A promoter is a person who starts up a business, particularly a corporation, including the financing. The formation of a corporation starts with an idea. Preincorporation activities transform this idea into an actual corporation. The individual who carries on these preincorporation activities is called a promoter. Usually the promoter is the main shareholder or one of the management team and receives stock for his/her efforts in organization. Most states limit the amount of "promotional stock" since it is supported only by effort and not by assets or cash. If preincorporation contracts are executed by the promoter in his/her own name and there is no further action, the promoter is personally liable on them, and the corporation is not.

Under the Federal Securities Act of 1933, a pre-organization certificate or subscription is included in the definition of a security. Therefore, a contract to issue securities in the future is itself a contract for the sale of securities. In order to secure an exemption, all stock subscription agreements involving intrastate offerings should contain representations by the purchasers that they are bona fide residents of the state of which the issuer is a resident and that they are purchasing the securities for their own account and not with the view to reselling them to nonresidents. A stock transfer restriction running for a period of at least one year or for nine months after the last sale of the issue by the issuer is customarily included to insure that securities have not only been initially sold to residents, but have "come to rest" in the hands of residents.

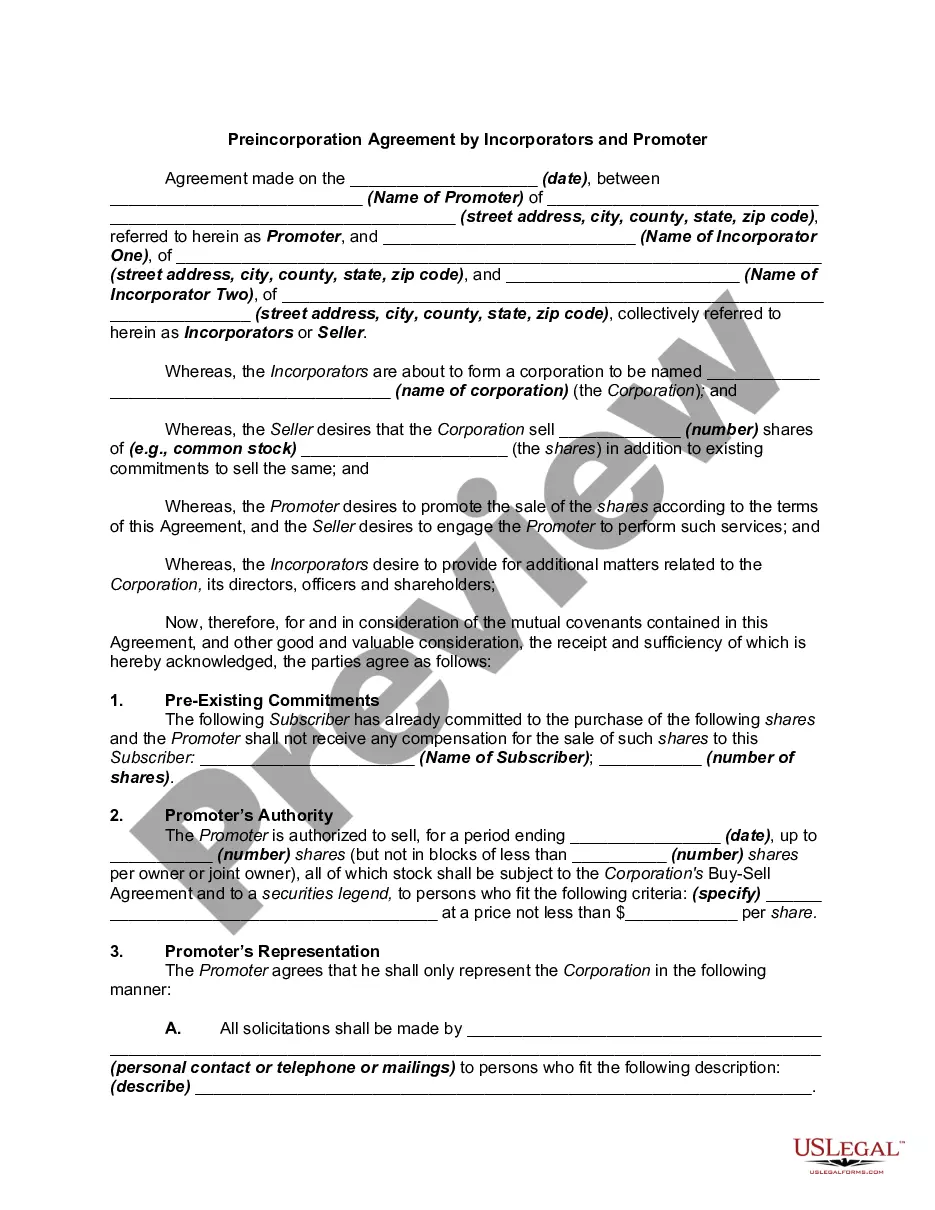

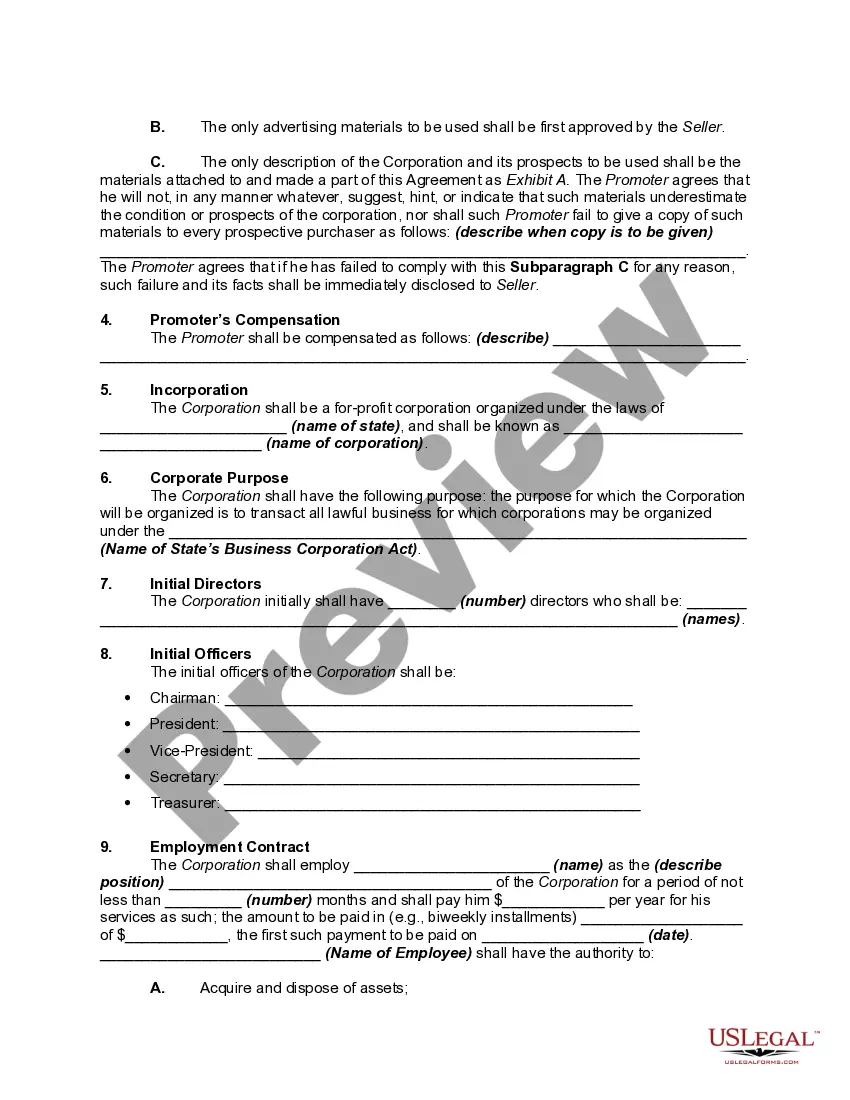

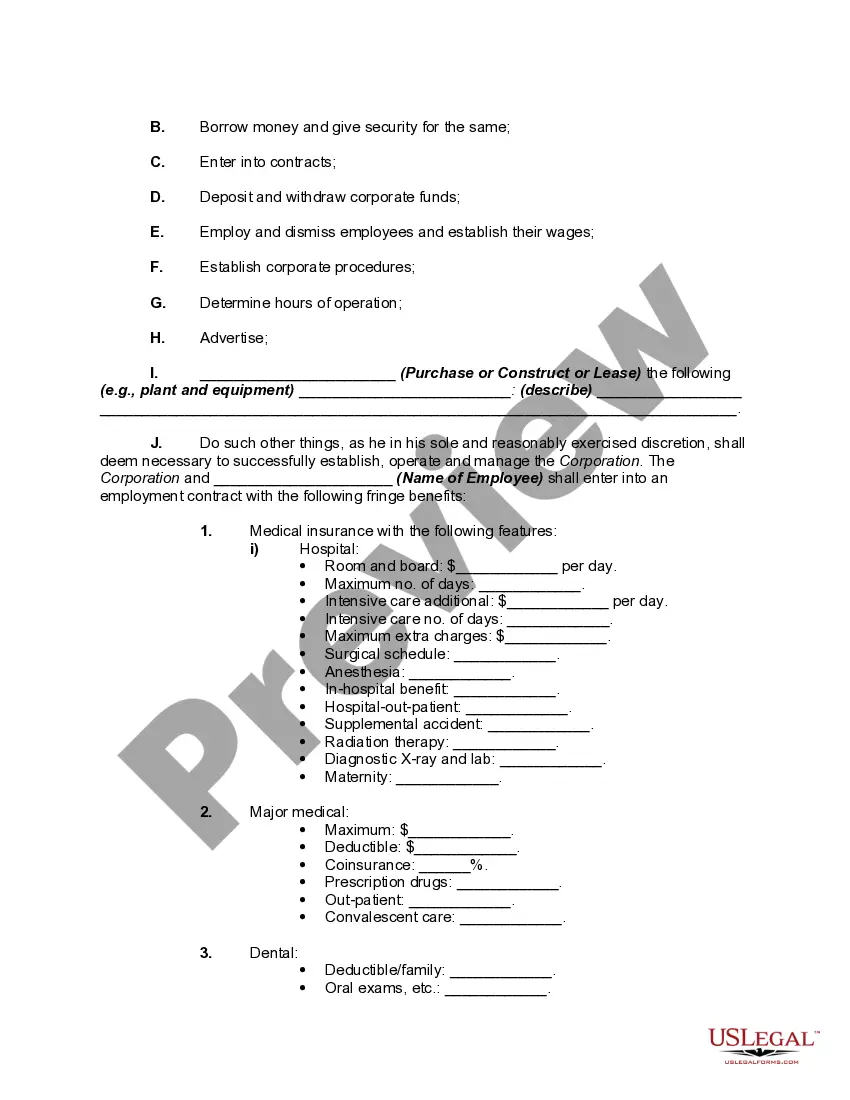

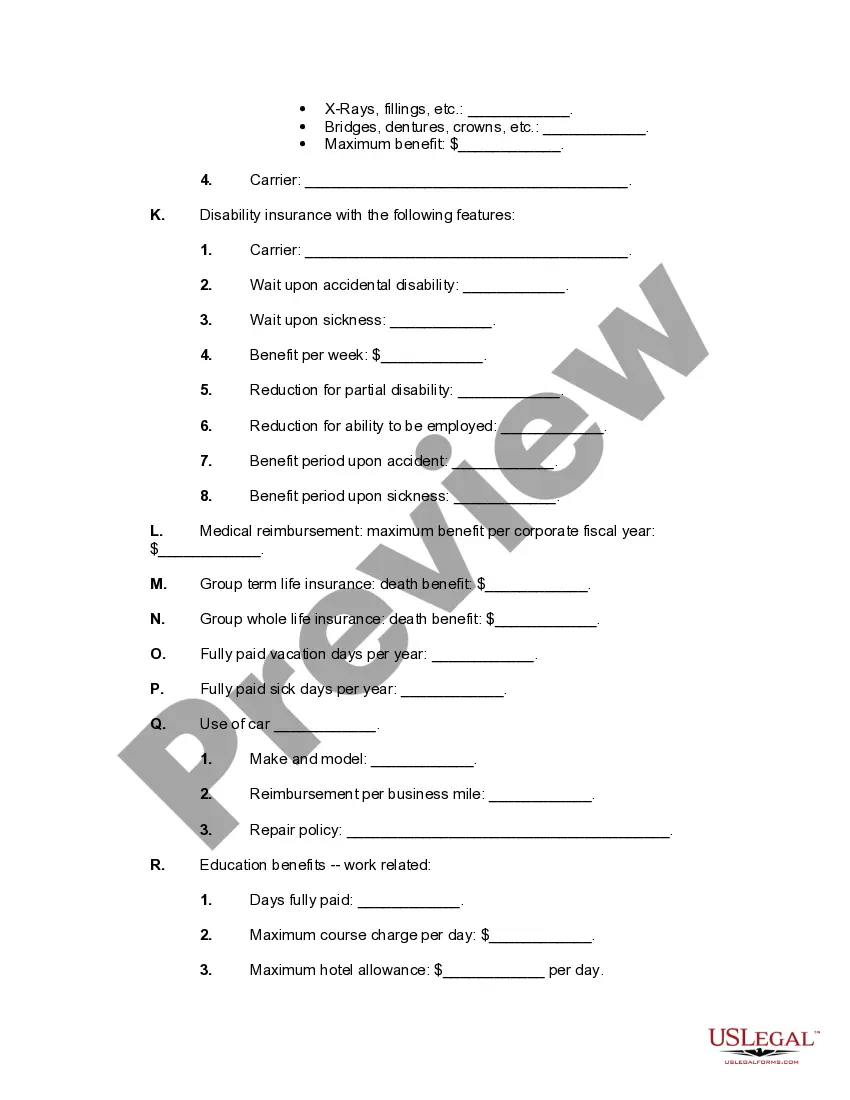

Illinois Preincorporation Agreement between Incorporates and Promoters is a legal document that outlines the terms and conditions agreed upon by individuals (incorporates) who are in the process of forming a corporation and the parties responsible for promoting the business venture (promoters). This agreement serves as a foundation for the future corporation and ensures clarity, transparency, and protection of the interests of all parties involved in the formation process. The Illinois Preincorporation Agreement consists of several key components, including: 1. Purpose: This section defines the main objective and purpose of the corporation being formed. It outlines the specific activities, products, or services the corporation will engage in once established. 2. Incorporates' Roles and Liabilities: This section specifies the responsibilities and liabilities of the incorporates, who are individuals initiating the formation process. It outlines their duties, contributions, and any limitations or restrictions on their involvement. 3. Promoters' Duties and Obligations: Here, the agreement defines the role and obligations of the promoters — the individuals responsible for bringing the idea or concept of the corporation to fruition. It outlines their responsibilities, compensation, and any potential conflicts of interest. 4. Capitalization: This section addresses the initial capital requirements for incorporating the business. It outlines the amount and sources of capital, including contributions from incorporates and promoters, as well as any loans or investments. 5. Share Ownership and Distribution: This section establishes the ownership structure of the corporation, including the allocation and distribution of shares among incorporates and promoters. It may outline the percentage of ownership each party holds and any provisions related to stock issuance or transfers. 6. Intellectual Property: Intellectual property rights, such as copyrights, trademarks, patents, and trade secrets, are addressed in this section. It establishes who owns the intellectual property created during the preincorporation stage and how it will be transferred to the corporation upon formation. 7. Confidentiality and Non-Compete: This section includes provisions that protect the confidentiality of proprietary information shared among incorporates and promoters during the formation process. Non-compete clauses may restrict individuals from engaging in similar business activities that could compete with the future corporation. 8. Governing Law and Dispute Resolution: The agreement specifies that Illinois laws govern the interpretation and enforcement of its provisions. It may also outline the preferred methods for resolving any disputes that arise during the preincorporation phase, such as negotiation, mediation, or arbitration. While the core components mentioned above are common to most Illinois Preincorporation Agreements between Incorporates and Promoters, there may be variations based on the specific needs and circumstances of the parties involved. These differences may include additional provisions related to taxation, management structure, buyout options, or any other terms agreed upon by the incorporates and promoters. It is crucial to consult an experienced attorney specializing in corporate law to draft or review an Illinois Preincorporation Agreement to ensure compliance with the state's legal requirements and to protect the interests and rights of all parties involved.Illinois Preincorporation Agreement between Incorporates and Promoters is a legal document that outlines the terms and conditions agreed upon by individuals (incorporates) who are in the process of forming a corporation and the parties responsible for promoting the business venture (promoters). This agreement serves as a foundation for the future corporation and ensures clarity, transparency, and protection of the interests of all parties involved in the formation process. The Illinois Preincorporation Agreement consists of several key components, including: 1. Purpose: This section defines the main objective and purpose of the corporation being formed. It outlines the specific activities, products, or services the corporation will engage in once established. 2. Incorporates' Roles and Liabilities: This section specifies the responsibilities and liabilities of the incorporates, who are individuals initiating the formation process. It outlines their duties, contributions, and any limitations or restrictions on their involvement. 3. Promoters' Duties and Obligations: Here, the agreement defines the role and obligations of the promoters — the individuals responsible for bringing the idea or concept of the corporation to fruition. It outlines their responsibilities, compensation, and any potential conflicts of interest. 4. Capitalization: This section addresses the initial capital requirements for incorporating the business. It outlines the amount and sources of capital, including contributions from incorporates and promoters, as well as any loans or investments. 5. Share Ownership and Distribution: This section establishes the ownership structure of the corporation, including the allocation and distribution of shares among incorporates and promoters. It may outline the percentage of ownership each party holds and any provisions related to stock issuance or transfers. 6. Intellectual Property: Intellectual property rights, such as copyrights, trademarks, patents, and trade secrets, are addressed in this section. It establishes who owns the intellectual property created during the preincorporation stage and how it will be transferred to the corporation upon formation. 7. Confidentiality and Non-Compete: This section includes provisions that protect the confidentiality of proprietary information shared among incorporates and promoters during the formation process. Non-compete clauses may restrict individuals from engaging in similar business activities that could compete with the future corporation. 8. Governing Law and Dispute Resolution: The agreement specifies that Illinois laws govern the interpretation and enforcement of its provisions. It may also outline the preferred methods for resolving any disputes that arise during the preincorporation phase, such as negotiation, mediation, or arbitration. While the core components mentioned above are common to most Illinois Preincorporation Agreements between Incorporates and Promoters, there may be variations based on the specific needs and circumstances of the parties involved. These differences may include additional provisions related to taxation, management structure, buyout options, or any other terms agreed upon by the incorporates and promoters. It is crucial to consult an experienced attorney specializing in corporate law to draft or review an Illinois Preincorporation Agreement to ensure compliance with the state's legal requirements and to protect the interests and rights of all parties involved.