Illinois Receipt for Payment of Account

Description

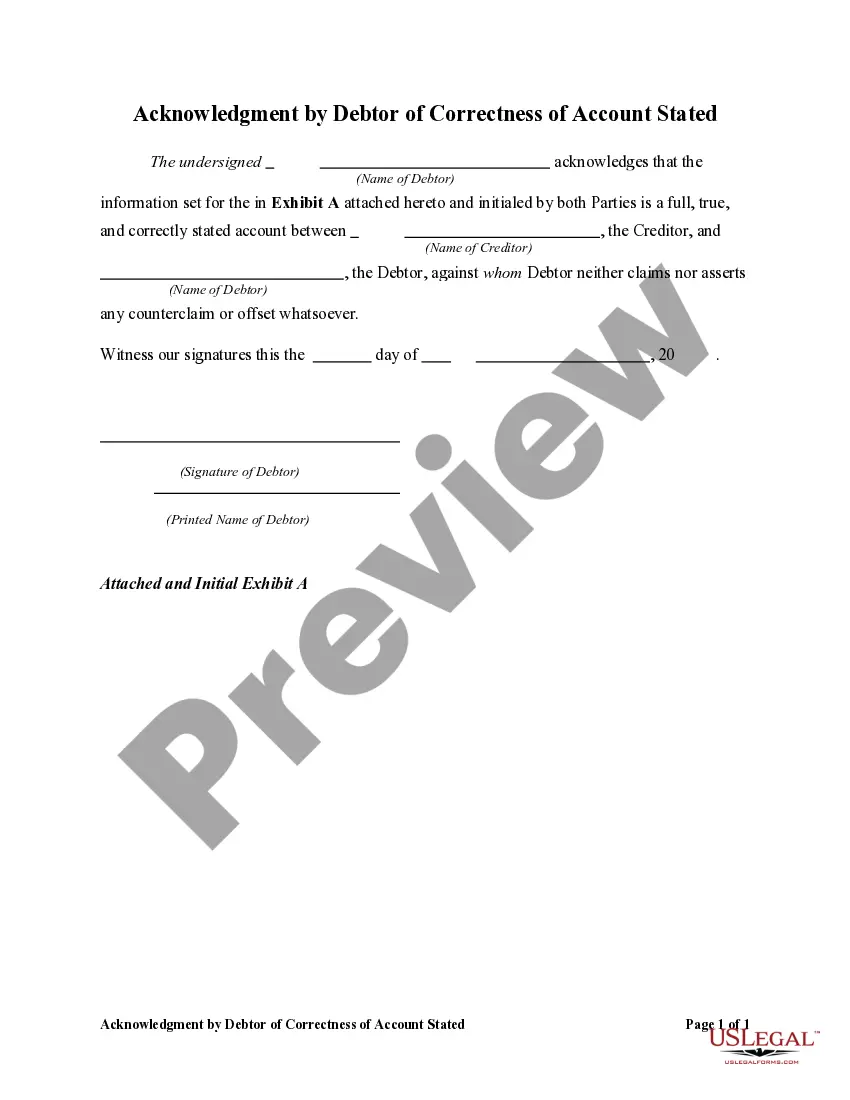

How to fill out Receipt For Payment Of Account?

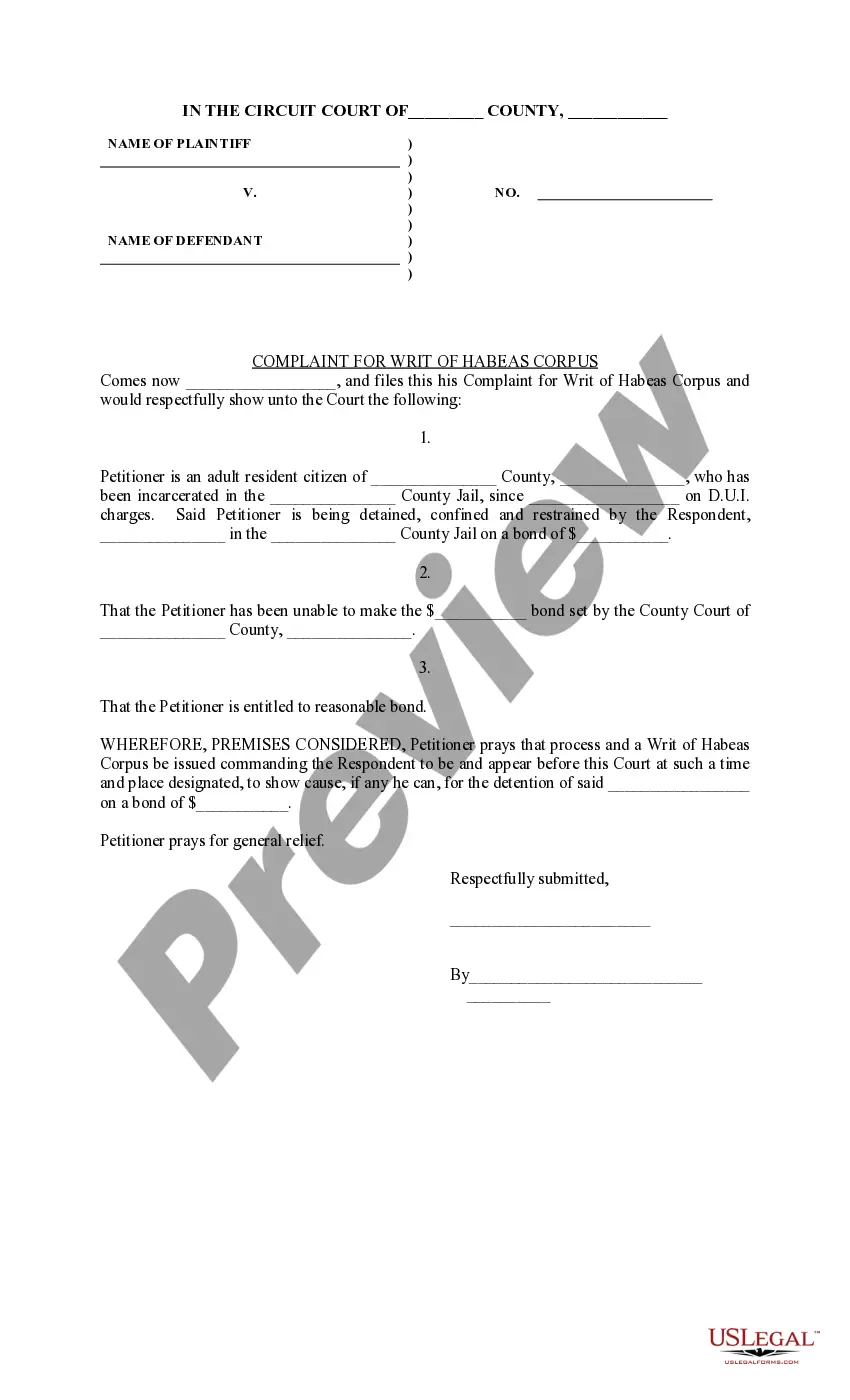

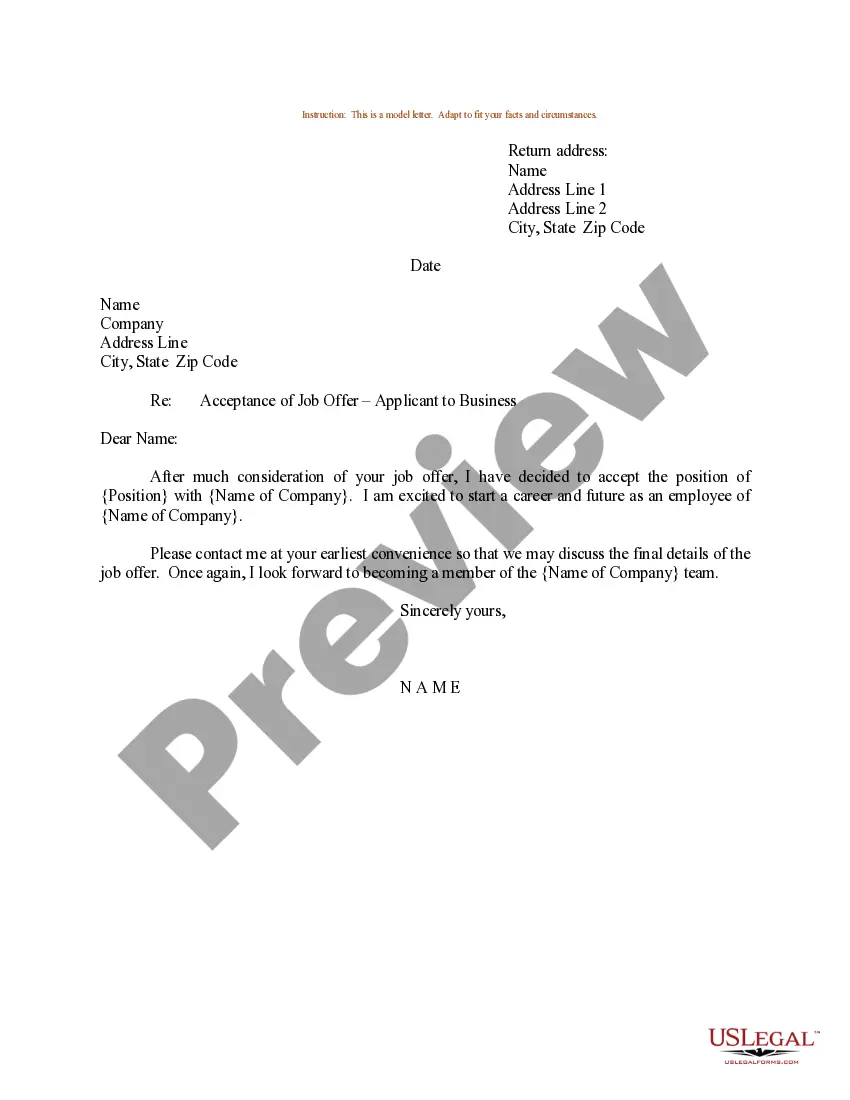

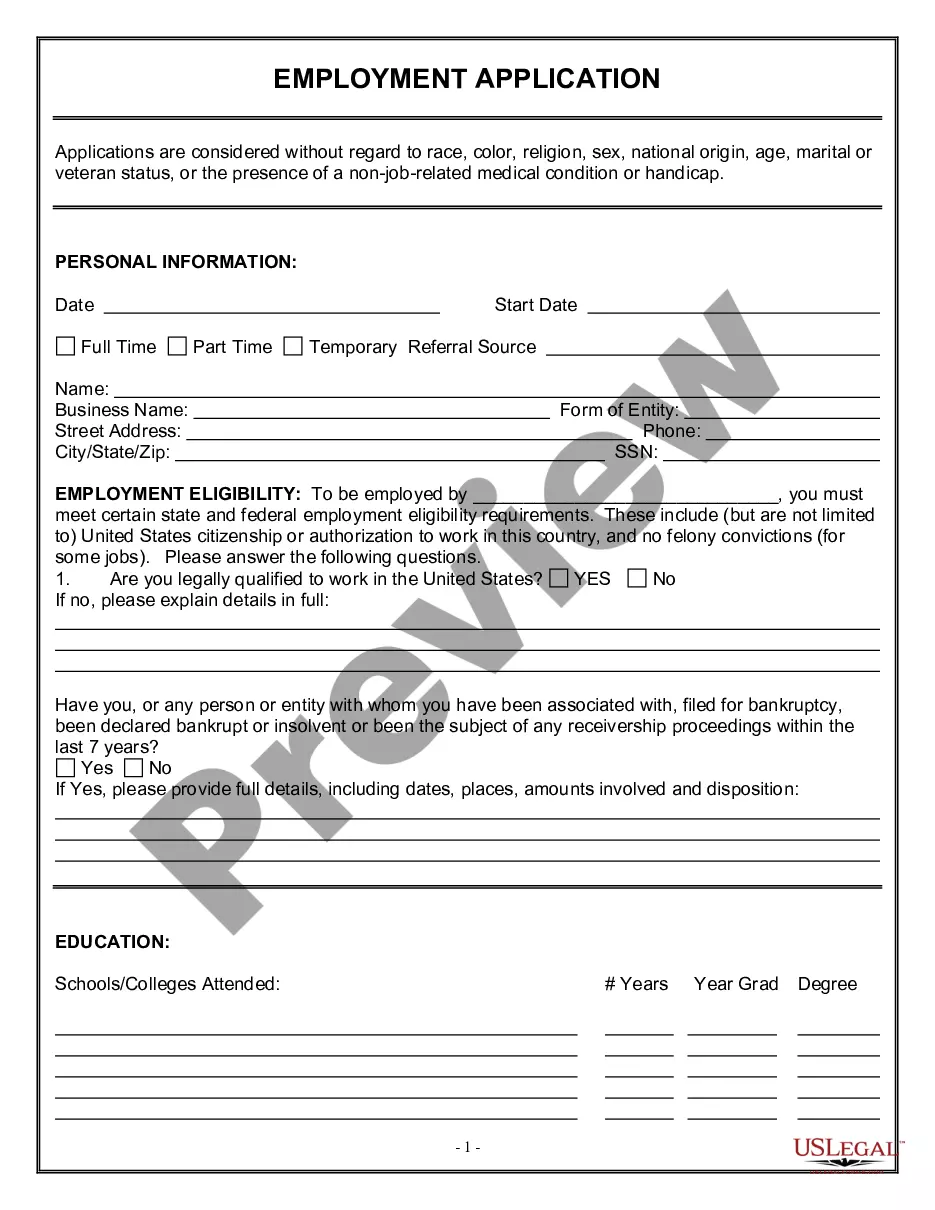

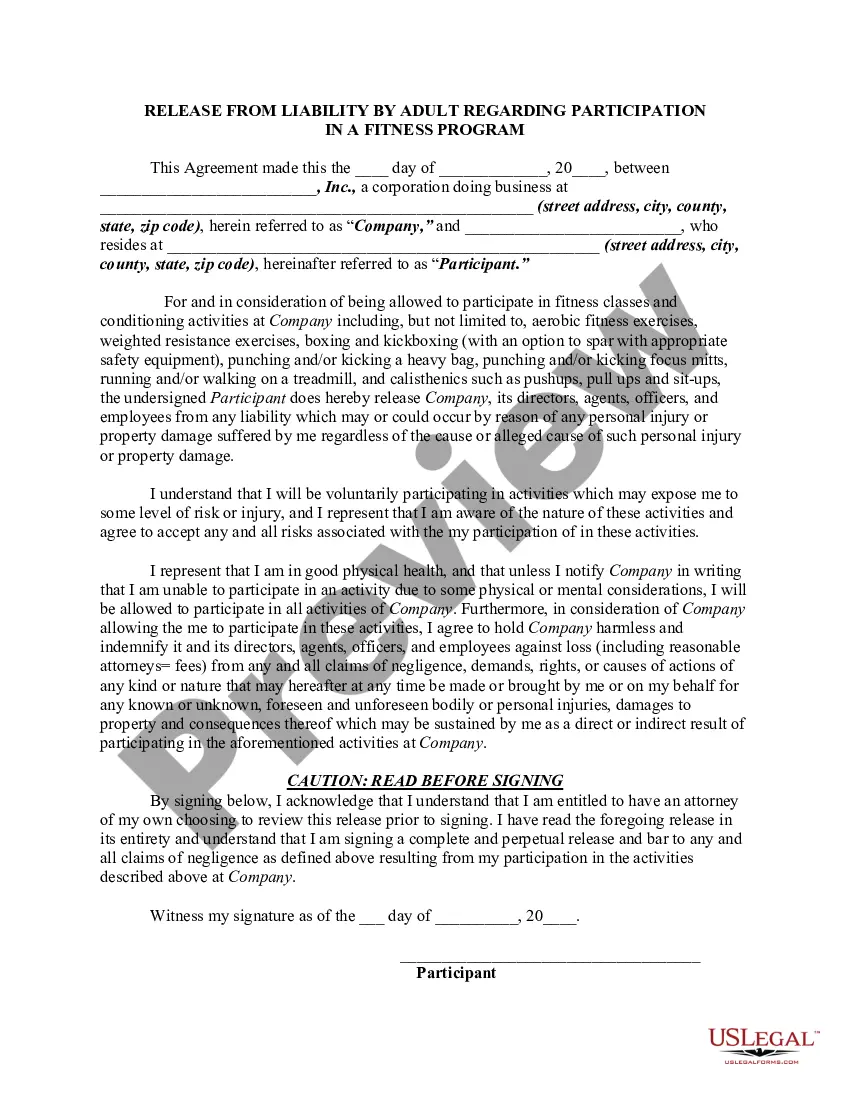

Choosing the best lawful document web template can be a struggle. Naturally, there are a variety of web templates available on the net, but how would you discover the lawful form you want? Utilize the US Legal Forms internet site. The services offers a huge number of web templates, for example the Illinois Receipt for Payment of Account, which you can use for enterprise and private requirements. Each of the varieties are inspected by pros and meet up with state and federal requirements.

When you are currently authorized, log in for your profile and click the Down load switch to have the Illinois Receipt for Payment of Account. Use your profile to look from the lawful varieties you may have ordered formerly. Proceed to the My Forms tab of your profile and acquire yet another backup in the document you want.

When you are a new consumer of US Legal Forms, allow me to share basic directions that you can stick to:

- Initially, make certain you have selected the correct form for the city/region. You can examine the form utilizing the Review switch and look at the form outline to guarantee it is the right one for you.

- In the event the form will not meet up with your needs, use the Seach field to obtain the proper form.

- Once you are positive that the form is acceptable, click on the Purchase now switch to have the form.

- Select the pricing prepare you desire and enter the needed information and facts. Make your profile and pay for your order making use of your PayPal profile or Visa or Mastercard.

- Select the submit formatting and obtain the lawful document web template for your system.

- Full, edit and produce and indicator the attained Illinois Receipt for Payment of Account.

US Legal Forms may be the greatest library of lawful varieties where you can see numerous document web templates. Utilize the service to obtain expertly-produced paperwork that stick to express requirements.

Form popularity

FAQ

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent.

2. State Withholding. Typically, Illinois employers must withhold 4.95% of taxable wages from employee pay, which will be remitted to the state. To correctly calculate the amount of state income tax withheld, employers must have Form IL-W-4 for each employee.

Form IL-501 is used to deposit Illinois income tax withheld. If the amount due is: Less than $500 a quarter - the employer may report and pay the tax using the IL-941. $500 or more a quarter - the employer must deposit the taxes with the Illinois Department of Revenue using Form IL-501 to transmit the deposit.

How is income taxed in Illinois? Illinois' flat income tax rate means that every resident, regardless of income level, pays the same individual income tax rate of 4.95 percent. Nonresidents who work in Illinois also must pay income tax to the state, unless they live in Wisconsin, Iowa, Kentucky or Michigan.

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in. ... Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

The Illinois Department of Revenue can seize funds from your bank account and use them to pay off your tax debt. Despite being notified beforehand, it can be challenging to stop the levy once it's already taken place. That's why it's essential to seek the help of a tax attorney as soon as possible.

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in. ... Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.