.