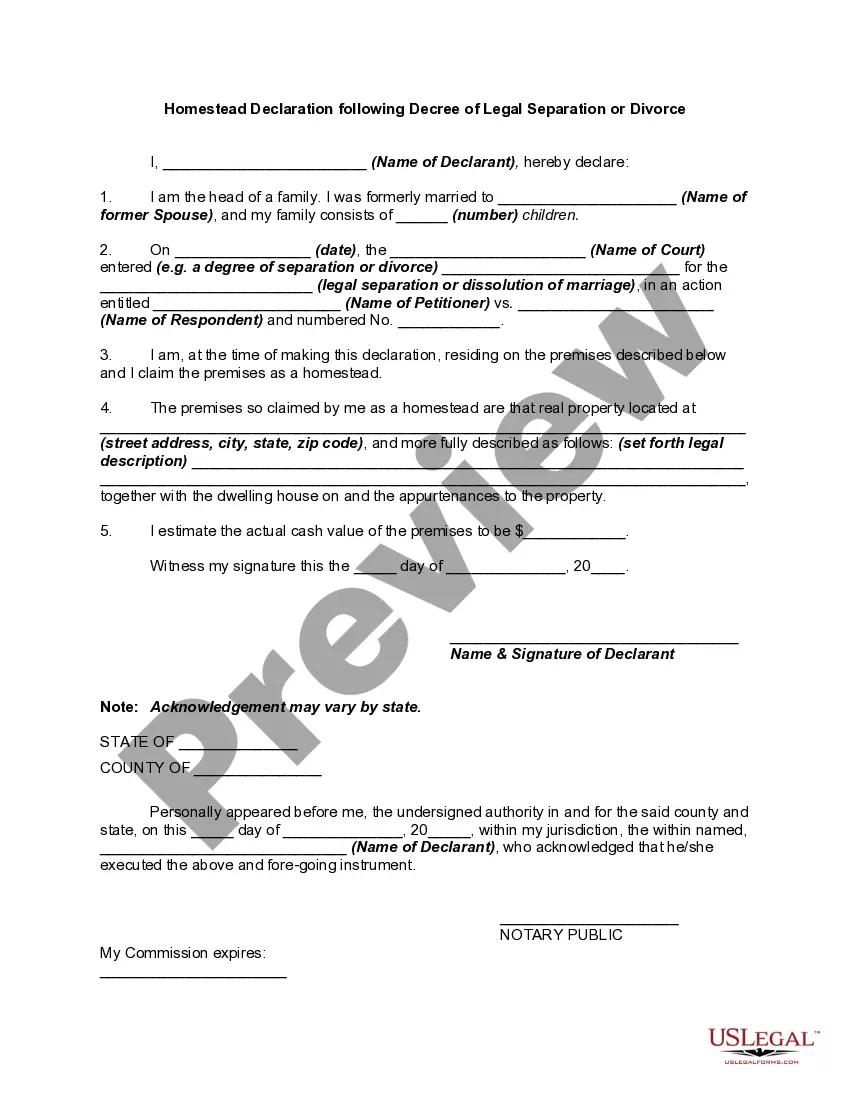

Ordinarily, the declaration must show that the claimant is the head of a family. In general, the claimant's right to select a homestead and to exempt it from forced sale must appear on the face of the declaration, and its omission cannot be supplied by extraneous evidence. Under some statutes, a declaration of homestead may be made by the owner or by his or her spouse.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.