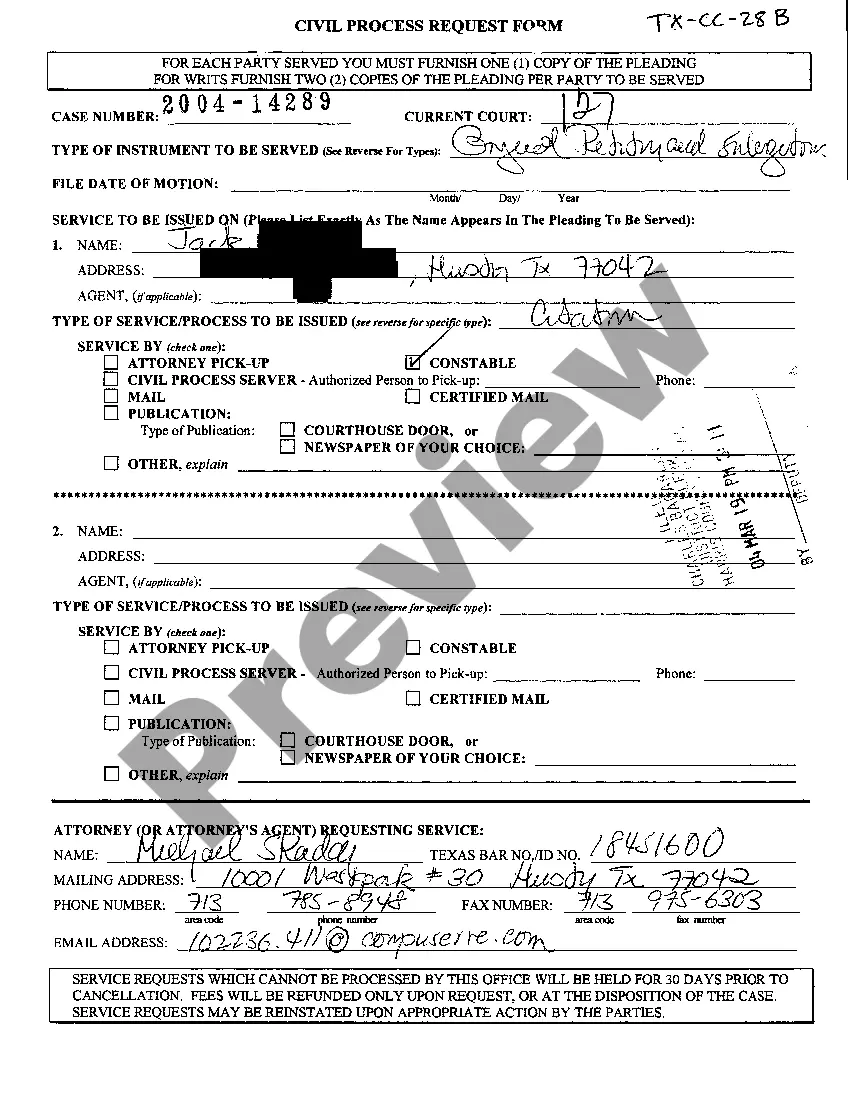

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities is an important legal document that serves as a comprehensive declaration of an individual's financial standing. This affidavit is typically used in various legal proceedings, such as divorce cases or child support hearings, to disclose one's financial resources, debts, assets, and liabilities accurately. By providing a detailed overview of an individual's financial situation, the affidavit assists in determining spousal support, child support, or division of assets and debts fairly. The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities contains several sections, each requiring specific information. It is crucial to complete each section accurately, as any false or misleading information can have legal consequences. The different sections of the affidavit include: 1. Personal Information: This section involves providing essential personal details, such as the full legal name, residential address, contact information, and social security number of the individual completing the affidavit. 2. Income: Here, the affidavit requires a breakdown of income sources, including employment salary, wages, bonuses, commissions, self-employment earnings, rental income, investment income, retirement benefits, and any other sources of income. It is vital to specify the amount and frequency of income received. 3. Expenses: This section necessitates detailing monthly expenses such as mortgage/rent payments, utilities, transportation costs, insurance premiums, medical expenses, child support payments (if any), education costs, and other regular expenses. It is essential to provide accurate information to demonstrate the individual's financial obligations. 4. Assets: This part involves disclosing all assets owned by the individual, including but not limited to real estate properties, bank accounts, investments, vehicles, valuable personal belongings, retirement accounts, and any other assets or investments. Complete and precise information on the value, location, and ownership of these assets is crucial. 5. Liabilities: In this section, all outstanding debts and liabilities must be disclosed. This includes mortgages, loans, credit card debts, student loans, medical bills, alimony, child support obligations, and any other financial obligations. It is important to provide detailed information about the creditors, outstanding balances, and monthly payment obligations. The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities is a vital tool for courts to evaluate an individual's financial capacity accurately. By ensuring full disclosure and compiling all relevant information, this affidavit supports the fair adjudication and resolution of legal matters related to financial support, division of assets, or determining child custody arrangements.The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities is an important legal document that serves as a comprehensive declaration of an individual's financial standing. This affidavit is typically used in various legal proceedings, such as divorce cases or child support hearings, to disclose one's financial resources, debts, assets, and liabilities accurately. By providing a detailed overview of an individual's financial situation, the affidavit assists in determining spousal support, child support, or division of assets and debts fairly. The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities contains several sections, each requiring specific information. It is crucial to complete each section accurately, as any false or misleading information can have legal consequences. The different sections of the affidavit include: 1. Personal Information: This section involves providing essential personal details, such as the full legal name, residential address, contact information, and social security number of the individual completing the affidavit. 2. Income: Here, the affidavit requires a breakdown of income sources, including employment salary, wages, bonuses, commissions, self-employment earnings, rental income, investment income, retirement benefits, and any other sources of income. It is vital to specify the amount and frequency of income received. 3. Expenses: This section necessitates detailing monthly expenses such as mortgage/rent payments, utilities, transportation costs, insurance premiums, medical expenses, child support payments (if any), education costs, and other regular expenses. It is essential to provide accurate information to demonstrate the individual's financial obligations. 4. Assets: This part involves disclosing all assets owned by the individual, including but not limited to real estate properties, bank accounts, investments, vehicles, valuable personal belongings, retirement accounts, and any other assets or investments. Complete and precise information on the value, location, and ownership of these assets is crucial. 5. Liabilities: In this section, all outstanding debts and liabilities must be disclosed. This includes mortgages, loans, credit card debts, student loans, medical bills, alimony, child support obligations, and any other financial obligations. It is important to provide detailed information about the creditors, outstanding balances, and monthly payment obligations. The Illinois Affidavit of Financial Resources and Debt — Assets and Liabilities is a vital tool for courts to evaluate an individual's financial capacity accurately. By ensuring full disclosure and compiling all relevant information, this affidavit supports the fair adjudication and resolution of legal matters related to financial support, division of assets, or determining child custody arrangements.